The Financial House Inspection: 10 Sneaky Money Leaks (And How to Plug Them Fast)

Let me ask you something… if your financial house was a real house, would you invite guests over right now?

Or would you do that frantic pre-visit panic clean where you shove everything into the laundry or the spare room and pray nobody opens that door?

Because that’s what most people are doing financially.

Not because they’re “bad with money” (you’re not), but because life is busy, expensive, and full of sneaky little costs that quietly set up camp in your bank account like they pay rent.

And the truth is… you don’t always need a bigger income to feel more in control.

Sometimes you just need to find the leaks.

Today, we’re doing a Financial House Inspection – warm cuppa in hand, no shame, no judgement, and definitely no stiff “financial coach voice.” You’ll walk away with practical fixes, a clearer head, and probably a few “WAIT… WHAT?!” moments.

Let’s inspect your money house.

Why “Money Leaks” Matter (Even If You Earn Good Money)

A money leak is not a big, dramatic purchase you remember forever (like buying a car or going on a holiday).

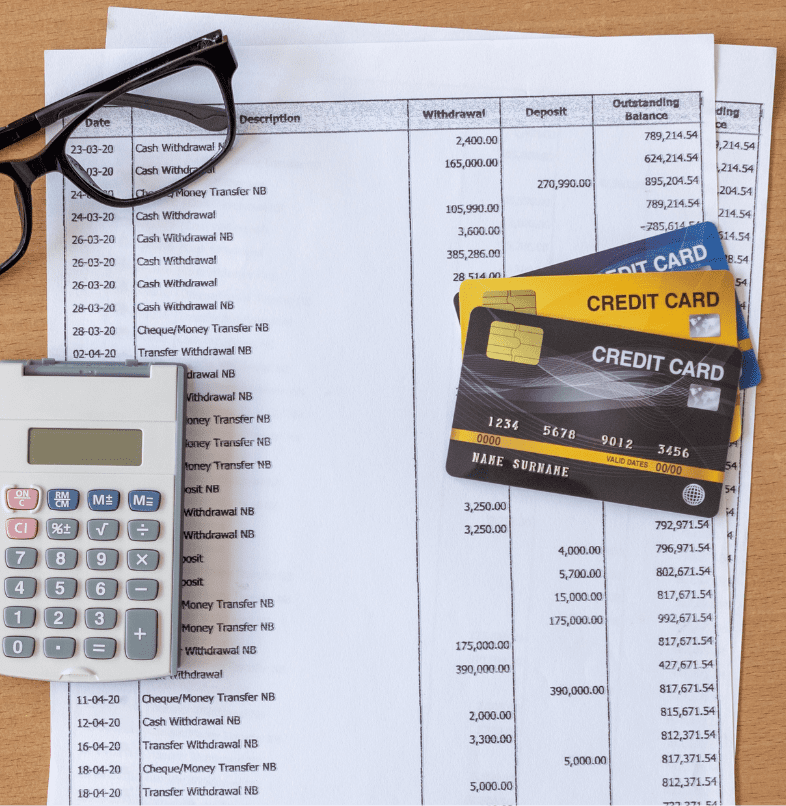

A money leak is the “small stuff” you don’t notice… until you look at your bank statement and think:

“Excuse me, where did my money go?”

Leaks are dangerous because they:

- feel harmless in the moment

- happen repeatedly

- add up faster than you think

- make you feel like you’re always behind even when you’re trying

And here’s the kicker: leaks are often emotionally driven, not logically driven. They’re convenience, comfort, habit, exhaustion, reward, stress, or just not having a system in place.

So let’s find them and plug them like the financially strong legend you are.

The Financial House Inspection Checklist: 10 Common Money Leaks

1) The Subscription Graveyard

This one is so common it deserves its own memorial plaque.

Streaming services, apps, software, gym memberships, delivery memberships, random “productivity tools,” audiobooks, meditation apps, cloud storage…

And you know what makes subscriptions sneaky?

They don’t hurt enough to notice. It’s just $9.99 here… $14.99 there… $24.99 for something you “might use.”

Until suddenly you’re donating $300 a month to the Subscription Graveyard.

Quick Fix:

- Go through your bank statements and highlight every recurring payment.

- Ask: “Would I buy this again today?”

- Cancel anything that isn’t a HELL YES.

Pro tip:

If cancelling makes you panic (“but what if I need it one day?”), that’s not logic, that’s fear. And fear is expensive.

2) Lazy Renewals (Insurance, Utilities, Phone Plans)

Lazy renewals are like leaving a tap dripping for years and being shocked your water bill is high.

Insurance companies love loyal customers… because loyal customers often don’t check the price.

Phone plans creep up. Internet deals expire. Electricity rates change. Suddenly you’re paying premium pricing for basic service.

Quick Fix:

- Put a recurring reminder in your calendar every 6–12 months:

- car/home insurance

- health insurance

- electricity/gas

- phone/internet

- Compare and renegotiate.

Money mindset note:

Being financially responsible is not being “cheap.” It’s being strategic.

3) Bank Fees and “Oops” Charges

Account keeping fees. International transaction fees. ATM fees. Late payment fees. Overdraft fees.

These aren’t “just the cost of banking.” They’re often the cost of not having the right account setup or system.

Quick Fix:

- Review your bank accounts and credit cards.

- Ask your bank: “Is there a fee-free option?”

- Set up alerts for low balances and bill due dates.

- Automate minimum payments to avoid late fees.

You don’t need to pay $10 – $30 a month in fees just to have a bank account. Your money deserves better.

4) Convenience Spending (AKA “I’m Too Tired” Tax)

This is the one people don’t want to admit because it’s so relatable.

Convenience spending is:

- takeaway because you’re exhausted

- Uber because parking feels like emotional warfare

- delivery apps because “I’ll just get one thing”

- pre-made meals because you can’t face thinking

And honestly? Sometimes it’s worth it. Life is busy. You’re human. But if it’s happening on autopilot, it becomes a leak.

Quick Fix:

- Create a weekly “convenience budget” – guilt-free, planned.

- Have one or two “emergency meals” at home (freezer meals, eggs, wraps, anything easy).

- Decide your rules before you’re tired.

This isn’t about perfection. It’s about awareness + boundaries.

5) Supermarket Drift (The “Just One More Thing” Trap)

You go in for milk and bread. You come out with:

- fancy dips

- a plant you didn’t need

- snacks for “school lunches” (even though you don’t have kids)

- and a candle because self-care.

The supermarket is designed to separate you from your money with maximum efficiency.

Quick Fix:

- Shop with a list (yes, like a grown-up, annoying but effective).

- Eat before you shop.

- Do click-and-collect if you’re an impulse buyer.

- Track your weekly grocery spend for 4 weeks and be honest about what’s happening.

Groceries are one of the easiest leaks to tighten without feeling deprived.

6) The Servo Snack & Coffee Leak

The little daily habits: coffee, snacks, “just grabbing something,” the quick drink on the way home, the “treat” because the day was hard.

And let me be clear: you’re allowed joy. But when joy is unplanned and daily, it becomes a leak.

Quick Fix:

- Choose what’s worth it.

- If café coffee is your thing, keep it, but make it intentional.

- Set a weekly allowance for treats and stick to it.

The goal isn’t to become a finance robot. The goal is to stop accidentally overspending.

7) Lifestyle Inflation (The “I Deserve It” Spiral)

This one is sneaky because it feels like progress. You earn more… so you spend more. New car. Nicer clothes. More dinners out. Better holidays. Upgraded everything.

And you might still feel broke. Lifestyle inflation isn’t about being irresponsible. It’s about missing the moment where you lock in your future before upgrading your present.

Quick Fix:

- When income increases, decide in advance:

- what percentage goes to lifestyle

- what percentage goes to savings/investing

- what percentage goes to debt reduction

- Automate “Future You” first.

Future You is not asking for everything.

Future You is asking for something.

8) “Buy Now Pay Later” (BNPL) and Payment Splitting

BNPL is basically like inviting little debts into your house and then being shocked they’re eating all your groceries.

It doesn’t feel like debt because it’s broken up into payments.

But it still reduces your future cash flow and adds mental load.

Quick Fix:

- List every BNPL account and total outstanding.

- Pause new purchases until the balances are cleared.

- Rebuild a sinking fund for things you commonly use BNPL for (clothes, gifts, school costs, etc.

BNPL is not evil. But it is dangerous if it becomes your normal.

9) Unused Memberships and “Aspirational Spending”

This is spending money on the version of you who:

- goes to the gym 5 days a week

- does yoga at sunrise

- reads 2 business books a week

- meal preps like a wellness influencer

- uses that online course “soon”

We’re funding our aspirational selves while our current selves are just trying to get through Tuesday.

Quick Fix:

- Keep one “growth” commitment at a time.

- If you’re not using it, pause it.

- Choose what actually fits your life right now.

The goal is to build financial muscle, not financial guilt.

10) The “No System” Leak (The Biggest One)

This is the mother of all leaks. Because even if you fix everything above, if you don’t have a system, the leaks come back.

A system is what creates calm. It tells your money where to go before life grabs it first.

Quick Fix:

Start with these basics:

- a separate bills account

- automatic transfers on pay day

- a weekly money check-in (10 minutes)

- clear spending categories (not 47 categories… just the ones that matter)

Most people don’t have a money problem. They have a money flow problem.

And that is fixable.

Your Mini Action Plan: Plug Leaks in 30 Minutes This Week

If you want to feel immediate relief, do this:

- Print your last 30 days of transactions (or pull them up on your banking app).

- Highlight anything that surprised you.

- Circle:

- subscriptions

- takeaway/coffee

- shopping

- fees

- Choose 3 leaks to plug this week.

- Move the money you save into a separate “Future Me” account.

That last step matters. If you don’t redirect the savings, it disappears into new spending. Money is like that. It loves momentum.

The Real Truth: You Don’t Need More Willpower – You Need Support + Structure

I want to say something kindly but clearly:

If you’ve tried to “get on top of money” before and it didn’t stick, it’s not because you’re hopeless. It’s because you’ve been trying to do it alone, in between work, kids, stress, bills, and exhaustion… with zero structure and a lot of pressure.

And that’s not a character flaw. That’s a strategy gap.

Come Into the Membership (Because This Is What We Do Together)

If reading this has you thinking, “Okay… I can see the leaks, but I need help making this a real system,” then babe – this is exactly why I created my Membership.

Inside the Membership, we don’t just talk about money. We build financial muscle.

✅ We identify your personal leaks (not generic ones).

✅ We set up a simple money system that actually fits your life.

✅ We make progress without shame, overwhelm, or perfection.

✅ You get guidance, structure, education, and support – so you’re not constantly starting over.

Because getting your financial house in order isn’t about a one-time clean-up.

It’s about building habits and systems that keep it running smoothly long-term.

If you’re ready to stop guessing and start feeling in control, join the Membership.

Let’s plug the leaks, create a plan, and turn your financial house into a place you feel proud to live in.

#HowToResetMyMoneyMindset #WhyDoIFeelOutOfControlWithMoney #HowToFeelInControlOfFinances #ResetMoneyMindset2025 #NewYearFinancialMindset #HowToStartFreshWithMoney Discover 10 sneaky money leaks draining your bank account and simple fixes to plug them fast. Get your financial house in order without the guilt. financial house in order, stop overspending, budgeting without stress, cash flow tips reduce financial stress, personal finance Australia spending habits save money fast, subscriptions costing me money, how to manage money better