How Can I Rebuild My Confidence After Making a Financial Mistake or Falling Behind on My Budget?

We’ve all had that moment.

You check your bank account… and it’s lower than you thought.

You open your credit card bill… and it’s higher than you expected.

You look at your budget… and realse you haven’t followed it for two weeks.

Cue the shame spiral.

If you’ve recently made a money mistake – or you just feel behind – I want you to know this:

You are not alone.

You are not a failure.

And you are absolutely capable of bouncing back stronger.

This blog will walk you through how to move from guilt to growth, and rebuild your confidence one step at a time.

1. Separate Your Self-Worth from Your Net Worth

First and foremost: you are not your bank balance.

Your financial missteps don’t make you “bad with money.” They make you human.

Whether you overspent, ignored your budget, or slipped back into old habits, it doesn’t define who you are. It’s a moment – not a life sentence.

Start here:

- Remind yourself: “I am capable of change.”

- Reflect on a past financial win, no matter how small

Say out loud: “I forgive myself. I’m ready to move forward.”

2. Get Honest (Without the Shame)

Let’s name what happened – not to beat yourself up, but to take your power back.

Ask yourself:

- What did I spend that I hadn’t planned for?

- Did I avoid tracking or checking in with my money?

- Did I say “yes” to things I couldn’t afford?

Write it all down. You’re not here to judge yourself – just to gain clarity so you can move forward with purpose.

3. Understand What Triggered the Slip-Up

There’s always a “why” behind every money misstep mand understanding it is key to change.

Common triggers:

- Emotional spending (boredom, stress, celebration)

- People-pleasing (saying yes to things out of guilt)

- Lack of planning (unexpected expenses you didn’t prep for)

- Old money stories (like “I’ll never get ahead anyway”)

Identifying the trigger gives you a new layer of awareness and that’s when real change begins.

4. Reset with a Micro-Goal

When your confidence is shaken, the best thing you can do is create a tiny win that rebuilds momentum.

Here are some examples:

- Track your spending for the next 3 days

- Create a mini budget just for this week

- Make one extra payment toward your credit card

- Pause one subscription and save the money instead

Success is a series of small, intentional steps. Start with one.

5. Watch Your Words (They Matter More Than You Think)

Your internal dialogue becomes your financial reality.

Let’s flip the script:

❌ “I’m terrible with money.”

✅ “I’m learning how to manage my money better every day.”

❌ “I’ll never get out of debt.”

✅ “Every payment I make moves me closer to freedom.”

❌ “I can’t stick to a budget.”

✅ “I’m figuring out a system that works for me.”

Language matters. Speak like someone who’s growing because you are.

6. Track Progress, Not Perfection

You don’t have to get everything right to be making progress. Celebrate the fact that:

- You noticed the slip-up

- You chose to stop and reflect

- You’re taking action now

That’s what winning with money actually looks like.

Make a habit of reflecting each month:

- What went well?

- Where did I struggle?

- What can I adjust?

And remember: even showing up for your finances when it’s hard is worth celebrating.

7. Lean Into Support – Don’t Do This Alone

Shame thrives in isolation. Confidence grows in community.

Find a space where:

- You can ask questions without feeling judged

- You can share your wins and struggles

- You can be held accountable to your goals

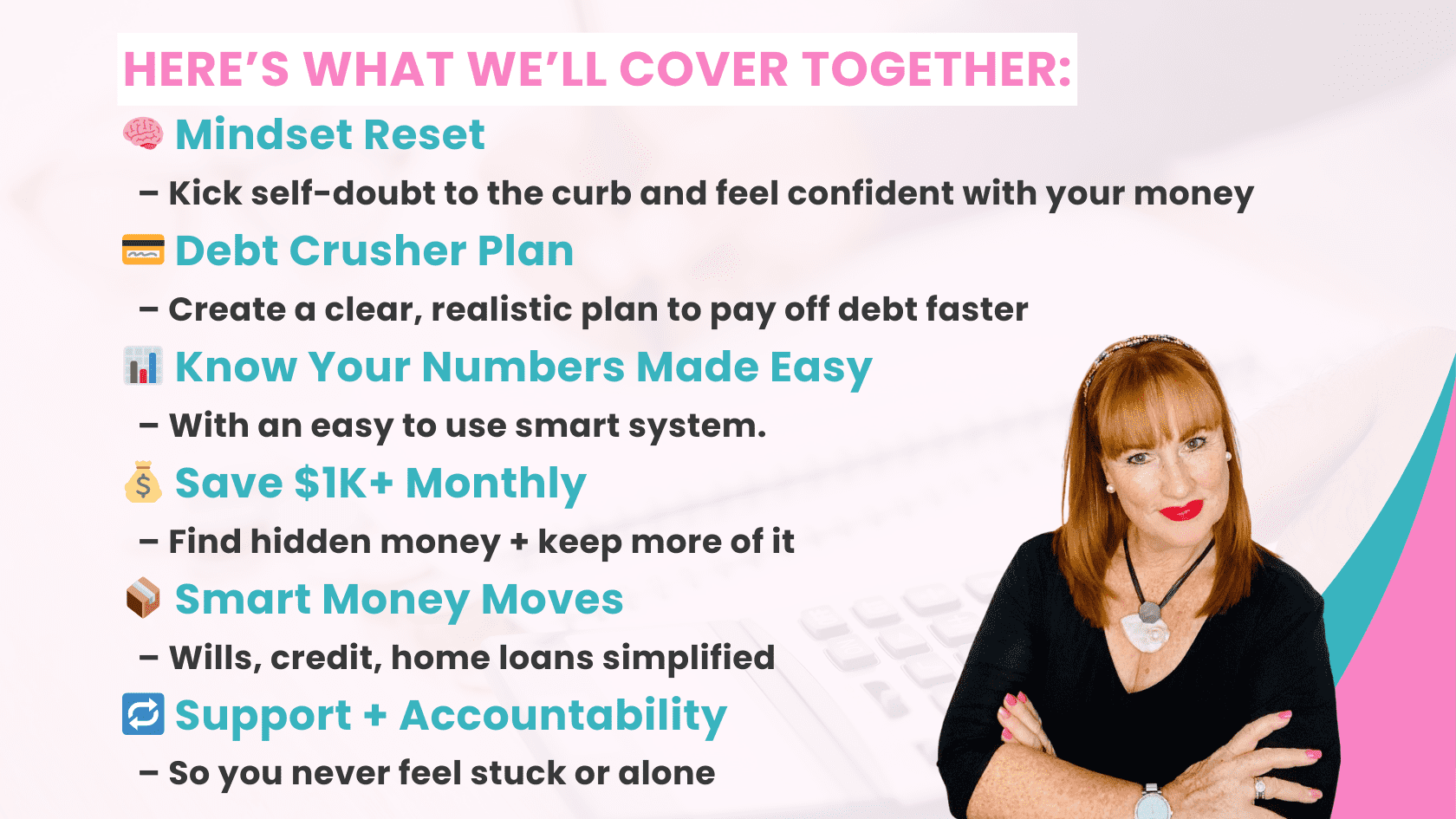

That’s exactly what Financial Muscle Coaching is a coaching and accountability space, where we normalise setbacks and celebrate bounce-backs.

Inside the membership, you’ll find structure, strategy, and support – all in one place.

8. Build Your Financial Muscle, One Rep at a Time

Rebuilding financial confidence is like building physical strength – it happens one rep at a time.

One decision to check your balance.

One habit of tracking your spending.

One conversation where you ask for help instead of hiding.

One payment that moves you forward.

You don’t need to leap – you just need to lift. And every lift makes you stronger.

Final Thoughts

Mistakes are part of the journey – not the end of it.

You are not behind. You are not bad with money. And you don’t have to do this perfectly to make progress.

Every time you choose to come back – to review, reflect, and reset – you’re rebuilding your confidence.

You’re showing yourself what you’re made of.

And you’re writing a new money story that’s rooted in self-trust, resilience, and growth.

You’ve got this. And I’m right here cheering you on.

? Join Financial Muscle Coaching

If you’re tired of navigating your money alone – or beating yourself up every time you slip – Financial Muscle Coaching is the place for you.

In this weekly coaching space, you’ll get:

✅ Encouragement instead of criticism

✅ Clear, doable action plans that meet you where you are

✅ Real accountability to build habits and confidence that last

No more shame. No more silence. Just strength, strategy, and steady growth.