Money Myths That Are Keeping You Broke & How to Break Free

Money is a topic surrounded by myths, misconceptions, and downright bad advice. These myths often creep into our minds, influencing our financial decisions and keeping us stuck in unhealthy patterns. Breaking free from these false beliefs is essential if you want to achieve financial success and peace of mind.

In this blog, we’ll bust some of the most common money myths that may be holding you back and provide practical steps to rewrite your money story for a brighter financial future.

Myth #1: “I’m Just Bad With Money”

This myth is one of the most damaging because it creates a sense of helplessness. Believing you’re inherently bad with money can stop you from even trying to improve your financial situation.

The Truth:

Nobody is born knowing how to manage money. Financial literacy is a skill that can be learned and improved over time. Even if you’ve made mistakes in the past, you can turn things around with education and practice.

How to Break Free:

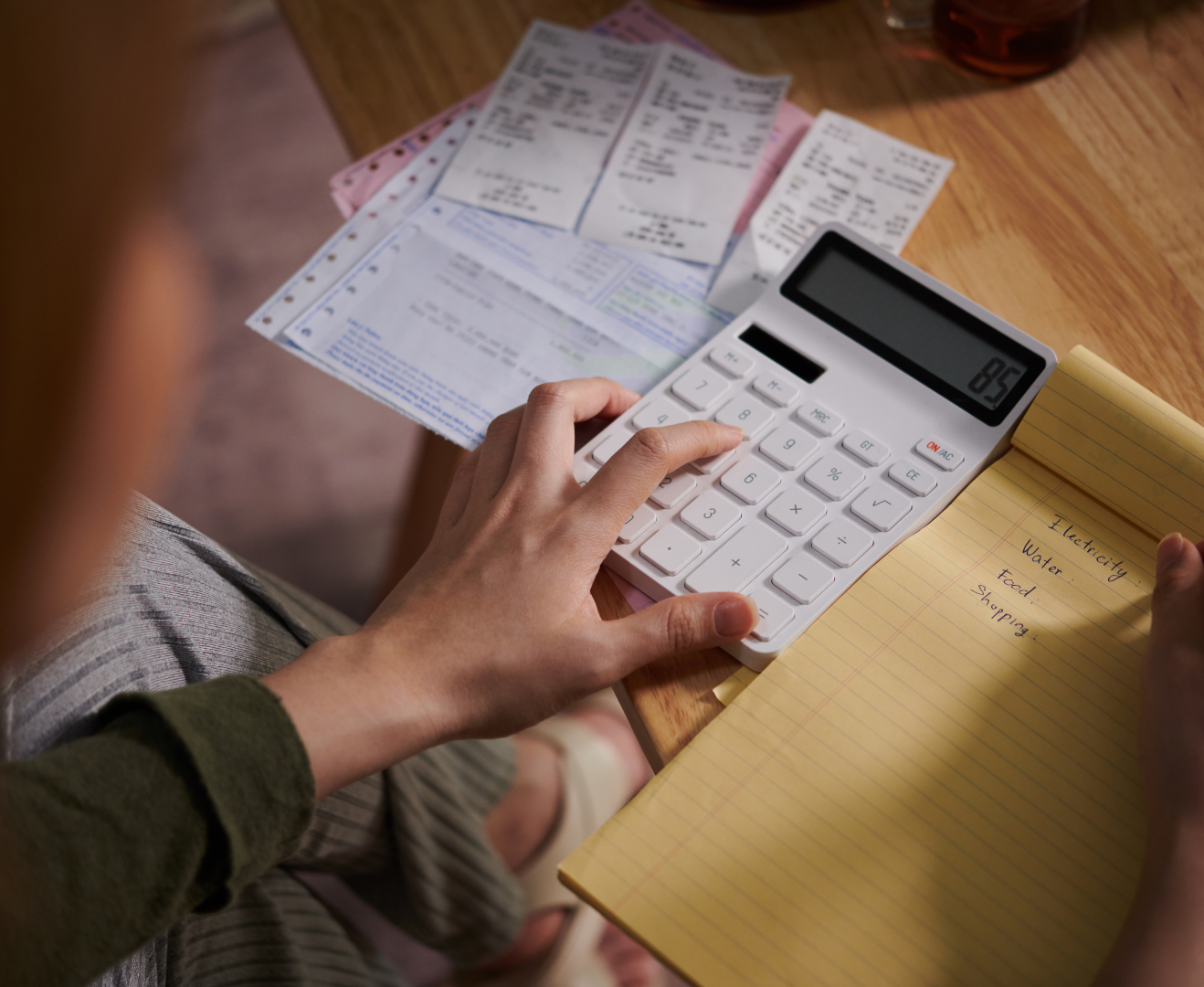

- Start small: Begin by learning basic budgeting techniques like the 50/30/20 rule.

- Track your spending for 30 days to understand where your money is going.

- Celebrate small wins, like paying off a bill or sticking to a budget for a month.

Myth #2: “Budgeting is Restrictive”

Many people think of budgets as joy-killers, imagining a spreadsheet that forces them to cut out everything fun. This misconception often leads to avoiding budgeting altogether.

The Truth:

A budget is a tool for freedom, not restriction. It helps you take control of your money and ensures you’re spending on what truly matters to you.

How to Break Free:

- Use a spending plan instead of calling it a “budget.” It feels less restrictive.

- Include fun money in your plan so you don’t feel deprived.

- Remember, budgeting is about prioritising, not punishing.

Myth #3: “Debt is Just a Part of Life”

Society normalises debt, from student loans to credit cards, convincing us that it’s an inevitable part of adulthood. While some debts, like a mortgage, can be strategic, many others can be avoided.

The Truth:

Not all debt is created equal. High-interest debt, like credit cards, can trap you in a cycle of repayments that feels endless. Living debt-free is achievable with the right approach.

How to Break Free:

- Focus on paying off high-interest debt first using the avalanche method (paying off debts with the highest interest rates first).

- Avoid taking on new debt unless absolutely necessary.

- Build an emergency fund to prevent relying on credit cards for unexpected expenses.

Myth #4: “I’ll Start Saving When I Make More Money”

This myth assumes that saving is only possible if you earn a certain amount. The reality is, most people increase their spending as their income rises, a phenomenon known as lifestyle inflation.

The Truth:

Saving is a habit, not a number. Even small amounts saved regularly can grow significantly over time, thanks to compound interest.

How to Break Free:

- Automate your savings so a portion of your income is transferred to a savings account before you even see it.

- Start with as little as $10 a week if that’s all you can manage, it’s the habit that counts.

- Set specific savings goals to stay motivated, like a holiday fund or emergency savings.

Myth #5: “Investing is Only For The Rich”

Investing can seem intimidating, with jargon and misconceptions making it feel like an exclusive club for the wealthy.

The Truth:

Anyone can start investing, even with small amounts of money. Platforms and tools now make it accessible for everyone, and starting early gives you a significant advantage.

How to Break Free:

- Begin with low-risk investments, like index funds or exchange-traded funds (ETFs).

- Educate yourself on the basics of investing, start with resources aimed at beginners.

- Focus on long-term growth rather than short-term gains.

Myth #6: “I Don’t Make Enough Money to Worry About Finances”

This myth suggests that financial planning is only necessary for people with substantial incomes, leaving those with modest earnings feeling excluded.

The Truth:

Regardless of your income, managing your finances is crucial. In fact, good financial habits are often more impactful for those with limited resources.

How to Break Free:

- Create a simple budget to ensure you’re living within your means.

- Look for ways to boost your income, like freelancing or selling unused items.

- Prioritise needs over wants and build a small savings cushion.

Myth #7: “Financial Success is About Luck”

People often credit financial success to inheritance, lucky investments, or good timing. While these factors can play a role, most financial success comes from consistent effort and smart decision-making.

The Truth:

Success with money is about habits, not luck. Small, consistent actions, like saving regularly and avoiding unnecessary debt have a greater impact than any windfall.

How to Break Free:

- Focus on what you can control, like reducing expenses and increasing savings.

- Set clear financial goals and work toward them step by step.

- Remember, slow and steady progress beats chasing “get rich quick” schemes.

How Breaking Free from Money Myths Can Change Your Life

When you stop believing these myths, you’ll gain:

- Clarity: Understand where your money is going and how to make it work for you.

- Confidence: Feel empowered to make decisions that align with your goals.

- Control: Take charge of your financial future instead of feeling like a victim of circumstance.

A Program to Help You Bust These Myths

If you’re ready to break free from these limiting beliefs, programs like Master Your Money can provide the guidance you need. By combining education, tools, and support, you’ll learn how to manage your finances with confidence and ease.

Conclusion

The myths we believe about money often hold us back from achieving financial freedom. By challenging these misconceptions and adopting healthier financial habits, you can rewrite your money story and create the life you deserve.

Remember, it’s not about where you star it’s about the steps you take to move forward. Start today by identifying one money myth you’ve believed and replacing it with a truth. You’ll be amazed at how quickly your mindset and your finances begin to change.

The Master Your Money Program is for YOU if you are tired of financial stress and ready to transform your relationship with money. This is the same strategy that I followed to generate 6 figure income in just 3 months! Click the image below to learn more about this program.