The holiday lights have dimmed, the decorations are packed away, and the credit card bill has landed in your inbox. January can feel like a financial hangover – but it doesn’t have to stay that way. The new year is the perfect time for a fresh start with your money. Let’s turn those post-holiday regrets into real financial progress.

Step 1: Acknowledge the Overspend – Without Shame

Let’s be real. You probably didn’t mean to go overboard, but the season has a way of loosening our wallets. Flash sales, peer pressure, holiday cheer – it’s a perfect storm of spending. Here’s the deal: You’re not bad with money. You’re human.

The first thing I tell my clients: “You can’t change what you won’t face.” So open those credit card statements, take a breath, and look at the total. It’s just data and now you’re in the driver’s seat.

Step 2: Have a “Money Review Day”

Set aside one focused hour this week for your personal “Money Review Day – grab a coffee, and get into CEO mode:

? Print or pull up your December statements

? List your total credit card balances

? Note the interest rates and minimum payments

✂️ Highlight 3 spending categories to cut back this month

This is about clarity, not judgment. Think of it as gathering puzzle pieces before you start putting them together.

Step 3: Set a Short-Term Payoff Goal

Massive goals feel good in theory, but small wins are what keep you going. Look at your balances and pick ONE target:

- Your smallest balance to clear quickly (Snowball method)

- Your highest-interest card to save money (Avalanche method)

Example: If you owe $3,000 across 3 cards, focus on paying off the $500 one first. That win builds confidence and momentum.

Step 4: Build a Realistic January Budget

Post-holiday budgeting is all about breathing room. Not punishment. Build a one-month “recovery budget” that helps you regain control:

✅ Cover essentials first: Rent/mortgage, food, utilities, transport

❌ Cut or pause: Subscriptions, takeout, impulse buys

? Redirect: Any leftover funds go straight to your debt goal

Even an extra $50 a week toward debt adds up. And if money is tight? See if you can generate a little extra (selling unused items, picking up a side hustle, cashback apps, etc.).

Step 5: Create a “Holiday Payback Plan”

If you overspent by $1,200 in December, divide that into 6 monthly chunks: $200/month. Add it to your budget now and automate it.

This isn’t about guilt – it’s about taking control on your terms. When you have a plan, the weight of the debt gets lighter.

Step 6: Replace Shame with Strategy

Negative self-talk like “I’m terrible with money” only reinforces stuck patterns. Flip the script:

❌ “I can’t believe I did this again.”

✅ “I’m learning new habits that support my goals.”

Money is emotional and mindset matters. Be your own biggest ally, not your harshest critic.

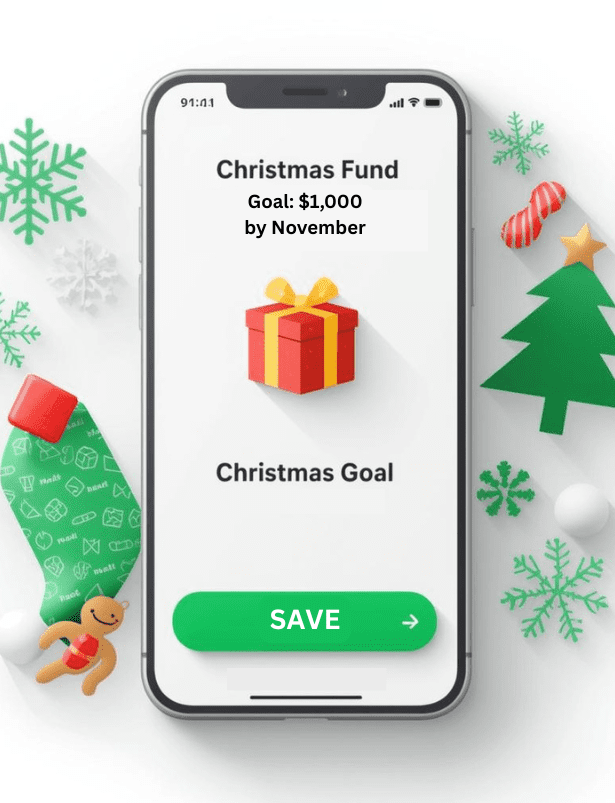

Step 7: Future-Proof Next Year with a Holiday Fund

Want to avoid this January stress next time? Start now with a holiday sinking fund:

- Name it: “Holiday Joy Fund”

- Set a goal: $1,000 by November

- Break it down: $42/month or $21/paycheck

Automate it. When next December hits, you’ll be ready, and proud of yourself.

Step 8: Find a Support System

This journey is easier (and more fun) when you don’t do it alone. Whether it’s a money buddy, group, or coach – accountability is the secret sauce. That’s where my “Financial Muscle Coaching Membership” helps keep you accountable and gives you to the tools and knowledge to update your financial future.

Most people don’t need more information. They need support, structure, and a system.

Final Thoughts

You don’t have to fix everything overnight. But you do have to start. And now is the perfect time. Your financial reset starts with one decision, one action, and one new mindset: You’re in control now.

Ready to stop feeling stuck and finally build real financial momentum? Join Financial Muscle Coaching – this is a membership designed to help you rebuild, reset, and grow stronger with your money. It’s time to train your financial muscles and feel powerful about your money choices.

Let’s make this your best money year yet. ??

#HowToRecoverFromOverspending #HolidayDebtHelp2025 #PostHolidayMoneyStress #GetBackOnTrackFinancially #HowToResetMoneyAfterTheHolidays #OverspentAtChristmasNowWhat #NewYearFinancialReset #HowToFixMyFinancesAfterHolidays #MoneyRecoveryPlan #CreditCardHangoverHelp