Money Isn’t the Problem – Your Brain Might Be!

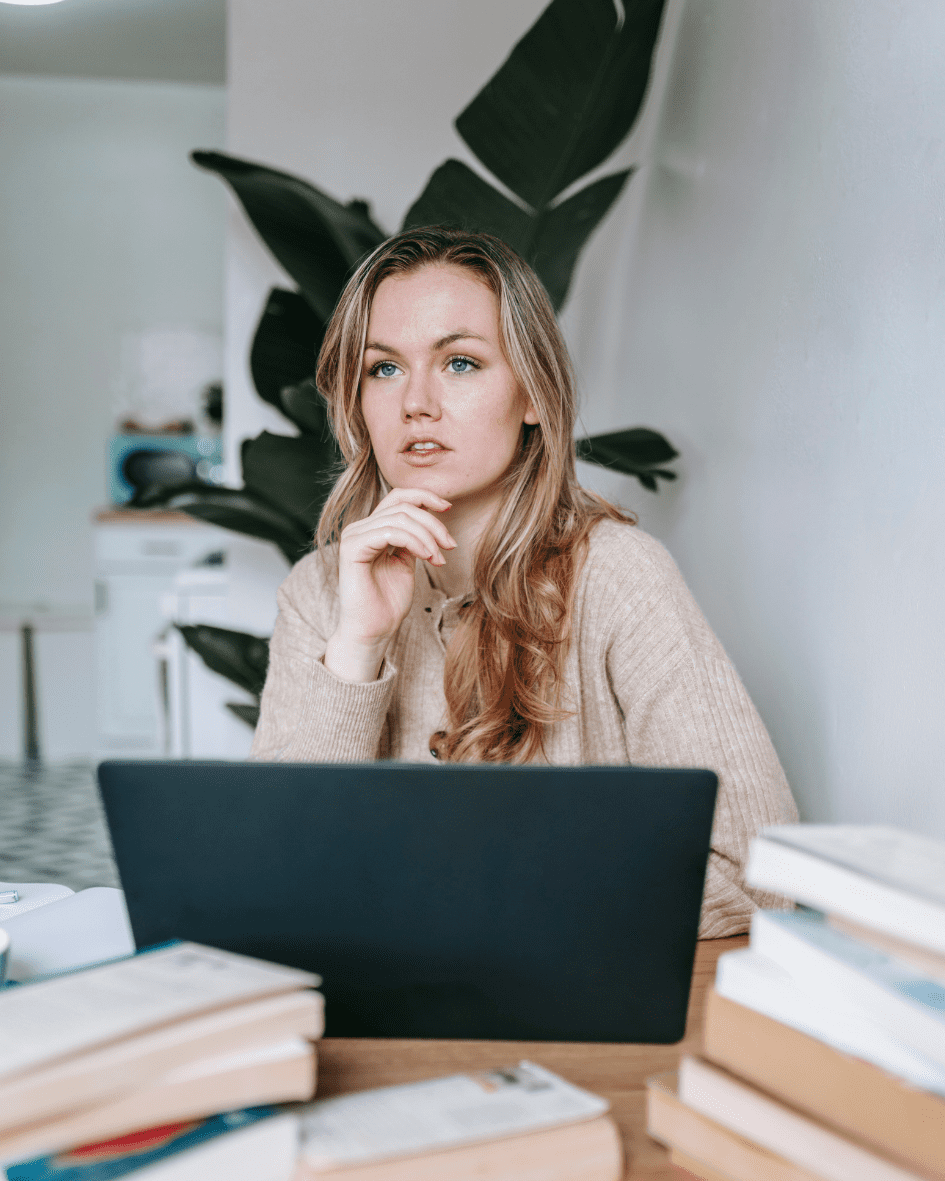

Feeling Stuck with Money? You’re Not Alone

Ever feel like no matter how hard you work, money keeps slipping through your fingers?

You track your spending, download another budgeting app, maybe even try a no-spend challenge (ugh)…

But nothing sticks. You’re still stressed, still overspending, and still wondering why money feels so hard.

Here’s a radical idea that might blow your mind:

Your financial struggle isn’t just about money. It’s about your mindset.

If you’ve ever told yourself:

- “I’m just not good with money.”

- “I’ll never get ahead.”

- “I’m terrible with numbers.”

- “There’s never enough to go around.”

…then guess what? You’re not bad with money.

You’re just running an outdated mental program and it’s time to upgrade your system.

? Your Mindset Is the Missing Link in Money Management

Let’s get one thing straight: You weren’t born with your current money habits.

They were learned, shaped, and reinforced over years often by:

- What you saw growing up

- What society tells you about money

- Your past financial “mistakes”

- Deep, often unconscious beliefs about what’s possible for you

Most of us were never taught how to actually think about money in a healthy, empowering way.

Instead, we internalise things like:

- “Money doesn’t grow on trees.”

- “Rich people are greedy.”

- “You have to work hard to make money.”

These beliefs shape our thoughts.

Our thoughts drive our behaviours.

Our behaviours determine our results.

? “Change your thoughts, and you change your world.” – Norman Vincent Peale

? Meet the RAS: The Tiny Brain Filter That Shapes Your Reality

One of the most powerful (yet overlooked) players in your financial journey is your Reticular Activating System (RAS).

It’s a tiny bundle of nerves in your brainstem that acts like a filter, allowing in information that matches your beliefs and blocking out everything else.

In short:

- If you believe money is hard to come by, your RAS will filter out opportunities and highlight obstacles.

- If you believe you’ll never get ahead, your RAS will literally make it harder to see paths to progress.

It’s not woo-woo. It’s neuroscience. ?⚡

But here’s the good news: You can train your RAS to focus on abundance, opportunity, and growth. That’s the work we do in my Master Your Money program – and it works.

? 5 Limiting Beliefs That Keep You Financially Stuck

Let’s get real for a moment. Most people are walking around with a money mindset full of invisible roadblocks.

Here are 5 common ones that might be running in the background of your brain:

- “I’m just not good with money.”

→ Translation: I’ve made mistakes, and now I believe they define me. - “There’s never enough.”

→ Leads to hoarding, fear-based spending, or total avoidance. - “I always mess it up.”

→ Creates shame, procrastination, and financial self-sabotage. - “If I make more, I’ll lose it anyway.”

→ Keeps you stuck at your current income level (or worse). - “Wanting wealth is greedy or selfish.”

→ Prevents you from receiving more, even when you’ve earned it.

Sound familiar?

The first step to changing your results is changing these beliefs. But how? Let’s walk through a simple reframe technique that works fast.

? Flip the Script: How to Rewire a Limiting Money Belief

Step 1: Identify the belief

Example: “I’ll never be debt-free.”

Step 2: Ask yourself, “Where did I learn this?”

Maybe from watching your parents struggle, or after repeated financial setbacks.

Step 3: Write the empowering opposite

✅ “I am taking steps every day toward financial freedom.”

✅ “My past doesn’t define my financial future.”

✅ “I am capable, committed, and in control.”

Now, speak that new belief out loud every morning.

Yes – out loud. You’re rewiring your brain. It needs to hear the new code.

?♀️ Practice Mindful Money: A Daily 5-Minute Ritual

You don’t need hours of meditation or 12-tab spreadsheets to take control of your finances.

You just need five intentional minutes a day.

Here’s a powerful money mindfulness ritual to try:

? Each morning or evening:

- Check in with your emotions around money.

- Am I feeling anxious? Grateful? Avoidant?

- Review your spending from the past 24 hours.

- One win + one lesson.

- Name your money goal for the week.

- Keep it small and actionable: “Track all spending” or “Bring lunch from home 3x.”

- Say your top 3 affirmations out loud.

- Examples: “I am aligned with abundance.” “Money flows to me with ease.” “I am in control of my financial future.”

Repeat for 30 days and watch how much more confident, clear, and calm you feel around money.

? Why This Work Matters More Than Spreadsheets

I’ve been in the financial industry since 1986.

I’ve seen people transform their finances not because they suddenly won the lotto or got a huge raise…

…but because they shifted how they think about money.

They rewired their brains for:

- Financial confidence

- Resilience

- Peace of mind

- And yes – wealtH

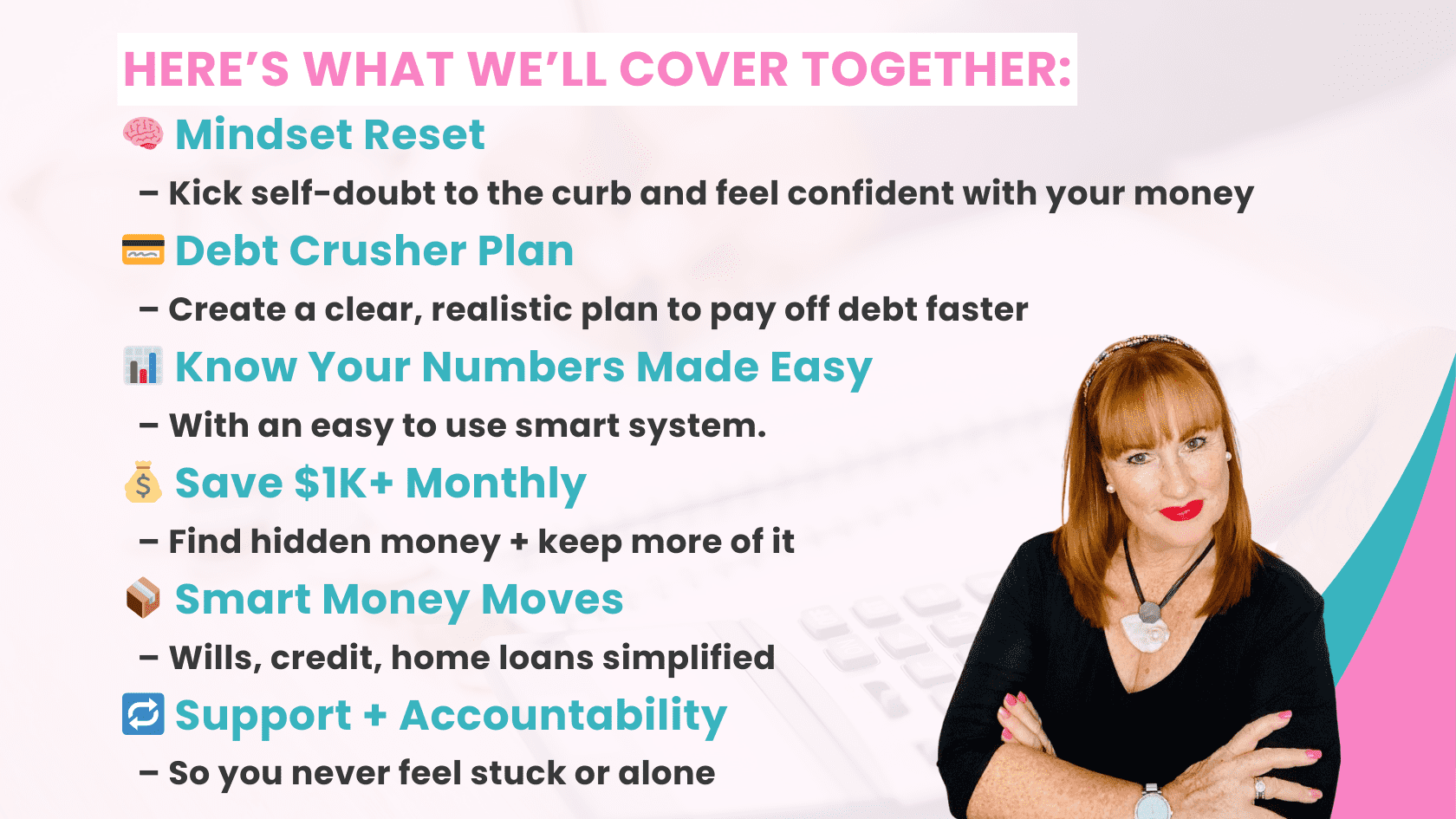

And that’s why I created the Master Your Money program.

It’s not just another budgeting course. It’s a 30-day, mindset-first reset that helps you finally stop the cycle of stress, sabotage, and shame around money and start creating real momentum towards financial freedom.

? What Happens When You Rewire Your Money Mindset?

✨ You stop panic-spending and start making calm, intentional choices.

✨ You forgive your past mistakes and take empowered action today.

✨ You feel in control – even if your income hasn’t changed yet.

✨ You start attracting new opportunities, support, and even more money.

This is the magic of mindset.

It works. It’s real. And it’s within your reach.

? Try This: Your 7-Day Money Mindset Challenge

Want to get a taste of what mindset work can do for you?

Here’s a simple challenge to try this week:

Day 1: Write your 3 biggest money fears

Day 2: Flip each into an empowering belief

Day 3: Create a 5-minute money ritual

Day 4: Track one spending habit with curiosity (not judgment)

Day 5: Visualise your ideal financial future

Day 6: Celebrate one money win

Day 7: Journal what’s shifted emotionally, mentally, or financially

You’ll be amazed what starts to change in just one week.

? Ready to Go Deeper? Join Master Your Money!

If you’re tired of feeling:

- Confused about where your money goes

- Anxious every time a bill lands

- Guilty when you spend (or don’t)

- Stuck in a financial Groundhog Day…

Then you’re ready for a reset.

Not just in your bank account – but in your brain.

My Master Your Money 30-day program walks you step-by-step through:

✅ Rewiring limiting beliefs

✅ Creating daily habits that stick

✅ Building emotional clarity around money

✅ Using mindset tools like visualisation, affirmations, and gratitude

✅ Becoming the CEO of your financial life (finally)

No judgment. No jargon. Just powerful, practical transformation.

? Final Thought: It Was Never About the Money

It was always about:

- The story you believed.

- The patterns you repeated.

- The mindset you inherited.

But here’s the best part:

You have the power to rewrite the story.

Let today be the day you stop blaming money and start mastering your mindset.

Because once your brain gets on board? Your bank account will follow.