Don’t Burn Out – Level Up: Why Tradies, Franchisees and Small Biz Owners Need More Than Just a Good Work Ethic

Let’s be real. If working hard were the only thing needed to succeed, most small business owners would be millionaires by now.

You show up early, stay late, grind through weekends, answer client calls after hours, and keep the business running even when you’re running on empty. But here’s the truth that most people won’t say out loud:

Hard work alone isn’t enough.

In fact, relying only on a strong work ethic without smart systems, boundaries, or support is the quickest way to burn out. And when you burn out, your business suffers, your health takes a hit, and the dream you started chasing starts feeling like a full-time trap.

This blog is for every hardworking tradie, sole trader, franchisee and small business owner who’s asking: “I’m doing everything – why am I still so exhausted, stressed, and broke?”

Let’s talk about why hustle culture is failing you, and what you can do instead to level up your business without running yourself into the ground.

The Burnout Warning Signs

Let’s start with a little self-check. If you tick two or more of these boxes, burnout is either already happening, or it’s not far off:

? You wake up dreading another day of work

?? You’re constantly overwhelmed and behind

? You’re earning money, but it never feels like enough

? You’re getting snappy with your partner, kids, or team

? You’ve had recurring health issues – headaches, poor sleep, exhaustion

? You’ve started fantasising about quitting or getting a “normal” job

Sound familiar? That’s your body, mind, and bank account waving the red flag.

The Problem with Hustle Culture

Somewhere along the way, we got sold a lie: “If you just work hard enough, everything will work out.”

But here’s what that advice doesn’t take into account:

- Poor pricing

- No cash flow plan

- Tax stress

- Overdue invoices

- Zero systems

- No boundaries with clients

- Mental and physical fatigue

Working longer hours without addressing these problems just leads to one thing: resentment and burnout.

Because when you’re stuck in the cycle of feast and famine, chasing money, and reacting to chaos, it doesn’t matter how committed you are. Your business starts to feel like a prison instead of the freedom you dreamed of.

Why Good Work Ethic Isn’t Enough Anymore

Don’t get me wrong, your work ethic is your superpower. But in today’s small business world, it’s not enough by itself. You also need:

? Smart systems

? A clear money plan

? Mindset support

?♂️ Time to rest and reset

? Clarity over numbers

? A game plan for growth

Hard work without structure is like running a job site with no tools, no blueprint, and no team – you might get something done, but it’ll be chaos, and you’ll be wrecked in the process.

The Reality of Being the Boss

You didn’t start your business to be stressed all the time. You started it for:

- Freedom

- Flexibility

- To create something of your own

- To make a good income doing what you love

But somewhere along the way, the business started running you.

You’re the operator, the bookkeeper, the admin, the marketer, the debt collector, the payroll officer, the complaint handler… and you’re trying to be a good partner/parent/friend on top of it all.

No wonder you’re fried.

So if you’ve ever said, “There’s got to be a better way…”

You’re right. There is.

Here’s How to Level Up (Instead of Burning Out)

Burnout happens when the pressure is constant but the systems are weak. Let’s flip the script. Here are 6 key shifts you can make to stop the burnout spiral and finally feel like the CEO of your business again.

1. PUT YOURSELF ON THE PAYROLL

This is a big one. If you’re still paying yourself “when there’s money left” or pulling cash out as needed, you’ll never feel in control.

Start paying yourself a consistent wage – weekly or fortnightly, and build it into your pricing. Even if it’s small to begin with, the habit changes everything.

2. BUILD A BUSINESS THAT PAYS YOU BACK

You can’t keep pouring into your business if it doesn’t pour back into you.

That means:

- Charging properly (not just guessing)

- Creating boundaries around your time

- Saying no to jobs that don’t serve you

- Building in breaks, even short ones

Rest is productive. And you’re allowed to take a day off without feeling guilty.

3. DITCH THE MONEY STRESS WITH A CASH FLOW PLAN

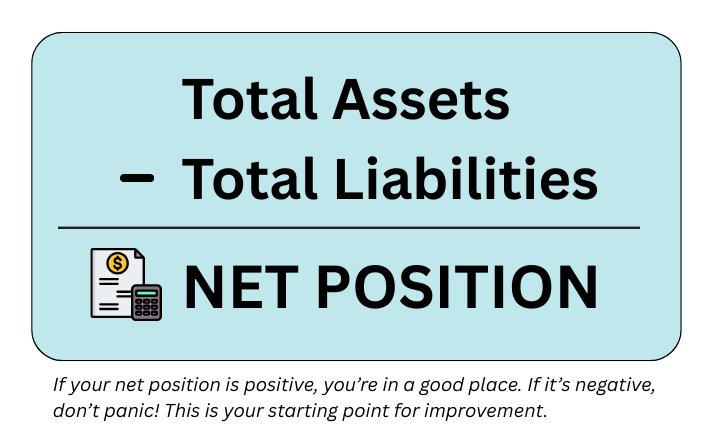

Most tradies, franchisees and small biz owners aren’t short on income – they’re short on structure. That’s why a simple money system can change your life. Inside THE EDGE, we teach you how to set up five simple buckets:

- Income

- Expenses

- Owner’s Pay

- Tax

- Profit

This stops the “Where did my money go?” panic, and gives you breathing room, even during quiet periods.

4. AUTOMATE THE ADMIN

If quoting, invoicing, and chasing payments takes up your evenings or weekends, you’re burning time you can never get back.

Use simple software (like Xero, MYOB, or Quickbooks) to automate as much admin as you can.

And if it’s still too much? Outsource it. You didn’t become a small biz owner to become a full-time administrator.

5. PROTECT YOUR MENTAL HEALTH LIKE YOU PROTECT YOUR TOOLS

Your mindset is everything. When you’re constantly overwhelmed, you start making decisions from a place of fear and fatigue.

That’s when undercharging happens. That’s when you say yes to jobs you shouldn’t take. That’s when you give up and go back to the tools full time because “it’s just easier.”

Your brain is your best business asset. Look after it.

✅ Take breaks

✅ Talk to someone

✅ Do something you enjoy that isn’t work

✅ Get support (not just financial, but emotional)

6. GET SUPPORT – STOP DOING IT ALL ALONE

This is the one that makes all the difference. Most small business owners feel isolated. No one sees the pressure you’re under. Everyone thinks you’re doing great because “you’re your own boss.”

But the truth is, the pressure is real. And you don’t have to carry it all on your own.

That’s exactly why I created THE EDGE – to give you tools, support, and a solid plan.

? Introducing The Edge: Your 6-Week Reset

The Edge is a coaching program for tradies, franchisees and small business owners who are ready to stop burning out and start building a business that works with them, not against them. Over 6 weeks, I’ll walk you through how to:

- Pay yourself a proper wage

- Set up a simple cash flow system

- Price with confidence

- Stop the tax panic

- Build structure and breathing room into your business

- Shift your mindset and get back in control

It’s everything you wish someone taught you when you first started your business – delivered in simple, actionable steps with my support the whole way.

You’ll go from overwhelmed and overworked…

To confident, structured, and finally in charge.

Final Thoughts: You Deserve to Thrive, Not Just Survive

You didn’t go into business to be exhausted.

You’re already working hard. Now it’s time to work smart.

Burnout isn’t a sign that you’re weak. It’s a sign that your systems need support. And with the right tools, you can reset – without starting from scratch.

So if you’re ready to level up, get your spark back, and build a business that supports your life – not swallows it whole…

? Join The Edge 6-Week Coaching Program Today

Let’s get your time, money, and sanity back TOGETHER.