Can you imagine seeing your home loan balance diminish every month to the point that you now have no debt and no mortgage? Now enjoy a happier, less stressed lifestyle, knowing the major debt in your life has finally been paid off.

Imagine receiving the deeds to your home with just your name on it and not your bank, as previously they had joint custody of your home.

Just imagine what it would be like to not pay a mortgage, or better yet, to be well on your way to owning your investment property.

Putting you, and not your bank, in the driver’s seat of your financial life.

We give you the tools to own your home faster – the one big debt looming over your head.

I am often asked to examine potential clients’ home loans, as they want to know if they have the right home loan structure to help them reduce it quicker.

There are 4 steps to becoming mortgage free faster, and they are:

1. Set your goal

2. Get a coach – mortgage coach and financial & mindset coach

3. Learn how and what to do to achieve your goal of becoming debt-free sooner.

4. Create a plan and stick to it

5. Take action, do what others won’t do, and you will see the benefits of becoming debt-free sooner.

So I hear you saying, what can a coach do?

Firstly, there are two types of coaches when it comes to reducing your mortgage. The first is a mortgage coach, and the second is a financial and mindset coach.

1. The mortgage coach is the one who ensures your home loan is structured and set up correctly, utilising the latest strategies available to maximise the full debt reduction potential. The mortgage coach’s responsibility is to ensure they are working with you to understand your home loan so you can work towards paying it down as quickly as possible.

2. The financial and mindset coach is the one who works with you regularly to help you stay focused and on track towards achieving your financial goals. The financial and mindset coach ensures that when life suddenly throws you a curveball, as it often does – they are there, ensuring you have the tools and resources necessary to stay motivated and on track.

So let’s take a look at what it may cost you to not get a coach.

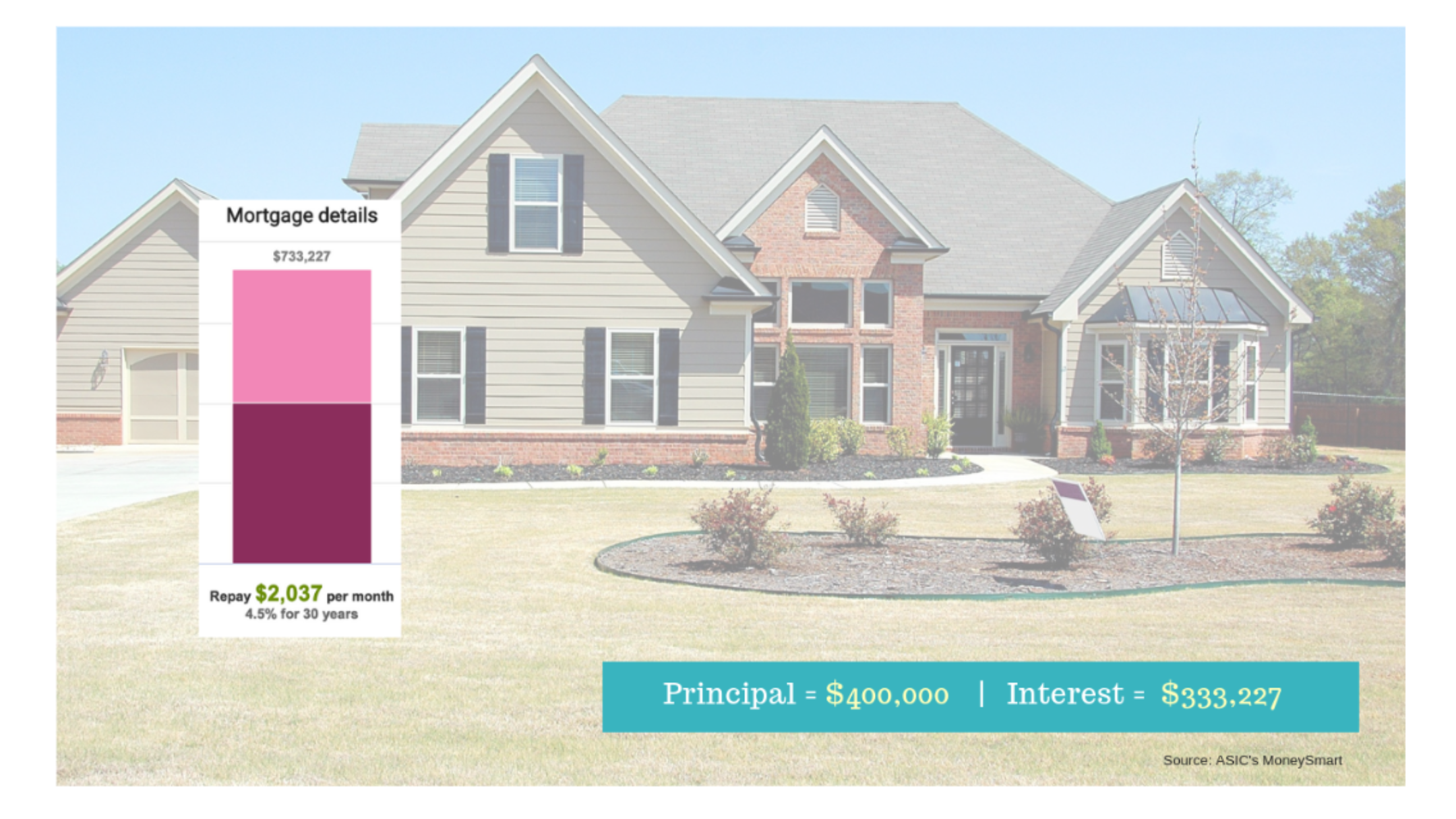

If you had a home loan of $400k with a 30-year term, this would cost you at the end of your loan around $733k. That’s an additional $333k of your hard-earned money going to the bank for the privilege of them loaning you the money.

Now let’s take a look at a home loan that’s adopting the mortgage reduction strategy along with getting support from a coach.

When the mortgage coach got to work with this client, they were able to save over $210k in interest payments alone, not to mention over 11 years in the term of their mortgage.

It’s really possible to pay your home loan off faster with the right home loan structure, and the right coach on board can help you achieve this.

This is one of the strategies I teach in my course “How to Keto Your Money – 21 Kick Start Program”. You get coaching from me on how to pay your home loan down fast and get the support you need to stay on track.

This is also what I often talk about in building financial muscle and having money work to YOUR advantage and not to your bank or financial institution’s benefit.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.

Let me help you!

Get in touch with me today to see firsthand if you have the right loan structure and how my coaching style can support you to achieve your financial goals sooner.