Mar 6, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

We’ve all had those moments standing at the checkout, second-guessing a purchase, or staring at a bank statement, feeling a wave of regret. Maybe you’ve told yourself, “I’m just bad with money,” or, “I can’t trust myself to make good financial decisions.” If this sounds familiar, you’re not alone. But here’s the truth: you are not inherently bad with money. You just need to rebuild your financial confidence.

Financial confidence isn’t about knowing every investment strategy or becoming a budgeting master overnight. It’s about trusting yourself to make empowered, intentional choices with your money without fear, guilt, or self-doubt.

So how do you start trusting yourself with money again? Let’s dive into the formula that can help you regain control and move forward with confidence.

STEP 1: Reframe Your Money Story

The beliefs you have about money shape how you handle it. If you’ve experienced financial struggles in the past, it’s easy to assume that you’ll always struggle. But that’s not true you are constantly evolving, and your financial reality can evolve with you.

Take a moment to reflect: What are the money stories you’ve been telling yourself? Do you believe money is hard to earn? Do you think you’re destined to be in debt? Once you identify these limiting beliefs, challenge them. Instead of saying, “I’m terrible with money,” try, “I am learning to manage my money with confidence.” Words matter, and so does your mindset.

STEP 2: Small Wins Lead to Big Confidence

Trust isn’t built overnight it’s created through consistent actions. If you’ve been avoiding your finances out of fear, start small. Set up a weekly “money date” with yourself to review your finances, even if it’s just for 15 minutes. Celebrate the small victories, like paying a bill on time or choosing to cook at home instead of eating out. These small wins add up, reinforcing the belief that you are capable of managing your money wisely.

STEP 3: Shift from Fear to Curiosity

Many people feel anxious when they look at their bank account, but what if you approached your finances with curiosity instead of fear? Instead of saying, “I don’t even want to look at my balance,” try asking yourself, “I wonder what I can learn from my spending habits this month?” By shifting your mindset, you turn financial management into a tool for empowerment rather than a source of stress.

STEP 4: Align Your Spending with Your Values

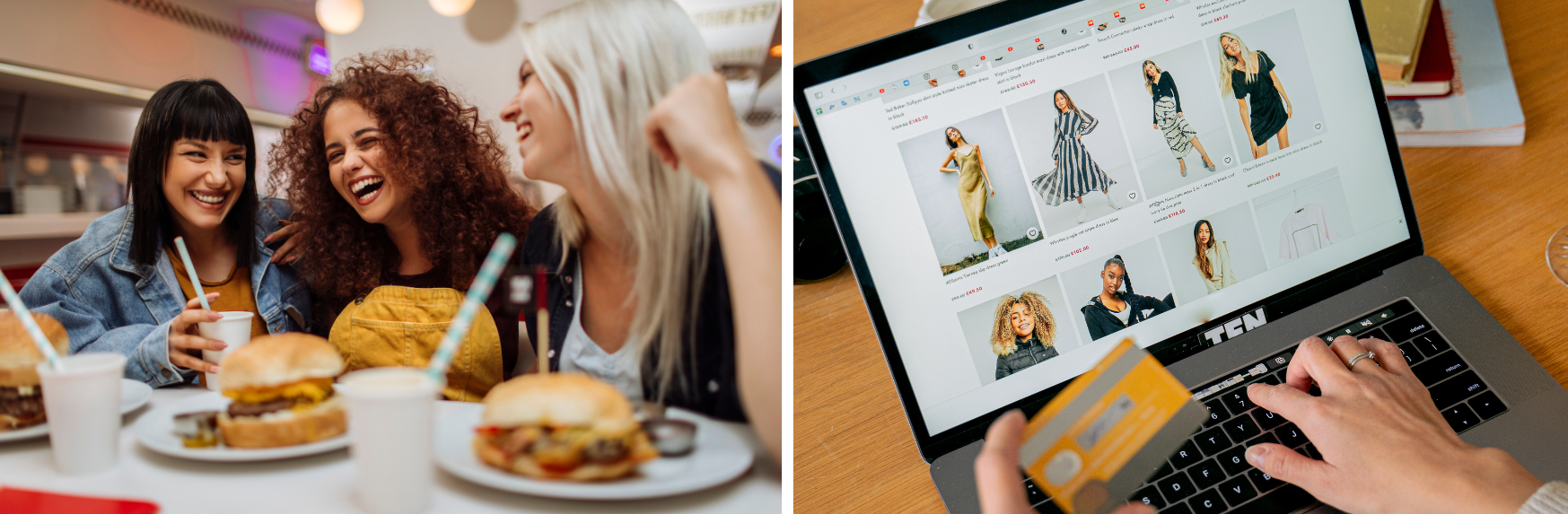

One of the fastest ways to feel good about your money is to ensure your spending reflects what truly matters to you. If financial guilt is a recurring theme, it may be because you’re spending in ways that don’t align with your priorities.

Ask yourself: What do I value most in life? If it’s family, are you investing in quality time with loved ones? If it’s health, are you prioritising your well-being over impulse purchases? When your spending aligns with your values, financial confidence follows naturally.

STEP 5: Give Yourself Permission to Learn

No one is born knowing how to manage money perfectly. Mistakes will happen, but they don’t define you. What matters is how you respond. Instead of beating yourself up over a financial misstep, treat it as a learning experience.

Ask: “What can I do differently next time?” This shift in perspective turns every challenge into an opportunity for growth, reinforcing your ability to trust yourself.

STEP 5: Give Yourself Permission to Learn

Confidence grows in the right environment. If you’ve been struggling alone, it may be time to seek out support whether that’s a financial coach, a community of like-minded individuals, or access to the right financial education.

That’s why I created my Monthly Coaching program, giving you access to The Vault a treasure trove of financial resources, courses, and guidance to help you build the skills and mindset necessary for long-term success. And if you’re ready to take full control of your finances, my Master Your Money program will guide you through everything you need to know to transform your financial future.

Final Thoughts

Rebuilding financial confidence isn’t about perfection it’s about progress. Every positive step you take strengthens your trust in yourself. You are fully capable of making empowered financial choices, and your journey starts today.

Take the first step, celebrate your wins, and remember: you are not alone in this. With the right mindset, tools, and support, you can rewrite your financial story and step into a future filled with confidence and abundance.

Are you ready to take control? Let’s do this together!

Feb 26, 2025 | Book of the Week, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle

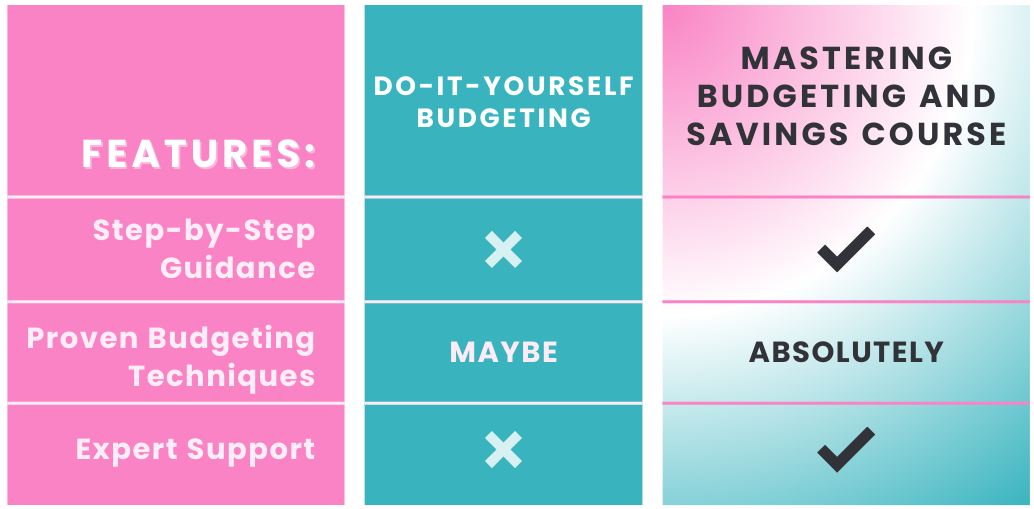

What does financial freedom mean to you? For some, it’s living debt-free; for others, it’s having enough savings to retire comfortably. Whatever your vision, one thing is certain: the journey to financial freedom starts with mastering the basics. That’s where the Mastering Budgeting and Savings Course comes in.

What is Financial Freedom?

Financial freedom isn’t about being rich – it’s about having the money to live the life you want without constant stress. Achieving it requires three things:

1. A clear understanding of your finances.

2. A plan to eliminate debt and build savings.

3. The discipline to stick with your plan long-term.

Why Budgeting is the Key to Freedom?

At the heart of every financial success story is a solid budget. Budgeting isn’t about restriction, it’s about prioritising what matters most to you. The Mastering Budgeting and Savings Course teaches you how to:

-

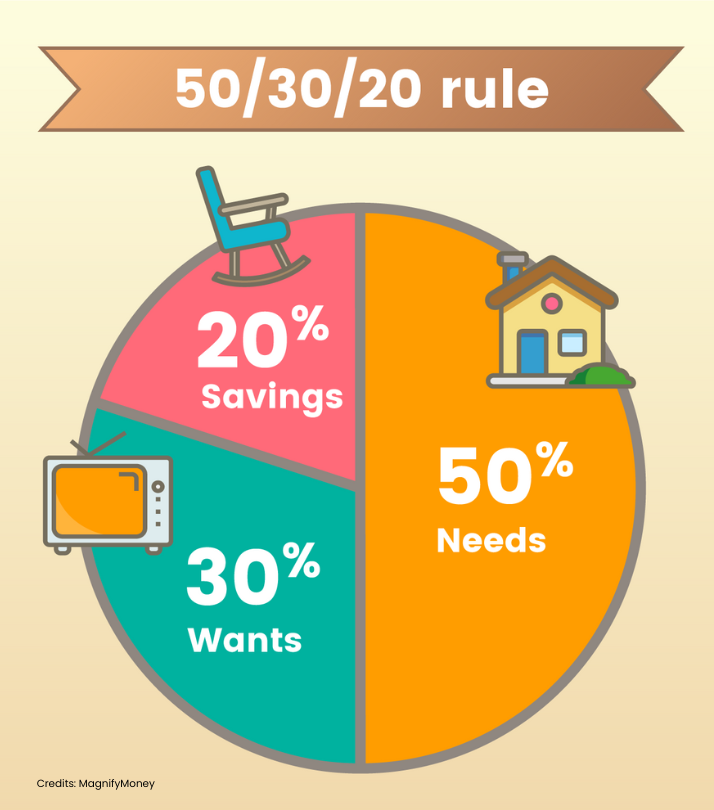

- Allocate your income effectively using the 50/30/20 rule (50% for needs, 30% for wants, and 20% for savings and debt).

- Identify and eliminate unnecessary expenses.

- Set realistic financial goals and track your progress.

How Savings Accelerate Your Journey

Saving money isn’t just about putting cash aside; it’s about creating financial security and opportunities. Through this course, you’ll learn how to:

-

- Build an emergency fund to cover unexpected expenses.

- Automate your savings for long-term goals like a home deposit or retirement.

- Maximise your savings by choosing the right accounts and tools.

Why This Course Works

The Mastering Budgeting and Savings Course is designed for busy individuals who want results. It’s broken down into actionable modules that guide you step-by-step through:

1. Assessing your financial situation.

2. Creating a budget that aligns with your goals.

3. Building and maintaining a sustainable savings plan.

4. Tackling debt with proven strategies.

Testimonials: Real People, Real Results

Meet Karen (yes, another Karen!), a 45-year-old who struggled to save for her dream home while juggling credit card debt. After taking the Mastering Budgeting and Savings Course, she:

- Saved $15,000 for a deposit in two years.

- Paid off her $10,000 credit card balance using the debt snowball method.

- Finally felt in control of her money for the first time in decades.

A Pathway to Financial Freedom

The journey to financial freedom starts with the first step. By enrolling in the Mastering Budgeting and Savings Course, you’ll gain the knowledge and confidence to take control of your money and create the life you’ve always wanted.

Are You Ready?

Financial freedom isn’t a dream – it’s a decision. Take action today and start building the foundation for a brighter tomorrow. Sign up now and make this the year you master your money and achieve financial freedom!

Don’t wait for the perfect moment – take control of your finances now! Enroll in the Mastering Budgeting and Savings Course today and start your journey to financial freedom.

Feb 19, 2025 | Book of the Week, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Side Hustle

If you’ve ever stayed awake at night worrying about bills, mounting debt, or an uncertain financial future, you’re not alone. Financial stress affects millions of people, but it doesn’t have to control your life. Through personalised support and expert guidance, THE VAULT can help you transform financial stress into lasting financial success.

The True Cost of Financial Stress

Financial stress doesn’t just impact your bank account – it affects every area of your life. Here’s how:

Mental Health

Anxiety and depression often stem from constant money worries.

Relationships

Money is one of the leading causes of conflict in relationships.

Physical Health

Stress-related illnesses like high blood pressure and migraines can arise from financial struggles.

The good news? You don’t have to stay stuck. Monthly Coaching provides the tools and strategies to regain control and start thriving.

How Monthly Coaching Inside THE VAULT Tackles Financial Stress

1. Clarity: Understand Your Money

Financial stress often comes from uncertainty. Where’s your money going? How much debt do you have? Monthly Coaching inside THE VAULT starts by helping you gain clarity. Your coach will work with you to map out your financial picture so you know exactly where you stand.

2. Actionable Plans: One Step At A Time

It’s easy to feel paralysed by the enormity of financial problems. A coach breaks things down into manageable steps, guiding you through proven strategies like those taught in the Mastering Budgeting and Savings Course.

3. Accountability: Stay On Track

Consistency is key to financial success, but life often gets in the way. Monthly check-ins ensure you stay focused on your goals, even when challenges arise.

4. Mindset Shifts: Turn Stress into Motivation

Managing money isn’t just about numbers, it’s about mindset. Coaches help you reframe negative thoughts about money, turning them into empowering beliefs that drive action.

Real Success Stories

Meet James and Laura, parents of two who were drowning in credit card debt and constantly stressed about unexpected expenses. Through Monthly Coaching, they learned how to:

Today, they’re financially stable and planning their first overseas holiday – a goal they once thought was impossible.

THE VAULT: Unlock Everything You Need

With courses, tools, and resources at your fingertips inside THE VAULT, you’ll have everything you need to succeed.

Key resources include:

-

- The Mastering Budgeting and Savings Course, which teaches you to manage your money with confidence.

- Debt reduction tools that help you pay off balances faster.

- Goal-setting worksheets to turn dreams into actionable plans.

From Stress to Success

Financial stress doesn’t have to define your life. With the right support and a clear plan, you can overcome challenges and achieve financial success.

Ready to take the next step? Join THE VAULT today and unlock access to the tools and resources you need to take the stress out of managing your money.

Feb 5, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Debt, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle

Managing money isn’t just about numbers; it’s about habits, mindset, and access to the right resources. That’s where THE VAULT comes in. It provides the roadmap, monthly coaching, tools, and support you need to transform your finances and unlock your financial potential.

Why Monthly Coaching Matters?

Imagine having a financial coach by your side every month, helping you navigate challenges, stay on track, and celebrate milestones. Here’s what makes regular coaching a life-changing experience:

1. Personalised Guidance

Your financial situation is unique, and cookie-cutter advice just won’t cut it. Monthly Coaching gives you tailored strategies to help you meet your goals, whether you’re tackling debt, building savings, or preparing for a big purchase.

2. Accountability

How often have you set a financial goal only to lose focus within weeks? A monthly check-in with your coach ensures you remain on track. Accountability is the key to transforming intentions into actions.

3. Supportive Community

Being part of a group of like-minded individuals who share their struggles, successes, and insights can be incredibly motivating. You’re not in this alone!

The Power of THE VAULT

1. Comprehensive Courses

THE VAULT includes everything from basic financial literacy to advanced topics like investment understanding. It also features my most popular program, the Mastering Budgeting and Savings Course, which has helped countless clients take control of their money.

2. Interactive Tools

Use tools like budget calculators, expense trackers, and goal-setting worksheets to make managing money practical and straightforward.

3. Live Webinars and Q&A Sessions

Join monthly webinars where you can ask questions, learn from experts, and gain new insights. Topics include budgeting, debt reduction, and financial goal setting.

4. Step-by-step Guides

Not sure where to start? THE VAULT includes step-by-step instructions to help you build a strong foundation in managing your money.

Success Stories: Real People, Real Results

Take the story of Lisa, a single mum working full-time. She joined THE VAULT after struggling for years to make ends meet. With Coach Karen’s guidance and the resources she got from THE VAULT, Lisa paid off $8,000 in credit card debt, built a $5,000 emergency fund, and started saving for her daughter’s education—all in under a year.

Her secret? Following the proven budgeting strategies in the Mastering Budgeting and Savings Course while leveraging the monthly coaching sessions for motivation and accountability.

Ready to Transform Your Finances?

With joining THE VAULT, the life you’ve always dreamed of is within reach. It’s not about earning more—it’s about managing what you have more effectively. Join today and start your journey to financial freedom!

Ready to take the next step? Join THE VAULT today and unlock access to the tools and resources you need to take the stress out of managing your money.

Jan 15, 2025 | Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Repayment, Educational Series, Episodes, Financial Health, Financial Management 101, Holiday Spending, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

Imagine if, in just three months, you could feel in control of your money, reduce your debt, and finally start saving for the future you’ve always dreamed of. It sounds ambitious, but it’s entirely possible with the right approach. Fixing your finances doesn’t have to be overwhelming or complicated, it just requires the right formula and commitment to taking small, consistent steps.

In this blog, I’ll break down a simple, three-month plan to get your finances on track. Whether you’re drowning in debt, struggling to save, or just looking to improve your financial habits, this formula will work for you.

Why Three Months?

Three months, or 90 days, is an ideal time frame to make significant progress without feeling like the journey is endless. It’s short enough to stay motivated but long enough to see measurable results. With a clear plan, you can achieve financial wins that build momentum and set the foundation for lasting success.

The Secret Formula: The 3-Step Plan

The formula for fixing your finances in three months revolves around three key pillars: Assess, Act, and Advance. Let’s break it down:

1. Assess: Understanding Your Starting Point (Week 1-4)

Before you can fix your finances, you need to understand them. Think of this as your financial health check.

Step 1: Audit Your Money

Start by tracking every dollar you spend for one month. Use a spreadsheet, app, or notebook to record:

-

-

- Fixed expenses (rent, bills, subscriptions)

- Variable expenses (groceries, dining out, entertainment)

- Irregular expenses (annual fees, gifts)

This exercise often reveals surprising patterns, like how much those small “treats” add up.

Step 2: Calculate Your Net Worth

Your net worth is your financial snapshot. Add up your assets (savings, investments, property) and subtract your liabilities (debts). Don’t be discouraged if it’s negative this is your starting point.

Step 3: Define Your Priorities

What matters most to you? Maybe it’s paying off debt, building an emergency fund, or saving for a holiday. Write down your top three financial goals for the next three months.

2. Act: Implementing Positive Change (Week 5-8)

This is where the magic happens. Once you know where you stand, it’s time to take action.

Step 1: Build a Realistic Budget aka Spending Plan

A budget or better known as spending plan, isn’t about deprivation; it’s about prioritising. Use the 50/30/20 rule as a guide:

-

-

- 50% for needs (housing, groceries, utilities)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

Adjust these percentages based on your goals. If you’re tackling debt, redirect some “wants” spending to accelerate repayment.

Step 2: Reduce Expenses Strategically

Look for quick wins, such as:

-

-

- Canceling unused subscriptions

- Cooking at home instead of dining out

- Negotiating bills like internet or insurance

Challenge yourself to a “no-spend week” to identify areas where you can cut back without feeling deprived.

Step 3: Start Paying-off Debts

List your debts and choose a repayment strategy:

-

-

- Snowball Method: Focus on the smallest debt first for quick wins.

- Avalanche Method: Prioritise the highest-interest debt to save money in the long term.

Set up automatic payments to avoid missed due dates and reduce financial stress.

Step 4: Automate Savings

Even if it’s just $10 a week, start saving. Set up an automatic transfer to a separate savings account. Treat it like a non-negotiable bill—it’s money for your future self.

3. Advance: Building Momentum (Week 9-12)

The final phase is about maintaining progress and preparing for the long term.

Step 1: Monitor and Adjust Your Plan

Review your budget and spending weekly. Are there areas where you’re overspending? Adjust as needed, but celebrate your wins along the way.

Step 2: Reduce Expenses Strategically

Consider ways to earn extra cash to speed up your progress:

-

-

- Selling unused items online

- Offering freelance services

- Picking up a side hustle

Even a small income boost can make a big difference when applied to debt or savings.

Step 3: Focus on Your Mindset

Financial success is as much about mindset as it is about math. Practice gratitude for what you have and visualize your financial goals. A positive attitude keeps you motivated during setbacks.

Common Challenges (and How to Overcome It)

1. “I don’t have enough money to save.”

Start small. Even $5 a week adds up over time. The habit of saving is more important than the amount at first.

2. “I don’t know where to start with my debt.”

Start with one debt. Focus on it, make a plan, and celebrate when you pay it off. Then move on to the next.

3. “It’s too overwhelming.”

Break it down into daily or weekly actions. Progress is progress, no matter how small.

The Ripple Effect of Fixing Your Finances

When you take control of your money, it doesn’t just impact your wallet. You’ll feel:

-

- Less Stress: No more sleepless nights worrying about bills.

- More Confidence: You’ll know exactly where your money is going.

- Increased Freedom: With less debt and more savings, you’ll have more choices in life.

Kickstart Your Journey is a 7-day motivational course on financial education, tailored to kick off a new year and aimed at achieving financial success, involves crafting a comprehensive and engaging curriculum.

Conclusion

Fixing your finances in just three months is entirely possible with the right formula. By assessing where you are, taking intentional action, and building momentum, you can transform your financial situation and set yourself up for long-term success.

Remember, it’s not about perfection, it’s about progress. Start today, and by the end of three months, you’ll be amazed at how much you’ve achieved.

Do you want to make smarter financial decisions but don’t know where to start? This monthly financial coaching program is designed to help you take control of your finances and achieve your financial goals.

With years of experience in financial management, Karen offers insightful guidance and coaching on budgeting, saving, debt reduction, and other financial know-how to help you live a life without financial stress.

Dec 23, 2024 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Relationships, Retirement, Saving Money, Self Development

As the year draws to a close, it’s natural to think about what’s next. But before you dive into new resolutions, let’s take a step back and look at your 2024 finances. Reflecting on what worked (and what didn’t) helps you move forward with clarity and confidence. Here’s a simple guide to reviewing your finances so you can start 2025 refreshed and ready to go.

1. Celebrate Your Wins

Before you jump into what needs improving, take a moment to celebrate your financial wins. Did you manage to save more than expected? Finally pay off a credit card? Stick to a new budget? Acknowledging your achievements, no matter how small, gives you a sense of progress and keeps you motivated.

Make a list of all the positive changes you’ve made or financial goals you’ve met this year. Reflecting on what you’ve achieved will give you a boost of confidence as you prepare for your next steps.

2. Identify Areas for Improvement

Once you’ve celebrated, it’s time to take an honest look at where you could improve. Ask yourself questions like:

-

- Were there any unexpected expenses that threw off your budget?

- Did you struggle to stick to any specific financial goals?

- Are there areas where you overspent?

This reflection isn’t about criticising yourself, it’s about understanding where things may have gone off track. Knowing where you struggled will help you set realistic goals for next year and find ways to tackle those challenges head-on.

3. Review Your Debt and Savings Process

Your debt and savings are two major pillars of financial health. Look at where you stand with each:

-

- Debt: How much debt have you paid down? Did you reach any of your debt reduction targets?

- Savings: How is your emergency fund? Are you on track with your retirement savings or other savings goals?

If you didn’t reach your targets, that’s okay. Use this information to adjust for next year. Maybe you’ll aim to contribute a bit more to your debt payments or bump up your savings rate. Small changes can have a big impact over time, so don’t feel pressured to overhaul everything at once.

4. Assess Your Spending Habits

Sometimes, our spending habits change without us even noticing. Take a look at your spending patterns over the past few months. Are there categories where you consistently overspend, like dining out, online shopping, or subscriptions?

This review can reveal where your budget could use a little tweaking. By identifying your personal spending triggers, you can plan ahead and avoid overspending in the future. It’s all about aligning your spending with your priorities and making sure your budget works for you, not the other way around.

5. Update Your Financial Goals for 2025

Based on your review, set fresh goals for 2025. Remember to keep your goals specific and realistic. Here are a few examples to get you started:

-

- Build an emergency fund with three months’ worth of expenses by the end of the year.

- Pay off one credit card or reduce your debt by a specific amount.

- Save for a family vacation or a big purchase, like a car or home improvement project.

Whatever goals you choose, make sure they’re meaningful to you. When your goals reflect what you truly value, you’re more likely to stay committed.

6. Adjust Your Budget to Reflect New Priorities

A new year often brings new priorities. After reflecting on your 2024 finances, update your budget to reflect any changes in your income, expenses, or financial goals. This might mean increasing your savings contributions, adjusting debt payments, or cutting back in certain areas to make room for new expenses.

Remember, your budget is a tool, it’s there to serve you. Make adjustments that help you live comfortably within your means while still working toward your goals.

7. Setup a New System for Regular Check-ins

One of the best ways to stay on track financially is to check in regularly. Whether it’s a monthly review or a weekly “money date,” commit to a consistent routine where you:

-

- Review your spending and savings.

- Track your progress toward goals.

- Adjust your budget as needed.

Regular check-ins make it easier to catch any issues early and keep your goals top of mind. Plus, they help you stay accountable and give you the chance to celebrate progress each step of the way.

Final Thoughts

Reflecting on your financial journey from the past year can give you valuable insights and help you start 2025 with confidence. By assessing where you are now, you’re giving yourself the power to make informed decisions and set realistic, meaningful goals. Here’s to wrapping up 2024 on a positive note and building a prosperous year ahead!

Are you ready to to build wealth without sacrificing the things you love? Do want to break free from limiting beliefs like “I’m bad with money” or “There’s never enough”?

MASTER YOUR MONEY is for YOU if you are tired of financial stress and ready to transform your relationship with money. Whether you’re managing a family, building your career, or chasing your dreams, this is your chance to gain the clarity, confidence, and habits you need to thrive.

This is more than a mindset shift—it’s a transformational program that puts you on the path to lasting financial success! ? Click the button below to book a call with Karen to see if this program is right for you!