Dec 31, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Net Worth, Relationships, Saving Money, Self Development

There’s something magical about a fresh new year. It feels like a blank notebook just waiting to be filled – new hopes, new habits, and new opportunities. And when it comes to your finances, January is the perfect time to channel that energy into building momentum that lasts all year long.

Forget the overwhelming resolutions list. This year, it’s about starting small, starting strong, and building money confidence that fuels everything else in your life. Ready to step into 2026 with fresh energy? Here’s how.

? Step 1: Choose Your 2026 Money Theme

Instead of setting a dozen resolutions, pick a single theme to guide your financial decisions this year.

Examples:

- Growth: Focus on building savings or investments

- Freedom: Prioritise paying off debt

- Stability: Build your emergency fund

- Intentionality: Track spending and align with your values

Your theme becomes a compass. Whenever you face a financial choice, you can ask: Does this support my 2026 money theme?

? Step 2: Set One Clear Goal for January

Don’t wait until mid-year to make progress. Start now with one achievable goal this month. Ideas:

- Save $100 by cutting one expense (like takeaway coffees or subscriptions)

- Track every expense for 30 days

- Make an extra payment toward debt

- Open a new savings account for your emergency fund

When you achieve a quick win in January, you build confidence that sets the tone for the year.

? Step 3: Refresh Your Budget for the New Year

Your life has probably shifted since last January, so your budget should too. Take stock of:

- Your current income

- Your fixed expenses (rent, utilities, insurance)

- Your variable expenses (groceries, fun, travel)

- Your financial goals (savings, debt, investing)

Give every dollar a purpose. Remember, your budget isn’t about restriction – it’s a plan for freedom and choice.

? Step 4: Build Money Habits That Stick

The new year isn’t about overnight change – it’s about consistency.

Focus on simple, sustainable habits:

- Weekly money check-ins (15 minutes to review spending and update your budget)

- Automatic savings transfers on payday

- Meal planning to cut food waste and overspending

- Tracking your progress toward one goal each month

Habits create momentum. And momentum creates results.

✨ Step 5: Infuse Your Money Journey With Joy

Money confidence isn’t just about numbers – it’s about how you feel. This year, commit to making your financial journey something you enjoy.

Ideas:

- Celebrate small wins with non-spending rewards (like a relaxing night in or a walk in nature)

- Share your goals with a friend or accountability partner

- Create a money vision board for 2026

- Journal about what financial freedom looks and feels like for you

When you connect money with joy, you’ll find it easier to stick with your goals.

? Step 6: Create a Future-You Fund

Want to feel truly confident? Start building a little cushion for the future.

- Begin or boost your emergency fund

- Start a sinking fund for Christmas, travel, or birthdays

- Increase your superannuation contributions, even by 1%

Every dollar you set aside is a gift to your future self. And future-you will thank you for it.

? Final Thoughts: Step Into 2026 With Confidence

This new year isn’t about perfection. It’s about progress. It’s about taking small, intentional steps that align with your goals and values.

So choose your theme, set your January goal, refresh your budget, and commit to simple habits. Celebrate the wins along the way, and don’t forget to enjoy the journey.

Because 2026 is your story to write – and this year, you get to write it with confidence, clarity, and fresh money energy.

Dec 24, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Mindset, Relationships, Saving Money, Self Development

The Christmas decorations are packed away, the calendar is almost at its final page, and 2026 is knocking on the door. Before we rush ahead with resolutions and new goals, this is the perfect moment to pause, reset, and give your finances a fresh start.

Think of it as a deep clean for your money: clearing out the clutter, tying up loose ends, and laying down a solid foundation for the year ahead. You don’t need a complete financial overhaul – just a few intentional steps to get organised, centred, and ready for what’s next.

Here’s your Year-End Money Reset in 5 simple steps.

Step 1: Review the Year That Was

Start by taking an honest look at your 2025 money story:

- How much did you save?

- What debts did you pay down?

- Where did most of your money go?

- What financial habits worked well, and which ones didn’t?

Pull up your bank statements, budgeting app, or a notebook and jot down your reflections. This isn’t about judgement – it’s about awareness. You can’t reset what you don’t measure.

Step 2: Tidy Up Loose Ends

Before the year ends, clear out the financial “clutter” that weighs you down:

- Pay off small lingering balances if you can

- Cancel unused subscriptions or memberships

- Return any holiday items you overspent on and don’t really need

- Check expiry dates on gift cards (and use them!)

These little steps free up money and mental space, setting you up for a cleaner slate in 2026.

Step 3: Check Your Financial Health

Now’s the time to give yourself a quick financial check-up:

- Emergency fund: Do you have at least $500 – $1,000 set aside for surprises?

- Debt: What balances remain, and what’s your repayment plan?

- Credit score: Check it – it’s easier (and cheaper) to fix issues early

- Savings and investments: Review your pension contributions, ISAs, or other savings accounts

Think of this as your “financial MOT.” A little check-up now prevents breakdowns later.

Step 4: Set a Fresh Budget Blueprint

Don’t wait for January 1st – start shaping your new budget now.

Your 2026 budget should reflect:

- Your income (any changes for the new year?)

- Your fixed expenses (rent, mortgage, bills)

- Your goals (savings, debt repayment, travel plans)

- Your lifestyle values (fun, hobbies, giving)

Keep it simple: Give every dollar a job. Whether it’s for bills, savings, or fun, assign it with intention. Use a budgeting app, a spreadsheet, or even pen and paper – whatever works for you.

Step 5: Choose One Money Focus for 2026

Instead of overwhelming yourself with a list of 10 resolutions, choose one core financial focus for the new year. This helps you stay clear, consistent, and motivated.

Examples:

- Build a $1,000 emergency fund

- Pay off one credit card completely

- Increase monthly savings by $100

- Track every expense for 90 days

Your focus becomes your compass, guiding your decisions and reminding you why you’re saying yes – or no – in the moment.

✨ Final Thoughts: Reset, Refresh, and Move Forward

A year-end reset doesn’t have to be complicated. By reviewing your year, clearing financial clutter, checking your money health, setting a new budget, and choosing one core focus, you’ll walk into 2026 lighter, clearer, and ready to thrive.

This isn’t about being perfect. It’s about progress. And every small step you take now builds momentum for a stronger financial future.

So, give yourself the gift of a money reset. 2026 is your blank page – make it a story you’re proud to write.

Dec 10, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Saving Money, Self Development

The tree has come down, the last slice of Christmas pudding is gone, and you’re finally catching your breath after the festive whirlwind. But then it happens – you open your credit card statement, and suddenly that Christmas cheer feels like a distant memory. The dreaded post-Christmas credit card hangover has arrived.

The good news? You can absolutely enjoy Christmas without carrying financial regret into the new year. With a few mindful strategies, you can celebrate fully and start January feeling confident, not crushed by debt. Here’s how to make it happen.

Step 1: Set a Christmas Spending Limit (Before You Shop)

Your credit card limit is not your Christmas budget. Decide what you can comfortably spend this festive season without borrowing from your future self.

Ask yourself:

- How much cash do I realistically have available for Christmas?

- What regular bills and obligations still need to be covered?

- Can I set aside money weekly in December to spread out costs?

Write down a total number – this is your Christmas spending cap. Stick to it, even when those festive sales scream your name.

Step 2: Create a Cash-First Plan

One of the easiest ways to avoid a credit card hangover is to use as little credit as possible during Christmas.

- Pay with debit or cash where possible

- Set aside weekly envelopes for gifts, food, and fun

- Use prepaid cards to cap your spending

- If using credit online, track it immediately and set a repayment date

Pro tip: Leave your credit card at home when shopping in person. It’s much harder to overspend when you don’t have the option. Try using a visa debit card, which is actually your money and when you run out that’s it!

Step 3: Track Every Dollar (Yes, Every Single One)

In the Christmas chaos, it’s easy to lose track of spending – but that’s how the January shock sets in. Ways to stay on top:

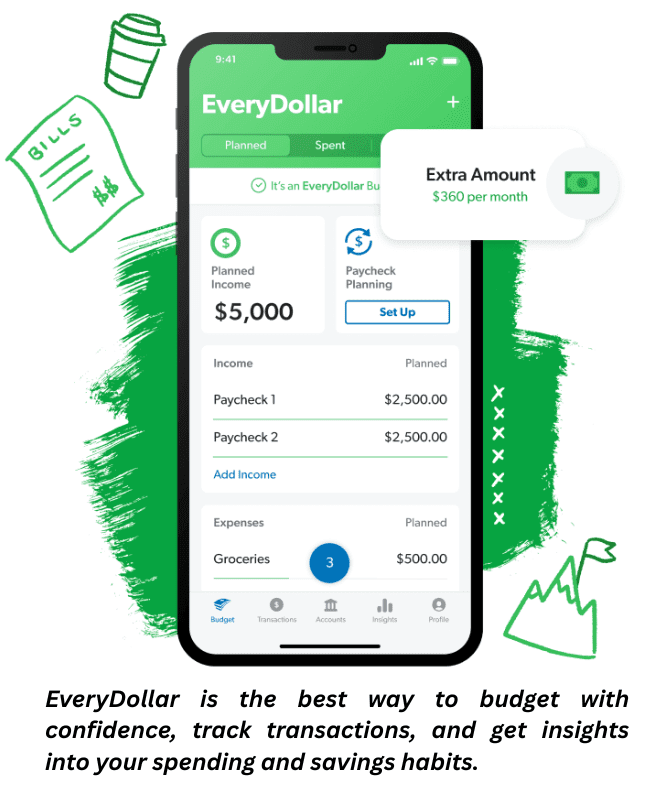

- Use budgeting apps like YNAB, EveryDollar, or Mint

- Keep a festive spending log in a notebook or phone note

-

- Do weekly money check-ins throughout December

Think of it as financial self-care. Awareness is your secret weapon.

Step 4: Be Strategic With Gifts

Gifts are often the biggest Christmas expense, but they don’t have to wreck your budget.

Tips for staying intentional:

- Make a list of who you’re buying for before you shop

- Set a per-person limit and stick to it

- Consider Secret Santa to cut the number of gifts

- Swap expensive items for homemade or experience-based gifts

- Remember: thoughtful beats flashy every time

No one worth celebrating wants you to go into debt for their gift.

Step 5: Plan for Food and Festivities

Christmas isn’t just about presents – the meals, parties, and little extras add up quickly. Save money by:

- Planning meals in advance

- Shopping early for non-perishables

- Hosting potluck-style dinners

- Saying no to extras that don’t truly add joy

When you prepare in advance, you avoid last-minute dashes (and expensive impulse buys).

Step 6: Watch Out for Emotional Spending Triggers

Christmas marketing is designed to play on your heartstrings. Nostalgia, urgency, and guilt can all push you to overspend. Ask yourself:

- Am I buying this because I want to – or because I feel pressured?

- Will this bring lasting joy, or just temporary excitement?

- Does this purchase align with my budget and values?

Your wallet deserves as much protection as your peace of mind.

Step 7: Practice Festive Financial Self-Care

Money stress can quickly steal your Christmas spirit. Make self-care part of your financial strategy:

- Take breaks from social media (comparison is a sneaky trigger)

- Remind yourself that Christmas isn’t a competition

- Journal your money intentions for the season

- Share your budget boundaries with loved ones

The more grounded you feel, the easier it is to resist overspending.

? Step 8: Create a January Recovery Plan

If you do use your credit card this Christmas, set a plan for repayment:

- Tally up what you’ve spent

- Divide it into weekly or monthly repayment goals

- Automate payments so you stay on track

Even better? Plan a “No-Spend January.” Cutting back in the new year can help you reset your budget and clear any lingering balances faster.

Bonus: Start a Christmas Sinking Fund for Next Year

Want to avoid the stress altogether next time? Build a sinking fund.

Example:

- Decide on for example a $3000 Christmas budget for 2025

- Divide by 12 months = $250/month

- Set up an automatic transfer to a separate savings account

Come December, you’ll be ready – no credit cards needed.

Final Thoughts: A Debt-Free Christmas Is the Best Gift

The magic of Christmas isn’t in the size of the presents or the amount spent – it’s in the moments, the laughter, and the love. Avoiding the post-Christmas credit card hangover means entering the new year lighter, freer, and more empowered.

So give yourself the gift of financial peace. Spend with intention, set boundaries, and remember: your presence is always more valuable than the presents under the tree.

Dec 3, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Mindset, Retirement, Saving Money

Christmas gift giving can feel like a marathon for your wallet. With ads flashing everywhere, social pressure building, and kids writing wish lists a mile long, it’s easy to get swept up in the spending frenzy. But here’s the truth: a meaningful Christmas doesn’t require maxing out your credit card or emptying your bank account. In fact, some of the most heartfelt and memorable gifts cost little to nothing at all.

This year, let’s flip the script. Instead of overspending, over-wrapping, and over-stressing, why not embrace mindful Christmas gift giving? It’s all about thoughtfulness, creativity, and connection – not dollar signs. Here’s how to spread joy this Christmas without draining your finances.

Why Mindful Christmas Gift Giving Matters

At its heart, Christmas is about love, gratitude, and connection. But when we let consumerism run the show, those values can get buried under receipts and regret.

Mindful gift giving helps you:

- Stay on budget while still being generous

- Give gifts that hold meaning and create memories

- Reduce waste and clutter

- Release the stress that comes with overspending

- Focus on presence over presents

A mindful Christmas gift says: “I thought of you. I know you. I care about you.” And that’s what makes it magical.

Step 1: Set a Realistic Christmas Gift Budget

Before you set foot in a store or open a shopping tab online, decide: What can I realistically afford to spend on gifts this year? Write down a total number. This is your overall Christmas gift budget. Next, break it down by category:

- Immediate family

- Extended family

- Friends

- Coworkers/teachers

- Neighbours/Secret Santa

Then set a maximum spend per person. Example: $500 total, split into $350 for immediate family, $50 for extended, $50 for friends, $25 for teachers/coworkers, $25 for fun extras.

Generosity isn’t about the amount you spend – it’s about the love behind it. Keep your numbers realistic and guilt-free.

✨ Step 2: Talk About Expectations

One of the biggest overspending traps at Christmas comes from unspoken expectations. Instead of stressing, have the conversation:

- Suggest a Secret Santa so each person only buys one gift

- Agree on spending limits

- Swap traditional presents for shared experiences

- Propose donating to a charity instead of exchanging gifts

Chances are, others will breathe a sigh of relief when you bring it up. Christmas is meant to bring joy, not financial strain.

Step 3: Give Thought, Not Just Things

The most meaningful Christmas gifts show that you paid attention. They reflect the recipient’s personality, hobbies, or values.

Affordable but thoughtful ideas:

- For the foodie: Homemade spice blends, a jar of cookie mix, or a handwritten recipe collection

- For the sentimental one: A framed family photo, a handwritten letter, or a playlist of songs with memories

- For the busy parent: Babysitting vouchers, a prepped meal kit, or a cosy blanket and journal

- For kids: Coupons for special experiences (like a “yes day” or baking day together)

It’s not about price tags. It’s about presence and care.

Step 4: Embrace DIY Magic

You don’t need to be Martha Stewart to pull off a DIY Christmas gift. Handmade gifts often mean the most because they’re personal and unique. DIY Christmas gift ideas:

- Festive baked goods in decorated tins

- Homemade ornaments with the year painted on

- Knitted scarves or cosy hand-sewn items

- DIY candles or bath salts

- A custom coupon book (think: “movie night of your choice,” “breakfast in bed,” “car wash on me”)

Pro tip: Make one type of DIY gift in bulk (like a big batch of biscults or candles) and hand them out to multiple people. It’s cost-effective and heartfelt.

Step 5: Focus on Experiences Over Excess

Some of the best Christmas gifts aren’t wrapped. They’re remembered.

Experience-based ideas:

- A Christmas movie night kit with hot chocolate, popcorn, and PJs

- Family game night vouchers

- A day trip to a local festive market

- A homemade “spa day” box with candles, tea, and bath salts

- Tickets to a future event (local theatre, kids’ activity, etc.)

These gifts create memories that outlast any toy or gadget.

Step 6: Shop Small and Local

Supporting small businesses this Christmas is a win-win. You’ll find unique gifts while supporting real people in your community. Where to shop:

- Local Christmas markets

- Independent shops or boutiques

- Etsy makers

- Farmers’ markets

Often, these gifts are higher quality and have more meaning than mass-produced items. Plus, your money helps local families thrive.

Step 7: Wrap It With Love

Presentation doesn’t have to be expensive. Get creative with eco-friendly and budget-friendly wrapping:

- Use brown paper with twine and greenery for a rustic look

- Wrap in fabric or scarves (two gifts in one!)

- Reuse gift bags and ribbons

- Add a handwritten note or tag

It’s the small details that make a gift feel special.

Bonus: Mindful Christmas Gift Ideas Under $30

Need quick inspiration? Here are some thoughtful, budget-friendly winners:

- A gratitude journal with a personal note inside

- A festive candle

- A homemade hot chocolate kit in a mason jar

- A puzzle or board game

- A plant in a decorated pot

- A favourite book with your handwritten reason why you loved it

- A tea or coffee sampler with a cute mug.

Final Thoughts: The Christmas Spirit Can’t Be Bought

Mindful Christmas gift giving is about slowing down, choosing with intention, and giving from the heart. It’s not about competing, comparing, or overspending.

This Christmas, release the pressure to impress. Your loved ones don’t need the latest gadget to feel loved, they need you. Your time, attention, and thoughtfulness are worth more than anything you could buy.

So let your budget be your guide, not your burden. Create gifts with meaning, memories with heart, and a Christmas that feels as magical as it should – without the financial stress.

Because at the end of the day, it really is the thought that counts. ??

Nov 26, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Estate Planning, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

The holiday season is often painted with glitter and gold – literally and financially. Between decorations, gifts, food, travel, and events, it can feel like every December demands a sky-high budget. But here’s the truth: you can absolutely have a joyful, memorable holiday without draining your bank account or maxing out your credit cards.

Enter the Holiday Season Budget Blueprint: a practical, five-step guide to help you spend wisely, celebrate fully, and start the new year without a financial hangover. It’s not about saying “no” to the fun stuff – it’s about saying “yes” to the things that truly matter.

Let’s break it down.

Step 1: Define What Matters Most

Before you open your wallet, take a step back and ask: What do I want this holiday season to feel like?

Is it about quality time, rest, giving back, tradition, creativity, or connection? When you define your values first, it becomes easier to:

- Cut unnecessary spending

- Set clear priorities

- Say no to what doesn’t align with your goals

Remember: Your budget isn’t just a money tool – it’s a reflection of your values.

Step 2: Set a Realistic, All-Inclusive Budget

Next, figure out your total holiday spending limit. This number should come from your current financial reality, not wishful thinking or social pressure. Include:

- Gifts

- Food and drinks

- Travel and accommodations

- Decorations

- Wrapping supplies and cards

- Event tickets or outings

- Donations and giving

- Festive extras (e.g., matching pajamas, holiday movies, etc.)

Bonus: Build in a “buffer” of 10% for those inevitable last-minute expenses.

Pro tip: If you haven’t started a holiday sinking fund yet, this is your sign to plan one for next year. Even $20/month makes a big difference by December.

Step 3: Create a Budget Blueprint That Works for You

Once you have your total holiday budget, break it into categories that fit your life.

Example Blueprint (for a $600 budget):

- Gifts: $300

- Food/Entertainment: $100

- Travel: $75

- Decorations: $50

- Charitable Giving: $25

- Misc/Fun: $50

Now, get specific:

- List who you’re buying gifts for and set a per-person amount

- Plan your meals or parties and estimate costs

- Look up travel prices now to avoid inflated last-minute bookings

Don’t forget digital tools:

- Budgeting apps (EveryDollar, YNAB, Mint)

- Spreadsheets – my budget/spending plan

- Cash envelope system

The key is to track as you go. Awareness prevents overspending.

Step 4: Use Smart Saving and Spending Strategies

Now for the fun part: making your budget go further without cutting the joy.

Holiday Saving Hacks:

- Use cashback apps (Rakuten, Honey, Fetch)

- Stack coupons and loyalty points

- Shop early to spread out costs

- Buy in bulk or split bundles with others

- Thrift or upcycle decor and outfits

Joyful (But Budget-Friendly) Alternatives:

- Experiences over things: movie nights, game nights, or DIY spa days

- DIY gifts: baked goods, photo albums, handmade crafts

- Shared hosting: make events potluck-style to share food and fun

- Decor on a dime: nature-inspired decor, secondhand finds, or family DIY sessions

With a little creativity, you can keep the festive spirit alive and keep your spending aligned with your values.

Step 5: Celebrate With Intention, Not Obligation

This one’s big: don’t let expectations drive your spending. Just because “you always do it this way” doesn’t mean you have to this year.

Say no to:

- Oversized gift exchanges that cause stress

- Events that don’t bring joy or fit your budget

- Trying to match what others are doing on social media

Say yes to:

- Meaningful moments over material things

- New traditions that reflect your current season of life

- Giving from the heart, not the wallet

When you let go of obligation, you make space for a holiday that’s truly aligned with your values and your finances.

Final Thoughts: Make Your Holiday Budget Work For You

The best holiday memories often come from the simple things: laughter, traditions, and time spent with the people who matter most. When you take control of your money with a clear budget, you remove stress and open up space for genuine joy. Remember, the holidays aren’t about how much you spend, they’re about how fully you show up. With a blueprint in place, you can step into the season with confidence, celebrate with intention, and start the new year feeling empowered instead of overwhelmed.

Want more support in building healthy money habits all year round? Join my Monthly Coaching Program and let’s strengthen your financial muscle together!

Nov 19, 2025 | Credit Score, Debt, Debt Payment, Debt Repayment, Financial Education, Financial Freedom, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

December is now just around the corner and while the holidays are meant to be joyful and magical, they can also bring a fair bit of financial pressure. Between gift shopping, party invites, travel plans, and festive food spreads, it’s easy to get overwhelmed.

But here’s the good news: you still have time to get financially prepared before the chaos fully kicks in. By taking action in November, you can hit December feeling calm, in control, and ready to actually enjoy the season. No panic required.

Let’s break down a simple, step-by-step countdown to Christmas that helps you stay on top of your money and make the most of the season – without going into debt or stressing out.

Step 1: Create Your Holiday Countdown Calendar

First things first, get a calendar (physical or digital) and mark off key holiday dates:

- Family events and parties

- School performances or community activities

- Gift exchanges and Secret Santas

- Travel days

- Shipping deadlines

Now add weekly financial check-ins leading up to Christmas. These can be short 15-minute sessions to:

- Review your spending

- Check your budget

- Adjust plans as needed

This turns your holiday prep into bite-sized, doable tasks instead of one big financial headache.

Step 2: Finalise Your Total Holiday Budget (Yes, Now)

If you haven’t done this yet, it’s time. Your total holiday budget should include:

- Gifts

- Travel

- Food (groceries, dining out, baking)

- Events and entertainment

- Decorations

- Wrapping supplies and cards

- Charitable giving

- Last-minute surprises (because there are always a few)

Decide what you can actually afford, without relying on credit cards or borrowing from your future self. Once you know your total, break it into weekly spending goals.

Example: If your total holiday budget is $600 and there are 4 weeks until Christmas, aim to spend no more than $150 per week.

Step 3: Organise Your Gift List Early

Now is the perfect time to get clear on your gift game plan. Make a list of:

- Everyone you want to buy for

- Gift ideas (with realistic price points)

- Spending limits per person

Bonus: Add a column to track when you’ve purchased or wrapped each gift.

This stops you from last-minute panic buying (aka overspending) and gives you time to shop sales or DIY something meaningful. And don’t forget:

- Suggest Secret Santa gift swaps

- Set expectations with extended family

- Consider non-material gifts (more on this below!)

Step 4: Shop Smarter, Not Harder

November is still prime time for scoring deals without the frenzy of last-minute shopping.

Here’s how to shop smart:

- Stick to your list and budget like glue

- Use cashback tools (like Honey or Rakuten)

- Compare prices online before heading out

- Stack coupons and use loyalty rewards

- Buy in bundles to save time and money (think gift packs split between people)

Also, leave a little wiggle room in your budget for unexpected finds. If you overspend in one area, adjust in another.

Step 5: Plan for Shipping Deadlines

Ordering gifts online? Mark down those final shipping dates now. Delayed packages = last-minute spending disasters.

Here’s what to do:

- Order by early December if possible

- Choose free shipping options to save money

- Consider digital gifts or subscriptions to skip shipping altogether

Pro tip: Avoid the expensive rush shipping fees by getting ahead now.

Step 6: Prep for Holiday Meals on a Budget

Holiday food is part of the fun, but it doesn’t have to wreck your finances.

Start meal planning:

- Choose dishes that are crowd-pleasers and budget-friendly

- Shop early for non-perishables and freeze what you can

- Host potlucks to share the load (and the cost!)

- Limit impulse snack and treat purchases

Want to cut down on December grocery bills? Start adding a few extra items to each weekly shop now.

Step 7: Say “No” to Financial FOMO

This time of year is full of pressure to say “yes” to everything:

- Every event

- Every outing

- Every gift exchange

- Every sale

But your time, energy, and wallet are limited resources. Be intentional. Practice saying:

- “That sounds fun, but it’s not in my budget right now.”

- “Let’s plan something low-key instead.”

- “I’m focusing on meaningful moments this year.”

You’ll be amazed how freeing it feels to stick to your holiday goals, not everyone else’s expectations.

Step 8: Create a “Festive Fun” Fund

Let’s be real, you still want to enjoy the season! Build in a little cushion for fun:

- Coffee catchups with friends

- Holiday movie nights

- Small treats for yourself

Put $10 – $20 per week aside for spontaneous seasonal joy. When it’s gone, it’s gone. No guilt, no overspending.

Final Thoughts: Plan Now, Celebrate Later

You don’t need a massive budget to have a magical holiday season. What you do need is a plan. One that prioritises your peace, your financial goals, and your version of holiday joy.

So use these final weeks of November wisely. Map it out. Budget it in. Say no when you need to. Say yes to what truly matters. And walk into December with clarity, confidence, and maybe even a little cash leftover.

You’ve got this – and Financial Management 101 is cheering you on every step of the way. ??