The Magic of 30 Days: Transform Your Money, Transform Your Life (Why One Month of Mindset Work Can Change Everything)

“Can 30 days really make a difference with money?”

Let’s be honest. You’ve probably tried budgeting apps. You’ve read the books. Maybe even taken a course or two.

And yet… money still feels stressful, complicated, or just plain overwhelming.

So when someone says, “Join a 30-day program that changes your financial life,” it’s normal to feel a little skeptical.

But what if the reason things haven’t clicked yet isn’t because you’re doing it wrong…

It’s because you’ve been starting in the wrong place.

Most People Start With the Numbers. I Start With the Mindset.

Think about it.

- Spreadsheets don’t fix self-doubt.

- Budgeting tools don’t heal money shame.

- Financial podcasts don’t shift limiting beliefs.

You can have all the best strategies in the world… But if your brain is still running on fear, scarcity, or old stories like “I’m bad with money,” you’ll sabotage every effort without meaning to.

That’s why the Master Your Money program is different. It doesn’t start with dollars. It starts with beliefs.

What 30 Days of Mindset Work Can Do

This isn’t just a course – it’s a reset.

In 30 days, you’ll go from:

❌ Avoiding your finances to ✅ Taking confident, calm action

❌ Feeling stuck or ashamed to ✅ Feeling empowered and aligned

❌ Reacting emotionally to ✅ Responding intentionally

It’s about building new mental pathways so that good money habits become natural – not forced.

“Your brain is your most powerful financial tool. Train it, and everything changes.”

Why 30 Days?

Because science says it takes about a month to rewire neural pathways and form new habits.

And because 30 days is long enough to create real change, but short enough to actually finish.

It’s a momentum-builder. A mindset shifter. A confidence catalyst.

30 days of doing the inner work can unlock the financial freedom you’ve been chasing for years.

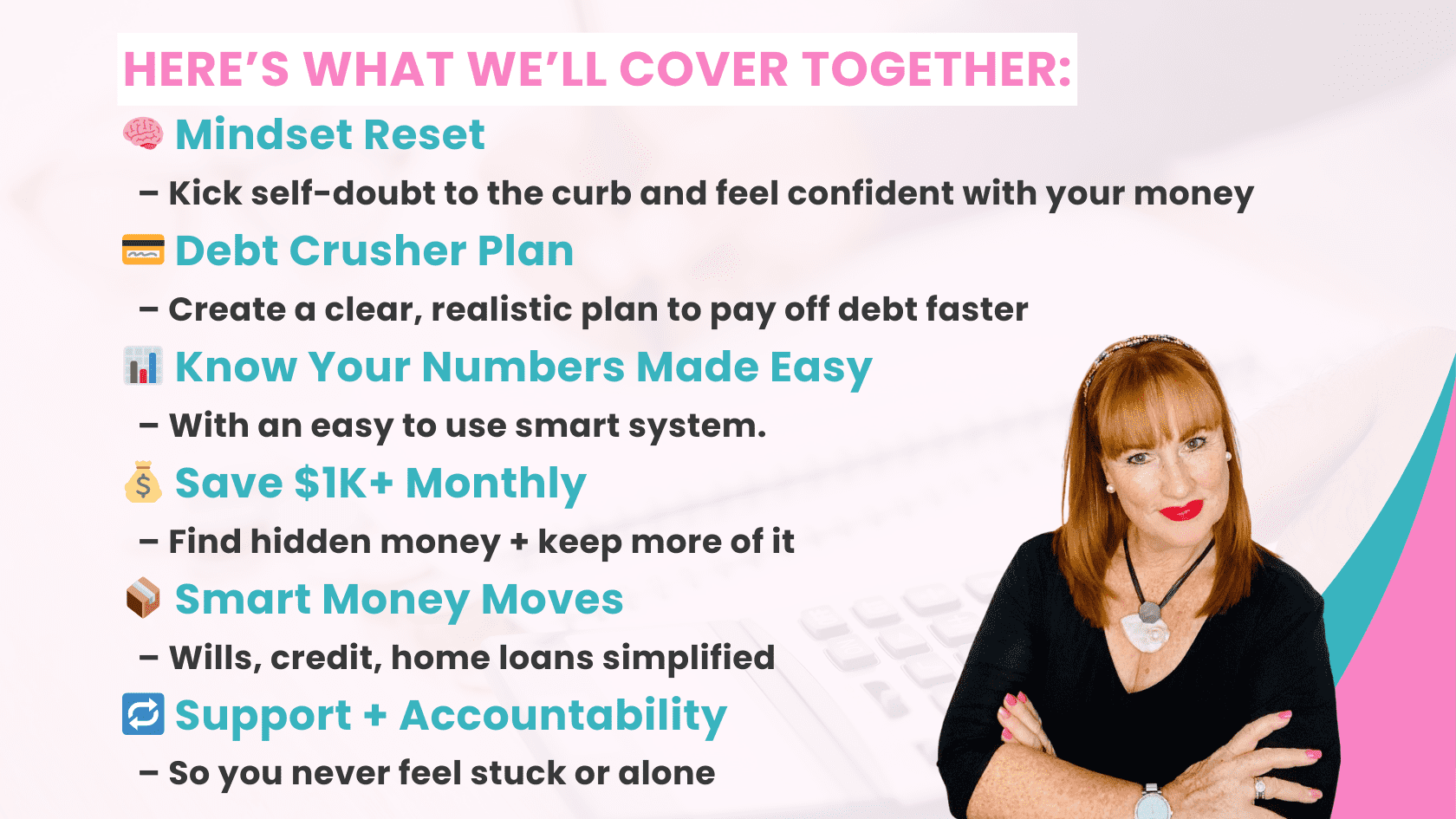

✨ What’s Inside the Program?

The Master Your Money program isn’t about tracking every cent. It’s about transforming the way you think and feel about money so that clarity, confidence, and abundance become your new normal.

Here’s what you’ll experience:

Week 1: Rewiring Your Financial Mindset

- Understand the power of your subconscious in money decisions

- Identify and replace limiting beliefs

- Start using daily affirmations that actually work

Week 2: Money + Mindfulness

- Create a daily 5-minute ritual to check in with your money

- Learn how to stop emotional spending

- Build self-trust around your decisions

Week 3: Habits + Intentional Action

- Learn how to stick to habits without burning out

- Create financial rituals that align with your lifestyle

- Start making empowered choices that feel good

Week 4: Abundance + Long-Term Freedom

- Shift from scarcity to sustainable abundance

- Use visualization and gratitude to attract new possibilities

- Walk away with a personalized plan for the next 90 days

Plus:

- 2 x 1:1 coaching sessions with me

- Daily support in a safe, private community with like-minded individuals

Bonuses like The Financial Confidence Framework + The Abundance Manifestation Method

Why This Works When Nothing Else Has

Because Master Your Money isn’t about “doing more” – it’s about thinking differently.

It’s for you if you’ve ever said:

- “I make good money but still feel behind.”

- “I know what to do, I just don’t do it.”

- “Money feels heavy, confusing, or emotional.”

- “I want peace, not just numbers on a spreadsheet.”

This program is your permission slip to ditch the shame, drop the stress, and finally feel free with your finances.

From Clients Who’ve Done the Work:

“In 30 days, I went from avoiding my bank account to checking it daily with confidence. This wasn’t just about money, it was about reclaiming my power.” – Lisa, 39

“I’ve done money courses before, but this one hit different. Karen helped me realise that I wasn’t broken, I just needed a mindset shift. It changed my life.” – Tom, 45

What Could Shift for You in the Next 30 Days?

Imagine this:

- You wake up without money anxiety.

- You feel calm when you check your balance.

- You trust yourself to make the right decisions.

- You’re building savings, reducing debt, and creating real financial momentum.

- You feel proud of how far you’ve come.

That’s what’s possible when you do the inner work first.

And it all starts with a yes.

Your Invitation: Join Me Inside Master Your Money

If you’re ready to:

- Stop spinning your wheels

- Break the fear-shame-stress cycle

- Create a healthy, peaceful relationship with money

- And feel aligned, abundant, and in control…

Then let’s do this together.

Click the image below or message me if you’ve got questions. Let’s make the next 30 days the most powerful ones yet.

Final Thoughts

You don’t need another spreadsheet. You need a mindset shift.

You don’t need to hustle harder. You need a plan that aligns with your values.

You don’t need to wait for “the right time.” Because this is the time.

“You’re only 30 days away from a completely different money story.”

Let’s write the next chapter together.

Click here to join the Master Your Money program now.

Ready. Aligned. Abundant. Let’s go.