Jan 21, 2026 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Saving Money, Self Development, Side Hustle, Welcome

It’s Not Just About the Numbers – It’s About Your Mindset

Look, you can have the best spreadsheet in the world…

You can download all the budget apps, cut back on coffee, and cancel every subscription.

But if your money mindset hasn’t shifted? You’ll still feel stuck, overwhelmed, or like “you’re just not good with money.”

Let’s fix that because 2026 is the year we stop dragging last year’s money baggage into our future.

This blog is your ultimate guide to resetting your mindset, clearing out old financial beliefs, and building a powerful, positive relationship with money.

And yes – it’s fun, it’s doable, and it’s way more effective than another boring budget.

Let’s go.

What Even Is a Money Mindset?

Your money mindset is the collection of beliefs, emotions, and thoughts you have about money. It’s your personal “money story” – the internal script you repeat (often subconsciously) about earning, saving, spending, and wealth.

Some of it comes from your childhood, your past experiences, or society’s weird money rules. And here’s the wild part: It influences every single money decision you make.

Your mindset determines whether you:

- Save confidently or hoard out of fear

- Ask for more money or shrink your value

- Budget with ease or avoid your bank balance like it’s haunted

Signs You Might Need a Money Mindset Reset

?♀️ You feel anxious or guilty every time you spend money

? You avoid looking at your bank account or credit card

?♂️ You say things like “I’m just bad with money” or “I’ll never get ahead”

?♀️ You feel stuck in a paycheck-to-paycheck cycle, even when your income grows

If that sounds like you, it doesn’t mean you’re broken – it means it’s time to reprogram your financial brain.

Step 1: Identify the Old Money Stories Holding You Back

Before you can shift your mindset, you need to see what you’re working with.

Ask yourself:

- What did I learn about money growing up?

- What do I believe about wealthy people?

- When I think about money, do I feel free or fearful?

Some common limiting beliefs:

- “There’s never enough money.”

- “Money is hard to manage.”

- “I’m not good with numbers.”

- “More money means more stress.”

? None of these are facts. They’re just beliefs. And beliefs can change.

Step 2: Choose Empowering New Money Beliefs

You get to write a new story this year. Start by replacing the old thoughts with intentional, positive ones:

Instead of: “I’m bad with money” → Say: “I’m learning how to manage my money powerfully.”

Instead of: “I’ll never get ahead” → Say: “Every dollar I manage well moves me forward.”

Instead of: “Money is stressful” → Say: “Money is a tool I’m learning to use with confidence.”

✨ Tip: Write your new beliefs down. Post them on your mirror. Make them your phone wallpaper. Say them out loud. Train your brain to believe better.

Step 3: Connect Your Money to What You Actually Value

Ask yourself:

- What do I want money to do for me this year?

- What do I value most – freedom? stability? generosity? joy?

- How can I align my spending and saving with those values?

Example:

If you value peace of mind, create a savings plan.

If you value freedom, reduce debt.

If you value fun, build in guilt-free spending money.

Money doesn’t just serve numbers – it should serve your life.

Step 4: Make Mindset Work Part of Your Routine

You don’t go to the gym once and expect abs, right?

Same with your mindset. It takes repetition.

Here’s a weekly reset routine you can follow:

? Money Mindset Reset (10 Minutes):

- Review your thoughts from the week – what came up around money?

- Journal one thing you’re proud of financially

- Write or say one new belief out loud

- Visualise yourself succeeding with money

? Do this every Sunday before your weekly budget check-in and you’ll be unstoppable.

Step 5: Surround Yourself With New Financial Energy

If you want to upgrade your mindset, you need to upgrade your environment.

That might look like:

- Listening to empowering money podcasts

- Following financial educators who speak your language (hello ? yes me ?)

- Talking about money with friends who are also growing

- Hiring a coach who helps you reframe, reset, and rise (hello ? yes me again ?)

You can’t change your money mindset in isolation. That’s why I created my Financial Muscle Coaching Membership. It’s where financial growth meets real community and support.

Step 6: Replace Shame With Curiosity

When things go “wrong” you overspend, forget a bill, or avoid a budget – don’t spiral into shame. Instead, ask:

- What triggered this?

- What do I need right now – support, structure, or space?

- What can I do differently next time?

Every financial hiccup is just data. Don’t let one moment of messiness define your entire money story.

You’re allowed to be a work in progress and a success story at the same time.

Step 7: Set Mindset-Based Goals for the Year

Let’s skip the boring “save more, spend less” vibe.

Try these instead:

- “This year, I’m building my financial self-trust.”

- “This year, I’m proving I can stick to one habit consistently.”

- “This year, I’m learning to enjoy managing my money.”

Then break that into monthly goals:

✅ January: Track every dollar

✅ February: Create a spending plan aligned to my values

✅ March: Build an emergency fund of $300

Momentum creates confidence and mindset fuels momentum.

Final Thoughts: You Can’t Budget Your Way Out of a Scarcity Mindset

If you’re stuck in fear, guilt, or shame around money, no spreadsheet will save you. You have to go deeper. And you have to believe that a new relationship with money is possible for you.

Because it is.

You are not bad with money.

You are not too far behind.

You are not stuck – you’re just getting started.

And when you build a strong, positive money mindset? Everything else gets easier.

Let’s build that mindset muscle together.

? Join Financial Muscle Coaching

If you’re ready to change your money mindset, build real financial confidence, and create a life that feels good – not just looks good on paper – I’ve got you.

Join Financial Muscle Coaching – my coaching community where we:

✅ Rewrite limiting money stories

✅ Build strong, sustainable habits

✅ Create aligned goals you actually want to follow

This isn’t just budgeting. This is mindset, motivation, and muscle – built week by week, with me in your corner.

Your money mindset reset starts here. Let’s go. ?

#HowToResetMyMoneyMindset #WhyDoIFeelOutOfControlWithMoney #HowToFeelInControlOfFinances #ResetMoneyMindset2025 #NewYearFinancialMindset #HowToStartFreshWithMoney #MindsetShiftForMoney #RebuildMoneyConfidence #WhatIsMoneyMindset #MoneyMindsetTransformation #MoneyMindset #MoneyConfidence #FinancialReset #MoneyHealing #FinancialEmpowerment #AbundanceMindset #WealthMindset #MoneyCoach #MoneyGoals2025 #FinancialMuscle

Apr 9, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle, Welcome

Financial freedom isn’t just about saving money or cutting costs; it’s about truly understanding your financial position. Knowing your numbers means gaining a clear picture of your assets, liabilities, income, and expenses. This knowledge is the foundation for making informed decisions, reducing financial stress, and achieving stability. In this blog, we’ll explore why knowing your numbers is essential and how you can start your journey toward financial clarity today.

Why Monthly Coaching is a Game-Changer

Financial success doesn’t happen overnight. It requires consistent effort, strategic planning, and the right tools. Monthly Coaching provides all of this and more:

1. EXPERT GUIDANCE

-

-

-

- Work with an experienced financial coach, like myself who understand the challenges you’re facing.

- Receive practical support tailored to your unique situation.

2. ACCOUNTABILITY

-

-

-

- Regular check-ins ensure you stay on track with your financial goals.

- Celebrate milestones and adjust your plan as needed.

3. ACCESS TO THE VAULT

-

-

-

- Unlimited access to a comprehensive library of courses, tools, and resources.

- Learn at your own pace and revisit materials anytime.

4. PERSONALISED STRATEGIES

-

-

-

- Receive a customized roadmap based on your financial priorities and challenges.

- Develop actionable steps to tackle debt, save effectively, and build wealth.

Joining THE VAULT gives you unlimited access to a comprehensive library of courses, tools, and resources.

What’s Inside THE VAULT?

Our THE VAULT is the heart of the Monthly Coaching program, packed with resources designed to simplify your financial journey

1. COMPREHENSIVE COURSES

-

-

-

- Covering topics like budgeting, saving, debt reduction, and financial mindset.

- Each course is broken into manageable modules, so you can learn step by step.

2. INTERACTIVE TOOLS

-

-

-

- Use calculators, trackers, and templates to monitor your progress.

- Visualise your goals and see how small changes make a big impact

3. EXCLUSIVE WEBINARS

-

-

-

- Monthly expert-led sessions on trending financial topics and strategies.

- Ask questions and gain insights from industry professionals.

4. SUPPORTIVE COMMUNITY

-

-

-

- Connect with other members for advice, motivation, and shared experiences.

- Build relationships with like-minded individuals who understand your journey.

How Monthly Coaching Fits Your Life?

We understand that life is busy, which is why Monthly Coaching is designed to be flexible and convenient:

1. LEARN ANYTIME, ANYWHERE

-

-

- Access courses and resources on your schedule, whether it’s during your morning coffee or after the kids are in bed.

2. QUICK CHECK-INS

-

-

- Regular updates keep you accountable without overwhelming your to-do list.

3. ACTIONABLE GOALS

-

-

- Break down big financial objectives into smaller, manageable steps.

Focus on one priority at a time to avoid feeling overwhelmed.

Success Stories

Hearing how others have transformed their finances can be incredibly motivating. Here are just a few examples of how the programs and training in THE VAULT has changed lives:

1. SARAH’S STORY

-

-

-

- A single mum struggling with debt, Sarah joined the program to regain control of her finances.

- With the support, she created a realistic budget, eliminated $5,000 of credit card debt, and started saving for her daughter’s education.

2. MARK’S JOURNEY

-

-

-

- Mark wanted to save for a down payment on a house but didn’t know where to start.

- Through THE VAULT, he learned how to track his expenses, cut unnecessary costs, and saved $20,000 in just 18 months.

3. LISA’S TRANSFORMATION

-

-

-

- Lisa was overwhelmed by her financial situation and didn’t know how to prioritise her goals.

- THE VAULT helped her identify her top priorities, pay off her car loan early, and build an emergency fund within a year.

Why Join Now?

April is the perfect time to take control of your finances. By enrolling in THE VAULT, you’ll gain access to all the tools and support you need to achieve your goals. Plus, our April focus on “Know Your Numbers” ensures you start with a solid foundation.

EXCLUSIVE APRIL BONUSES:

1. PERSONALISED NET POSITION

-

-

- Receive a detailed breakdown of your financial standing to kickstart your journey.

2. ADDITIONAL SOURCES

-

-

- Bonus worksheets and guides to help you implement what you learn.

Conclusion

Regular coaching isn’t just about managing money; it’s about creating a lifestyle that aligns with your values and aspirations. With expert guidance, a wealth of resources, and a supportive community, you’ll gain the clarity and confidence to take control of your financial future. Don’t wait – join THE VAULT today and make this the year you achieve your financial dreams!

Mar 26, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle, Welcome

What if managing money felt effortless instead of stressful? What if financial decisions felt natural rather than overwhelming? Welcome to the concept of financial flow – where money moves in and out of your life with ease, and you feel confident and in control every step of the way.

Financial flow isn’t about luck, nor is it reserved for the wealthy. It’s about aligning your mindset, habits, and systems so that money becomes a source of empowerment rather than anxiety. Let’s dive into the secrets of mastering money with ease.

Secret #1: Trust That Money Flows to and Through You

One of the biggest money struggles people face is the feeling of scarcity – thinking there’s never enough. But here’s a powerful reframe: Money is energy. It moves, circulates, and returns when managed intentionally.

Rather than clinging tightly to every dollar out of fear, shift your perspective:

-

- Trust that more opportunities to earn will come.

- Believe that when you spend intentionally, money will return in other ways.

- Recognise that wealth grows when you let money work for you through smart investments and aligned spending.

The key is to create a flow where money moves through your life in a way that serves you, rather than feeling stuck or stagnant.

Secret #2: Design a Financial System That Works for You

Many people resist financial planning because they think it’s restrictive. But the truth is, having a system actually frees you. A good financial system automates the boring stuff so you can focus on what matters. A simple, effective system includes:

-

- A Spending Plan (not a strict budget, but a flexible plan for where your money should go each month)

- Automatic Transfers to savings and investments so they grow without you overthinking it

- A Guilt-Free Fun Fund so you can enjoy your money without worry

- A Weekly Money Check-In to keep things on track without stress

When your system is designed for ease, managing money stops being a chore and starts feeling like second nature.

Secret #3: Align Your Money with Your Joy

Ever notice how some purchases feel amazing while others leave you with regret? That’s because true financial satisfaction comes from spending in alignment with your values and priorities.

Take a look at your expenses and ask:

-

- Does this purchase bring me joy, security, or opportunity?

- Am I spending out of habit, pressure, or impulse?

- How can I redirect my money toward things that truly enrich my life?

When money is spent intentionally on things that light you up rather than weigh you down, you feel at ease with your financial decisions.

Secret #4: Remove the Money Blocks Keeping You Stuck

Sometimes, it’s not just financial strategies that hold people back – it’s emotional and mental blocks. Thoughts like:

-

- “I’ll never get ahead.”

- “Money is stressful.”

- “I don’t deserve to be wealthy.”

These hidden money blocks create resistance, keeping you stuck in the same cycles. The key is to identify them, challenge them, and replace them with beliefs that support financial ease.

Instead of “Money is stressful,” try “I am learning to manage money with confidence.” Small shifts in mindset create massive shifts in financial reality.

Secret #5: Surround Yourself with Financial Flow Energy

Just like anything in life, who and what you surround yourself with influences your financial experience. If your circle is always complaining about money or reinforcing scarcity thinking, it’s harder to break free.

Instead, seek out:

-

- Books and podcasts that expand your financial knowledge

- Mentors or communities that uplift and encourage abundance

- Coaching or courses that provide actionable steps toward financial confidence

This is exactly why I created my Monthly Coaching program, giving you access to THE VAULT – a collection of resources to help you create lasting financial flow. And if you’re ready to take full control of your financial journey, the Master Your Money program will guide you every step of the way.

Final Thoughts: Financial Flow is a Choice

Mastering money with ease isn’t about earning more, it’s about creating a relationship with money that feels natural and empowering. When you remove resistance, align your money with your joy, and put systems in place, you create a life where money works for you, not against you.

So ask yourself: What’s one step you can take today to step into financial flow? Your money journey is yours to design, and you have everything it takes to make it happen and effortless.

Jul 12, 2024 | Building Emotional Muscle, Building Financial Muscle, Debt, Educational Series, Episodes, Financial Management 101, Home Loan, Mindset, Mortgage, Relationships, Retirement, Saving Money, Self Development, Welcome

Feeling like a hamster on a wheel, running fast but getting nowhere? High debt and living costs can do that. But fear not, because even a hamster can break free with a plan! Let’s explore how you can save money even when debt and high living costs are dragging you down.

The Debt Dillema

Debt is like an unwelcome guest who overstays their welcome, eating away at your peace of mind and your wallet. High living costs add fuel to this fire, making it seem impossible to save. But just as there’s a way out of every maze, there’s a path to financial freedom for you too.

STEP 1. TRACK EVERY DOLLAR

The first step to saving is knowing where your money is going. You might think you have a good handle on your spending, but tracking every dollar can reveal surprising patterns and money leaks you didn’t know existed.

Action Steps:

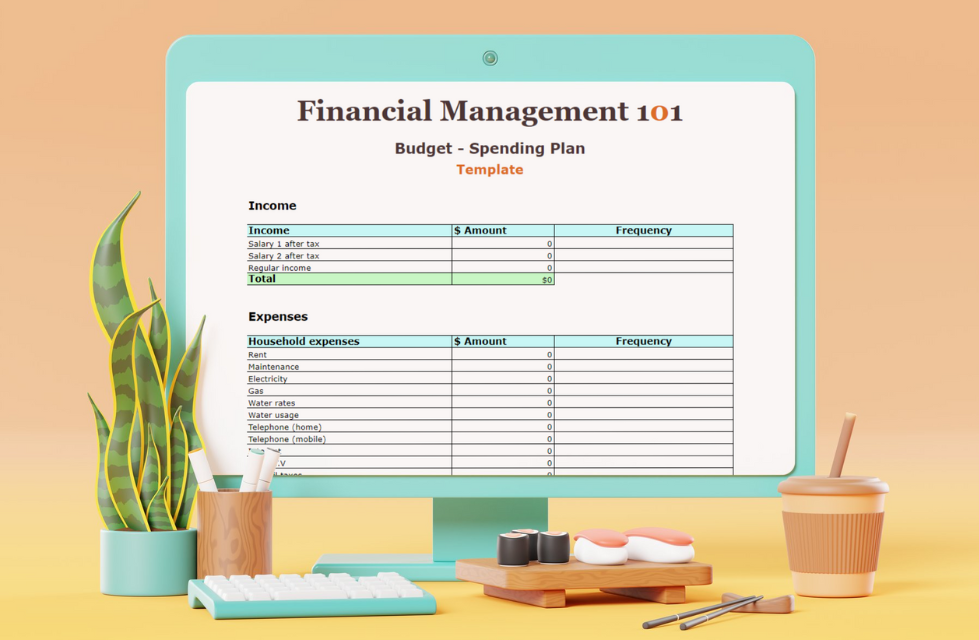

- Use Budgeting Apps: They can help you track your spending in real-time. They categorise your expenses and show you where your money goes. I have a budgeting spreadsheet that you can download and use, it’s free so check the link below.

- Manual Tracking: If you prefer, use an excel spreadsheet or a good old notebook. Write down every expense, no matter how small. This manual process can make you more mindful of your spending.

By tracking your expenses, you gain awareness of your spending habits, which is the first step to making changes.

They can help you track your spending in real-time.

STEP 2: PRIORITISE YOUR DEBTS

Not all debts are created equal. High-interest debts like credit card balances can quickly spiral out of control. By prioritising these, you can reduce the amount of interest you pay, freeing up money for savings.

Action Steps:

- List Your Debts: Write down all your debts, including interest rates and minimum payments. This gives you a clear picture of what you’re dealing with.

- Debt Avalanche Method: Focus on paying off the debt with the highest interest rate first while making minimum payments on others. Once the highest interest debt is paid off,move one to the next highest. This method saves you the most money in interest.

- Debt Snowball Method: Alternatively, pay off the smallest debt first to gain a psychological win. This boosts your confidence and motivation to tackle larger debts.

Prioritising your debts helps you tackle them systematically, reducing your overall financial burden.

STEP 3: NEGOTIATE YOUR BILLS

You’d be surprised at how often you can negotiate better terms on your bills. From credit card interest rates to cable bills, a simple phone call can result in significant savings.

Action Steps:

- Credit Card Rates: Call your credit card companies and ask for a lower interest rate. Explain your situation and your history as a good customer. You might be surprised at their willingness to help.

- Utility Bills: Check your monthly utility bills for any errors or unnecessary services. Contact your providers and negotiate lower rates or switch to a cheaper plan.

- Subscriptions and Services: Review your subscriptions (like cable, internet, gym memberships) and see if you can negotiate a lower rate or cancel unused services

Negotiating your bills can free up extra cash to put towards savings or debt repayment.

Review your subscriptions (like cable, internet, gym memberships) and see if you can negotiate a lower rate or cancel unused services.

STEP 4: BOOST YOUR INCOME WITH SIDE HUSTLES

Increasing your income can make a significant difference when you’re trying to save and pay off debt. A side hustle can provide the extra cash you need to get ahead.

Action Steps:

- Identify Your Skills: What skills do you have that others might pay for? Freelancing, tutoring, pet sitting, or even selling crafts online can be great side gigs.

- Explore Gig Economy Jobs: Consider gig economy jobs like driving for Uber or Lyft, delivering groceries with Instacart, or doing tasks on TaskRabbit. These flexible jobs can fit into your schedule and provide additional income.

- Sell Unused Items: Declutter your home and sell items you no longer need on platforms like eBay, Craigslist, or Facebook Marketplace.

A side hustle can provide the financial boost you need to start saving and pay off debt faster.

STEP 5: CUT COSTS CLEVERLY

When living costs are high, cutting expenses might seem impossible. But with some creativity, you can find ways to reduce your spending without sacrificing too much.

Action Steps:

- Meal Planning and Cooking at Home: Eating out can drain your budget quickly. Plan your meals, buy groceries in bulk, and cook at home to save money. Consider batch cooking and freezing meals to save time.

- DIY and Repair: Before buying something new, see if you can repair or repurpose what you already have. YouTube is a great resource for DIY repair tutorials.

- Shop Smart: Use coupons, cashback apps, and shop during sales to save on groceries and household items. Compare prices online before making purchases.

- Energy Efficiency: Save on utility bills by making your home more energy-efficient. Use LED bulbs, unplug electronics when not in use, and adjust your thermostat to save on heating and cooling costs.

Cutting costs doesn’t mean you have to live a frugal, joyless life. It’s about making smarter choices that align with your financial goals.

Meal planning, doing your own house repairs, and using discount coupons and cashback apps can help you cut costs and save some bucks!

STEP 6: BUILD A SAVINGS HABIT

Even when money is tight, it’s important to build the habit of saving. Start small and gradually increase your savings as you pay off debt and free up more income.

Action Steps:

- Automate Your Savings: Set up automatic transfers to your savings account. Start with a small amount, like $5 or $10 a week, and increase it over time.

- Save Windfalls: Whenever you receive unexpected money (like a tax refund, bonus, or gift), put a portion of it into savings. This can give your savings a significant boost.

- Create a Savings Challenge: Challenge yourself to save a specific amount each month. Track your progress and reward yourself when you hit your targets.

Building a savings habit, even with small amounts, sets the foundation for long-term financial security.

STEP 7: STAY MOTIVATED AND FOCUSED

Paying off debt and saving money can be a long journey, but staying motivated is key to your success.

Action Steps:

- Set Clear Goals: Define your savings and debt repayment goals. Write them down and review them regularly to keep yourself focused.

- Celebrate Milestones: Celebrate your progress along the way. Whether it’s paying off a debt or reaching a savings milestone, acknowledge your achievements.

- Stay Positive: It’s easy to get discouraged when progress is slow. Surround yourself with positive influences, whether it’s friends, family, or online communities focused on financial goals.

Remember, every small step you take brings you closer to financial freedom. Stay focused, stay motivated, and keep pushing forward.

Conclusion

Saving money when you have debt and the cost of living is high might seem like a daunting task, but it’s not impossible. By tracking your expenses, prioritising your debts, negotiating your bills, boosting your income, cutting costs cleverly, building a savings habit, and staying motivated, you can make significant progress toward your financial goals. Remember, it’s not about making huge changes overnight, but about taking small, consistent steps that add up over time. So, start today and watch as your financial situation gradually improves, one penny at a time.

Learn the fundamental concepts of how budgeting and saving are important to your financial well-being. Registration is now open for the course: Mastering Budget and Saving Techniques. This is a hands-on course with me guiding you on how to budget, track and look at managing your money like a pro.

May 22, 2024 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Debt, Educational Series, Episodes, Financial Health, Financial Management 101, Home Loan, Mortgage, Relationships, Retirement, Saving Money, Self Development, Welcome

Retirement planning entails taking into account a number of factors, including your current age, anticipated retirement age, lifestyle expectations, and current savings.

Here’s a general guideline to help you estimate how much you might need to save:

ESTIMATE RETIREMENT EXPENSES

Start by estimating your annual retirement expenses. This will depend on your desired lifestyle. A common rule of thumb is to aim for about 70-80% of your pre-retirement annual income.

CONSIDER YOUR RETIREMENT AGE

The earlier you plan to retire, the more you’ll need to save. Also, think about your life expectancy, as this will influence how long your retirement savings need to last.

CALCULATE SOCIAL SECURITY OR PENSION BENEFITS

If you’re eligible for Social Security or a pension, factor these into your calculations. These benefits can significantly reduce the amount you need to save on your own.

USE THE 4% RULE

A common rule for retirement savings is the 4% rule, which suggests that you can withdraw 4% of your retirement savings annually (adjusted for inflation each year) without running out of money. To use this rule, multiply your estimated annual retirement expenses by 25.

ADJUST FOR INFLATION AND INVESTMENT RETURNS

Remember that inflation will affect your purchasing power. Also, consider the potential returns from investing your savings, which can help your money grow over time.

EMERGENCY AND HEALTH CARE FUNDS

Set aside extra savings for unexpected health care costs and emergencies.

REGULARLY REVIEW AND ADJUST YOUR PLAN

Your needs and circumstances can change, so it’s important to review and adjust your retirement savings plan regularly.

Each individual’s situation is unique, so it is beneficial to consult with a financial planner to create a personalised retirement savings plan.

Remember, the earlier you start saving and the more you can put away, the better your chances of having a comfortable retirement.

Looking to get your money in order before retirement? Book an appointment with me today and join me for “Ignite Your Financial Spark: My Blueprint 30 Minute Call,” where we’ll transform your financial dreams into a solid, actionable blueprint plan —in just 30 minutes!

May 15, 2024 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Debt, Educational Series, Episodes, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Relationships, Saving Money, Self Development, Welcome

If you’re feeling overwhelmed and just not sure how to make a start, I’ve got you covered in this blog. To pay off debt efficiently, you must employ a variety of strategies that are tailored to your specific financial situation.

Here are some general steps to consider:

ASSESS YOUR DEBT

Start by listing all your debts, including credit cards, loans, and mortgages. Note the balance, interest rate, and minimum payment for each.

CREATE A BUDGET

Understand your monthly income and expenses. This helps in identifying how much extra you can allocate towards debt repayment.

EMERGENCY FUND

Before aggressively paying off debt, it’s wise to have a small emergency fund (like $1,000) to cover unexpected expenses without adding more debt.

CHOOSE A DEBT REPAYMENT STRATEGY:

- Debt Snowball Method: Pay off debts from smallest to largest balance, regardless of interest rate. This method can offer quick wins and motivation.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rates first while maintaining minimum payments on others. This method saves money on interest over time.

MAKE EXTRA PAYMENTS

Whenever possible, make extra payments. Even small additional amounts can significantly reduce your total interest and repayment duration.

CUT EXPENSES

Review your budget for areas to reduce spending. Redirecting these savings toward your debt can accelerate repayment.

CONSIDER CONSOLIDATION OR REFINANCING

If you have high-interest debt, consolidating into a lower-interest loan or refinancing can reduce the total interest paid.

AVOID NEW DEBT

While paying off existing debt, try to avoid taking on new debt, as this can derail your repayment plan.

INCREASE INCOME

Consider ways to boost your income, such as a side job or selling unused items, and use this extra income to pay down debt.

SEEK PROFESSIONAL ADVICE

If you’re overwhelmed, consider consulting a financial advisor or a credit counselor for personalised advice and possible debt management plans.

Remember, the best method depends on your personal financial situation, your discipline, and your motivation. It’s important to choose a strategy that you can stick with until all your debts are paid off.

Grab a FREE COPY of my Budget Spending Plan to track your income and expenses. CLICK HERE!

Need help and accountability? The LEARNING HUB helps you gain more financial knowledge, while providing you with the support and help you and others need. Join now for only $79 USD per month.