From Fear to Freedom: Rewiring Your Money Beliefs for Good (How to Break Free from Financial Anxiety and Finally Take Control)

Let’s Talk About Fear…

We don’t like to admit it… But fear is driving way more of our financial decisions than we realise.

- Fear of not having enough

- Fear of messing it up

- Fear of making the wrong choice

- Fear of looking stupid, selfish, or irresponsible

- Fear of repeating past mistakes

Fear whispers, “You’ll never get ahead.”

Fear says, “Better play it safe.”

Fear convinces us that we’re not smart enough, disciplined enough, or lucky enough to get it right.

But here’s the truth: Fear doesn’t protect your finances – it paralyses them.

Where Fear-Based Money Beliefs Come From

You weren’t born afraid of money. You learned fear – often without even knowing it.

Maybe you grew up watching your parents fight about bills. Or maybe money was tight, and you internalised the message: “There’s never enough.” Maybe a big mistake left you feeling ashamed, and now you avoid money altogether.

Whatever the story, the result is the same: You’re stuck making decisions from a place of fear, not freedom.

The Cost of Financial Fear

Fear shows up in sneaky ways:

- You avoid opening bills

- You put off financial planning

- You overspend to feel better (hello, retail therapy)

- You say yes when you mean no – because you’re afraid to “miss out”

- You hoard money and still feel unsafe

- You stay small, stuck, and stressed

It’s not because you’re lazy or irresponsible. It’s because fear is running the show.

And here’s the breakthrough: You can reprogram your fear-based beliefs and unlock a completely new financial reality.

Beliefs = Behaviors = Bank Balance

In Master Your Money, I teach that your beliefs create your results. Full stop! Let’s look at a few common fear-based beliefs and what they lead to:

| Fear-Based Belief | Behavior | Result |

| “I’m not good with money.” | Avoid finances altogether | Confusion & anxiety |

| “Money is never enough.” | Scarcity mindset, hoarding | Constant stress |

| “I always mess it up.” | Self-sabotage | Lack of progress |

| “People like me don’t build wealth.” | Low risk tolerance | Missed opportunities |

If you want to change your behaviour, you have to start with the belief that’s fueling it.

How to Rewire Fear Into Empowerment

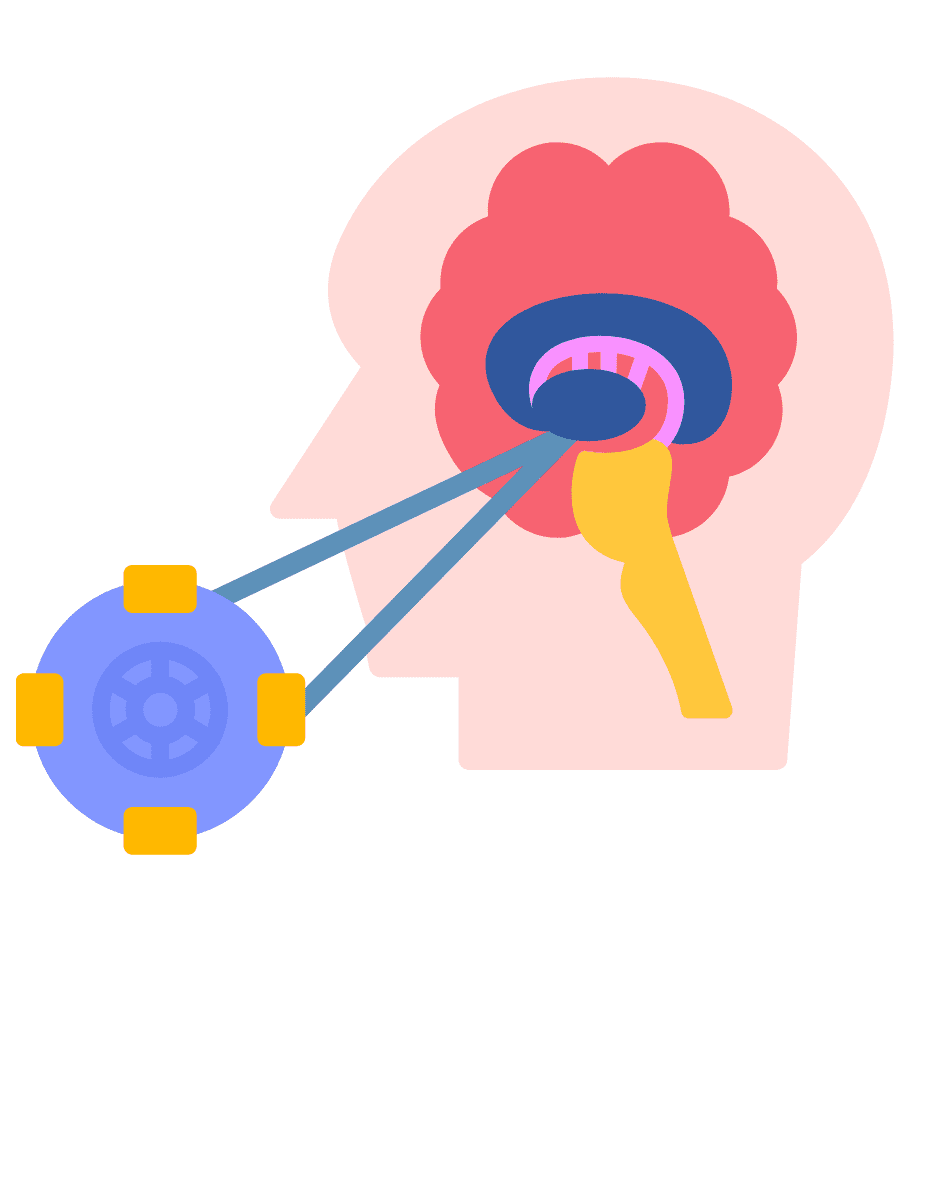

Here’s the 3-step belief flip framework we use in the program and you can try it right now.

✍️ Step 1: Name the Fear

What’s the thought that’s been keeping you stuck?

“I’ll never be financially secure.”

Step 2: Flip the Belief

Ask yourself, What’s a more empowering version of this belief?

“I am learning how to create financial security – one step at a time.”

Step 3: Speak It Daily

Say your new belief out loud every day. Especially when fear creeps in.

“I am creating safety and stability through intentional choices.”

Powerful Affirmations to Rewire Fear-Based Thinking

Start repeating these daily and feel the shift begin:

- “I trust myself to make wise financial decisions.”

- “It is safe for me to grow, earn, and invest.”

- “I am not my past – I create my financial future.”

- “I welcome abundance into my life with confidence.”

- “Every decision I make brings me closer to financial peace.”

These aren’t fluffy phrases, they are neural rewiring tools backed by the science of neuroplasticity.

How to Handle Fear in Real Time

Here’s what to do when fear pops up (because it will):

- Pause – Don’t make the decision immediately.

- Name the fear – “I’m afraid I’ll mess this up.”

- Breathe and ground – Get back to the present.

- Ask – “What would future-me, who trusts herself, do right now?”

- Act with intention – Even a small move toward courage shifts everything.

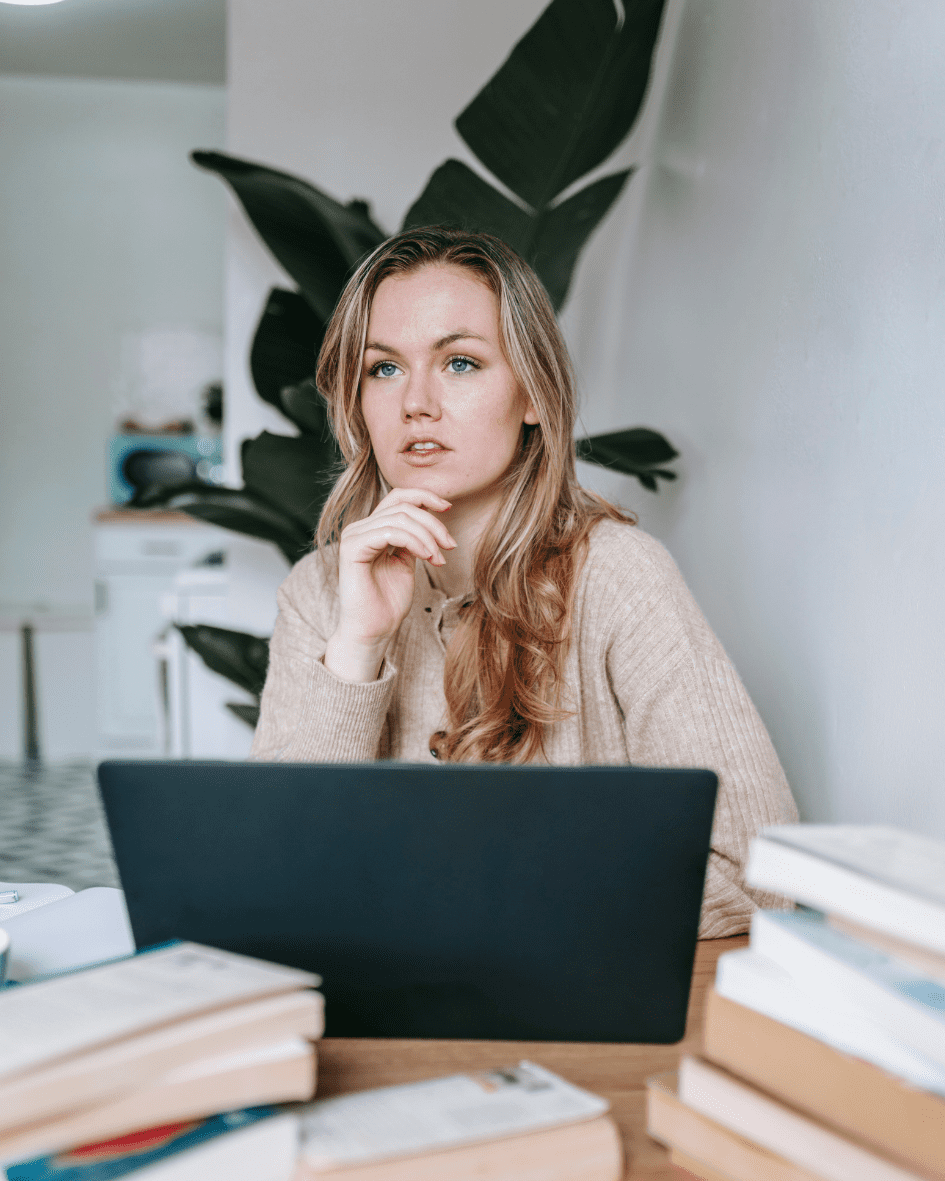

Client Story: From “I Can’t” to “I’m In Control”

When Mel joined the Master Your Money program, she was terrified of looking at her finances. She hadn’t opened a credit card bill in 6 months.

“I just kept telling myself I was bad with money,” she said. “I felt frozen.”

Together, we rewrote that belief. Her new mantra? “I’m learning to lead my finances with courage.”

She committed to one 10-minute financial action a day. Within 30 days, she’d:

✅ Paid off two lingering bills

✅ Set up automated savings

✅ Felt confident opening her banking app

Her financial situation didn’t change overnight – but her mindset did. And that changed everything.

The Transformation: From Fear to Freedom

When you start making money decisions from a place of empowerment, you begin to:

- Trust yourself

- Take consistent action

- Let go of shame

- Step into the driver’s seat of your financial future

This is the shift we make in the Master Your Money program. Because real transformation doesn’t happen through guilt or hustle. It happens through mindset + habits + belief.

Ready to Ditch Financial Fear for Good?

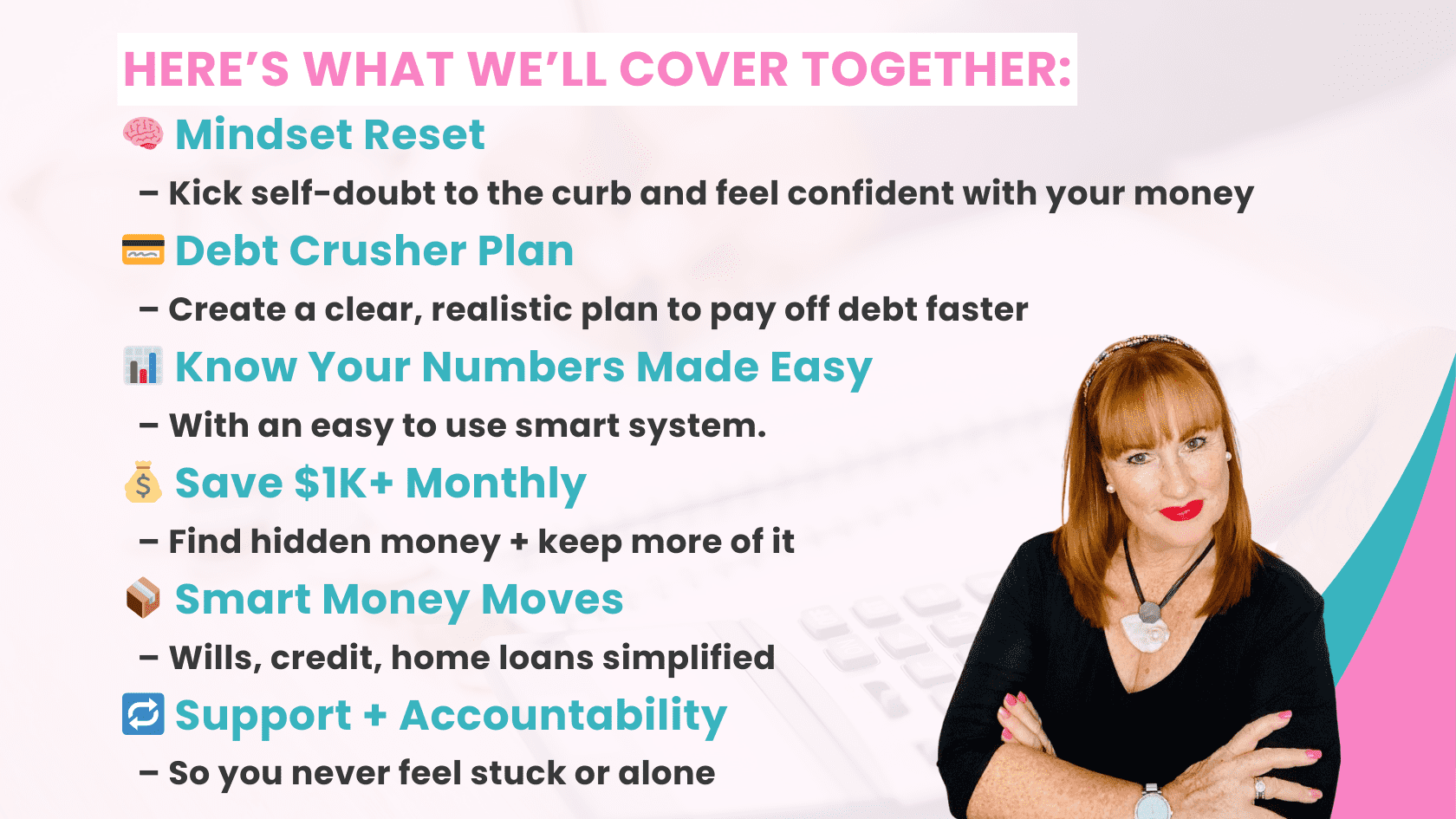

Inside the 30-Day Master Your Money program, we walk step-by-step through:

✅ Identifying and rewiring limiting beliefs

✅ Shifting from scarcity to abundance

✅ Creating emotional safety around money

✅ Replacing fear with confidence, clarity, and calm

Whether you’re paying off debt, growing your income, or just trying to feel good about your bank account again, this program gives you the tools to stop reacting and start rising.

“Freedom begins the moment you stop letting fear make your decisions.”

Final Thoughts

You are not broken.

You are not bad with money.

You are not behind.

You’ve just been living with fear-based programing that no longer serves you.

And today – you get to choose something better.

You get to choose freedom.

Click here to join Master Your Money and start rewriting your money story.