How to Stop the Feast and Famine Cycle and Finally Take Control of Your Business Money

Let’s get real for a moment.

Running a small business is a wild ride. One month you’re rolling in sales and feeling unstoppable. The next, you’re counting coins, putting off paying that supplier, and wondering if you’ll need to dip into your personal savings again (that’s if you have any left).

Sound familiar?

If you’re living in the stressful loop of feast and famine, you’re not alone – and it’s not your fault. Most business owners start their business because they’re great at what they do, not because they’re experts in money management.

But here’s the good news: you can absolutely break the cycle and build a business that pays you consistently, without losing your mind in the process.

Let’s dive into what causes this rollercoaster and, more importantly, how to hop off it for good.

What is the Feast and Famine Cycle, Anyway?

It’s the classic small business trap. When you’re in “feast” mode, you’re busy delivering services, taking on all the clients, and hustling hard. You’re making money, and it feels great.

But because you’re so busy working in the business, you’re not working on it. Marketing falls off. You don’t follow up on leads. You’re not planning ahead.

Then, suddenly – bam! – the work dries up. The cash stops flowing, and panic sets in. So, you hustle hard again to find more clients. And the cycle repeats.

It’s exhausting, stressful, and totally unsustainable.

Why It Happens (And Why It’s Not Your Fault)

Here’s what no one tells you when you start your own business: Cash flow is everything.

But too many small business owners don’t have a plan for their money. They treat their business account like a personal piggy bank, or they’re too busy wearing 15 hats to track expenses properly.

Without systems, buffers, and strategy, you’re flying blind. And that’s a dangerous way to run a business – no matter how good you are at what you do.

How to Break the Cycle: 7 Steps to Consistent, Confident Business Finances

It’s time to turn your financial chaos into clarity. Here’s how you do it – step by step.

1. GET CLEAR ON YOUR NUMBERS

Let’s start with a little tough love: if you don’t know your numbers, you don’t know your business.

That means knowing:

- How much it really costs to run your business monthly

- Your average monthly revenue

- Your break-even point

- How much you need to earn to pay yourself properly

This doesn’t have to be complicated. Use a simple spreadsheet or accounting tool (like Xero, QuickBooks, or even a Google Sheet) to track everything that comes in and goes out.

Knowledge is power, and in business, it’s the difference between survival and success.

2. SEPARATE YOUR PERSONAL AND BUSINESS FINANCES

If you’re still using one bank account for everything, we need to talk.

Mixing personal and business money is a recipe for confusion, stress, and tax-time nightmares.

Set up a separate business account, and commit to paying yourself a “business wage” regularly, even if it starts small. This not only helps you manage your cash flow better, it makes you feel more like the CEO you are.

3. CREATE A MONEY FLOW SYSTEM THAT WORKS FOR YOU

Ever heard of Profit First? It’s a simple but powerful cash management system where you allocate money into separate “buckets” every time income comes in.

Here’s a basic version you can try:

- Income Account – where all your revenue lands

- Profit Account – set aside 5-10% for long-term savings or growth

- Owner’s Pay Account – your regular wage

- Tax Account – avoid nasty surprises at BAS time

- Expenses Account – to cover day-to-day costs

The goal is to become intentional with every dollar. This way, you’re not wondering where all the money went at the end of the month.

4. PLAN FOR THE LOWS – WHILE YOU’RE IN THE HIGHS

In “feast” mode, it’s easy to feel like the good times will last forever.

They won’t. And that’s okay, if you’re prepared.

Start building a business buffer fund – at least one month’s worth of operating expenses. When things slow down, you’ve got breathing room and don’t have to make decisions from a place of fear.

Pro tip: Automate transfers to your buffer fund after every client payment. Out of sight, out of spend.

5. SET REGULAR MONEY DATES (WITH YOURSELF OR WITH YOUR BOOKKEEPER)

You wouldn’t ignore a partner for months and expect the relationship to thrive, right? Same goes for your business finances.

Block out 30–60 minutes every week to:

- Check your cash flow

- Send invoices

- Pay bills

- Review your numbers

- Track your goals

Make it fun – grab a coffee and put on your favourite playlist. The more you connect with your money, the more empowered you’ll feel.

6. DITCH THE HUSTLE CULTURE AND CREATE RECURRING REVENUE

Feast and famine often come from project-based or one-off work. If every sale requires a new client or fresh hustle, your income will always be up and down.

What can you do to create consistent income?

- Offer monthly retainers or packages

- Launch a membership or group program

- Create digital products (courses, ebooks, templates)

- Automate a funnel that sells for you in the background

Even just one recurring income stream can bring serious stability.

7. GET HELP SOONER, NOT LATER

You don’t have to do this alone.

If you’re constantly stuck in financial stress, it’s time to call in some support. A good financial coach (🙋♀️ like me!) can help you set up systems, build a plan, and create a business that pays you – without the burnout.

Sometimes the biggest breakthrough is admitting you need help and taking that first step toward real change.

Bonus Tips for Aussie Small Biz Owners

Since I’m based in Australia and many of my clients are too, here are a few extra pointers:

- Stay on top of BAS and GST obligations – set aside a percentage of income as soon as you get paid.

- Consider using accounting software like Xero to automate your BAS and income tracking.

- Use the ATO’s small business cash flow projection tool to forecast your months ahead.

- Look into government grants or support – there may be funding or mentoring programs available.

Final Thoughts: You Deserve Consistent Cash, Not Constant Stress

Here’s the truth: You didn’t start your business to feel financially anxious all the time. You started it for freedom, flexibility, and fulfillment.

The feast and famine cycle might feel normal – but it’s not healthy, and it’s not inevitable.

With the right systems, support, and mindset, you can step into a whole new way of doing business. One where you feel in control, empowered, and finally able to enjoy the fruits of your hard work.

Ready to Ditch Feast and Famine for Good?

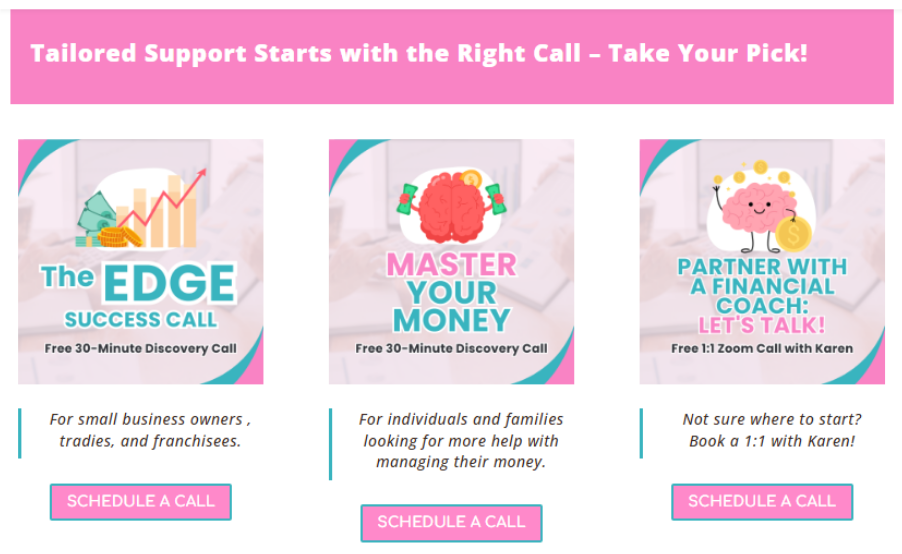

If this blog lit a fire in you, and you’re ready to say goodbye to cash flow stress, I’ve got your back.

Book a call so we can talk about how I can help you build your financial muscle, take control of your cash flow, and finally get paid like the boss you are.

💪 Let’s stop just surviving—and start thriving.