New Financial Year, New Money Goals: 7 Smart Habits to Start Now

Welcome to a brand-new financial year! There’s nothing quite like the feeling of a clean slate, especially when it comes to your money. Whether you’re someone who loves spreadsheets or someone who avoids bank statements like laundry day, the start of the financial year is a powerful time to hit reset and make money moves that actually stick.

If you’re ready to ditch the overwhelm and finally feel in control, confident, and clear about your finances, then this is your year. And it all starts with habits.

Here are 7 smart money habits to kick off the financial year and set yourself up for real success (yes, even if numbers aren’t your thing!).

1. Review Your Last Financial Year (The Good, The Bad, and the “Wait, What Was That?”)

Before you charge ahead, take 30 minutes to reflect on where your money went last year. What worked? What didn’t? Did you hit any of your goals?

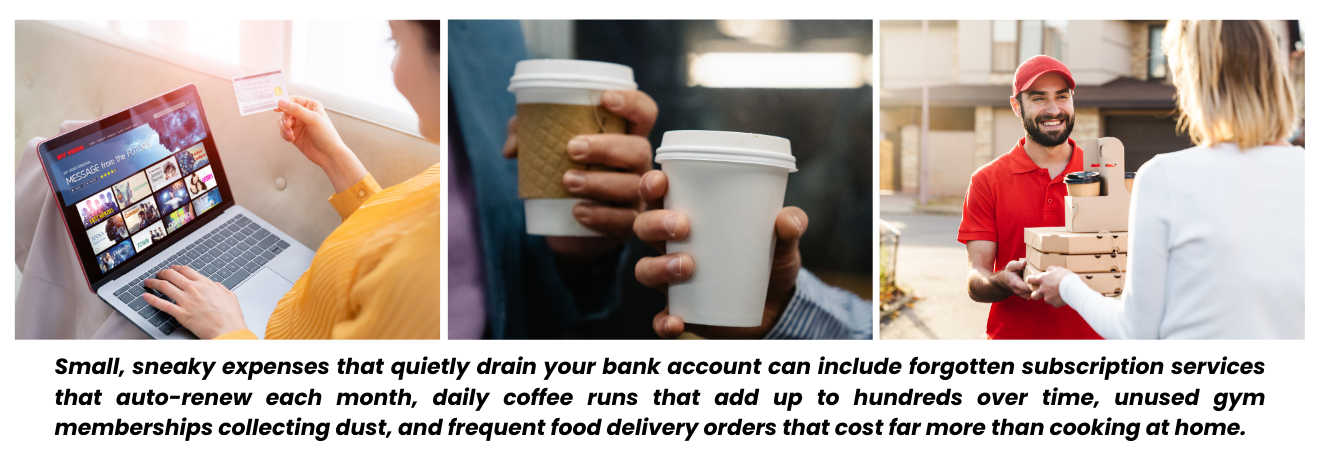

Start by looking at your bank and credit card statements for the past 6–12 months. You don’t need to categorise every coffee, but look for patterns. Did subscriptions creep up? Were there any surprise splurges? Were you saving regularly or only when you remembered?

Action Step: Choose 3 things you want to stop, start, or continue based on what you discover.

2. Set Money Goals That Light You Up

Generic goals like “save more” or “spend less” are boring. And boring goals get ignored.

Instead, tie your goals to something meaningful. Want to save $10,000? Why? Maybe it’s for a trip to Italy, a house deposit, or to finally feel free from credit card debt. Attach emotion to the goal and you’re more likely to stay committed.

Action Step: Write down your top 1–3 financial goals for the year and give each one a name, a number, and a reason.

3. Automate Your Money Flow

This is where the magic happens. One of the easiest ways to reduce stress and grow your savings is to automate everything you can.

That includes:

- Regular transfers to savings accounts

- Automatic bill payments

- Super contributions (if you’re self-employed)

When you automate, you take the guesswork (and willpower!) out of the equation.

Action Step: Set up a “money date” this week and automate one key area of your finances.

4. Create a Conscious Spending Plan (Not a Budget)

The word “budget” makes most people want to nap. So let’s reframe it.

A conscious spending plan is about being intentional. You don’t need to restrict every dollar, but you do need to know where your money is going so you can spend on what matters most.

Divide your income into these four buckets:

- Essentials (50%): rent, groceries, bills

- Financial goals (20%): savings, debt, investments

- Lifestyle (20%): dining, entertainment, fun

- Future freedom (10%): extra super, long-term investments

Action Step: Run your numbers and see where your current spending fits in. What needs adjusting?

5. Build a Mini Emergency Buffer

Life throws curveballs: vet bills, car repairs, random birthday gifts. Having a mini emergency fund (even $1,000 to start) gives you peace of mind.

Even if you already have savings, separate your emergency stash from your everyday accounts. That way, it’s out of sight and you’re less tempted to “accidentally” dip into it.

Action Step: Open a high-interest savings account and aim to build your first $1,000 buffer.

6. Check Your Super (Yes, Really!)

It’s easy to ignore your superannuation because retirement feels so far away. But guess what? Super is your future freedom fund. And it deserves some love.

Make sure:

- Your super fund has low fees

- You’re not paying for duplicate insurance

- Your investment strategy suits your risk tolerance and goals

Action Step: For Australians, log into your MyGov account or contact your super fund and review your setup. It could be the easiest $100,000 you ever make.

7. Invest in Financial Education (You Deserve to Feel Empowered)

You don’t need a finance degree to be good with money. But learning the basics – how to grow wealth, how compound interest works, how to protect your assets – makes all the difference.

The more you understand your money, the more confident and in control you’ll feel.

Action Step: Pick one financial book, podcast, or course to dive into this quarter. Or book a FREE session with “ME” your financial coach ?. CLICK HERE TO BOOK A CALL.

Ready to Make This Financial Year Your Best One Yet?

You don’t need a total money makeover overnight. Just consistent small steps in the right direction.

By reviewing where you’ve been, setting exciting goals, and building smart systems, you can create a financial life that feels aligned, empowered, and abundant.

Remember: it’s not about being perfect. It’s about making progress.

Let’s do this together.

If you’re ready for some guidance, motivation, or a tailored money plan that actually works with your lifestyle, book your free discovery session today or jump straight into THE VAULT. This is your year!

You deserve to feel confident with your money. And it all starts NOW.