The Art of Financial Freedom: Designing a Life Where Money Works for You

Imagine waking up in the morning knowing that your bills are covered, your savings are growing, and your money is working for you – even while you sleep. Financial freedom isn’t about winning the lottery or working until you’re 80; it’s about designing a life where money is a tool, not a trap.

The best part? Achieving financial freedom is more like creating art than following rigid rules. You get to design your own path, and today, I’m going to show you how.

Step 1: Define What Financial Freedom Means to You

Most people assume financial freedom means being rich, but in reality, it’s deeply personal. Ask yourself:

- Is it about never worrying about bills?

- Is it the ability to travel whenever you want?

- Does it mean leaving a 9-to-5 job for something you love?

Once you define your version of financial freedom, you can start crafting a strategy to achieve it.

Step 2: Reverse-Engineer Your Ideal Lifestyle

Instead of focusing on what you lack, start with what you want. Picture your financially free life, then break it down:

- How much do you need to cover your dream lifestyle each month?

- What sources of income would allow you to achieve this?

- What expenses could you eliminate or reduce to get there faster?

When you shift your mindset from “how do I survive?” to “how do I build my ideal life?” everything changes.

Step 3: Build Multiple Streams of Income

One paycheck isn’t enough to create financial freedom. The wealthy don’t just rely on one source of income – they create multiple streams.

Here’s how you can, too:

- Passive Income: Rental properties, dividend stocks, or automated businesses can earn money with little daily effort.

- Side Hustles: Selling digital products, freelancing, or tutoring can supplement your main income.

- Investing: Even small amounts in stocks, bonds, or real estate can build wealth over time.

Start with one new income stream and expand as you go.

Step 4: Automate Wealth-Building Habits

Financial freedom isn’t about extreme budgeting; it’s about making wealth-building automatic. Set up:

Automatic savings deposits – Treat savings like a bill that must be paid first.

- Recurring investments – Even $50 a month in an index fund grows significantly over time.

- Debt payments – Automate payments to eliminate high-interest debt faster.

Automation removes decision fatigue and keeps you on track effortlessly.

Step 5: Stop Trading Time for Money

Most people are stuck in the cycle of trading hours for dollars. The secret to financial freedom? Making money work for you, not the other way around.

Ask yourself:

- How can I earn without directly exchanging my time?

- Can you create a course or write a book that sells on autopilot?

- Can you invest in assets that generate returns?

- Can you build a business that runs without you being involved every minute?

Shifting away from time-based income frees up your life in unimaginable ways.

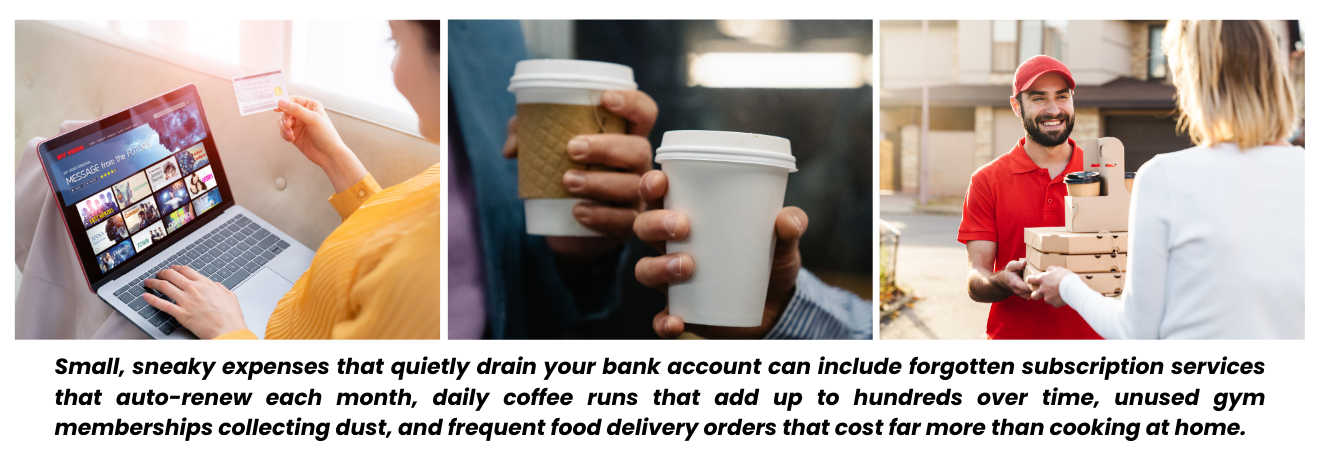

Step 6: Master the Art of Smart Money Decisions

The wealthy don’t just earn more; they make smart money moves. Every dollar you spend or invest should align with your financial freedom vision. Before any purchase, ask yourself:

- Does this get me closer to or further from financial freedom?

- Will this purchase create value or just short-term satisfaction?

- Could this money be better used in an investment?

Shifting your financial decision-making process puts you in control.

Step 7: Surround Yourself with Financially Free Thinkers

Your environment shapes your mindset. If you spend time with people who believe financial freedom is impossible, you’ll start believing it too. Instead:

- Join groups or follow people who are financially free or on the path.

- Learn from mentors, books, and courses that empower you.

- Avoid negativity and scarcity-based money conversations.

Financial freedom starts with a wealth-focused mindset.

FINAL THOUGHTS

Creating financial freedom is an art – you get to shape it, refine it, and make it uniquely yours. The key is to start now, take small steps, and stay committed to your vision.

If you’re ready to take control of your financial future and for those wanting a full financial transformation, my Master Your Money program is your step-by-step guide to designing a life where money truly works for you.

Your masterpiece of financial freedom starts today – pick up the brush and start painting your future!