Debt Freedom: 3 Simple Shifts That Accelerate Your Payoff Plan (Without Losing Your Mind!)

Let’s get honest for a second. Debt… it’s a heavy word, right? For many of us, just hearing it triggers:

- A knot in the stomach.

- A wave of shame or regret.

- That overwhelming thought: “Will I ever get out of this?”

If this sounds familiar, take a deep breath – you are not alone. Whether it’s credit cards, student loans, car payments, or that lingering medical bill, debt can feel like a mountain that just keeps growing. But here’s the truth most people won’t tell you:

Debt freedom isn’t just about paying more toward your balances – it’s about shifting the way you think, act, and plan with your money.

Today, I’m going to walk you through:

- Why traditional debt payoff advice often backfires.

- The three powerful mindset shifts that can accelerate your debt payoff (without sucking all the joy out of your life).

- How your credit score, saving, and debt freedom are more connected than you think.

- Simple steps you can take right now to start feeling empowered and in control.

And yes, we’ll keep it light, fun, and inspiring, because you deserve to feel good about your money journey, even while tackling debt.

? The Problem with Traditional Debt Advice (Why It Doesn’t Work for Most People)

Let’s start here. If you’ve ever Googled “how to pay off debt fast,” you’ve probably seen some version of this advice:

- “Cut out all unnecessary spending.”

- “Stop eating out.”

- “Work a second (or third) job.”

- “Sell everything you own.”

And sure… some of these tips can help in extreme situations. But for most people, this kind of advice:

- Feels impossible to stick with long-term.

- Creates a cycle of guilt and burnout.

- Ignores the emotional and psychological side of debt.

Here’s the truth:

Debt isn’t just a numbers problem, it’s a behavior and mindset problem, too. Yes, we need to talk about strategy, but if we skip the emotional side of debt, we’ll never create lasting results.

✨ Why Getting Out of Debt Starts in Your Mind (Not Just Your Wallet)

Debt can feel like quicksand, but it’s often not just about the math. It’s about:

- The stories you tell yourself about money.

- The shame or guilt you carry from past mistakes.

- The anxiety that makes you want to avoid looking at your accounts.

Think about it:

- How many times have you avoided checking your credit card balance?

- How often do you think, “I’ll deal with this later,” when it comes to debt?

- How many times have you paid off a balance, only to end up back in debt again later?

This isn’t about being “bad” with money – it’s about being human.

We live in a world that encourages overspending, instant gratification, and comparison. Debt happens. But freedom from it? That happens when you combine practical steps with internal shifts.

? The 3 Simple Shifts That Can Speed Up Your Debt Freedom Journey

Let’s dive into the real magic. Here are the three powerful mindset shifts that can help you:

- Pay off debt faster.

- Stop the cycle of yo-yo debt.

- Build financial confidence along the way.

Shift #1: From Shame to Ownership

Here’s the thing about debt: It thrives in secrecy.

The more we hide from it, the more it grows, and the worse we feel. Shame sounds like:

- “I should have known better.”

- “I’m terrible with money.”

- “I’ll never get ahead.”

But here’s the truth:

- Debt doesn’t define you.

- Your past mistakes don’t determine your future.

- You can learn new skills and create different results.

The first step toward debt freedom isn’t cutting expenses, it’s cutting the shame.

Action Step:

- Write down your total debt, every dollar, every balance.

- Look at it with neutrality – this is data, not a character flaw.

Say this out loud:

“This is where I am right now. It’s not permanent. I have the power to change it.” This simple shift from shame to ownership changes everything.

Shift #2: From Scarcity to Empowered Planning

Many people approach debt payoff from a place of fear:

“I need to get rid of this ASAP or else!”

“I have to sacrifice everything until I’m debt-free.”

But here’s the problem:

- Extreme approaches rarely last.

- Scarcity leads to burnout and yo-yo spending.

Instead, approach debt payoff from a place of empowerment: “I am intentionally choosing where my money goes each month.”

This means:

- Making a realistic debt payoff plan that fits your actual life.

- Balancing progress with joy, you don’t have to cut everything you love.

- Prioritising consistency over speed.

Action Step: Choose a debt payoff method that feels good to you:

- Debt Snowball: Pay off the smallest balance first for quick wins.

- Debt Avalanche: Pay off the highest-interest debt first to save money long-term.

Create a monthly payment plan that includes money for fun and savings. This way, you’ll stay motivated—and avoid slipping back into debt later.

Shift #3: From Avoidance to Proactive Credit Care

Ah, credit scores, the mysterious numbers that somehow rule our financial lives. Many people either obsess over their credit or completely avoid it. But here’s the truth:

- Your credit score isn’t your enemy, it’s just a tool.

- You don’t need to obsess over it daily, but ignoring it won’t help either.

Proactive credit care means:

- Checking your credit report at least once a year (you can do this for free!).

- Disputing any errors that could be dragging your score down.

- Making consistent, on-time payments to build positive credit history.

- Keeping credit utilization low (aim for under 30% of your limits).

Action Step:

- Go to equifax.com.au and pull your free credit report.

- Check for errors or suspicious activity.

- Set up automatic payments for at least the minimum on all debts to protect your score.

When you face your credit head-on, it becomes a tool, not a threat.

? Debt Freedom & Saving: The Power Duo

Here’s something most debt advice misses: Paying off debt without saving at the same time can backfire. Why? Because if you throw every dollar at debt but don’t have any savings, guess what happens the next time life throws a curveball? Yep – you end up right back in debt.

Even while you’re paying off debt, it’s essential to:

- Build a starter emergency fund (even just $500 to $1,000).

- Save a little every month, even if it’s $10 or $25.

This small cushion keeps you from relying on credit when unexpected expenses pop up, and they will.

Action Step:

- Open a separate savings account (nicknamed “Safety Net” if you like!).

- Set up automatic transfers – even small ones.

- Celebrate every deposit, no matter how small.

This helps break the cycle of debt for good.

? Why Debt Freedom Is More Emotional Than You Think

Here’s something I see all the time in my coaching work: People think paying off debt will automatically make them feel better.

But here’s the secret:

- Debt freedom feels amazing, but it also brings up unexpected emotions.

- Many people feel a strange sense of loss when they finish paying off debt.

- Others struggle with identity shifts – “Who am I without debt?”

- And some even self-sabotage and fall back into debt again.

This is why working on your money mindset while paying off debt is so important. It’s not just about the numbers, it’s about your emotional relationship with money, freedom, and self-worth.

? Your Debt-Free Future Starts with One Step (But It’s Not What You Think)

If you’re feeling overwhelmed by your debt right now, here’s what I want you to know:

You don’t need to:

- Have a perfect plan.

- Pay it all off overnight.

- Deprive yourself to succeed.

You just need to:

- Get clear on your numbers.

- Shift your mindset from shame to empowerment.

- Take consistent, small actions.

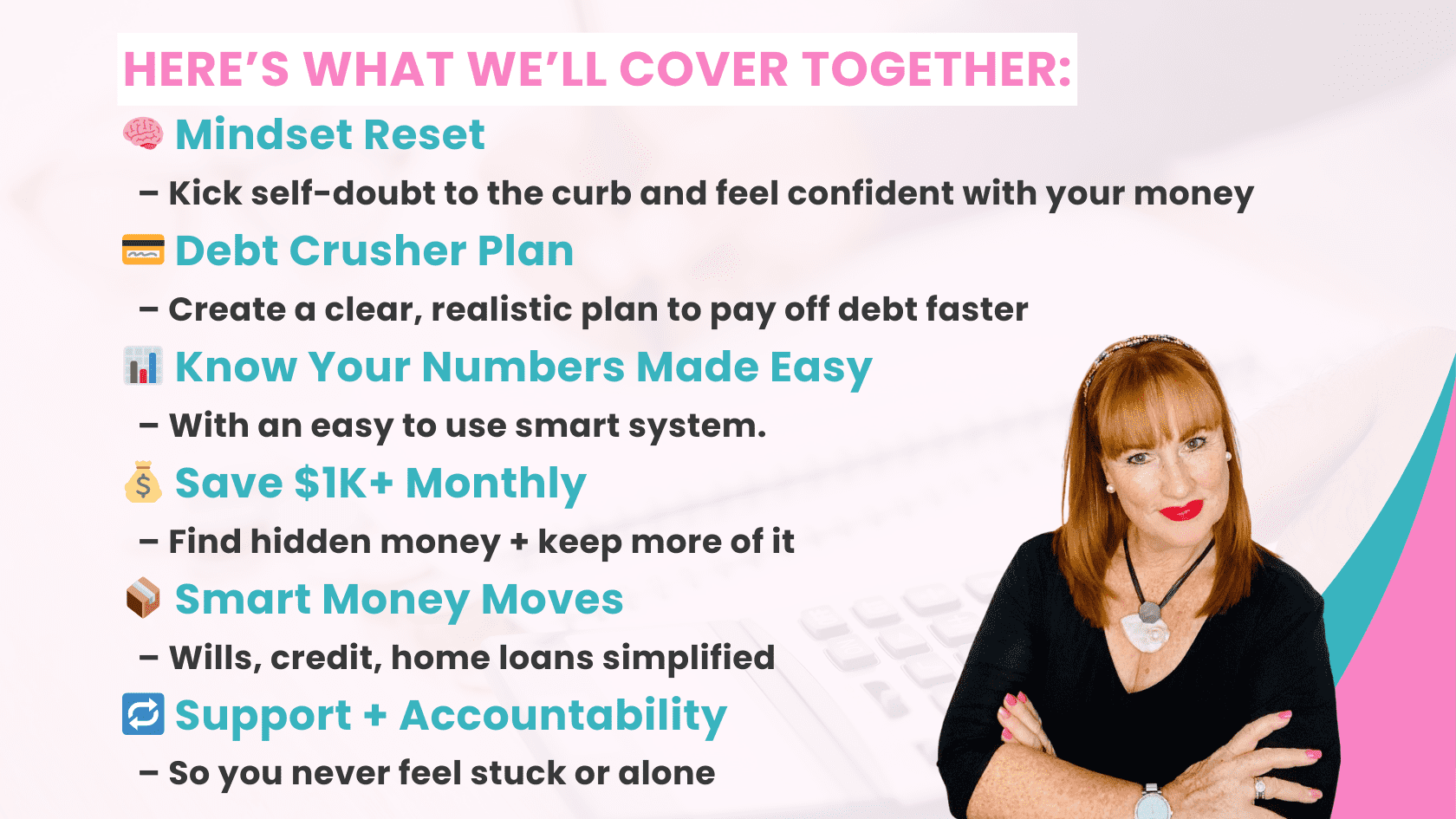

And yes – this is exactly why inside my Your Financial Freedom Breakthrough™ – 90 Day Money Makeover program, we don’t just talk about debt payoff tactics. We go deep into:

- Money mindset shifts that last.

- Customised debt payoff strategies that work for your real life.

- Credit confidence – so you’re empowered, not intimidated.

- Saving alongside debt payoff to build true financial stability.

It’s about creating a debt-free life you love – not one that feels like a punishment.

? Ready to Take Action? (Mini Challenge!)

Let’s finish this post with a quick action step to help you get started today.

Debt Freedom Mini Challenge:

- Write down your current total debt balance – no judgment, just facts.

- Choose your preferred payoff method: Snowball (smallest balance first) or Avalanche (highest interest first).

- Set a realistic target date for your first major milestone – paying off ONE account.

- Automate your minimum payments, plus an extra small amount toward your top-priority debt.

- Start a tiny emergency fund – even just $10 this week – to protect your progress.

Take one step at a time, and watch the momentum build.

? Final Thoughts: You’re Closer to Debt Freedom Than You Think

Here’s what I want you to walk away with today: Debt freedom isn’t about punishment – it’s about empowerment. You don’t have to wait to feel good about your money – you can start now, even while in debt. Small, consistent shifts – both practical and emotional – are what create lasting change.

And if you’re ready to take this work deeper – so you can finally break free from debt, grow your savings, and feel peaceful with your money? Your Financial Freedom Breakthrough™ – 90 Day Money Makeover program opens on September 10th. Inside, we’ll tackle:

- Debt payoff (without shame or extreme restrictions).

- Credit confidence (in plain English!).

- Sustainable saving habits.

- And the deep money mindset work that makes all the difference.

This isn’t just another debt payoff plan, it’s a total transformation for your financial life. Get ready, friend – your next chapter starts soon.