Affirm Your Abundance: How to Train Your Brain for Wealth

? “I’m terrible with money.”

? “I’ll never be debt-free.”

? “There’s just never enough.”

Sound familiar?

Most of us say things like this without even thinking.

But did you know that every time you repeat these phrases, you’re cementing them into your brain like financial super glue?

? What you speak, you strengthen. What you affirm, you attract.

Welcome to the world of affirmations, visualisation, and neuroplasticity – where your brain is your best financial tool, and your words are the instructions you’re programing it with.

? What Is Neuroplasticity (And Why Should You Care)?

Let’s break this down, Financial Management 101 style: Your brain isn’t fixed – it’s plastic (not like a credit card ?). It constantly rewires itself based on what you think, feel, and repeatedly say.

This is called neuroplasticity, and it means:

- You can unlearn bad money habits.

- You can rewire old beliefs.

- You can train your brain to support financial growth.

Your thoughts become patterns. Your patterns become habits. Your habits become your bank balance.

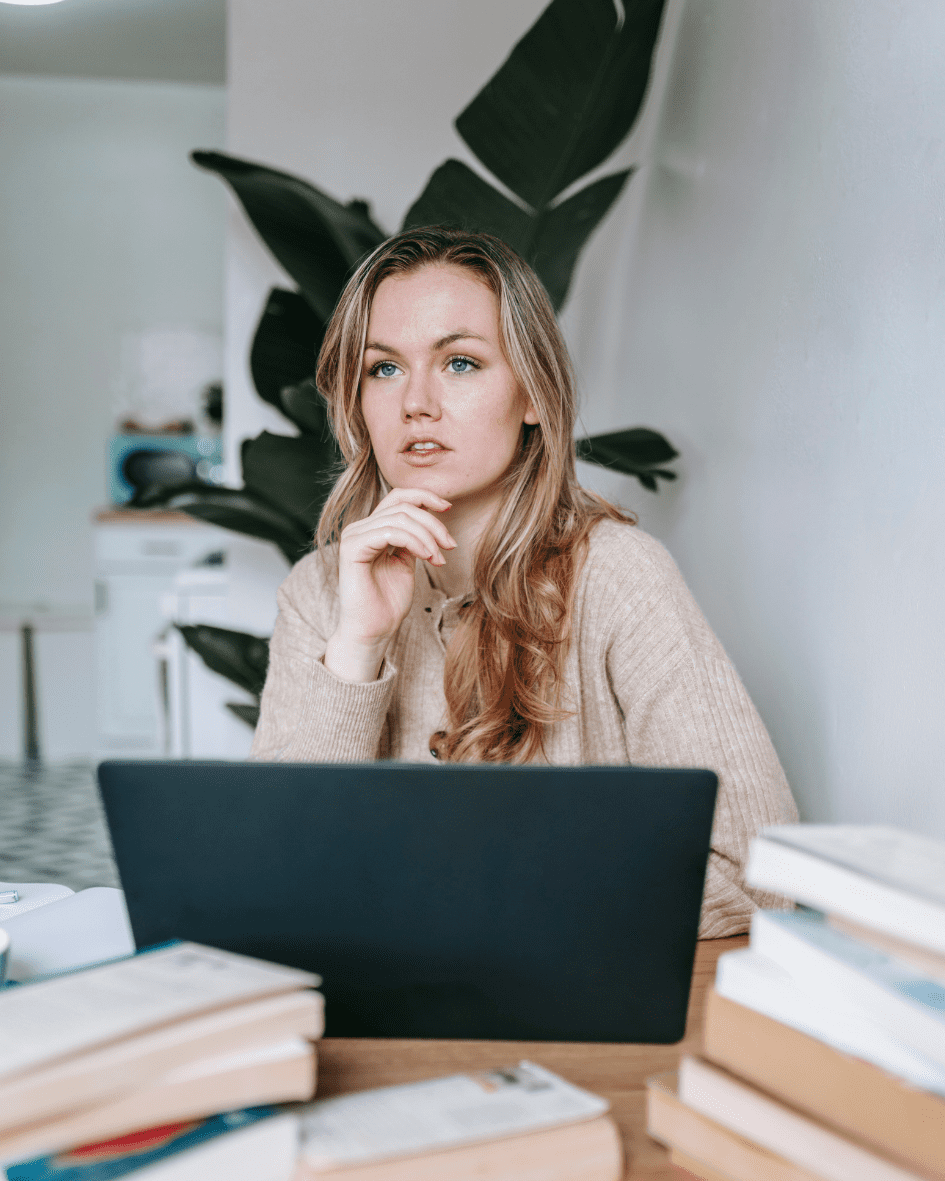

? Why You’re Stuck (It’s Not What You Think)

If you’re earning good money but still feel stuck, it’s likely not your income – it’s your internal dialogue.

Every time you say:

- “I’m bad with numbers.”

- “I can’t afford that.”

- “Money is stressful.”

…you’re telling your brain to stay in the struggle cycle.

But here’s the exciting news: You can flip the script. You can literally affirm your way into a wealth mindset. Let’s talk about how.

✅ What Are Affirmations?

Affirmations are positive, present-tense statements that help rewire your subconscious beliefs.

They’re not magic spells. They’re mental training tools. Think of them like push-ups for your mindset. ?

When you repeat an affirmation, you:

- Interrupt old, limiting beliefs

- Create new, empowering thoughts

- Build neural pathways aligned with success

? Repetition creates reinforcement. Reinforcement creates reality.

?️ How to Create Affirmations That Actually Work

Not all affirmations are created equal.

To make them work, follow this formula:

- Keep it present-tense.

“I am” instead of “I will.”

- Make it believable.

Stretch your mindset – don’t snap it. (Say “I am open to wealth” before “I am a millionaire.”)

- Anchor it to your goal.

Affirmations should support your financial intentions.

- Add emotion.

Feel it. Say it with conviction.

- Repeat daily.

Morning and night are brain-priming gold.

? 15 Empowering Money Affirmations to Try Toda

Pick a few that resonate and start using them now:

- ? “I am in control of my financial future.”

- ? “Money flows to me with ease and purpose.”

- ? “I make wise, empowered money choices.”

- ? “I am worthy of wealth and abundance.”

- ? “I forgive myself for past financial mistakes.”

- ? “I attract opportunities that grow my income.”

- ? “I trust myself to manage money well.”

- ? “Every dollar I spend returns multiplied.”

- ? “I am building a strong financial foundation.”

- ? “My savings grow consistently and joyfully.”

- ? “I am aligned with financial freedom.”

- ? “It is safe for me to be wealthy.”

- ? “My income exceeds my expenses.”

- ? “I celebrate my financial progress daily.”

- ? “I am a magnet for financial abundance.”

Pro tip: Record them in your own voice and listen while driving, walking, or sipping your morning coffee. ☕

? Bonus Tool: Visualisation – Make Your Goals Feel Real

Affirmations are powerful. But when you pair them with visualisation? Next-level transformation.

Visualisation is the practice of mentally seeing your goals as already done.

Your brain doesn’t know the difference between a vividly imagined scenario and reality. So when you visualise success, you’re giving your brain a preview of coming attractions.

Try this:

?♀️ Close your eyes for 2 minutes.

? Picture your ideal money life:

- Debt-free

- Stress-free

- Savings growing

- Confident, calm, in control

✨ Now feel it in your body. Smile. Breathe it in. Say your top affirmation 3 times.

That’s it. That’s the practice.

? The Science Behind “Woo-Woo”

Still skeptical? That’s okay. Here’s the science:

- Neuroscience confirms that repeated thoughts create new neural pathways.

- Psychology shows that positive affirmations reduce stress and anxiety.

- Visualisation is used by elite athletes, CEOs, and high performers globally.

So no – this isn’t magic. It’s mental conditioning. Just like going to the gym, but for your money mindset.

? Real-World Exercise: 7-Day Affirmation Reset

Want to see a shift fast? Try this 7-day challenge:

? Day 1: Write down 3 negative money thoughts

? Day 2: Flip them into positive affirmations

? Day 3: Say them aloud every morning and night

? Day 4: Visualise one financial goal for 2 minutes

? Day 5: Journal your emotions after practising

? Day 6: Add 1 new affirmation to your list

? Day 7: Reflect on how your mindset has shifted

✨ Stick with it, and you’ll notice real changes – in how you think, feel, and act with money.

? From Clients Like You…

? “I used to dread looking at my accounts. After doing daily affirmations for 30 days, I actually enjoy tracking my finances.” – Sarah, 42

? “I never realised how negative I was about money until I heard myself out loud. Repeating affirmations helped me take control – without judgment.” – Dean, 38

? Want to Make This a Habit?

This is exactly what we do in the Master Your Money 30-day program:

✅ Build affirmations that align with your financial goals

✅ Practice daily visualisation and brain rewiring

✅ Replace fear-based thinking with empowering beliefs

✅ Create lasting transformation from the inside out

It’s not about forcing change. It’s about creating an environment where success becomes inevitable.

? “What the mind can conceive and believe, it can achieve.” – Napoleon Hill

? Ready to Train Your Brain for Wealth?

If you’re serious about:

- Feeling good about your money

- Attracting more income and opportunity

- Creating consistent, healthy financial habits

- And finally breaking free from the old stories that keep you stuck…

Then it’s time to affirm your abundance and live it.

? Click here to learn more about the Master Your Money program.

Or send me a DM if you want to chat about how this could work for you.

? Final Thoughts

You are not behind. You are not broken. You are becoming the kind of person who manages money with confidence, clarity, and joy.

Start speaking that truth today and watch your reality shift.

? “Affirm it until your mind believes it. Then act on it until your life reflects it.”

Let’s go get that abundance. You’re ready.