Apr 9, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle, Welcome

Financial freedom isn’t just about saving money or cutting costs; it’s about truly understanding your financial position. Knowing your numbers means gaining a clear picture of your assets, liabilities, income, and expenses. This knowledge is the foundation for making informed decisions, reducing financial stress, and achieving stability. In this blog, we’ll explore why knowing your numbers is essential and how you can start your journey toward financial clarity today.

Why Monthly Coaching is a Game-Changer

Financial success doesn’t happen overnight. It requires consistent effort, strategic planning, and the right tools. Monthly Coaching provides all of this and more:

1. EXPERT GUIDANCE

-

-

-

- Work with an experienced financial coach, like myself who understand the challenges you’re facing.

- Receive practical support tailored to your unique situation.

2. ACCOUNTABILITY

-

-

-

- Regular check-ins ensure you stay on track with your financial goals.

- Celebrate milestones and adjust your plan as needed.

3. ACCESS TO THE VAULT

-

-

-

- Unlimited access to a comprehensive library of courses, tools, and resources.

- Learn at your own pace and revisit materials anytime.

4. PERSONALISED STRATEGIES

-

-

-

- Receive a customized roadmap based on your financial priorities and challenges.

- Develop actionable steps to tackle debt, save effectively, and build wealth.

Joining THE VAULT gives you unlimited access to a comprehensive library of courses, tools, and resources.

What’s Inside THE VAULT?

Our THE VAULT is the heart of the Monthly Coaching program, packed with resources designed to simplify your financial journey

1. COMPREHENSIVE COURSES

-

-

-

- Covering topics like budgeting, saving, debt reduction, and financial mindset.

- Each course is broken into manageable modules, so you can learn step by step.

2. INTERACTIVE TOOLS

-

-

-

- Use calculators, trackers, and templates to monitor your progress.

- Visualise your goals and see how small changes make a big impact

3. EXCLUSIVE WEBINARS

-

-

-

- Monthly expert-led sessions on trending financial topics and strategies.

- Ask questions and gain insights from industry professionals.

4. SUPPORTIVE COMMUNITY

-

-

-

- Connect with other members for advice, motivation, and shared experiences.

- Build relationships with like-minded individuals who understand your journey.

How Monthly Coaching Fits Your Life?

We understand that life is busy, which is why Monthly Coaching is designed to be flexible and convenient:

1. LEARN ANYTIME, ANYWHERE

-

-

- Access courses and resources on your schedule, whether it’s during your morning coffee or after the kids are in bed.

2. QUICK CHECK-INS

-

-

- Regular updates keep you accountable without overwhelming your to-do list.

3. ACTIONABLE GOALS

-

-

- Break down big financial objectives into smaller, manageable steps.

Focus on one priority at a time to avoid feeling overwhelmed.

Success Stories

Hearing how others have transformed their finances can be incredibly motivating. Here are just a few examples of how the programs and training in THE VAULT has changed lives:

1. SARAH’S STORY

-

-

-

- A single mum struggling with debt, Sarah joined the program to regain control of her finances.

- With the support, she created a realistic budget, eliminated $5,000 of credit card debt, and started saving for her daughter’s education.

2. MARK’S JOURNEY

-

-

-

- Mark wanted to save for a down payment on a house but didn’t know where to start.

- Through THE VAULT, he learned how to track his expenses, cut unnecessary costs, and saved $20,000 in just 18 months.

3. LISA’S TRANSFORMATION

-

-

-

- Lisa was overwhelmed by her financial situation and didn’t know how to prioritise her goals.

- THE VAULT helped her identify her top priorities, pay off her car loan early, and build an emergency fund within a year.

Why Join Now?

April is the perfect time to take control of your finances. By enrolling in THE VAULT, you’ll gain access to all the tools and support you need to achieve your goals. Plus, our April focus on “Know Your Numbers” ensures you start with a solid foundation.

EXCLUSIVE APRIL BONUSES:

1. PERSONALISED NET POSITION

-

-

- Receive a detailed breakdown of your financial standing to kickstart your journey.

2. ADDITIONAL SOURCES

-

-

- Bonus worksheets and guides to help you implement what you learn.

Conclusion

Regular coaching isn’t just about managing money; it’s about creating a lifestyle that aligns with your values and aspirations. With expert guidance, a wealth of resources, and a supportive community, you’ll gain the clarity and confidence to take control of your financial future. Don’t wait – join THE VAULT today and make this the year you achieve your financial dreams!

Apr 2, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle

Financial freedom isn’t just about saving money or cutting costs; it’s about truly understanding your financial position. Knowing your numbers means gaining a clear picture of your assets, liabilities, income, and expenses. This knowledge is the foundation for making informed decisions, reducing financial stress, and achieving stability. In this blog, we’ll explore why knowing your numbers is essential and how you can start your journey toward financial clarity today.

Why Knowing Your Numbers Matter

Many people focus on earning more or spending less, but without knowing your numbers, it’s like driving a car without a map or GPS. You might be moving, but you’re not necessarily headed in the right direction. Here’s why understanding your financial position is crucial:

-

- Know Where You Stand: Your net position – the difference between what you own and what you owe is a snapshot of your financial health. It gives you a clear idea of whether you’re building wealth or falling behind.

- Set Realistic Goals: When you know your numbers, you can set achievable financial goals, like paying off debt, saving for a home, or building an emergency fund.

- Identify Opportunities for Growth: Understanding your financial position helps you spot areas where you can save more, invest smarter, or cut unnecessary expenses.

- Reduce Financial Stress: Clarity about your finances reduces anxiety and empowers you to make confident decisions.

Your financial assets consist of your savings, investments, and retirement funds, which represent the resources you own that can contribute to your financial security and future wealth.

Breaking Down the Basics – What to Track

Knowing your numbers involves more than just looking at your bank balance. Here’s what you need to assess:

1. ASSETS

-

-

-

- Tangible Assets: Your home, car, or valuable items like jewellery or collectibles.

- Financial Assets: Savings accounts, investments, and retirement funds.

2. LIABILITIES

-

-

-

- Debts: Credit cards, personal loans, student loans, and mortgages.

- Recurring Obligations: Bills, subscriptions, and other regular expenses.

3. INCOME

-

-

-

- Primary Income: Salary or wages.

- Secondary Income: Side hustles, investment dividends, or rental income.

4. EXPENSES

-

-

-

- Fixed Expenses: Rent, insurance, and utilities.

- Variable Expenses: Groceries, entertainment, and travel.

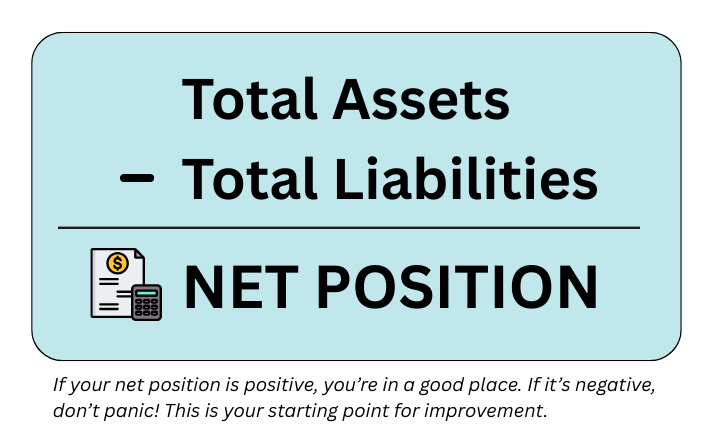

How to Calculate Your Net Position

The formula is simple: Net Position = Total Assets – Total Liabilities. Here’s an example:

Assets: $200,000 (home equity, savings, investments)

Liabilities: $150,000 (mortgage, credit card debt, loans)

Net Position: $50,000

If your net position is positive, you’re in a good place. If it’s negative, don’t panic this is your starting point for improvement.

Steps to Take Control of Your Numbers

1. START WITH A FINANCIAL INVENTORY

-

-

-

- Make a detailed list of all assets and liabilities.

- Use tools like spreadsheets or budgeting apps for accuracy.

2. TRACK YOUR SPENDING

-

-

-

- Review your bank and credit card statements to understand your spending habits.

- Categorise expenses to identify areas for adjustment.

3. CREATE A FINANCIAL PLAN

-

-

-

- Set short-term, medium-term, and long-term goals.

- Prioritise high-interest debt and build an emergency fund.

4. REVIEW REGULARLY

-

-

-

- Schedule monthly or quarterly reviews to track progress.

- Adjust your plan as needed based on life changes.

Common Mistakes to Avoid

1. IGNORING THE BIGGER PICTURE

-

-

- Focusing only on day-to-day expenses without understanding your overall financial health.

2. PROCRASTINATING

-

-

- Delaying the process of assessing your finances can make it harder to take control.

3. OVERLOOKING SMALL DEBTS

-

-

- Small debts add up and can significantly impact your net position.

4. NOT SEEKING HELP

-

-

- Don’t hesitate to consult a financial coach or use resources like our “Know Your Numbers” course.

How Our Course Can Help

Our “Know Your Numbers” course is designed to make this process easy and actionable. Here’s what you’ll gain:

1. STEP-BY-STEP GUIDANCE

-

-

- Learn how to assess and improve your financial position.

2. PRACTICAL TOOLS

-

-

- Access calculators, templates, and worksheets.

3. EXPERT INSIGHTS

-

-

- Benefit from tips and strategies sared by experienced financial coaches.

4. ONGOING SUPPORT

-

-

- Get access to our community and resources for continued learning.

Real Life Success Stories

- Emma’s Journey: After taking the “Know Your Numbers” course, Emma discovered she had enough savings to pay off a small loan. She’s now building her emergency fund and feels more confident about her future.

- James’ Transformation: James used the tools from the course to identify unnecessary expenses. By cutting these costs, he’s saved over $500 a month and is on track to pay off his credit card debt.

Conclusion

Knowledge is power, especially when it comes to your finances. Understanding your numbers isn’t just a one-time task—it’s a habit that leads to financial freedom. Take control of your financial future by joining our “Know Your Numbers” course today. Let’s build a stress-free, confident financial life together.

Mar 26, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle, Welcome

What if managing money felt effortless instead of stressful? What if financial decisions felt natural rather than overwhelming? Welcome to the concept of financial flow – where money moves in and out of your life with ease, and you feel confident and in control every step of the way.

Financial flow isn’t about luck, nor is it reserved for the wealthy. It’s about aligning your mindset, habits, and systems so that money becomes a source of empowerment rather than anxiety. Let’s dive into the secrets of mastering money with ease.

Secret #1: Trust That Money Flows to and Through You

One of the biggest money struggles people face is the feeling of scarcity – thinking there’s never enough. But here’s a powerful reframe: Money is energy. It moves, circulates, and returns when managed intentionally.

Rather than clinging tightly to every dollar out of fear, shift your perspective:

-

- Trust that more opportunities to earn will come.

- Believe that when you spend intentionally, money will return in other ways.

- Recognise that wealth grows when you let money work for you through smart investments and aligned spending.

The key is to create a flow where money moves through your life in a way that serves you, rather than feeling stuck or stagnant.

Secret #2: Design a Financial System That Works for You

Many people resist financial planning because they think it’s restrictive. But the truth is, having a system actually frees you. A good financial system automates the boring stuff so you can focus on what matters. A simple, effective system includes:

-

- A Spending Plan (not a strict budget, but a flexible plan for where your money should go each month)

- Automatic Transfers to savings and investments so they grow without you overthinking it

- A Guilt-Free Fun Fund so you can enjoy your money without worry

- A Weekly Money Check-In to keep things on track without stress

When your system is designed for ease, managing money stops being a chore and starts feeling like second nature.

Secret #3: Align Your Money with Your Joy

Ever notice how some purchases feel amazing while others leave you with regret? That’s because true financial satisfaction comes from spending in alignment with your values and priorities.

Take a look at your expenses and ask:

-

- Does this purchase bring me joy, security, or opportunity?

- Am I spending out of habit, pressure, or impulse?

- How can I redirect my money toward things that truly enrich my life?

When money is spent intentionally on things that light you up rather than weigh you down, you feel at ease with your financial decisions.

Secret #4: Remove the Money Blocks Keeping You Stuck

Sometimes, it’s not just financial strategies that hold people back – it’s emotional and mental blocks. Thoughts like:

-

- “I’ll never get ahead.”

- “Money is stressful.”

- “I don’t deserve to be wealthy.”

These hidden money blocks create resistance, keeping you stuck in the same cycles. The key is to identify them, challenge them, and replace them with beliefs that support financial ease.

Instead of “Money is stressful,” try “I am learning to manage money with confidence.” Small shifts in mindset create massive shifts in financial reality.

Secret #5: Surround Yourself with Financial Flow Energy

Just like anything in life, who and what you surround yourself with influences your financial experience. If your circle is always complaining about money or reinforcing scarcity thinking, it’s harder to break free.

Instead, seek out:

-

- Books and podcasts that expand your financial knowledge

- Mentors or communities that uplift and encourage abundance

- Coaching or courses that provide actionable steps toward financial confidence

This is exactly why I created my Monthly Coaching program, giving you access to THE VAULT – a collection of resources to help you create lasting financial flow. And if you’re ready to take full control of your financial journey, the Master Your Money program will guide you every step of the way.

Final Thoughts: Financial Flow is a Choice

Mastering money with ease isn’t about earning more, it’s about creating a relationship with money that feels natural and empowering. When you remove resistance, align your money with your joy, and put systems in place, you create a life where money works for you, not against you.

So ask yourself: What’s one step you can take today to step into financial flow? Your money journey is yours to design, and you have everything it takes to make it happen and effortless.

Mar 19, 2025 | Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

We all have a money story. It’s the narrative we’ve built over time based on our experiences, upbringing, and beliefs about money. Some of us grew up hearing, “Money doesn’t grow on trees,” while others were told, “You have to work hard for every penny.” These messages, whether spoken or unspoken, shape how we interact with money as adults.

But what if your money story is holding you back? What if deep down, you believe you’re not capable of financial success or that you’re destined to struggle? The good news is that your money story isn’t set in stone. You have the power to rewrite it.

Here’s how to break free from limiting beliefs and create a financial narrative that empowers you.

STEP 1: KNOW YOUR NUMBERS

Before you can change your money story, you need to understand what it is. Ask yourself:

-

- What did I hear about money growing up?

- How did my parents or caregivers handle money?

- What emotions come up when I think about my finances?

- Do I believe money is a source of stress, power, freedom, or something else?

Write down the recurring patterns you’ve noticed in your financial life. Have you always lived paycheck to paycheck, even when you earn more? Do you sabotage financial success out of guilt or fear? Awareness is the first step to transformation.

STEP 2: CHALLENGE THE BELIEFS THAT NO LONGER SERVE YOU

Many of our money beliefs were inherited, not chosen. But just because you grew up with certain financial patterns doesn’t mean you have to continue them.

Take a belief like, “I’m just bad with money.” Ask yourself: Is this actually true? Or have I just made mistakes in the past that I can learn from? Reframe it: “I am learning how to manage my money in a way that aligns with my goals.”

Your beliefs create your reality. If you constantly tell yourself you’ll never be wealthy, your actions will reflect that. Instead, adopt empowering beliefs like:

-

- “I am capable of building wealth.”

- “Money is a tool that supports my dreams.”

- “I deserve financial abundance.”

STEP 3: REWRITE YOUR MONEY STORY

Now it’s time to create a new money story, one that aligns with your goals and values. Imagine your ideal financial future. What does it look like? How do you feel about money? How do you handle it?

Write down your new story as if it’s already true. For example: “I am financially confident. I make smart decisions with my money, and I attract opportunities for abundance. I feel secure, knowing that I am in control of my finances. Money flows to me easily, and I use it to create a fulfilling life.”

The more you affirm this new story, the more your subconscious mind starts to accept it as reality.

STEP 4: ELIMINATE DEBT STRATEGICALLY

Your environment shapes your mindset. If you’re constantly hearing negative messages about money, it’s harder to shift your beliefs. Seek out people, books, and resources that reinforce your new money story.

This is why I created my Monthly Coaching program, where you can access THE VAULT – a collection of financial courses, tools, and community support designed to help you step into financial empowerment. And if you’re ready for a full financial transformation, the Master Your Money program will guide you through everything you need to break free from financial limitations.

Ready to Master Your Money?

Your financial future isn’t dictated by your past. You have the power to rewrite your money story and create a new reality – one where you feel confident, in control, and financially free.

The question is: What story will you choose to tell yourself from today onward?

The pen is in your hands.

Mar 12, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle

If you’ve ever felt like no matter how much you earn, it’s never enough, or if you catch yourself worrying about money even when things are going well, you might be stuck in a scarcity mindset. This mindset keeps you feeling like there’s never enough; enough money, enough opportunities, enough security. But the truth is, abundance is everywhere; we just have to shift our perspective to see it.

Breaking free from scarcity thinking doesn’t just improve your finances; it transforms how you approach life. Let’s explore how you can step into an abundant money mindset and start seeing possibilities instead of limitations.

Step 1: Recognise the Signs of Scarcity Thinking

The first step to shifting your mindset is awareness. Scarcity thinking can show up in many ways, such as:

-

-

- Feeling like you never have enough money, no matter how much you make.

- Being afraid to spend, even on things that align with your values.

- Hoarding money out of fear rather than saving with intention.

- Avoiding financial planning because you assume there’s no way to improve your situation.

- Comparing your financial success to others and feeling discouraged.

If any of these resonate with you, don’t worry – you’re not alone, and these patterns can be changed.

Step 2: Reframe Your Money Beliefs

Scarcity isn’t about how much money you have; it’s about how you think about money. If you believe money is hard to earn or that financial success is only for the lucky few, those beliefs will shape your financial reality.

Start by shifting your internal dialogue. Instead of saying, “I can’t afford that,” try, “How can I afford that?” This simple shift turns money from a limitation into an opportunity for creativity and resourcefulness.

Another powerful reframe is to see money as a tool rather than a source of stress. Money is neutral, it’s how we use it and think about it that determines whether it empowers us or controls us.

Step 3: Cultivate an Abundance Mindset Daily

Shifting from scarcity to abundance requires daily practice. Here are some ways to rewire your thinking:

-

-

- Gratitude Practice: Take a moment each day to appreciate the financial abundance you already have whether it’s a roof over your head, food in your fridge, or even a steady paycheck.

- Generosity: Giving, even in small ways, signals to your brain that there’s more than enough to go around. It could be donating a small amount to charity, tipping generously, or even sharing knowledge with someone who needs it.

- Visualisation: Spend time visualising your ideal financial future. Imagine yourself thriving, making wise financial choices, and feeling completely at ease with money.

Step 4: Take Action Toward Abundance

An abundance mindset isn’t just about thinking differently – it’s also about acting differently. Some action steps include:

-

-

- Investing in Yourself: Whether it’s taking a course, hiring a coach, or developing new skills, investing in yourself creates long-term financial and personal growth.

- Creating Multiple Income Streams: People with an abundance mindset look for opportunities, not just limitations. Could you start a side hustle? Negotiate a raise? Explore passive income options?

- Letting Go of Money Guilt: If you’ve been conditioned to feel guilty about spending or earning money, it’s time to release that. Money is simply an exchange of value, and you deserve financial prosperity.

Step 5: Surround Yourself with Abundance Thinkers

Your environment influences your mindset. If you’re constantly surrounded by negativity about money, it’s harder to adopt an abundance perspective. Seek out people, books, podcasts, and communities that reinforce abundance thinking.

This is exactly why I created my Monthly Coaching program, where you gain access to THE VAULT – a wealth of financial education, tools, and resources to shift your mindset and transform your money habits. And for those ready to take full control of their financial future, the Master Your Money program offers step-by-step guidance on building lasting wealth.

Final Thoughts: Abundance is a Choice

Stepping into an abundant money mindset isn’t about waiting until you have “enough” money – it’s about changing how you view the money you already have. When you see possibilities instead of limitations, you unlock new levels of financial growth and confidence.

You are already capable of abundance. Now, it’s time to claim it.

Mar 6, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

We’ve all had those moments standing at the checkout, second-guessing a purchase, or staring at a bank statement, feeling a wave of regret. Maybe you’ve told yourself, “I’m just bad with money,” or, “I can’t trust myself to make good financial decisions.” If this sounds familiar, you’re not alone. But here’s the truth: you are not inherently bad with money. You just need to rebuild your financial confidence.

Financial confidence isn’t about knowing every investment strategy or becoming a budgeting master overnight. It’s about trusting yourself to make empowered, intentional choices with your money without fear, guilt, or self-doubt.

So how do you start trusting yourself with money again? Let’s dive into the formula that can help you regain control and move forward with confidence.

STEP 1: Reframe Your Money Story

The beliefs you have about money shape how you handle it. If you’ve experienced financial struggles in the past, it’s easy to assume that you’ll always struggle. But that’s not true you are constantly evolving, and your financial reality can evolve with you.

Take a moment to reflect: What are the money stories you’ve been telling yourself? Do you believe money is hard to earn? Do you think you’re destined to be in debt? Once you identify these limiting beliefs, challenge them. Instead of saying, “I’m terrible with money,” try, “I am learning to manage my money with confidence.” Words matter, and so does your mindset.

STEP 2: Small Wins Lead to Big Confidence

Trust isn’t built overnight it’s created through consistent actions. If you’ve been avoiding your finances out of fear, start small. Set up a weekly “money date” with yourself to review your finances, even if it’s just for 15 minutes. Celebrate the small victories, like paying a bill on time or choosing to cook at home instead of eating out. These small wins add up, reinforcing the belief that you are capable of managing your money wisely.

STEP 3: Shift from Fear to Curiosity

Many people feel anxious when they look at their bank account, but what if you approached your finances with curiosity instead of fear? Instead of saying, “I don’t even want to look at my balance,” try asking yourself, “I wonder what I can learn from my spending habits this month?” By shifting your mindset, you turn financial management into a tool for empowerment rather than a source of stress.

STEP 4: Align Your Spending with Your Values

One of the fastest ways to feel good about your money is to ensure your spending reflects what truly matters to you. If financial guilt is a recurring theme, it may be because you’re spending in ways that don’t align with your priorities.

Ask yourself: What do I value most in life? If it’s family, are you investing in quality time with loved ones? If it’s health, are you prioritising your well-being over impulse purchases? When your spending aligns with your values, financial confidence follows naturally.

STEP 5: Give Yourself Permission to Learn

No one is born knowing how to manage money perfectly. Mistakes will happen, but they don’t define you. What matters is how you respond. Instead of beating yourself up over a financial misstep, treat it as a learning experience.

Ask: “What can I do differently next time?” This shift in perspective turns every challenge into an opportunity for growth, reinforcing your ability to trust yourself.

STEP 5: Give Yourself Permission to Learn

Confidence grows in the right environment. If you’ve been struggling alone, it may be time to seek out support whether that’s a financial coach, a community of like-minded individuals, or access to the right financial education.

That’s why I created my Monthly Coaching program, giving you access to The Vault a treasure trove of financial resources, courses, and guidance to help you build the skills and mindset necessary for long-term success. And if you’re ready to take full control of your finances, my Master Your Money program will guide you through everything you need to know to transform your financial future.

Final Thoughts

Rebuilding financial confidence isn’t about perfection it’s about progress. Every positive step you take strengthens your trust in yourself. You are fully capable of making empowered financial choices, and your journey starts today.

Take the first step, celebrate your wins, and remember: you are not alone in this. With the right mindset, tools, and support, you can rewrite your financial story and step into a future filled with confidence and abundance.

Are you ready to take control? Let’s do this together!