Are You Ignoring Your Financial Safety Net? Why Wills & Estate Planning Matter (Even If You’re Young!)

Alright, friend… it’s time we talk about something that everyone needs, but almost no one wants to deal with.

Wills. Estate Planning. Life insurance.

Did your eyes just glaze over?

Did you suddenly feel an overwhelming urge to click away or scroll to the fun stuff on Instagram?

Stay with me, because this may just be one of the most important money conversations you’ll ever have. Here’s the hard truth:

If you’re ignoring estate planning because you think it’s “only for rich people” or “something I can figure out later,” you’re playing a dangerous game with your financial future, and the people you love most.

In this post, I’m going to:

- Bust the biggest myths about wills and estate planning.

- Show you why everyone (yes, even you!) needs a plan.

- Break down exactly what you need to do – without confusing legal jargon.

- Help you take simple, meaningful action to protect your future.

And don’t worry, this isn’t going to be dry or boring.

We’re going to make this approachable, empowering, and (dare I say?) a little fun. Because protecting your future should feel like an act of love and self-respect, not something you dread.

? Myth #1: “Estate Planning Is Only for Rich People”

Let’s start here, because this myth is everywhere. When most people hear the phrase “estate planning,” they picture wealthy people with sprawling mansions, yachts, and family fortunes that need protecting. But here’s the truth: If you own anything – even a car, a bank account, or a pet – you have an estate.

Estate planning isn’t just for millionaires. It’s for:

- The young professional with a growing savings account.

- The parent who wants to protect their kids.

- The small business owner with assets tied to their company.

- The renter with a car loan and a retirement fund.

If you have money, possessions, dependents, or even digital assets – estate planning applies to you.

? Why Avoiding Estate Planning Could Cost You (Big Time)

I get it – thinking about wills, death, and “what ifs” isn’t exactly a fun Friday night activity. But here’s the thing… Avoiding estate planning doesn’t make it go away. It just creates more chaos for the people you care about most. Without a will or estate plan in place:

- The courts decide who gets your assets – and it may not align with your wishes.

- Your loved ones could be tied up in legal battles for months (or even years).

- Minor children could end up with a guardian chosen by the court – not you.

- Your hard-earned money could get eaten up by legal fees, taxes, or other costs.

In short, not planning can create stress, delays, and heartache at the worst possible time.

But when you take just a little time to set up your financial safety net? You give your loved ones clarity, protection, and peace of mind.

? “But I’m Too Young for a Will!”

Another common myth? Thinking you’re too young to need a will. Here’s a little truth bomb:

Wills aren’t about age – they’re about responsibility.

You may not think you need one yet, but ask yourself:

- Do you have savings, retirement accounts, or life insurance?

- Do you have pets who rely on you?

- Do you own a car, home, or business?

- Do you have people who depend on your income?

- Do you have strong opinions about where your money should go if something happens to you?

If you answered yes to any of those, it’s time to start planning. Remember—estate planning isn’t about expecting the worst. It’s about being prepared for whatever life throws your way.

✨ Estate Planning: It’s Not Just About Death – It’s About Life, Too!

One of the most overlooked parts of estate planning? It’s not just about what happens after you’re gone. It also protects you while you’re alive, especially if you ever:

- Become seriously ill.

- Get injured and can’t manage your finances or healthcare decisions.

Your estate plan can include documents like:

- Power of Attorney: Designating someone you trust to manage your finances if you can’t.

- Healthcare Directive: Outlining your wishes for medical treatment and end-of-life care.

- Guardianship Designations: Naming who will care for your minor children if you’re unable to.

These documents ensure your voice is heard – no matter what.

? What’s Actually Included in a Basic Estate Plan?

Let’s strip away the legal jargon and break this down simply. Here’s what most people need in their estate plan:

1. A Will

This legal document spells out:

- Who will inherit your assets (money, property, belongings, etc.).

- Who will take care of your children or dependents (if applicable).

- Who will manage your estate (called an executor)

2. Power of Attorney (POA)

This gives someone legal authority to:

- Handle your finances if you’re incapacitated.

- Make decisions on your behalf if you can’t.

3. Healthcare Directive (Living Will)

This outlines your medical wishes if you’re unable to communicate them.

4. Beneficiary Designations

Certain accounts (like life insurance, retirement accounts, and some bank accounts) allow you to name a beneficiary directly. These override your will, so it’s crucial to keep them updated.

5. Guardianship Designations (If Applicable)

If you have minor children, this document names who you want to raise them if you’re unable to.

Bonus: Trusts (Optional for Some)

While not necessary for everyone, trusts can:

- Help avoid probate (the legal process of validating a will).

- Provide additional control over how and when assets are distributed.

- Offer potential tax benefits.

? How to Get Started with Estate Planning (Without Feeling Overwhelmed)

Deep breath – this doesn’t have to be complicated! Here’s how to start, step by step:

Step 1: Take Inventory

List all your:

- Bank accounts

- Retirement accounts

- Investments

- Properties

- Vehicles

- Insurance policies

- Personal belongings of high value

- Digital assets (crypto, social media, etc.)

Step 2: Clarify Your Wishes

Think about:

- Who should inherit your assets?

- Who do you trust to handle your finances and healthcare if needed?

- Who would you want to care for your kids or pets?

- Are there any charitable causes you’d like to support?

Step 3: Get Legal Help (If Needed)

While you can create simple wills online for a low cost, it’s often wise to consult an estate attorney, especially if:

- You have significant assets.

- You own a business.

- You have a blended family or complex situation.

Step 4: Communicate Your Plan

This is the step most people skip, but it’s essential! Let your loved ones know:

- That you’ve created an estate plan.

- Where they can find the documents.

- Who has been designated for certain roles.

Transparency now avoids confusion later.

Step 5: Review & Update Regularly

Life changes – your estate plan should too. Revisit your documents anytime you:

- Get married or divorced.

- Have children.

- Move to a new state (laws vary).

- Experience major financial changes.

? But What If You Don’t Have Much to Leave Behind?

Here’s a powerful truth: Estate planning isn’t just about leaving behind money – it’s about leaving behind clarity. Even if your financial picture feels “small” right now, your loved ones will still need to:

- Handle your debts and bills.

- Access your accounts.

- Close out your digital presence.

- Make healthcare decisions if needed.

Having a clear plan ensures they can do so smoothly. Plus, it sends a strong message: “I respect myself and the people I care about enough to plan ahead.”

? Estate Planning = Empowerment, Not Fear

I get it – this can all feel heavy. But here’s how I want you to reframe it:

Estate planning isn’t about preparing for doom and gloom.

It’s about:

- Taking ownership of your life.

- Protecting your family.

- Making your wishes known.

- Creating peace of mind, for you and for those you love.

It’s one of the most profound acts of love and responsibility you can make.

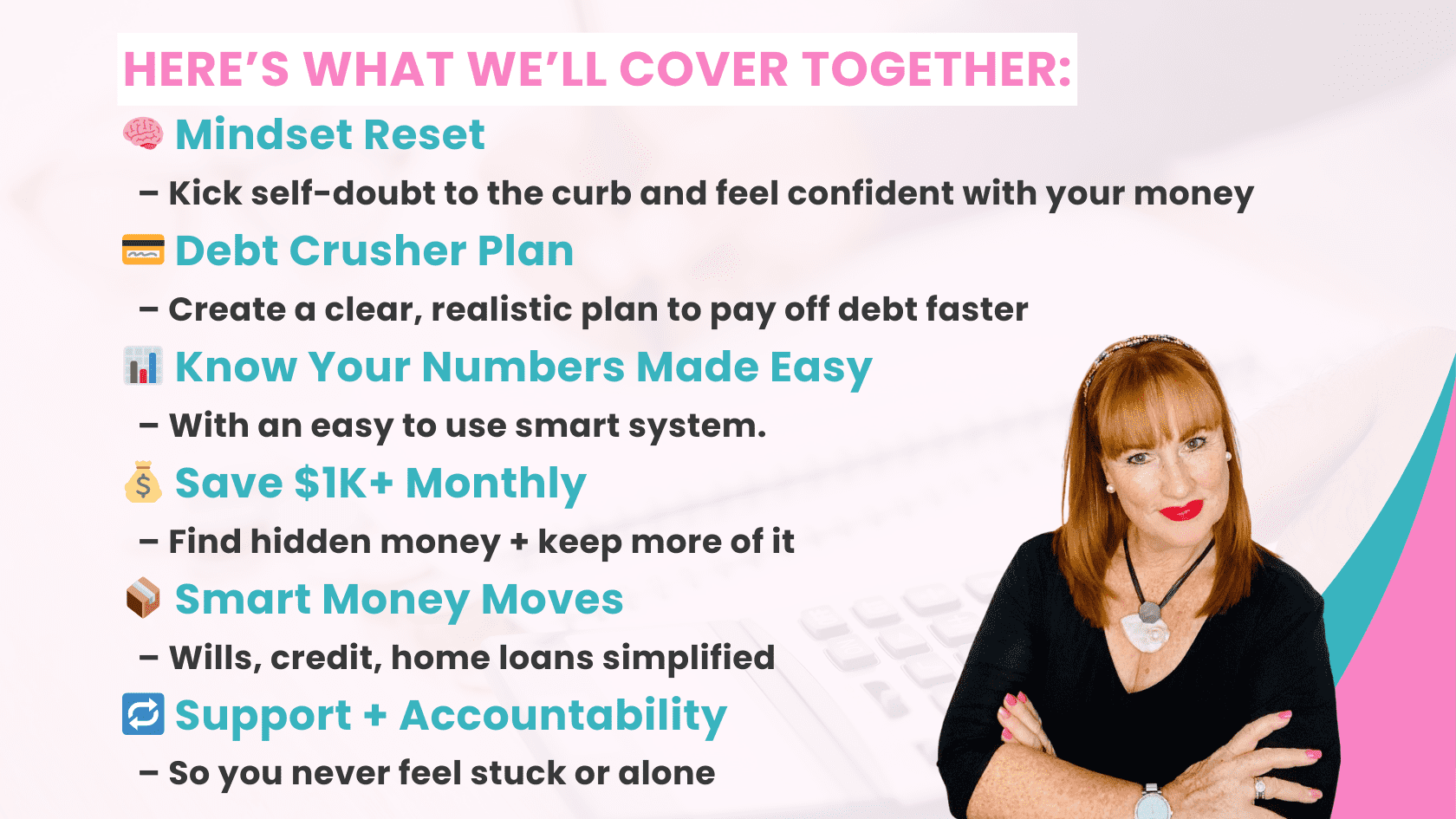

? How This Connects to Your Financial Breakthrough

In my Your Financial Freedom Breakthrough™ – 90 Day Money Makeover program, we don’t just focus on day-to-day money tasks like budgeting and debt. We go deeper, because true financial empowerment covers everything. That includes:

- Building your savings.

- Tackling your debt.

- Creating an intentional spending plan.

- AND making sure your financial house is in order with estate planning.

Most programs skip this step, but I refuse to. Why? Because I’ve seen firsthand how having a financial safety net changes lives.

In the program, you’ll:

- Learn exactly what legal documents you need.

- Get simple checklists to help you start (even if you’re a total beginner).

- Be guided through tough but important questions with compassion and clarity.

It’s all about making this process approachable, doable, and even empowering.

? Ready to Take Action? (Mini Challenge!)

Let’s get you started today with a bite-sized action step.

Estate Planning Mini Challenge:

Make a list of ALL your current accounts and assets. Check the beneficiaries on your bank accounts and retirement funds. Update them if needed.

Choose ONE document to tackle this month:

- Will

- Power of Attorney

- Healthcare Directive

Start with the easiest one for you. This tiny step will start creating massive peace of mind, and it’s easier than you think.

? Final Thoughts: Your Legacy Starts Now

Here’s what I want you to remember: Estate planning isn’t just for “older” or “wealthy” people – it’s for everyone who wants to protect their future.

You don’t need to do it all at once, but starting somewhere is powerful. This isn’t about fear – it’s about empowerment, peace of mind, and love.

And if you’re ready to take this even further to finally build a money plan that covers everything from budgeting to wills and beyond, get ready. My Your Financial Freedom Breakthrough™ – 90 Day Money Makeover opens on September 10th, and it’s designed to help you:

- Create lasting financial change.

- Build a money system that works for your life.

- Feel empowered, organised, and confident with your finances – once and for all.

You’ve got this, and I’m cheering you on every step of the way.