Dec 3, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Mindset, Retirement, Saving Money

Christmas gift giving can feel like a marathon for your wallet. With ads flashing everywhere, social pressure building, and kids writing wish lists a mile long, it’s easy to get swept up in the spending frenzy. But here’s the truth: a meaningful Christmas doesn’t require maxing out your credit card or emptying your bank account. In fact, some of the most heartfelt and memorable gifts cost little to nothing at all.

This year, let’s flip the script. Instead of overspending, over-wrapping, and over-stressing, why not embrace mindful Christmas gift giving? It’s all about thoughtfulness, creativity, and connection – not dollar signs. Here’s how to spread joy this Christmas without draining your finances.

Why Mindful Christmas Gift Giving Matters

At its heart, Christmas is about love, gratitude, and connection. But when we let consumerism run the show, those values can get buried under receipts and regret.

Mindful gift giving helps you:

- Stay on budget while still being generous

- Give gifts that hold meaning and create memories

- Reduce waste and clutter

- Release the stress that comes with overspending

- Focus on presence over presents

A mindful Christmas gift says: “I thought of you. I know you. I care about you.” And that’s what makes it magical.

Step 1: Set a Realistic Christmas Gift Budget

Before you set foot in a store or open a shopping tab online, decide: What can I realistically afford to spend on gifts this year? Write down a total number. This is your overall Christmas gift budget. Next, break it down by category:

- Immediate family

- Extended family

- Friends

- Coworkers/teachers

- Neighbours/Secret Santa

Then set a maximum spend per person. Example: $500 total, split into $350 for immediate family, $50 for extended, $50 for friends, $25 for teachers/coworkers, $25 for fun extras.

Generosity isn’t about the amount you spend – it’s about the love behind it. Keep your numbers realistic and guilt-free.

✨ Step 2: Talk About Expectations

One of the biggest overspending traps at Christmas comes from unspoken expectations. Instead of stressing, have the conversation:

- Suggest a Secret Santa so each person only buys one gift

- Agree on spending limits

- Swap traditional presents for shared experiences

- Propose donating to a charity instead of exchanging gifts

Chances are, others will breathe a sigh of relief when you bring it up. Christmas is meant to bring joy, not financial strain.

Step 3: Give Thought, Not Just Things

The most meaningful Christmas gifts show that you paid attention. They reflect the recipient’s personality, hobbies, or values.

Affordable but thoughtful ideas:

- For the foodie: Homemade spice blends, a jar of cookie mix, or a handwritten recipe collection

- For the sentimental one: A framed family photo, a handwritten letter, or a playlist of songs with memories

- For the busy parent: Babysitting vouchers, a prepped meal kit, or a cosy blanket and journal

- For kids: Coupons for special experiences (like a “yes day” or baking day together)

It’s not about price tags. It’s about presence and care.

Step 4: Embrace DIY Magic

You don’t need to be Martha Stewart to pull off a DIY Christmas gift. Handmade gifts often mean the most because they’re personal and unique. DIY Christmas gift ideas:

- Festive baked goods in decorated tins

- Homemade ornaments with the year painted on

- Knitted scarves or cosy hand-sewn items

- DIY candles or bath salts

- A custom coupon book (think: “movie night of your choice,” “breakfast in bed,” “car wash on me”)

Pro tip: Make one type of DIY gift in bulk (like a big batch of biscults or candles) and hand them out to multiple people. It’s cost-effective and heartfelt.

Step 5: Focus on Experiences Over Excess

Some of the best Christmas gifts aren’t wrapped. They’re remembered.

Experience-based ideas:

- A Christmas movie night kit with hot chocolate, popcorn, and PJs

- Family game night vouchers

- A day trip to a local festive market

- A homemade “spa day” box with candles, tea, and bath salts

- Tickets to a future event (local theatre, kids’ activity, etc.)

These gifts create memories that outlast any toy or gadget.

Step 6: Shop Small and Local

Supporting small businesses this Christmas is a win-win. You’ll find unique gifts while supporting real people in your community. Where to shop:

- Local Christmas markets

- Independent shops or boutiques

- Etsy makers

- Farmers’ markets

Often, these gifts are higher quality and have more meaning than mass-produced items. Plus, your money helps local families thrive.

Step 7: Wrap It With Love

Presentation doesn’t have to be expensive. Get creative with eco-friendly and budget-friendly wrapping:

- Use brown paper with twine and greenery for a rustic look

- Wrap in fabric or scarves (two gifts in one!)

- Reuse gift bags and ribbons

- Add a handwritten note or tag

It’s the small details that make a gift feel special.

Bonus: Mindful Christmas Gift Ideas Under $30

Need quick inspiration? Here are some thoughtful, budget-friendly winners:

- A gratitude journal with a personal note inside

- A festive candle

- A homemade hot chocolate kit in a mason jar

- A puzzle or board game

- A plant in a decorated pot

- A favourite book with your handwritten reason why you loved it

- A tea or coffee sampler with a cute mug.

Final Thoughts: The Christmas Spirit Can’t Be Bought

Mindful Christmas gift giving is about slowing down, choosing with intention, and giving from the heart. It’s not about competing, comparing, or overspending.

This Christmas, release the pressure to impress. Your loved ones don’t need the latest gadget to feel loved, they need you. Your time, attention, and thoughtfulness are worth more than anything you could buy.

So let your budget be your guide, not your burden. Create gifts with meaning, memories with heart, and a Christmas that feels as magical as it should – without the financial stress.

Because at the end of the day, it really is the thought that counts. ??

Nov 26, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Estate Planning, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

The holiday season is often painted with glitter and gold – literally and financially. Between decorations, gifts, food, travel, and events, it can feel like every December demands a sky-high budget. But here’s the truth: you can absolutely have a joyful, memorable holiday without draining your bank account or maxing out your credit cards.

Enter the Holiday Season Budget Blueprint: a practical, five-step guide to help you spend wisely, celebrate fully, and start the new year without a financial hangover. It’s not about saying “no” to the fun stuff – it’s about saying “yes” to the things that truly matter.

Let’s break it down.

Step 1: Define What Matters Most

Before you open your wallet, take a step back and ask: What do I want this holiday season to feel like?

Is it about quality time, rest, giving back, tradition, creativity, or connection? When you define your values first, it becomes easier to:

- Cut unnecessary spending

- Set clear priorities

- Say no to what doesn’t align with your goals

Remember: Your budget isn’t just a money tool – it’s a reflection of your values.

Step 2: Set a Realistic, All-Inclusive Budget

Next, figure out your total holiday spending limit. This number should come from your current financial reality, not wishful thinking or social pressure. Include:

- Gifts

- Food and drinks

- Travel and accommodations

- Decorations

- Wrapping supplies and cards

- Event tickets or outings

- Donations and giving

- Festive extras (e.g., matching pajamas, holiday movies, etc.)

Bonus: Build in a “buffer” of 10% for those inevitable last-minute expenses.

Pro tip: If you haven’t started a holiday sinking fund yet, this is your sign to plan one for next year. Even $20/month makes a big difference by December.

Step 3: Create a Budget Blueprint That Works for You

Once you have your total holiday budget, break it into categories that fit your life.

Example Blueprint (for a $600 budget):

- Gifts: $300

- Food/Entertainment: $100

- Travel: $75

- Decorations: $50

- Charitable Giving: $25

- Misc/Fun: $50

Now, get specific:

- List who you’re buying gifts for and set a per-person amount

- Plan your meals or parties and estimate costs

- Look up travel prices now to avoid inflated last-minute bookings

Don’t forget digital tools:

- Budgeting apps (EveryDollar, YNAB, Mint)

- Spreadsheets – my budget/spending plan

- Cash envelope system

The key is to track as you go. Awareness prevents overspending.

Step 4: Use Smart Saving and Spending Strategies

Now for the fun part: making your budget go further without cutting the joy.

Holiday Saving Hacks:

- Use cashback apps (Rakuten, Honey, Fetch)

- Stack coupons and loyalty points

- Shop early to spread out costs

- Buy in bulk or split bundles with others

- Thrift or upcycle decor and outfits

Joyful (But Budget-Friendly) Alternatives:

- Experiences over things: movie nights, game nights, or DIY spa days

- DIY gifts: baked goods, photo albums, handmade crafts

- Shared hosting: make events potluck-style to share food and fun

- Decor on a dime: nature-inspired decor, secondhand finds, or family DIY sessions

With a little creativity, you can keep the festive spirit alive and keep your spending aligned with your values.

Step 5: Celebrate With Intention, Not Obligation

This one’s big: don’t let expectations drive your spending. Just because “you always do it this way” doesn’t mean you have to this year.

Say no to:

- Oversized gift exchanges that cause stress

- Events that don’t bring joy or fit your budget

- Trying to match what others are doing on social media

Say yes to:

- Meaningful moments over material things

- New traditions that reflect your current season of life

- Giving from the heart, not the wallet

When you let go of obligation, you make space for a holiday that’s truly aligned with your values and your finances.

Final Thoughts: Make Your Holiday Budget Work For You

The best holiday memories often come from the simple things: laughter, traditions, and time spent with the people who matter most. When you take control of your money with a clear budget, you remove stress and open up space for genuine joy. Remember, the holidays aren’t about how much you spend, they’re about how fully you show up. With a blueprint in place, you can step into the season with confidence, celebrate with intention, and start the new year feeling empowered instead of overwhelmed.

Want more support in building healthy money habits all year round? Join my Monthly Coaching Program and let’s strengthen your financial muscle together!

Nov 19, 2025 | Credit Score, Debt, Debt Payment, Debt Repayment, Financial Education, Financial Freedom, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

December is now just around the corner and while the holidays are meant to be joyful and magical, they can also bring a fair bit of financial pressure. Between gift shopping, party invites, travel plans, and festive food spreads, it’s easy to get overwhelmed.

But here’s the good news: you still have time to get financially prepared before the chaos fully kicks in. By taking action in November, you can hit December feeling calm, in control, and ready to actually enjoy the season. No panic required.

Let’s break down a simple, step-by-step countdown to Christmas that helps you stay on top of your money and make the most of the season – without going into debt or stressing out.

Step 1: Create Your Holiday Countdown Calendar

First things first, get a calendar (physical or digital) and mark off key holiday dates:

- Family events and parties

- School performances or community activities

- Gift exchanges and Secret Santas

- Travel days

- Shipping deadlines

Now add weekly financial check-ins leading up to Christmas. These can be short 15-minute sessions to:

- Review your spending

- Check your budget

- Adjust plans as needed

This turns your holiday prep into bite-sized, doable tasks instead of one big financial headache.

Step 2: Finalise Your Total Holiday Budget (Yes, Now)

If you haven’t done this yet, it’s time. Your total holiday budget should include:

- Gifts

- Travel

- Food (groceries, dining out, baking)

- Events and entertainment

- Decorations

- Wrapping supplies and cards

- Charitable giving

- Last-minute surprises (because there are always a few)

Decide what you can actually afford, without relying on credit cards or borrowing from your future self. Once you know your total, break it into weekly spending goals.

Example: If your total holiday budget is $600 and there are 4 weeks until Christmas, aim to spend no more than $150 per week.

Step 3: Organise Your Gift List Early

Now is the perfect time to get clear on your gift game plan. Make a list of:

- Everyone you want to buy for

- Gift ideas (with realistic price points)

- Spending limits per person

Bonus: Add a column to track when you’ve purchased or wrapped each gift.

This stops you from last-minute panic buying (aka overspending) and gives you time to shop sales or DIY something meaningful. And don’t forget:

- Suggest Secret Santa gift swaps

- Set expectations with extended family

- Consider non-material gifts (more on this below!)

Step 4: Shop Smarter, Not Harder

November is still prime time for scoring deals without the frenzy of last-minute shopping.

Here’s how to shop smart:

- Stick to your list and budget like glue

- Use cashback tools (like Honey or Rakuten)

- Compare prices online before heading out

- Stack coupons and use loyalty rewards

- Buy in bundles to save time and money (think gift packs split between people)

Also, leave a little wiggle room in your budget for unexpected finds. If you overspend in one area, adjust in another.

Step 5: Plan for Shipping Deadlines

Ordering gifts online? Mark down those final shipping dates now. Delayed packages = last-minute spending disasters.

Here’s what to do:

- Order by early December if possible

- Choose free shipping options to save money

- Consider digital gifts or subscriptions to skip shipping altogether

Pro tip: Avoid the expensive rush shipping fees by getting ahead now.

Step 6: Prep for Holiday Meals on a Budget

Holiday food is part of the fun, but it doesn’t have to wreck your finances.

Start meal planning:

- Choose dishes that are crowd-pleasers and budget-friendly

- Shop early for non-perishables and freeze what you can

- Host potlucks to share the load (and the cost!)

- Limit impulse snack and treat purchases

Want to cut down on December grocery bills? Start adding a few extra items to each weekly shop now.

Step 7: Say “No” to Financial FOMO

This time of year is full of pressure to say “yes” to everything:

- Every event

- Every outing

- Every gift exchange

- Every sale

But your time, energy, and wallet are limited resources. Be intentional. Practice saying:

- “That sounds fun, but it’s not in my budget right now.”

- “Let’s plan something low-key instead.”

- “I’m focusing on meaningful moments this year.”

You’ll be amazed how freeing it feels to stick to your holiday goals, not everyone else’s expectations.

Step 8: Create a “Festive Fun” Fund

Let’s be real, you still want to enjoy the season! Build in a little cushion for fun:

- Coffee catchups with friends

- Holiday movie nights

- Small treats for yourself

Put $10 – $20 per week aside for spontaneous seasonal joy. When it’s gone, it’s gone. No guilt, no overspending.

Final Thoughts: Plan Now, Celebrate Later

You don’t need a massive budget to have a magical holiday season. What you do need is a plan. One that prioritises your peace, your financial goals, and your version of holiday joy.

So use these final weeks of November wisely. Map it out. Budget it in. Say no when you need to. Say yes to what truly matters. And walk into December with clarity, confidence, and maybe even a little cash leftover.

You’ve got this – and Financial Management 101 is cheering you on every step of the way. ??

Apr 23, 2025 | Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Management 101, Holiday Season, Holiday Spending, Net Worth, Retirement, Saving Money, Self Development

Consistency is the secret ingredient to financial success. But how do you stay consistent when life throws curveballs, and managing money feels overwhelming? That’s where Monthly Coaching steps in. By providing expert guidance, actionable strategies, and a supportive community, the program empowers you to take charge of your finances one month at a time. In this blog, we’ll explore how Coaching can transform your financial journey and help you achieve your dreams.

What Makes Monthly Coaching Unique?

Financial success isn’t about drastic changes; it’s about building sustainable habits. Monthly Coaching focuses on:

1. STRUCTURED SUPPORT

-

-

-

- Each month, you’ll receive clear steps to tackle specific financial goals.

- Your coach, Karen provides personalised feedback and strategies tailored to your needs.

2. COMMUNITY CONNECTION

-

-

-

- Join a network of like-minded individuals who are on similar journeys.

- Share experiences, celebrate wins, and find motivation through the community.

3. CUSTOMISED PLANS

-

-

-

- Your financial situation is unique, and so is your plan. Monthly Coaching adapts to your life and priorities.

Key Features of the Program

The Monthly Coaching program offers a comprehensive suite of resources and tools designed to make managing money simple and effective:

1. MONTHLY THEMES

-

-

-

- Each month focuses on a specific financial topic, such as saving strategies, debt reduction, or financial mindset.

- April’s theme is “Know Your Numbers,” providing a solid foundation for understanding your net position.

2. PRACTICAL TOOLS

-

-

-

- Access downloadable guides, budgeting templates, and expense trackers.

- Use calculators to visualize your goals and measure progress.

3. EXPERT-LED WEBINARS

-

-

-

- Attend monthly sessions hosted by your financial expert, Karen G Adams.

- Gain insights into trending topics and proven strategies.

4. FLEXIBLE LEARNING

-

-

-

- Access resources anytime, anywhere. Learn at your own pace without disrupting your daily routine.

Why Monthly Coaching within THE VAULT Works:

We understand that life is busy, which is why Monthly Coaching is designed to be flexible and convenient:

1. ACCOUNTABILITY

-

-

-

- Regular check-ins keep you on track and motivated.

- Small, consistent steps lead to significant progress over time.

2. CLARITY AND FOCUS

-

-

-

- Break down overwhelming financial goals into manageable tasks.

- Focus on one priority at a time to avoid burnout.

3. EXPERTISE AT YOUR FINGERTIPS

-

-

-

- Financial Coach, Karen provides insights and strategies that save you time and frustration.

- Learn from real-life examples and proven methods.

Success Stories

Hearing about others’ success can inspire you to take the leap. Here are some real-life transformations:

1. JOHN’S JOURNEY TO SAVINGS

-

-

-

- John joined THE VAULT and learnt how to build an emergency fund. Within six months, he had saved $5,000, giving him peace of mind and financial security.

2. LISA’S DEBT-FREE VICTORY

-

-

-

- Lisa used the program to tackle her credit card debt. With tailored strategies and monthly guidance, she paid off $10,000 in just 18 months.

3. MARK’S HOMEOWNERSHIP DREAM

-

-

-

- Mark wanted to save for a house deposit but struggled with inconsistent savings habits. Monthly Coaching within THE VAULT helped him create a plan, and he achieved his goal in two years.

Why Join Now?

April is the ideal time to start your financial transformation. This month’s theme, “Know Your Numbers,” is the perfect foundation for understanding your financial health and building a roadmap to success.

EXCLUSIVE APRIL BONUSES:

1. PERSONALISED NET POSITION REPORT

-

-

- Gain a detailed breakdown of your financial standing, including assets, liabilities, and net worth.

2. BONUS RESOURCES

-

-

- Access exclusive guides and tools to help you implement what you learn.

How To Get Started?

1. SIGN UP FOR THE VAULT

-

-

- Enrollment is quick and easy. Join today to gain immediate access to the programs and tools within THE VAULT.

2. SET YOUR GOALS

-

-

- Work with your financial coach, Karen to identify your top priorities and create a customised plan.

3. ENGAGE WITH THE COMMUNITY

-

-

- Connect with others for support, motivation, and shared experiences.

4. TAKE ACTION

-

-

- Use the resources and guidance provided to implement small, consistent changes that lead to big results.

Conclusion

Monthly Coaching isn’t just a program; it’s a partnership that helps you take control of your financial future. By focusing on structured support, personalised strategies, and community connection, this program equips you with everything you need to succeed. Make April the month you start your transformation. Join THE VAULT today and discover the tools, insights, and encouragement to achieve your financial dreams.

Apr 9, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle, Welcome

Financial freedom isn’t just about saving money or cutting costs; it’s about truly understanding your financial position. Knowing your numbers means gaining a clear picture of your assets, liabilities, income, and expenses. This knowledge is the foundation for making informed decisions, reducing financial stress, and achieving stability. In this blog, we’ll explore why knowing your numbers is essential and how you can start your journey toward financial clarity today.

Why Monthly Coaching is a Game-Changer

Financial success doesn’t happen overnight. It requires consistent effort, strategic planning, and the right tools. Monthly Coaching provides all of this and more:

1. EXPERT GUIDANCE

-

-

-

- Work with an experienced financial coach, like myself who understand the challenges you’re facing.

- Receive practical support tailored to your unique situation.

2. ACCOUNTABILITY

-

-

-

- Regular check-ins ensure you stay on track with your financial goals.

- Celebrate milestones and adjust your plan as needed.

3. ACCESS TO THE VAULT

-

-

-

- Unlimited access to a comprehensive library of courses, tools, and resources.

- Learn at your own pace and revisit materials anytime.

4. PERSONALISED STRATEGIES

-

-

-

- Receive a customized roadmap based on your financial priorities and challenges.

- Develop actionable steps to tackle debt, save effectively, and build wealth.

Joining THE VAULT gives you unlimited access to a comprehensive library of courses, tools, and resources.

What’s Inside THE VAULT?

Our THE VAULT is the heart of the Monthly Coaching program, packed with resources designed to simplify your financial journey

1. COMPREHENSIVE COURSES

-

-

-

- Covering topics like budgeting, saving, debt reduction, and financial mindset.

- Each course is broken into manageable modules, so you can learn step by step.

2. INTERACTIVE TOOLS

-

-

-

- Use calculators, trackers, and templates to monitor your progress.

- Visualise your goals and see how small changes make a big impact

3. EXCLUSIVE WEBINARS

-

-

-

- Monthly expert-led sessions on trending financial topics and strategies.

- Ask questions and gain insights from industry professionals.

4. SUPPORTIVE COMMUNITY

-

-

-

- Connect with other members for advice, motivation, and shared experiences.

- Build relationships with like-minded individuals who understand your journey.

How Monthly Coaching Fits Your Life?

We understand that life is busy, which is why Monthly Coaching is designed to be flexible and convenient:

1. LEARN ANYTIME, ANYWHERE

-

-

- Access courses and resources on your schedule, whether it’s during your morning coffee or after the kids are in bed.

2. QUICK CHECK-INS

-

-

- Regular updates keep you accountable without overwhelming your to-do list.

3. ACTIONABLE GOALS

-

-

- Break down big financial objectives into smaller, manageable steps.

Focus on one priority at a time to avoid feeling overwhelmed.

Success Stories

Hearing how others have transformed their finances can be incredibly motivating. Here are just a few examples of how the programs and training in THE VAULT has changed lives:

1. SARAH’S STORY

-

-

-

- A single mum struggling with debt, Sarah joined the program to regain control of her finances.

- With the support, she created a realistic budget, eliminated $5,000 of credit card debt, and started saving for her daughter’s education.

2. MARK’S JOURNEY

-

-

-

- Mark wanted to save for a down payment on a house but didn’t know where to start.

- Through THE VAULT, he learned how to track his expenses, cut unnecessary costs, and saved $20,000 in just 18 months.

3. LISA’S TRANSFORMATION

-

-

-

- Lisa was overwhelmed by her financial situation and didn’t know how to prioritise her goals.

- THE VAULT helped her identify her top priorities, pay off her car loan early, and build an emergency fund within a year.

Why Join Now?

April is the perfect time to take control of your finances. By enrolling in THE VAULT, you’ll gain access to all the tools and support you need to achieve your goals. Plus, our April focus on “Know Your Numbers” ensures you start with a solid foundation.

EXCLUSIVE APRIL BONUSES:

1. PERSONALISED NET POSITION

-

-

- Receive a detailed breakdown of your financial standing to kickstart your journey.

2. ADDITIONAL SOURCES

-

-

- Bonus worksheets and guides to help you implement what you learn.

Conclusion

Regular coaching isn’t just about managing money; it’s about creating a lifestyle that aligns with your values and aspirations. With expert guidance, a wealth of resources, and a supportive community, you’ll gain the clarity and confidence to take control of your financial future. Don’t wait – join THE VAULT today and make this the year you achieve your financial dreams!

Apr 2, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle

Financial freedom isn’t just about saving money or cutting costs; it’s about truly understanding your financial position. Knowing your numbers means gaining a clear picture of your assets, liabilities, income, and expenses. This knowledge is the foundation for making informed decisions, reducing financial stress, and achieving stability. In this blog, we’ll explore why knowing your numbers is essential and how you can start your journey toward financial clarity today.

Why Knowing Your Numbers Matter

Many people focus on earning more or spending less, but without knowing your numbers, it’s like driving a car without a map or GPS. You might be moving, but you’re not necessarily headed in the right direction. Here’s why understanding your financial position is crucial:

-

- Know Where You Stand: Your net position – the difference between what you own and what you owe is a snapshot of your financial health. It gives you a clear idea of whether you’re building wealth or falling behind.

- Set Realistic Goals: When you know your numbers, you can set achievable financial goals, like paying off debt, saving for a home, or building an emergency fund.

- Identify Opportunities for Growth: Understanding your financial position helps you spot areas where you can save more, invest smarter, or cut unnecessary expenses.

- Reduce Financial Stress: Clarity about your finances reduces anxiety and empowers you to make confident decisions.

Your financial assets consist of your savings, investments, and retirement funds, which represent the resources you own that can contribute to your financial security and future wealth.

Breaking Down the Basics – What to Track

Knowing your numbers involves more than just looking at your bank balance. Here’s what you need to assess:

1. ASSETS

-

-

-

- Tangible Assets: Your home, car, or valuable items like jewellery or collectibles.

- Financial Assets: Savings accounts, investments, and retirement funds.

2. LIABILITIES

-

-

-

- Debts: Credit cards, personal loans, student loans, and mortgages.

- Recurring Obligations: Bills, subscriptions, and other regular expenses.

3. INCOME

-

-

-

- Primary Income: Salary or wages.

- Secondary Income: Side hustles, investment dividends, or rental income.

4. EXPENSES

-

-

-

- Fixed Expenses: Rent, insurance, and utilities.

- Variable Expenses: Groceries, entertainment, and travel.

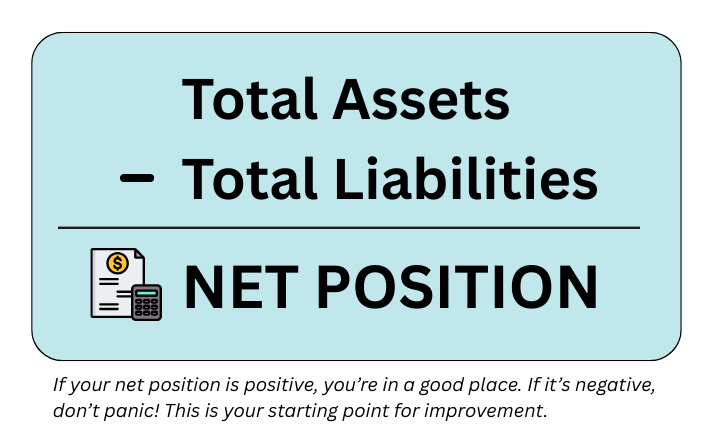

How to Calculate Your Net Position

The formula is simple: Net Position = Total Assets – Total Liabilities. Here’s an example:

Assets: $200,000 (home equity, savings, investments)

Liabilities: $150,000 (mortgage, credit card debt, loans)

Net Position: $50,000

If your net position is positive, you’re in a good place. If it’s negative, don’t panic this is your starting point for improvement.

Steps to Take Control of Your Numbers

1. START WITH A FINANCIAL INVENTORY

-

-

-

- Make a detailed list of all assets and liabilities.

- Use tools like spreadsheets or budgeting apps for accuracy.

2. TRACK YOUR SPENDING

-

-

-

- Review your bank and credit card statements to understand your spending habits.

- Categorise expenses to identify areas for adjustment.

3. CREATE A FINANCIAL PLAN

-

-

-

- Set short-term, medium-term, and long-term goals.

- Prioritise high-interest debt and build an emergency fund.

4. REVIEW REGULARLY

-

-

-

- Schedule monthly or quarterly reviews to track progress.

- Adjust your plan as needed based on life changes.

Common Mistakes to Avoid

1. IGNORING THE BIGGER PICTURE

-

-

- Focusing only on day-to-day expenses without understanding your overall financial health.

2. PROCRASTINATING

-

-

- Delaying the process of assessing your finances can make it harder to take control.

3. OVERLOOKING SMALL DEBTS

-

-

- Small debts add up and can significantly impact your net position.

4. NOT SEEKING HELP

-

-

- Don’t hesitate to consult a financial coach or use resources like our “Know Your Numbers” course.

How Our Course Can Help

Our “Know Your Numbers” course is designed to make this process easy and actionable. Here’s what you’ll gain:

1. STEP-BY-STEP GUIDANCE

-

-

- Learn how to assess and improve your financial position.

2. PRACTICAL TOOLS

-

-

- Access calculators, templates, and worksheets.

3. EXPERT INSIGHTS

-

-

- Benefit from tips and strategies sared by experienced financial coaches.

4. ONGOING SUPPORT

-

-

- Get access to our community and resources for continued learning.

Real Life Success Stories

- Emma’s Journey: After taking the “Know Your Numbers” course, Emma discovered she had enough savings to pay off a small loan. She’s now building her emergency fund and feels more confident about her future.

- James’ Transformation: James used the tools from the course to identify unnecessary expenses. By cutting these costs, he’s saved over $500 a month and is on track to pay off his credit card debt.

Conclusion

Knowledge is power, especially when it comes to your finances. Understanding your numbers isn’t just a one-time task—it’s a habit that leads to financial freedom. Take control of your financial future by joining our “Know Your Numbers” course today. Let’s build a stress-free, confident financial life together.