New financial year. New mindset. New money moves. ?

There’s something incredibly powerful about the start of a new financial year. It’s like someone pressed the reset button and handed you a fresh shot at reaching your goals.

And this time? It’s personal. This is your year to get ahead – not just in your bank account, but in your mindset, your confidence, and your whole relationship with money.

Here’s how to make this year the one where you finally feel in control, empowered, and excited about your finances.

1. Own the Clean Slate (And Leave the Shame Behind)

We’ve all made money mistakes. Whether it was overspending, ignoring super, or living paycheck to paycheck, the past doesn’t define your future.

The new financial year is your opportunity to let that go and start fresh – no guilt required.

Try this:

- Write down one lesson you learned last financial year

- Then write down one intention you have for this year

Acknowledge it. Release it. Reset.

2. Create a Vision That Excites You (Not Just a Budget)

Most people avoid budgets because they feel like punishment. So let’s reframe it.

Instead of thinking “how do I cut back?” think: “how can I build a life I love through intentional spending?”

Visualise:

- Where you want to be 12 months from now

- What you want more of (freedom, travel, less stress?)

- What needs to shift to make that happen

Pro tip: Make a vision board or write a “money mission statement” for the year. Put it somewhere you’ll see often.

3. Get Clear on Your Numbers (Clarity is Confidence)

You can’t get ahead if you’re in the dark about where you stand. It’s time to face the numbers with curiosity, not fear.

Check in on:

- Your income sources

- Your fixed expenses (bills, mortgage/rent, etc.)

- Your variable spending (fun stuff, subscriptions, eating out)

- Your debt (what you owe and to who)

- Your savings and investments

Action step: Do a quick money audit this week. You don’t need to obsess, just get an honest snapshot.

4. Set One Bold Financial Goal (And Break It Down)

Big goals are inspiring. But if they feel too far away, you might give up before you start. Pick one bold, exciting goal for the year – something that lights a fire in your belly.

Examples:

- Save $15,000 for a home deposit

- Pay off a credit card

- Start investing for the first time

- Build a 3-month emergency fund

Then break it down:

- What does that look like monthly?

- What habits need to change?

- What support or tools will help?

5. Build a System That Works on Autopilot

Motivation comes and goes. Systems stick. Use the new financial year to design your money flow:

- Set up automatic transfers to savings and bills

- Separate accounts for spending, bills, and fun

- Review and reduce expenses where possible

Make it easy to win. That way, even on your off days, your money is still working for you.

6. Learn One New Money Skill Each Quarter

Financial growth isn’t just about earning more, it’s about knowing more. Commit to learning just one new skill every quarter. That could be:

How to invest in ETFs

How to negotiate your bills

How superannuation actually works

How to set up a side hustle

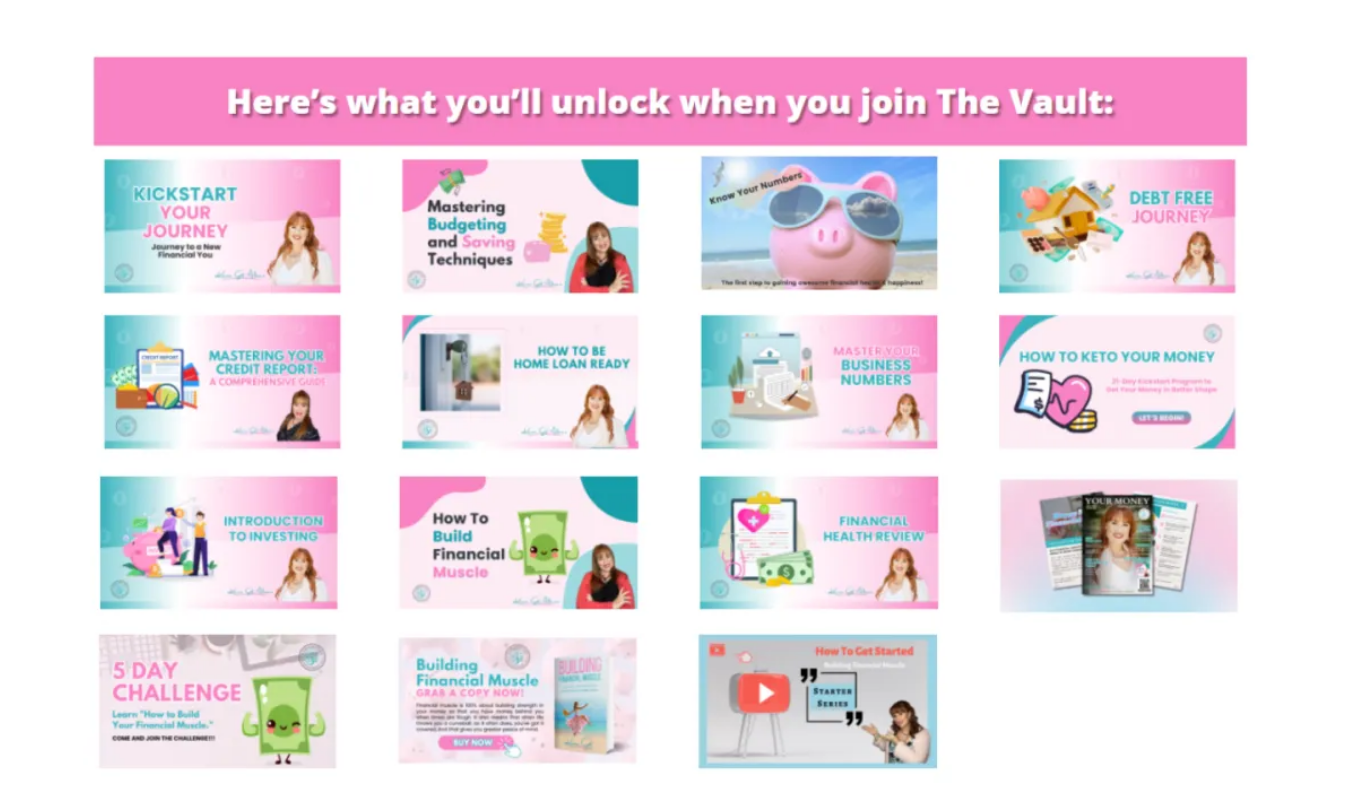

Try this: Choose a podcast, book, YouTube series, or online course. Block out one hour a week to learn. That’s it. I have plenty of these to help you get started, just head over my website and see what resources you can download. CLICK HERE.

7. Celebrate Every Win (Progress Over Perfection)

Too often we focus on what’s not working. But building confidence comes from celebrating small wins consistently.

- Did you transfer $100 to savings? Win. Did you say no to something you didn’t really want to buy? Win.

- Did you open your super statement for the first time ever? Win.

Progress creates momentum. And momentum creates results. Create a “money wins” list and add to it every month. You’ll be amazed how far you’ve come.

This is Your Year Because You Say So

You don’t need to wait for a pay rise, a partner, or perfect timing. You have everything you need right now to take the next step.

- A fresh new year

- A clean slate

- A decision to back yourself

Whether your goal is to pay off debt, grow savings, or simply feel less anxious when you open your bank app, this year is yours to make it happen.

If you’re ready for a fresh plan and a financial coach in your corner, let’s chat. Book your free discovery session and let’s make this the year you finally get ahead – with clarity, confidence, and ease. You’ve got this. And I’ve got you.

Let’s make this financial year your best one yet.