New Year, New Money Energy: How to Kick Off 2026 With Confidence

There’s something magical about a fresh new year. It feels like a blank notebook just waiting to be filled – new hopes, new habits, and new opportunities. And when it comes to your finances, January is the perfect time to channel that energy into building momentum that lasts all year long.

Forget the overwhelming resolutions list. This year, it’s about starting small, starting strong, and building money confidence that fuels everything else in your life. Ready to step into 2026 with fresh energy? Here’s how.

? Step 1: Choose Your 2026 Money Theme

Instead of setting a dozen resolutions, pick a single theme to guide your financial decisions this year.

Examples:

- Growth: Focus on building savings or investments

- Freedom: Prioritise paying off debt

- Stability: Build your emergency fund

- Intentionality: Track spending and align with your values

Your theme becomes a compass. Whenever you face a financial choice, you can ask: Does this support my 2026 money theme?

? Step 2: Set One Clear Goal for January

Don’t wait until mid-year to make progress. Start now with one achievable goal this month. Ideas:

- Save $100 by cutting one expense (like takeaway coffees or subscriptions)

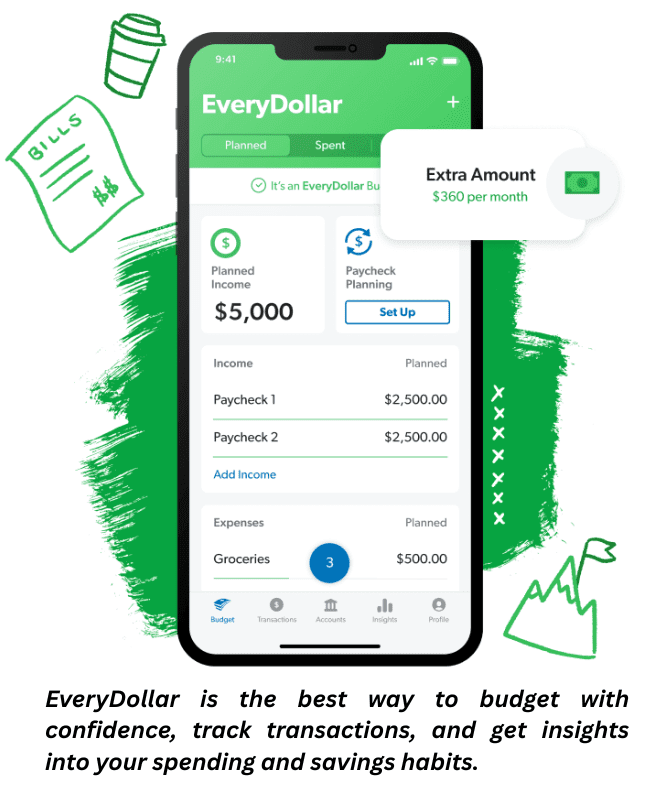

- Track every expense for 30 days

- Make an extra payment toward debt

- Open a new savings account for your emergency fund

When you achieve a quick win in January, you build confidence that sets the tone for the year.

? Step 3: Refresh Your Budget for the New Year

Your life has probably shifted since last January, so your budget should too. Take stock of:

- Your current income

- Your fixed expenses (rent, utilities, insurance)

- Your variable expenses (groceries, fun, travel)

- Your financial goals (savings, debt, investing)

Give every dollar a purpose. Remember, your budget isn’t about restriction – it’s a plan for freedom and choice.

? Step 4: Build Money Habits That Stick

The new year isn’t about overnight change – it’s about consistency.

Focus on simple, sustainable habits:

- Weekly money check-ins (15 minutes to review spending and update your budget)

- Automatic savings transfers on payday

- Meal planning to cut food waste and overspending

- Tracking your progress toward one goal each month

Habits create momentum. And momentum creates results.

✨ Step 5: Infuse Your Money Journey With Joy

Money confidence isn’t just about numbers – it’s about how you feel. This year, commit to making your financial journey something you enjoy.

Ideas:

- Celebrate small wins with non-spending rewards (like a relaxing night in or a walk in nature)

- Share your goals with a friend or accountability partner

- Create a money vision board for 2026

- Journal about what financial freedom looks and feels like for you

When you connect money with joy, you’ll find it easier to stick with your goals.

? Step 6: Create a Future-You Fund

Want to feel truly confident? Start building a little cushion for the future.

- Begin or boost your emergency fund

- Start a sinking fund for Christmas, travel, or birthdays

- Increase your superannuation contributions, even by 1%

Every dollar you set aside is a gift to your future self. And future-you will thank you for it.

? Final Thoughts: Step Into 2026 With Confidence

This new year isn’t about perfection. It’s about progress. It’s about taking small, intentional steps that align with your goals and values.

So choose your theme, set your January goal, refresh your budget, and commit to simple habits. Celebrate the wins along the way, and don’t forget to enjoy the journey.

Because 2026 is your story to write – and this year, you get to write it with confidence, clarity, and fresh money energy.