Jan 21, 2026 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Saving Money, Self Development, Side Hustle, Welcome

It’s Not Just About the Numbers – It’s About Your Mindset

Look, you can have the best spreadsheet in the world…

You can download all the budget apps, cut back on coffee, and cancel every subscription.

But if your money mindset hasn’t shifted? You’ll still feel stuck, overwhelmed, or like “you’re just not good with money.”

Let’s fix that because 2026 is the year we stop dragging last year’s money baggage into our future.

This blog is your ultimate guide to resetting your mindset, clearing out old financial beliefs, and building a powerful, positive relationship with money.

And yes – it’s fun, it’s doable, and it’s way more effective than another boring budget.

Let’s go.

What Even Is a Money Mindset?

Your money mindset is the collection of beliefs, emotions, and thoughts you have about money. It’s your personal “money story” – the internal script you repeat (often subconsciously) about earning, saving, spending, and wealth.

Some of it comes from your childhood, your past experiences, or society’s weird money rules. And here’s the wild part: It influences every single money decision you make.

Your mindset determines whether you:

- Save confidently or hoard out of fear

- Ask for more money or shrink your value

- Budget with ease or avoid your bank balance like it’s haunted

Signs You Might Need a Money Mindset Reset

?♀️ You feel anxious or guilty every time you spend money

? You avoid looking at your bank account or credit card

?♂️ You say things like “I’m just bad with money” or “I’ll never get ahead”

?♀️ You feel stuck in a paycheck-to-paycheck cycle, even when your income grows

If that sounds like you, it doesn’t mean you’re broken – it means it’s time to reprogram your financial brain.

Step 1: Identify the Old Money Stories Holding You Back

Before you can shift your mindset, you need to see what you’re working with.

Ask yourself:

- What did I learn about money growing up?

- What do I believe about wealthy people?

- When I think about money, do I feel free or fearful?

Some common limiting beliefs:

- “There’s never enough money.”

- “Money is hard to manage.”

- “I’m not good with numbers.”

- “More money means more stress.”

? None of these are facts. They’re just beliefs. And beliefs can change.

Step 2: Choose Empowering New Money Beliefs

You get to write a new story this year. Start by replacing the old thoughts with intentional, positive ones:

Instead of: “I’m bad with money” → Say: “I’m learning how to manage my money powerfully.”

Instead of: “I’ll never get ahead” → Say: “Every dollar I manage well moves me forward.”

Instead of: “Money is stressful” → Say: “Money is a tool I’m learning to use with confidence.”

✨ Tip: Write your new beliefs down. Post them on your mirror. Make them your phone wallpaper. Say them out loud. Train your brain to believe better.

Step 3: Connect Your Money to What You Actually Value

Ask yourself:

- What do I want money to do for me this year?

- What do I value most – freedom? stability? generosity? joy?

- How can I align my spending and saving with those values?

Example:

If you value peace of mind, create a savings plan.

If you value freedom, reduce debt.

If you value fun, build in guilt-free spending money.

Money doesn’t just serve numbers – it should serve your life.

Step 4: Make Mindset Work Part of Your Routine

You don’t go to the gym once and expect abs, right?

Same with your mindset. It takes repetition.

Here’s a weekly reset routine you can follow:

? Money Mindset Reset (10 Minutes):

- Review your thoughts from the week – what came up around money?

- Journal one thing you’re proud of financially

- Write or say one new belief out loud

- Visualise yourself succeeding with money

? Do this every Sunday before your weekly budget check-in and you’ll be unstoppable.

Step 5: Surround Yourself With New Financial Energy

If you want to upgrade your mindset, you need to upgrade your environment.

That might look like:

- Listening to empowering money podcasts

- Following financial educators who speak your language (hello ? yes me ?)

- Talking about money with friends who are also growing

- Hiring a coach who helps you reframe, reset, and rise (hello ? yes me again ?)

You can’t change your money mindset in isolation. That’s why I created my Financial Muscle Coaching Membership. It’s where financial growth meets real community and support.

Step 6: Replace Shame With Curiosity

When things go “wrong” you overspend, forget a bill, or avoid a budget – don’t spiral into shame. Instead, ask:

- What triggered this?

- What do I need right now – support, structure, or space?

- What can I do differently next time?

Every financial hiccup is just data. Don’t let one moment of messiness define your entire money story.

You’re allowed to be a work in progress and a success story at the same time.

Step 7: Set Mindset-Based Goals for the Year

Let’s skip the boring “save more, spend less” vibe.

Try these instead:

- “This year, I’m building my financial self-trust.”

- “This year, I’m proving I can stick to one habit consistently.”

- “This year, I’m learning to enjoy managing my money.”

Then break that into monthly goals:

✅ January: Track every dollar

✅ February: Create a spending plan aligned to my values

✅ March: Build an emergency fund of $300

Momentum creates confidence and mindset fuels momentum.

Final Thoughts: You Can’t Budget Your Way Out of a Scarcity Mindset

If you’re stuck in fear, guilt, or shame around money, no spreadsheet will save you. You have to go deeper. And you have to believe that a new relationship with money is possible for you.

Because it is.

You are not bad with money.

You are not too far behind.

You are not stuck – you’re just getting started.

And when you build a strong, positive money mindset? Everything else gets easier.

Let’s build that mindset muscle together.

? Join Financial Muscle Coaching

If you’re ready to change your money mindset, build real financial confidence, and create a life that feels good – not just looks good on paper – I’ve got you.

Join Financial Muscle Coaching – my coaching community where we:

✅ Rewrite limiting money stories

✅ Build strong, sustainable habits

✅ Create aligned goals you actually want to follow

This isn’t just budgeting. This is mindset, motivation, and muscle – built week by week, with me in your corner.

Your money mindset reset starts here. Let’s go. ?

#HowToResetMyMoneyMindset #WhyDoIFeelOutOfControlWithMoney #HowToFeelInControlOfFinances #ResetMoneyMindset2025 #NewYearFinancialMindset #HowToStartFreshWithMoney #MindsetShiftForMoney #RebuildMoneyConfidence #WhatIsMoneyMindset #MoneyMindsetTransformation #MoneyMindset #MoneyConfidence #FinancialReset #MoneyHealing #FinancialEmpowerment #AbundanceMindset #WealthMindset #MoneyCoach #MoneyGoals2025 #FinancialMuscle

Jan 14, 2026 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Estate Planning, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Mindset, Mortgage, Net Worth, Retirement, Saving Money, Self Development

New Year, Same Resolutions? Let’s Talk About It.

Ahhh January the month of green smoothies, gym selfies, and freshly purchased planners that are definitely going to change your life this time, right?

If you’re like most people, you’ve probably made a few New Year’s resolutions that sounded amazing on January 1st… but by February? They’re long forgotten, buried under Uber Eats receipts and good intentions.

And when it comes to money goals? Ohhh, this is where the guilt hits hard.

So let’s break it down: Why do New Year’s resolutions fail and what can you do instead to actually stick to your financial goals this year?

Spoiler: It’s not about willpower. It’s about building financial muscle and that’s what I help people do every day.

The Stats Don’t Lie – Most Resolutions Don’t Last

According to research:

- 43% of people expect to fail their resolutions by February

- Only 9% actually feel successful by the end of the year

- The most common failed resolutions? Diet, fitness… and yes — money

Why? Because most resolutions are made in the heat of a moment – not rooted in a system, a strategy, or support.

We say things like:

- “I’m going to save $5,000 this year!”

- “I’m cutting up ALL my credit cards!”

- “I’ll never spend money on takeout again!”

…but we don’t have a real plan behind it. Just hope, hype, and maybe a pretty notebook.

Why Financial Resolutions Fail: The Real Talk

Here’s what I’ve seen in my coaching practice over and over:

- The goal is too vague.

“Get better with money” isn’t a goal – it’s a wish. Your brain doesn’t know what to do with that.

- There’s no timeline.

Saving “someday” or “this year” doesn’t create urgency or clarity.

- You try to do too much, too fast.

Going from zero to “never spending a dollar unless it’s pre-budgeted” is like deciding to run a marathon when you haven’t walked around the block in months.

- No accountability.

When you’re the only one who knows your goals… it’s easy to quit. Life gets busy, bills pile up, and suddenly, your “big resolution” is a tab you closed weeks ago.

- Shame gets in the way.

One slip-up, and your inner critic screams, “See?! You always mess this up!” And so you give up again.

Sound familiar?

So What Actually Works? (This Is Where It Gets Fun)

Instead of setting rigid resolutions, try this instead:

✅ Set Clear Financial Intentions – Not Punishments

Financial intentions focus on who you want to become and how you want to feel – not just what you want to do.

For example:

- “I want to feel peaceful when I check my bank account.”

- “I want to be someone who saves consistently.”

- “I want to feel proud of my money decisions.”

From there, we build small, tangible goals that align with that intention. That’s the sweet spot.

✅ Build Micro Goals That Stack Into Momentum

Instead of “Save $5,000 this year,” try:

- “Transfer $100 every payday to my savings account.”

- “Do 1 no-spend weekend per month.”

- “Track my spending daily for 30 days.”

These small actions feel doable and when done consistently, they change everything.

✅ Have a System – Not Just a Goal

Anyone can write a goal. But what’s your system to get there?

Here’s a basic system I teach inside my Financial Muscle Coaching:

- Weekly money check-ins (10 minutes)

- Monthly budget reviews

- Track 1 habit at a time (like spending or debt payments)

- Celebrate progress every month.

Systems create structure and structure creates success. Don’t wait – join the membership now and start living your best life from today.

#WhyDoResolutionsFail #HowToStickToFinancialGoals #WhyCantIKeepNewYearGoals #NewYearMoneyResolutionHelp #HowToMakeMoneyGoalsThatLast #MoneyGoalsNotResolutions #HowToStayMotivatedWithMoney #BreakTheCycleWithMoney #SmartFinancialGoals2025 #BuildBetterMoneyHabits #NewYearsResolutionFail #MoneyGoals2025 #FinancialGoalsThatStick #BudgetGoals #MoneyHabits #ResolutionReset #MoneyCoaching #FinancialMuscle #GoalSettingTips #SmartMoneyMoves

Jan 7, 2026 | Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Side Hustle

The holiday lights have dimmed, the decorations are packed away, and the credit card bill has landed in your inbox. January can feel like a financial hangover – but it doesn’t have to stay that way. The new year is the perfect time for a fresh start with your money. Let’s turn those post-holiday regrets into real financial progress.

Step 1: Acknowledge the Overspend – Without Shame

Let’s be real. You probably didn’t mean to go overboard, but the season has a way of loosening our wallets. Flash sales, peer pressure, holiday cheer – it’s a perfect storm of spending. Here’s the deal: You’re not bad with money. You’re human.

The first thing I tell my clients: “You can’t change what you won’t face.” So open those credit card statements, take a breath, and look at the total. It’s just data and now you’re in the driver’s seat.

Step 2: Have a “Money Review Day”

Set aside one focused hour this week for your personal “Money Review Day – grab a coffee, and get into CEO mode:

? Print or pull up your December statements

? List your total credit card balances

? Note the interest rates and minimum payments

✂️ Highlight 3 spending categories to cut back this month

This is about clarity, not judgment. Think of it as gathering puzzle pieces before you start putting them together.

Step 3: Set a Short-Term Payoff Goal

Massive goals feel good in theory, but small wins are what keep you going. Look at your balances and pick ONE target:

- Your smallest balance to clear quickly (Snowball method)

- Your highest-interest card to save money (Avalanche method)

Example: If you owe $3,000 across 3 cards, focus on paying off the $500 one first. That win builds confidence and momentum.

Step 4: Build a Realistic January Budget

Post-holiday budgeting is all about breathing room. Not punishment. Build a one-month “recovery budget” that helps you regain control:

✅ Cover essentials first: Rent/mortgage, food, utilities, transport

❌ Cut or pause: Subscriptions, takeout, impulse buys

? Redirect: Any leftover funds go straight to your debt goal

Even an extra $50 a week toward debt adds up. And if money is tight? See if you can generate a little extra (selling unused items, picking up a side hustle, cashback apps, etc.).

Step 5: Create a “Holiday Payback Plan”

If you overspent by $1,200 in December, divide that into 6 monthly chunks: $200/month. Add it to your budget now and automate it.

This isn’t about guilt – it’s about taking control on your terms. When you have a plan, the weight of the debt gets lighter.

Step 6: Replace Shame with Strategy

Negative self-talk like “I’m terrible with money” only reinforces stuck patterns. Flip the script:

❌ “I can’t believe I did this again.”

✅ “I’m learning new habits that support my goals.”

Money is emotional and mindset matters. Be your own biggest ally, not your harshest critic.

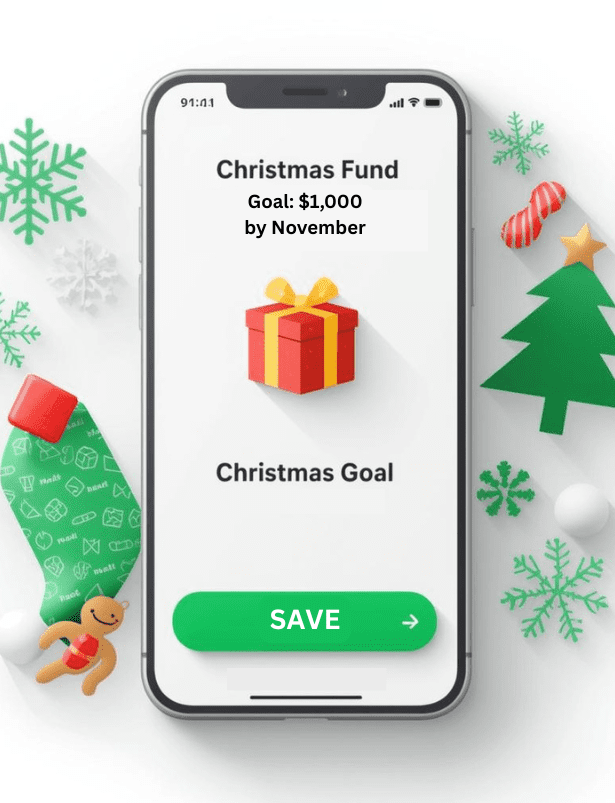

Step 7: Future-Proof Next Year with a Holiday Fund

Want to avoid this January stress next time? Start now with a holiday sinking fund:

- Name it: “Holiday Joy Fund”

- Set a goal: $1,000 by November

- Break it down: $42/month or $21/paycheck

Automate it. When next December hits, you’ll be ready, and proud of yourself.

Step 8: Find a Support System

This journey is easier (and more fun) when you don’t do it alone. Whether it’s a money buddy, group, or coach – accountability is the secret sauce. That’s where my “Financial Muscle Coaching Membership” helps keep you accountable and gives you to the tools and knowledge to update your financial future.

Most people don’t need more information. They need support, structure, and a system.

Final Thoughts

You don’t have to fix everything overnight. But you do have to start. And now is the perfect time. Your financial reset starts with one decision, one action, and one new mindset: You’re in control now.

Ready to stop feeling stuck and finally build real financial momentum? Join Financial Muscle Coaching – this is a membership designed to help you rebuild, reset, and grow stronger with your money. It’s time to train your financial muscles and feel powerful about your money choices.

Let’s make this your best money year yet. ??

#HowToRecoverFromOverspending #HolidayDebtHelp2025 #PostHolidayMoneyStress #GetBackOnTrackFinancially #HowToResetMoneyAfterTheHolidays #OverspentAtChristmasNowWhat #NewYearFinancialReset #HowToFixMyFinancesAfterHolidays #MoneyRecoveryPlan #CreditCardHangoverHelp

Dec 31, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Net Worth, Relationships, Saving Money, Self Development

There’s something magical about a fresh new year. It feels like a blank notebook just waiting to be filled – new hopes, new habits, and new opportunities. And when it comes to your finances, January is the perfect time to channel that energy into building momentum that lasts all year long.

Forget the overwhelming resolutions list. This year, it’s about starting small, starting strong, and building money confidence that fuels everything else in your life. Ready to step into 2026 with fresh energy? Here’s how.

? Step 1: Choose Your 2026 Money Theme

Instead of setting a dozen resolutions, pick a single theme to guide your financial decisions this year.

Examples:

- Growth: Focus on building savings or investments

- Freedom: Prioritise paying off debt

- Stability: Build your emergency fund

- Intentionality: Track spending and align with your values

Your theme becomes a compass. Whenever you face a financial choice, you can ask: Does this support my 2026 money theme?

? Step 2: Set One Clear Goal for January

Don’t wait until mid-year to make progress. Start now with one achievable goal this month. Ideas:

- Save $100 by cutting one expense (like takeaway coffees or subscriptions)

- Track every expense for 30 days

- Make an extra payment toward debt

- Open a new savings account for your emergency fund

When you achieve a quick win in January, you build confidence that sets the tone for the year.

? Step 3: Refresh Your Budget for the New Year

Your life has probably shifted since last January, so your budget should too. Take stock of:

- Your current income

- Your fixed expenses (rent, utilities, insurance)

- Your variable expenses (groceries, fun, travel)

- Your financial goals (savings, debt, investing)

Give every dollar a purpose. Remember, your budget isn’t about restriction – it’s a plan for freedom and choice.

? Step 4: Build Money Habits That Stick

The new year isn’t about overnight change – it’s about consistency.

Focus on simple, sustainable habits:

- Weekly money check-ins (15 minutes to review spending and update your budget)

- Automatic savings transfers on payday

- Meal planning to cut food waste and overspending

- Tracking your progress toward one goal each month

Habits create momentum. And momentum creates results.

✨ Step 5: Infuse Your Money Journey With Joy

Money confidence isn’t just about numbers – it’s about how you feel. This year, commit to making your financial journey something you enjoy.

Ideas:

- Celebrate small wins with non-spending rewards (like a relaxing night in or a walk in nature)

- Share your goals with a friend or accountability partner

- Create a money vision board for 2026

- Journal about what financial freedom looks and feels like for you

When you connect money with joy, you’ll find it easier to stick with your goals.

? Step 6: Create a Future-You Fund

Want to feel truly confident? Start building a little cushion for the future.

- Begin or boost your emergency fund

- Start a sinking fund for Christmas, travel, or birthdays

- Increase your superannuation contributions, even by 1%

Every dollar you set aside is a gift to your future self. And future-you will thank you for it.

? Final Thoughts: Step Into 2026 With Confidence

This new year isn’t about perfection. It’s about progress. It’s about taking small, intentional steps that align with your goals and values.

So choose your theme, set your January goal, refresh your budget, and commit to simple habits. Celebrate the wins along the way, and don’t forget to enjoy the journey.

Because 2026 is your story to write – and this year, you get to write it with confidence, clarity, and fresh money energy.

Dec 24, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Mindset, Relationships, Saving Money, Self Development

The Christmas decorations are packed away, the calendar is almost at its final page, and 2026 is knocking on the door. Before we rush ahead with resolutions and new goals, this is the perfect moment to pause, reset, and give your finances a fresh start.

Think of it as a deep clean for your money: clearing out the clutter, tying up loose ends, and laying down a solid foundation for the year ahead. You don’t need a complete financial overhaul – just a few intentional steps to get organised, centred, and ready for what’s next.

Here’s your Year-End Money Reset in 5 simple steps.

Step 1: Review the Year That Was

Start by taking an honest look at your 2025 money story:

- How much did you save?

- What debts did you pay down?

- Where did most of your money go?

- What financial habits worked well, and which ones didn’t?

Pull up your bank statements, budgeting app, or a notebook and jot down your reflections. This isn’t about judgement – it’s about awareness. You can’t reset what you don’t measure.

Step 2: Tidy Up Loose Ends

Before the year ends, clear out the financial “clutter” that weighs you down:

- Pay off small lingering balances if you can

- Cancel unused subscriptions or memberships

- Return any holiday items you overspent on and don’t really need

- Check expiry dates on gift cards (and use them!)

These little steps free up money and mental space, setting you up for a cleaner slate in 2026.

Step 3: Check Your Financial Health

Now’s the time to give yourself a quick financial check-up:

- Emergency fund: Do you have at least $500 – $1,000 set aside for surprises?

- Debt: What balances remain, and what’s your repayment plan?

- Credit score: Check it – it’s easier (and cheaper) to fix issues early

- Savings and investments: Review your pension contributions, ISAs, or other savings accounts

Think of this as your “financial MOT.” A little check-up now prevents breakdowns later.

Step 4: Set a Fresh Budget Blueprint

Don’t wait for January 1st – start shaping your new budget now.

Your 2026 budget should reflect:

- Your income (any changes for the new year?)

- Your fixed expenses (rent, mortgage, bills)

- Your goals (savings, debt repayment, travel plans)

- Your lifestyle values (fun, hobbies, giving)

Keep it simple: Give every dollar a job. Whether it’s for bills, savings, or fun, assign it with intention. Use a budgeting app, a spreadsheet, or even pen and paper – whatever works for you.

Step 5: Choose One Money Focus for 2026

Instead of overwhelming yourself with a list of 10 resolutions, choose one core financial focus for the new year. This helps you stay clear, consistent, and motivated.

Examples:

- Build a $1,000 emergency fund

- Pay off one credit card completely

- Increase monthly savings by $100

- Track every expense for 90 days

Your focus becomes your compass, guiding your decisions and reminding you why you’re saying yes – or no – in the moment.

✨ Final Thoughts: Reset, Refresh, and Move Forward

A year-end reset doesn’t have to be complicated. By reviewing your year, clearing financial clutter, checking your money health, setting a new budget, and choosing one core focus, you’ll walk into 2026 lighter, clearer, and ready to thrive.

This isn’t about being perfect. It’s about progress. And every small step you take now builds momentum for a stronger financial future.

So, give yourself the gift of a money reset. 2026 is your blank page – make it a story you’re proud to write.

Dec 10, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Saving Money, Self Development

The tree has come down, the last slice of Christmas pudding is gone, and you’re finally catching your breath after the festive whirlwind. But then it happens – you open your credit card statement, and suddenly that Christmas cheer feels like a distant memory. The dreaded post-Christmas credit card hangover has arrived.

The good news? You can absolutely enjoy Christmas without carrying financial regret into the new year. With a few mindful strategies, you can celebrate fully and start January feeling confident, not crushed by debt. Here’s how to make it happen.

Step 1: Set a Christmas Spending Limit (Before You Shop)

Your credit card limit is not your Christmas budget. Decide what you can comfortably spend this festive season without borrowing from your future self.

Ask yourself:

- How much cash do I realistically have available for Christmas?

- What regular bills and obligations still need to be covered?

- Can I set aside money weekly in December to spread out costs?

Write down a total number – this is your Christmas spending cap. Stick to it, even when those festive sales scream your name.

Step 2: Create a Cash-First Plan

One of the easiest ways to avoid a credit card hangover is to use as little credit as possible during Christmas.

- Pay with debit or cash where possible

- Set aside weekly envelopes for gifts, food, and fun

- Use prepaid cards to cap your spending

- If using credit online, track it immediately and set a repayment date

Pro tip: Leave your credit card at home when shopping in person. It’s much harder to overspend when you don’t have the option. Try using a visa debit card, which is actually your money and when you run out that’s it!

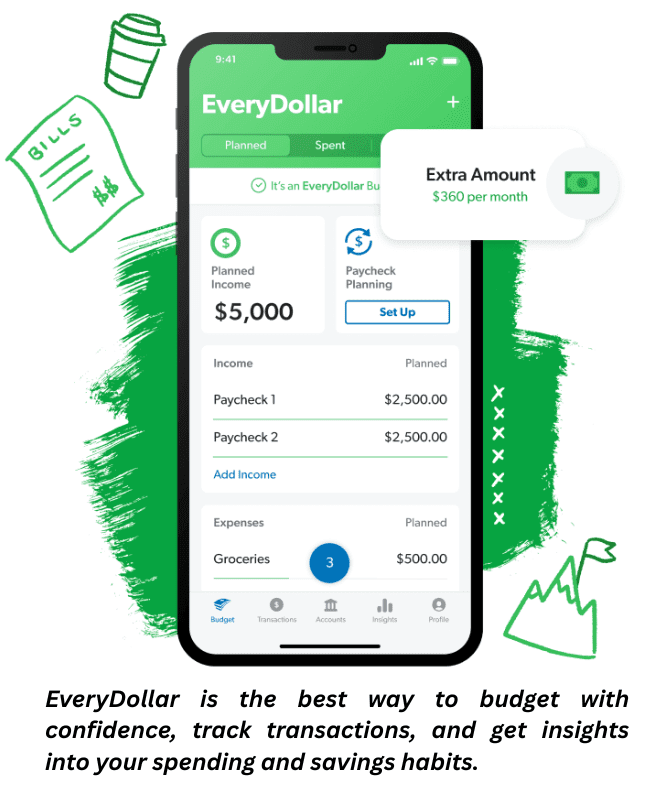

Step 3: Track Every Dollar (Yes, Every Single One)

In the Christmas chaos, it’s easy to lose track of spending – but that’s how the January shock sets in. Ways to stay on top:

- Use budgeting apps like YNAB, EveryDollar, or Mint

- Keep a festive spending log in a notebook or phone note

-

- Do weekly money check-ins throughout December

Think of it as financial self-care. Awareness is your secret weapon.

Step 4: Be Strategic With Gifts

Gifts are often the biggest Christmas expense, but they don’t have to wreck your budget.

Tips for staying intentional:

- Make a list of who you’re buying for before you shop

- Set a per-person limit and stick to it

- Consider Secret Santa to cut the number of gifts

- Swap expensive items for homemade or experience-based gifts

- Remember: thoughtful beats flashy every time

No one worth celebrating wants you to go into debt for their gift.

Step 5: Plan for Food and Festivities

Christmas isn’t just about presents – the meals, parties, and little extras add up quickly. Save money by:

- Planning meals in advance

- Shopping early for non-perishables

- Hosting potluck-style dinners

- Saying no to extras that don’t truly add joy

When you prepare in advance, you avoid last-minute dashes (and expensive impulse buys).

Step 6: Watch Out for Emotional Spending Triggers

Christmas marketing is designed to play on your heartstrings. Nostalgia, urgency, and guilt can all push you to overspend. Ask yourself:

- Am I buying this because I want to – or because I feel pressured?

- Will this bring lasting joy, or just temporary excitement?

- Does this purchase align with my budget and values?

Your wallet deserves as much protection as your peace of mind.

Step 7: Practice Festive Financial Self-Care

Money stress can quickly steal your Christmas spirit. Make self-care part of your financial strategy:

- Take breaks from social media (comparison is a sneaky trigger)

- Remind yourself that Christmas isn’t a competition

- Journal your money intentions for the season

- Share your budget boundaries with loved ones

The more grounded you feel, the easier it is to resist overspending.

? Step 8: Create a January Recovery Plan

If you do use your credit card this Christmas, set a plan for repayment:

- Tally up what you’ve spent

- Divide it into weekly or monthly repayment goals

- Automate payments so you stay on track

Even better? Plan a “No-Spend January.” Cutting back in the new year can help you reset your budget and clear any lingering balances faster.

Bonus: Start a Christmas Sinking Fund for Next Year

Want to avoid the stress altogether next time? Build a sinking fund.

Example:

- Decide on for example a $3000 Christmas budget for 2025

- Divide by 12 months = $250/month

- Set up an automatic transfer to a separate savings account

Come December, you’ll be ready – no credit cards needed.

Final Thoughts: A Debt-Free Christmas Is the Best Gift

The magic of Christmas isn’t in the size of the presents or the amount spent – it’s in the moments, the laughter, and the love. Avoiding the post-Christmas credit card hangover means entering the new year lighter, freer, and more empowered.

So give yourself the gift of financial peace. Spend with intention, set boundaries, and remember: your presence is always more valuable than the presents under the tree.