Do you ever feel like your finances are controlling you, instead of the other way around? The good news is that financial control isn’t about being perfect – it’s about making intentional choices and taking consistent steps toward your goals. Let’s break down the five steps that can help you master your money and regain control of your financial future.

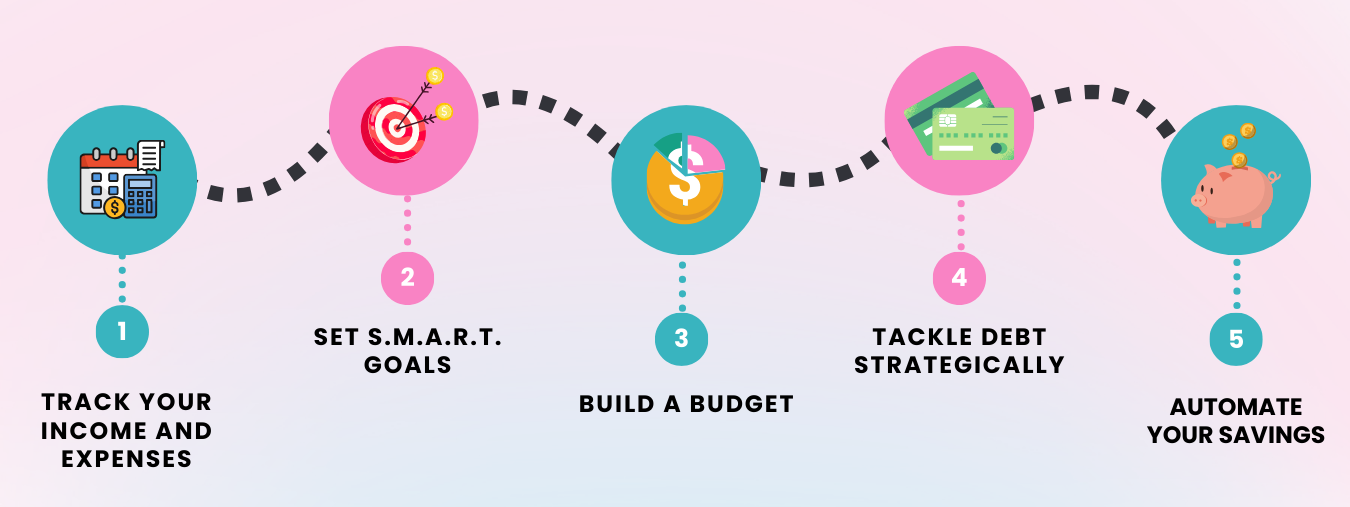

STEP 1: KNOW YOUR NUMBERS

Before you can improve, you need to understand your starting point. Here’s how:

- Track your income and expenses. Use an app, spreadsheet, or pen and paper to list every dollar coming in and going out.

- Identify your financial position. Calculate your net worth by subtracting your liabilities (debts) from your assets (savings, property, etc.).

- Spot patterns. Are there expenses you can cut back on or habits you can change?

The insights from this step often surprise people, and they’re the foundation for everything else.

STEP 2: SET SMART GOALS

Vague goals like “save money” don’t work. Instead, use the SMART framework to set goals that are Specific, Measurable, Achievable, Relevant, and Time-bound.

For example:

- Short-term Goal: Save $1,000 for an emergency fund in three months.

- Medium-term Goal: Pay off a $5,000 credit card balance within a year.

- Long-term Goal: Save a 20% deposit for a home in five years

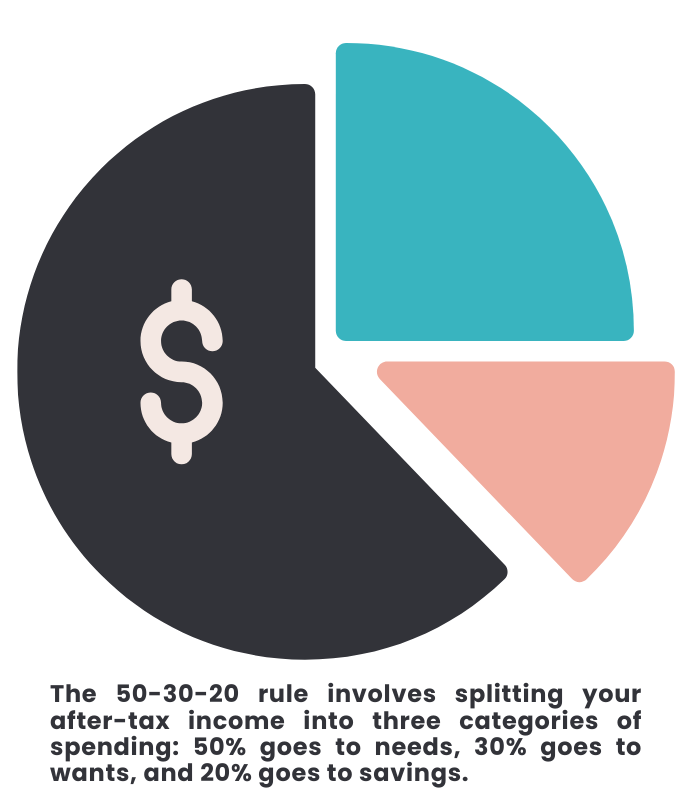

STEP 3: MASTER THE ART OF BUDGETING

The cornerstone of financial success is budgeting—and there’s no better resource to guide you than the Master Your Money Program. This program teaches you to create a budget that balances your needs, wants, and financial goals.

Key takeaways include:

- Understanding the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment).

- Setting up separate accounts for different spending categories.

- Tracking your progress and adjusting as need

STEP 4: ELIMINATE DEBT STRATEGICALLY

Debt doesn’t just drain your wallet; it drains your peace of mind. The Mastering Budgeting and Savings Course provides actionable strategies to tackle debt, including:

- The debt snowball method, which focuses on paying off smaller debts first.

- The debt avalanche method, which prioritizes high-interest debts.

- Techniques for negotiating lower interest rates or consolidating debt.

STEP 5: BUILD A FINANCIAL SAFETY NET

Life is unpredictable, but your finances don’t have to be. Automate your savings to build a robust emergency fund, ideally covering 3–6 months’ worth of expenses. Once your safety net is in place, you can focus on other financial goals with confidence.

Ready to Master Your Money?

Mastering your money isn’t a one-time fix, it’s a journey. But with the right tools, guidance, and a solid plan, you can achieve financial freedom. The Master Your Money Program is for YOU if you are tired of financial stress and ready to transform your relationship with money. Whether you’re managing a family, building your career, or chasing your dreams, this is your chance to gain the clarity, confidence, and habits you need to thrive.

This is more than a mindset shift—it’s a transformation that puts you on the path to lasting financial success! ?