Know Your Numbers, Know Your Power: The Financial Foundation Everyone Needs

Here’s a truth bomb:

You can’t master what you won’t measure.

So if you’re serious about taking control of your money, building wealth, and creating financial freedom, you need to know your numbers.

And no, we’re not talking about becoming a spreadsheet wizard or tracking every cent forever. We’re talking about building a relationship with your money that feels empowering, clear, and doable.

In this post, we’ll cover:

- What “knowing your numbers” actually means

- The 5 key numbers everyone should know

- How avoiding your numbers keeps you stuck

- Tools and tips to make it simple

- How this connects to building your financial muscle

? Why Knowing Your Numbers Matters?

If money feels overwhelming, it’s often because we’re operating in the dark.

Most people avoid their finances until something breaks:

- Overdraft fees hit

- A credit card gets declined

- A bill goes unpaid

Sound familiar?

But here’s the thing: Clarity is power. When you know your numbers, you take the wheel. You can:

- Make informed decisions

- Set real goals

- Eliminate guesswork

- Reduce stress

Knowing your numbers is one of the core steps to building financial muscle.

? What Is Financial Muscle, Anyway?

Financial muscle is your ability to make money work for you. It’s a mix of mindset, knowledge, habits, and systems that give you control over your finances – instead of the other way around.

Think of it like going to the gym. When you first start working out, everything feels awkward and hard. But the more consistent you are, the stronger and more confident you become.

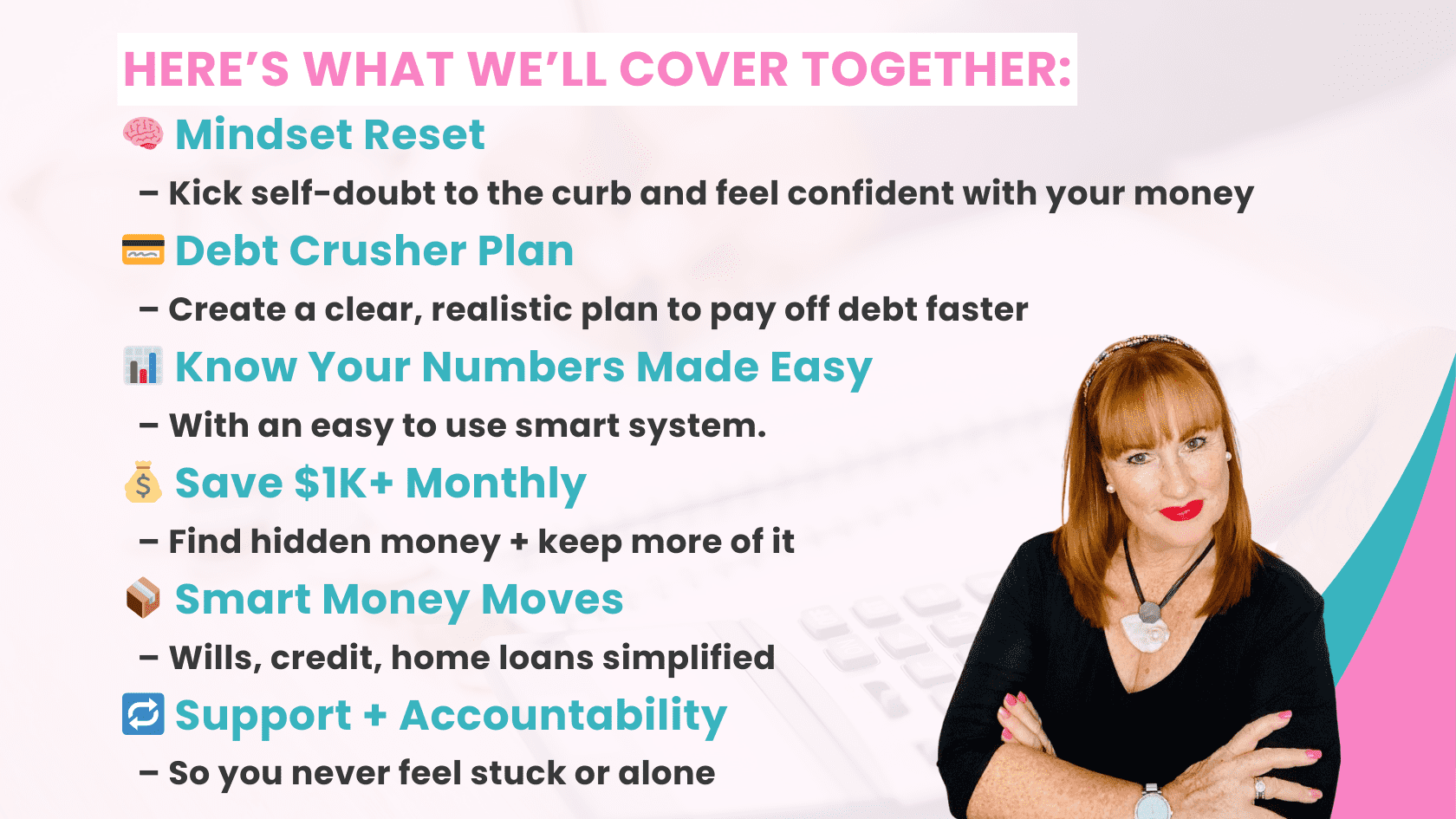

Your financial muscle works the same way. It’s built by:

- Mastering your money mindset

- Creating strong financial foundations (like budgeting and saving)

- Knowing your numbers (and facing them with clarity)

- Managing debt with a plan

- Understanding credit and how it works for you

- Building wealth step-by-step

- Protecting that wealth through planning and legacy tools

Sound like a lot? Don’t worry, it’s a process, and you don’t have to do it alone.

The 5 Key Numbers Everyone Should Know

Let’s break it down.

1. Your Income (Actual, Not Theoretical)

Not just your salary, your actual monthly take-home income after tax.

- Include side hustles, child support, Centrelink, etc.

- This is your fuel. You can’t budget what you don’t track.

2. Your Expenses (Fixed + Flexible)

- Fixed: Rent, utilities, phone bills

- Flexible: Groceries, fuel, entertainment

- This helps you spot leaks and adjust without guessing

3. Your Debt (Total & Monthly Minimums)

- What you owe (credit cards, personal loans, BNPL, student debt)

- Include interest rates and payment due dates

- This is key to making a realistic debt reduction plan

4. Your Savings (Emergency + Short-Term Goals)

- Do you have 3-6 months’ worth of living expenses?

- Are you saving for holidays, home, or retirement?

- Even $10/week adds up with consistency

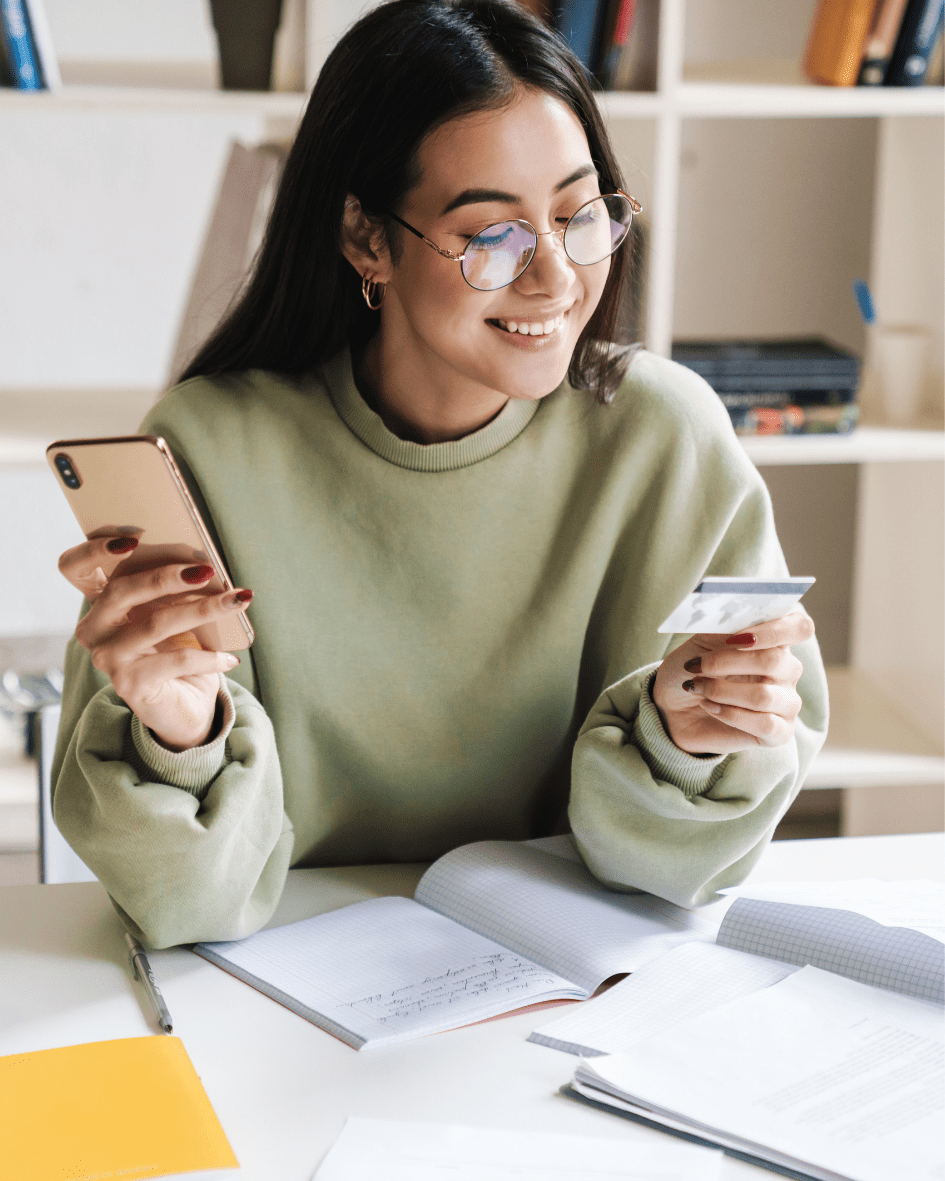

5. Your Credit Score

- It impacts everything from loan approvals to interest rates

- Many people never check it until it’s too late

When you know these numbers, you’re no longer in the dark. You’re in control.

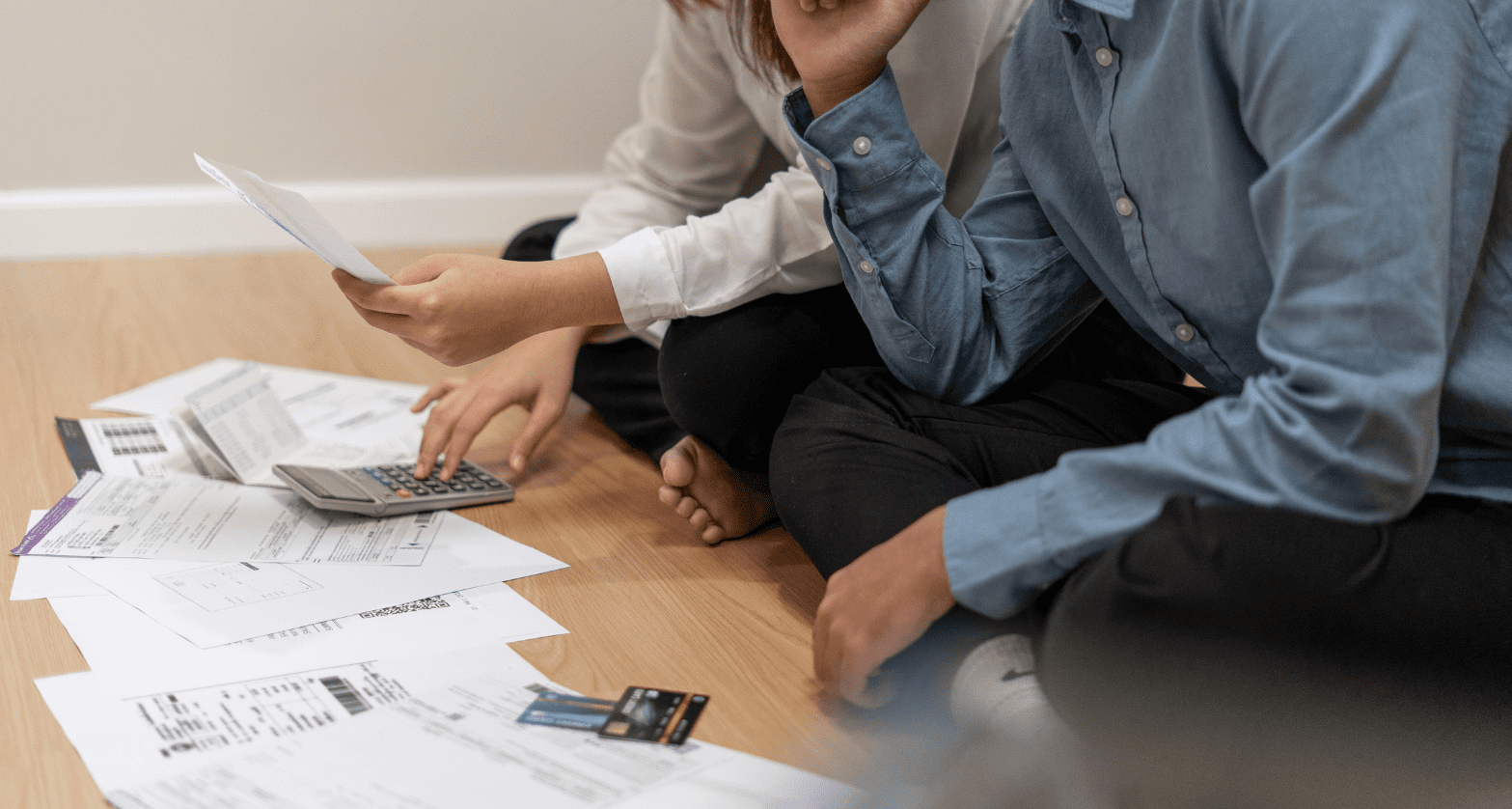

What Happens When You Don’t Know Your Numbers

Let’s be real. Avoiding your numbers can lead to:

- Overspending without realising it

- Paying late fees or higher interest

- Never knowing where your money is going

- Constant financial anxiety

This creates the cycle of financial fog:

Avoid → Panic → Overspend → Avoid again

You deserve better.

? The Empowered Alternative: Financial Awareness

Knowing your numbers:

- Reduces anxiety

- Helps you set boundaries with money

- Boosts your confidence

- Allows you to plan for the future (not just react)

Think of it like GPS for your finances. If you don’t know where you are, how can you get where you want to go?

? Budgeting Doesn’t Mean Restriction – It Means Freedom

A budget is not a punishment. It’s a permission slip to spend without guilt.

When aligned with your values, budgeting becomes a powerful tool:

- You decide where your money goes

- You save for the things that matter most

- You stop impulse spending because you’re clear on your goals

We teach this inside the Financial Freedom Breakthrough Program – with simple systems that are easy to stick to.

? How to Start Knowing Your Numbers (Without Getting Overwhelmed)

1. Track 30 Days of Spending

You can’t fix what you don’t see. Use a spreadsheet, notebook, or an app like Pocketbook or MoneyBrilliant.

2. Create a Budget Based on Real Life

Use your actual spending to create a living, breathing budget, not a fantasy one.

3. List All Your Debts

Use a debt tracker to list balances, interest rates, and minimum payments. Knowledge is power here.

4. Automate What You Can

Set up auto-transfers to savings and bills. Remove the mental effort.

5. Schedule a Monthly Money Date

Pick one day each month to check in with your budget, debt, savings, and goals.

6. Join a Community or Program for Support

You don’t have to figure this out alone. Our program gives you coaching, templates, and accountability.

? Where This Fits in the Financial Freedom Diagram

Let’s revisit the Financial Management 101 Diagram. (See below)

People at the bottom (“struggling” and “overwhelmed”) often don’t know their numbers. That’s what keeps them stuck.

The middle of the diagram (“frustrated” or “surviving”) is where awareness starts to grow, but without a system, it’s hard to sustain progress.

At the top, people are confident, focused, and building financial muscle. They know their numbers, make decisions with clarity, and have money working for them.

? You Deserve to Feel Financially Empowered

Knowing your numbers isn’t about perfection. It’s about progress.

Every time you check in with your money, you send a powerful message: “I’m in charge. I’m building something better.”

? Ready to Know Your Numbers and Take Control?

Here are 3 ways to start:

- Download our free Budget & Money Map Tracker (coming soon)

- Join the waitlist for the September launch of the Financial Freedom Breakthrough Program

- Book a free clarity call to assess your current financial foundation

? Final Thoughts

Your numbers are not something to fear. They are your freedom tools.

The sooner you understand them, the sooner you can start using them to build a life you love.

Remember: Know your numbers, know your power.

Let’s build that financial foundation, one step at a time.