Avoiding the Post-Christmas Credit Card Hangover

The tree has come down, the last slice of Christmas pudding is gone, and you’re finally catching your breath after the festive whirlwind. But then it happens – you open your credit card statement, and suddenly that Christmas cheer feels like a distant memory. The dreaded post-Christmas credit card hangover has arrived.

The good news? You can absolutely enjoy Christmas without carrying financial regret into the new year. With a few mindful strategies, you can celebrate fully and start January feeling confident, not crushed by debt. Here’s how to make it happen.

Step 1: Set a Christmas Spending Limit (Before You Shop)

Your credit card limit is not your Christmas budget. Decide what you can comfortably spend this festive season without borrowing from your future self.

Ask yourself:

- How much cash do I realistically have available for Christmas?

- What regular bills and obligations still need to be covered?

- Can I set aside money weekly in December to spread out costs?

Write down a total number – this is your Christmas spending cap. Stick to it, even when those festive sales scream your name.

Step 2: Create a Cash-First Plan

One of the easiest ways to avoid a credit card hangover is to use as little credit as possible during Christmas.

- Pay with debit or cash where possible

- Set aside weekly envelopes for gifts, food, and fun

- Use prepaid cards to cap your spending

- If using credit online, track it immediately and set a repayment date

Pro tip: Leave your credit card at home when shopping in person. It’s much harder to overspend when you don’t have the option. Try using a visa debit card, which is actually your money and when you run out that’s it!

Step 3: Track Every Dollar (Yes, Every Single One)

In the Christmas chaos, it’s easy to lose track of spending – but that’s how the January shock sets in. Ways to stay on top:

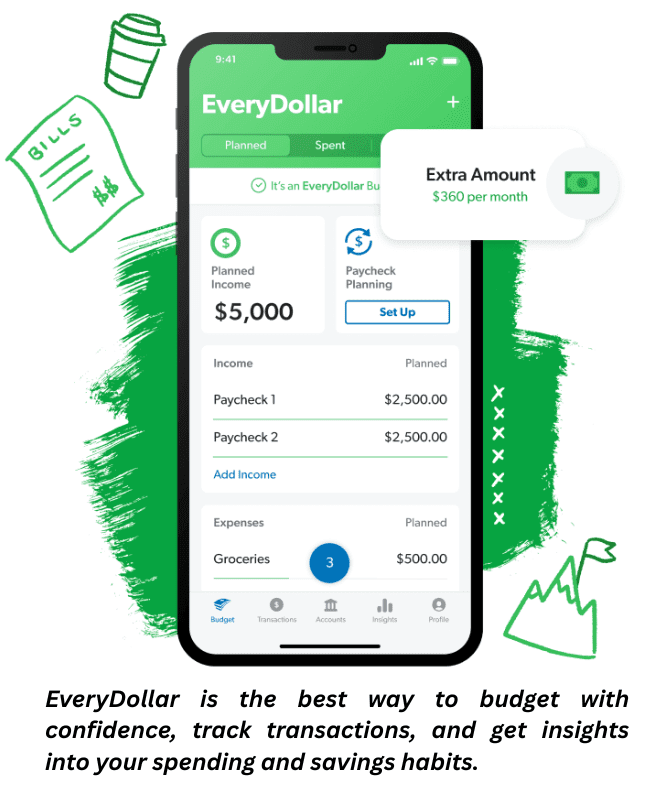

- Use budgeting apps like YNAB, EveryDollar, or Mint

- Keep a festive spending log in a notebook or phone note

- Do weekly money check-ins throughout December

Think of it as financial self-care. Awareness is your secret weapon.

Step 4: Be Strategic With Gifts

Gifts are often the biggest Christmas expense, but they don’t have to wreck your budget.

Tips for staying intentional:

- Make a list of who you’re buying for before you shop

- Set a per-person limit and stick to it

- Consider Secret Santa to cut the number of gifts

- Swap expensive items for homemade or experience-based gifts

- Remember: thoughtful beats flashy every time

No one worth celebrating wants you to go into debt for their gift.

Step 5: Plan for Food and Festivities

Christmas isn’t just about presents – the meals, parties, and little extras add up quickly. Save money by:

- Planning meals in advance

- Shopping early for non-perishables

- Hosting potluck-style dinners

- Saying no to extras that don’t truly add joy

When you prepare in advance, you avoid last-minute dashes (and expensive impulse buys).

Step 6: Watch Out for Emotional Spending Triggers

Christmas marketing is designed to play on your heartstrings. Nostalgia, urgency, and guilt can all push you to overspend. Ask yourself:

- Am I buying this because I want to – or because I feel pressured?

- Will this bring lasting joy, or just temporary excitement?

- Does this purchase align with my budget and values?

Your wallet deserves as much protection as your peace of mind.

Step 7: Practice Festive Financial Self-Care

Money stress can quickly steal your Christmas spirit. Make self-care part of your financial strategy:

- Take breaks from social media (comparison is a sneaky trigger)

- Remind yourself that Christmas isn’t a competition

- Journal your money intentions for the season

- Share your budget boundaries with loved ones

The more grounded you feel, the easier it is to resist overspending.

? Step 8: Create a January Recovery Plan

If you do use your credit card this Christmas, set a plan for repayment:

- Tally up what you’ve spent

- Divide it into weekly or monthly repayment goals

- Automate payments so you stay on track

Even better? Plan a “No-Spend January.” Cutting back in the new year can help you reset your budget and clear any lingering balances faster.

Bonus: Start a Christmas Sinking Fund for Next Year

Want to avoid the stress altogether next time? Build a sinking fund.

Example:

- Decide on for example a $3000 Christmas budget for 2025

- Divide by 12 months = $250/month

- Set up an automatic transfer to a separate savings account

Come December, you’ll be ready – no credit cards needed.

Final Thoughts: A Debt-Free Christmas Is the Best Gift

The magic of Christmas isn’t in the size of the presents or the amount spent – it’s in the moments, the laughter, and the love. Avoiding the post-Christmas credit card hangover means entering the new year lighter, freer, and more empowered.

So give yourself the gift of financial peace. Spend with intention, set boundaries, and remember: your presence is always more valuable than the presents under the tree.