Jan 29, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Side Hustle

When it comes to improving your finances, it’s easy to feel like you need a big windfall or drastic lifestyle changes to make progress. But here’s the truth: small, consistent changes often lead to the biggest wins. Whether it’s trimming everyday expenses, tweaking your habits, or making smarter financial decisions, these small steps can create a ripple effect that transforms your wallet—and your life.

In this blog, we’ll explore 10 simple yet impactful changes you can make today to start seeing big financial results.

1 – Automate Your Savings

One of the easiest ways to build your savings without even thinking about it is to automate the process.

How It Helps:

-

-

- You prioritise savings before spending.

- It removes the temptation to skip saving.

How To Do It:

Set up a recurring transfer from your checking account to a savings account on payday. Even $10 or $20 a week adds up over time.

2 – Cancel Subscriptions You Don’t Use

Streaming services, gym memberships, and subscription boxes can quietly drain your wallet if you’re not careful.

How It Helps:

-

-

- Frees up money for other priorities.

- Eliminates guilt over unused services.

How To Do It:

Review your bank statements for recurring charges. Cancel any subscription you haven’t used in the past month.

3 – Switch to Cash for Discretionary Spending

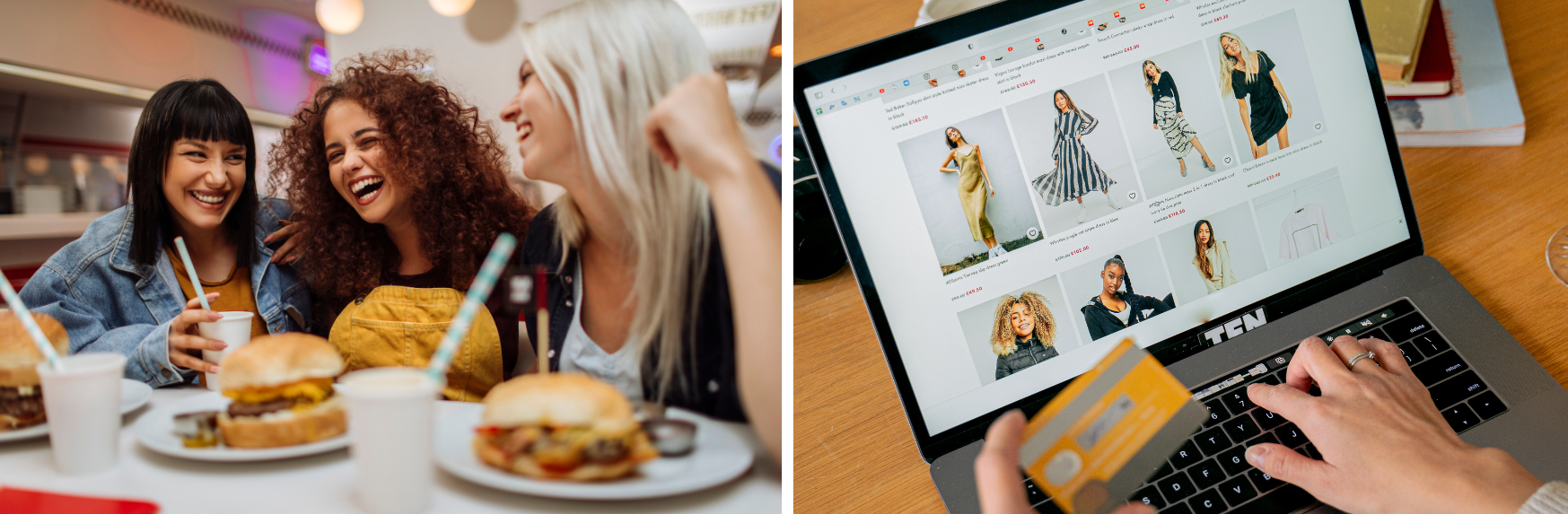

Using cash or visa debit card instead of credit cards for things like dining out, entertainment, or shopping helps you stay within budget.

How It Helps:

-

-

- Makes spending feel more tangible.

- Helps you avoid overspending.

How To Do It:

As cash is getting hard these days to use and get out, you can either – withdraw a set amount each week for discretionary spending or open a visa debit card where it’s your cash and you can see what you spend and what you have left over. When the cash or money in your visa debit card is gone, you’re done for the week.

4 – Meal Prep to Avoid Eating Out

Eating out frequently is one of the biggest budget busters. Preparing meals at home is not only healthier but also significantly cheaper.

How It Helps:

-

-

- Reduces dining-out expenses.

- Saves time and stress during busy weeks.

How To Do It:

Plan and prepare your meals for the week on Sunday. Cook in batches and store portions in the fridge or freezer.

5 – Negotiate Your Bills

You’d be surprised how many service providers are willing to offer discounts or promotions if you simply ask.

How It Helps:

-

-

- Lowers your monthly expenses.

- Gives you more breathing room in your budget.

How To Do It:

Call your internet, phone, or insurance provider and ask if they can lower your rate. Mention competitor pricing to strengthen your case.

6 – Unsubscribe from Retail Emails

Retailers are experts at tempting you with “limited-time offers” and discounts. Avoid unnecessary spending by unsubscribing.

How It Helps:

-

-

- Reduces impulse purchases.

- Keeps your inbox less cluttered.

How To Do It:

Take five minutes to unsubscribe from any email lists that promote shopping. Out of sight, out of mind.

7 – Set Mini Financial Goals

Big goals like paying off debt or saving for a house can feel overwhelming. Breaking them into smaller milestones makes them more achievable

How It Helps:

-

-

- Keeps you motivated.

- Allows you to celebrate small wins.

How To Do It:

If your goal is to save $5,000, start with a mini goal of $500. Reward yourself (in a budget-friendly way) when you hit each milestone.

8 – Sell Items You No Longer Need

Decluttering your home can also give your wallet a boost. From clothes to gadgets, many unused items could be turned into cash.

How It Helps:

-

-

- Provides extra money for savings or debt repayment.

- Clears up space in your home.

How To Do It:

List items on platforms like Facebook Marketplace, eBay, or Gumtree. Focus on selling things you haven’t used in the past year.

9 – Use Cashback and Rewards Programs

If you’re already spending money, you might as well earn something back. Cashback and rewards programs offer a way to save while you spend.

How It Helps:

-

-

- Reduces the cost of everyday purchases.

- Can provide free perks like gift cards or travel rewards.

How To Do It:

Take five minutes to unsubscribe from any email lists that promote shopping. Out of sight, out of mind.

10 – Track Your Progress

Financial wins can feel invisible if you’re not paying attention. Regularly tracking your progress helps you stay motivated and see how far you’ve come.

How It Helps:

-

-

- Keeps you accountable.

- Provides encouragement to stick with your plan.

How To Do It:

Set aside 15 minutes each week to review your budget, check your savings, and reflect on your financial goals.

How Small Changes Add Up To Big Wins

Each of these changes might seem minor on its own, but together, they can create a powerful impact. For example:

-

- Automating savings builds a habit that grows over time.

- Canceling unused subscriptions frees up money to pay down debt.

- Tracking progress keeps you on track toward your larger financial goals.

When combined, these small actions help you feel more in control of your money and reduce financial stress.

Why Programs Like Master Your Money Make a Difference

If you’re looking for a structured way to implement these changes, programs like Master Your Money can guide you. By combining practical tips with personalised coaching, you’ll learn how to make sustainable financial progress and achieve your goals faster.

Conclusion

Improving your finances doesn’t have to involve drastic changes or sacrifices. By focusing on small, consistent actions, you can make big strides toward financial stability and freedom. Start with just one or two changes from this list and build from there.

Remember, every step you take brings you closer to a brighter financial future. So, what small change will you make today?

?? You’re earning good income but still feel stuck in a cycle of stress or overspending.

?? You want to break free from limiting beliefs like “I’m bad with money” or “There’s never enough.”

?? You’re ready to build wealth without sacrificing the things you love.

?? You dream of financial freedom and need the tools and mindset to make it happen.

This is more than a mindset shift—it’s a transformation that puts you on the path to lasting financial success! ?

Jan 15, 2025 | Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Repayment, Educational Series, Episodes, Financial Health, Financial Management 101, Holiday Spending, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development

Imagine if, in just three months, you could feel in control of your money, reduce your debt, and finally start saving for the future you’ve always dreamed of. It sounds ambitious, but it’s entirely possible with the right approach. Fixing your finances doesn’t have to be overwhelming or complicated, it just requires the right formula and commitment to taking small, consistent steps.

In this blog, I’ll break down a simple, three-month plan to get your finances on track. Whether you’re drowning in debt, struggling to save, or just looking to improve your financial habits, this formula will work for you.

Why Three Months?

Three months, or 90 days, is an ideal time frame to make significant progress without feeling like the journey is endless. It’s short enough to stay motivated but long enough to see measurable results. With a clear plan, you can achieve financial wins that build momentum and set the foundation for lasting success.

The Secret Formula: The 3-Step Plan

The formula for fixing your finances in three months revolves around three key pillars: Assess, Act, and Advance. Let’s break it down:

1. Assess: Understanding Your Starting Point (Week 1-4)

Before you can fix your finances, you need to understand them. Think of this as your financial health check.

Step 1: Audit Your Money

Start by tracking every dollar you spend for one month. Use a spreadsheet, app, or notebook to record:

-

-

- Fixed expenses (rent, bills, subscriptions)

- Variable expenses (groceries, dining out, entertainment)

- Irregular expenses (annual fees, gifts)

This exercise often reveals surprising patterns, like how much those small “treats” add up.

Step 2: Calculate Your Net Worth

Your net worth is your financial snapshot. Add up your assets (savings, investments, property) and subtract your liabilities (debts). Don’t be discouraged if it’s negative this is your starting point.

Step 3: Define Your Priorities

What matters most to you? Maybe it’s paying off debt, building an emergency fund, or saving for a holiday. Write down your top three financial goals for the next three months.

2. Act: Implementing Positive Change (Week 5-8)

This is where the magic happens. Once you know where you stand, it’s time to take action.

Step 1: Build a Realistic Budget aka Spending Plan

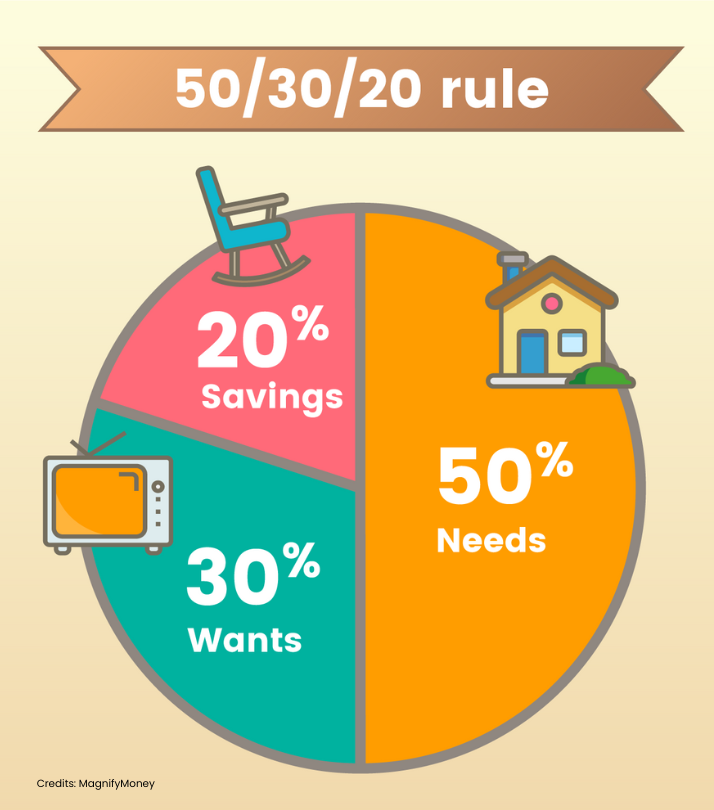

A budget or better known as spending plan, isn’t about deprivation; it’s about prioritising. Use the 50/30/20 rule as a guide:

-

-

- 50% for needs (housing, groceries, utilities)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

Adjust these percentages based on your goals. If you’re tackling debt, redirect some “wants” spending to accelerate repayment.

Step 2: Reduce Expenses Strategically

Look for quick wins, such as:

-

-

- Canceling unused subscriptions

- Cooking at home instead of dining out

- Negotiating bills like internet or insurance

Challenge yourself to a “no-spend week” to identify areas where you can cut back without feeling deprived.

Step 3: Start Paying-off Debts

List your debts and choose a repayment strategy:

-

-

- Snowball Method: Focus on the smallest debt first for quick wins.

- Avalanche Method: Prioritise the highest-interest debt to save money in the long term.

Set up automatic payments to avoid missed due dates and reduce financial stress.

Step 4: Automate Savings

Even if it’s just $10 a week, start saving. Set up an automatic transfer to a separate savings account. Treat it like a non-negotiable bill—it’s money for your future self.

3. Advance: Building Momentum (Week 9-12)

The final phase is about maintaining progress and preparing for the long term.

Step 1: Monitor and Adjust Your Plan

Review your budget and spending weekly. Are there areas where you’re overspending? Adjust as needed, but celebrate your wins along the way.

Step 2: Reduce Expenses Strategically

Consider ways to earn extra cash to speed up your progress:

-

-

- Selling unused items online

- Offering freelance services

- Picking up a side hustle

Even a small income boost can make a big difference when applied to debt or savings.

Step 3: Focus on Your Mindset

Financial success is as much about mindset as it is about math. Practice gratitude for what you have and visualize your financial goals. A positive attitude keeps you motivated during setbacks.

Common Challenges (and How to Overcome It)

1. “I don’t have enough money to save.”

Start small. Even $5 a week adds up over time. The habit of saving is more important than the amount at first.

2. “I don’t know where to start with my debt.”

Start with one debt. Focus on it, make a plan, and celebrate when you pay it off. Then move on to the next.

3. “It’s too overwhelming.”

Break it down into daily or weekly actions. Progress is progress, no matter how small.

The Ripple Effect of Fixing Your Finances

When you take control of your money, it doesn’t just impact your wallet. You’ll feel:

-

- Less Stress: No more sleepless nights worrying about bills.

- More Confidence: You’ll know exactly where your money is going.

- Increased Freedom: With less debt and more savings, you’ll have more choices in life.

Kickstart Your Journey is a 7-day motivational course on financial education, tailored to kick off a new year and aimed at achieving financial success, involves crafting a comprehensive and engaging curriculum.

Conclusion

Fixing your finances in just three months is entirely possible with the right formula. By assessing where you are, taking intentional action, and building momentum, you can transform your financial situation and set yourself up for long-term success.

Remember, it’s not about perfection, it’s about progress. Start today, and by the end of three months, you’ll be amazed at how much you’ve achieved.

Do you want to make smarter financial decisions but don’t know where to start? This monthly financial coaching program is designed to help you take control of your finances and achieve your financial goals.

With years of experience in financial management, Karen offers insightful guidance and coaching on budgeting, saving, debt reduction, and other financial know-how to help you live a life without financial stress.

Jan 8, 2025 | Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Relationships, Retirement, Saving Money, Self Development

Money is a topic surrounded by myths, misconceptions, and downright bad advice. These myths often creep into our minds, influencing our financial decisions and keeping us stuck in unhealthy patterns. Breaking free from these false beliefs is essential if you want to achieve financial success and peace of mind.

In this blog, we’ll bust some of the most common money myths that may be holding you back and provide practical steps to rewrite your money story for a brighter financial future.

Myth #1: “I’m Just Bad With Money”

This myth is one of the most damaging because it creates a sense of helplessness. Believing you’re inherently bad with money can stop you from even trying to improve your financial situation.

The Truth:

Nobody is born knowing how to manage money. Financial literacy is a skill that can be learned and improved over time. Even if you’ve made mistakes in the past, you can turn things around with education and practice.

How to Break Free:

- Start small: Begin by learning basic budgeting techniques like the 50/30/20 rule.

- Track your spending for 30 days to understand where your money is going.

- Celebrate small wins, like paying off a bill or sticking to a budget for a month.

Myth #2: “Budgeting is Restrictive”

Many people think of budgets as joy-killers, imagining a spreadsheet that forces them to cut out everything fun. This misconception often leads to avoiding budgeting altogether.

The Truth:

A budget is a tool for freedom, not restriction. It helps you take control of your money and ensures you’re spending on what truly matters to you.

How to Break Free:

- Use a spending plan instead of calling it a “budget.” It feels less restrictive.

- Include fun money in your plan so you don’t feel deprived.

- Remember, budgeting is about prioritising, not punishing.

Myth #3: “Debt is Just a Part of Life”

Society normalises debt, from student loans to credit cards, convincing us that it’s an inevitable part of adulthood. While some debts, like a mortgage, can be strategic, many others can be avoided.

The Truth:

Not all debt is created equal. High-interest debt, like credit cards, can trap you in a cycle of repayments that feels endless. Living debt-free is achievable with the right approach.

How to Break Free:

- Focus on paying off high-interest debt first using the avalanche method (paying off debts with the highest interest rates first).

- Avoid taking on new debt unless absolutely necessary.

- Build an emergency fund to prevent relying on credit cards for unexpected expenses.

Myth #4: “I’ll Start Saving When I Make More Money”

This myth assumes that saving is only possible if you earn a certain amount. The reality is, most people increase their spending as their income rises, a phenomenon known as lifestyle inflation.

The Truth:

Saving is a habit, not a number. Even small amounts saved regularly can grow significantly over time, thanks to compound interest.

How to Break Free:

- Automate your savings so a portion of your income is transferred to a savings account before you even see it.

- Start with as little as $10 a week if that’s all you can manage, it’s the habit that counts.

- Set specific savings goals to stay motivated, like a holiday fund or emergency savings.

Myth #5: “Investing is Only For The Rich”

Investing can seem intimidating, with jargon and misconceptions making it feel like an exclusive club for the wealthy.

The Truth:

Anyone can start investing, even with small amounts of money. Platforms and tools now make it accessible for everyone, and starting early gives you a significant advantage.

How to Break Free:

- Begin with low-risk investments, like index funds or exchange-traded funds (ETFs).

- Educate yourself on the basics of investing, start with resources aimed at beginners.

- Focus on long-term growth rather than short-term gains.

Myth #6: “I Don’t Make Enough Money to Worry About Finances”

This myth suggests that financial planning is only necessary for people with substantial incomes, leaving those with modest earnings feeling excluded.

The Truth:

Regardless of your income, managing your finances is crucial. In fact, good financial habits are often more impactful for those with limited resources.

How to Break Free:

- Create a simple budget to ensure you’re living within your means.

- Look for ways to boost your income, like freelancing or selling unused items.

- Prioritise needs over wants and build a small savings cushion.

Myth #7: “Financial Success is About Luck”

People often credit financial success to inheritance, lucky investments, or good timing. While these factors can play a role, most financial success comes from consistent effort and smart decision-making.

The Truth:

Success with money is about habits, not luck. Small, consistent actions, like saving regularly and avoiding unnecessary debt have a greater impact than any windfall.

How to Break Free:

- Focus on what you can control, like reducing expenses and increasing savings.

- Set clear financial goals and work toward them step by step.

- Remember, slow and steady progress beats chasing “get rich quick” schemes.

How Breaking Free from Money Myths Can Change Your Life

When you stop believing these myths, you’ll gain:

- Clarity: Understand where your money is going and how to make it work for you.

- Confidence: Feel empowered to make decisions that align with your goals.

- Control: Take charge of your financial future instead of feeling like a victim of circumstance.

A Program to Help You Bust These Myths

If you’re ready to break free from these limiting beliefs, programs like Master Your Money can provide the guidance you need. By combining education, tools, and support, you’ll learn how to manage your finances with confidence and ease.

Conclusion

The myths we believe about money often hold us back from achieving financial freedom. By challenging these misconceptions and adopting healthier financial habits, you can rewrite your money story and create the life you deserve.

Remember, it’s not about where you star it’s about the steps you take to move forward. Start today by identifying one money myth you’ve believed and replacing it with a truth. You’ll be amazed at how quickly your mindset and your finances begin to change.

The Master Your Money Program is for YOU if you are tired of financial stress and ready to transform your relationship with money. This is the same strategy that I followed to generate 6 figure income in just 3 months! Click the image below to learn more about this program.

Dec 30, 2024 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Relationships, Retirement, Saving Money, Self Development, Side Hustle

As the year wraps up, it’s time to give your finances a little TLC and prepare to start the new year strong! Think of this as your yearly financial check-up, a simple routine that sets you up for a financially fit future. Here are seven straightforward steps to help you close out 2024 with confidence.

1. Review Your Budget with Fresh Eyes

December is perfect for giving your budget a quick health check. Ask yourself:

-

- Did you stick to your budget most months?

- Are there categories where you regularly overspent?

If you find that certain areas of your budget were tough to stick to, don’t worry; you’re not alone! Make notes on what worked and what didn’t, and consider if those categories need adjusting. Next year’s budget will feel easier to manage if it aligns more closely with your actual spending patterns.

2. Evaluate Your Financial Goals for 2024

Reflect on the goals you set at the beginning of 2024. Did you aim to build an emergency fund, pay off a certain amount of debt, or save for a big purchase? Take a moment to celebrate any wins, big or small, you’ve earned it! If there were goals you couldn’t reach, try to pinpoint what might have held you back. Life happens, and sometimes, adjustments are necessary. Use these reflections to set realistic goals for 2025 that build on the progress you’ve made.

3. Audit Your Subscriptions and Recurring Expenses

Subscriptions can sneak up on you! Take a look at all the services you’re subscribed to, streaming platforms, gym memberships, software, meal kits and decide if they’re still worth the monthly or annual fee. Ask yourself:

-

- Do you use each service enough to justify the cost?

- Are there better deals or bundles that could help you save?

Canceling or downgrading services you no longer use can free up cash you can redirect toward your savings or debt goals.

4. Set a Holiday Spending Plan

The holiday season can be a big budget-buster if you’re not careful. This December, approach holiday spending with a clear plan:

-

- Set a total holiday budget and stick to it.

- Focus on meaningful gifts within your budget and avoid last-minute splurges.

- Consider experiences instead of material items, they often make more memorable gifts and can be cost-effective.

You’ll thank yourself in January when your credit card bills aren’t sky-high!

5. Check-in On Your Emergency Fund

Your emergency fund is your financial safety net, and December is a great time to assess its status. Ideally, you want enough to cover three to six months’ worth of essential expenses.

If your fund has been depleted due to unexpected expenses this year, make a plan to rebuild it. If it’s in good shape, well done!

Consider adding a little extra, even if it’s just a small amount each month, it’s always better to be prepared.

5. Update Your Financial Goals for 2025

End the year by setting some intentional goals for 2025. These don’t have to be massive changes; small, achievable goals can have a big impact on your financial future. A few ideas:

-

- Set a target for increasing your savings rate, even if it’s by a modest amount.

- Commit to paying down a certain percentage of your debt.

- Plan to invest in education or skills that could lead to higher income opportunities.

Whatever your financial goals, write them down and keep them visible. By starting now, you’ll be well-prepared to tackle them come January.

Final Thoughts

Closing out the year with a financial check-up is a powerful way to put yourself in the driver’s seat for 2025. These six steps are simple but effective and give you a clear view of your financial health. Here’s to closing out 2024 strong and stepping into 2025 with confidence!

Are you ready to make 2025 your breakthrough year?

MASTER YOUR MONEY is for YOU if you are tired of financial stress and ready to transform your relationship with money. Whether you’re managing a family, building your career, or chasing your dreams, this is your chance to gain the clarity, confidence, and habits you need to thrive.

This is more than a mindset shift—it’s a transformational program that puts you on the path to lasting financial success! ? Click the button below to book a call with Karen to see if this program is right for you!

Dec 23, 2024 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Home Loan, Mindset, Mortgage, Relationships, Retirement, Saving Money, Self Development

As the year draws to a close, it’s natural to think about what’s next. But before you dive into new resolutions, let’s take a step back and look at your 2024 finances. Reflecting on what worked (and what didn’t) helps you move forward with clarity and confidence. Here’s a simple guide to reviewing your finances so you can start 2025 refreshed and ready to go.

1. Celebrate Your Wins

Before you jump into what needs improving, take a moment to celebrate your financial wins. Did you manage to save more than expected? Finally pay off a credit card? Stick to a new budget? Acknowledging your achievements, no matter how small, gives you a sense of progress and keeps you motivated.

Make a list of all the positive changes you’ve made or financial goals you’ve met this year. Reflecting on what you’ve achieved will give you a boost of confidence as you prepare for your next steps.

2. Identify Areas for Improvement

Once you’ve celebrated, it’s time to take an honest look at where you could improve. Ask yourself questions like:

-

- Were there any unexpected expenses that threw off your budget?

- Did you struggle to stick to any specific financial goals?

- Are there areas where you overspent?

This reflection isn’t about criticising yourself, it’s about understanding where things may have gone off track. Knowing where you struggled will help you set realistic goals for next year and find ways to tackle those challenges head-on.

3. Review Your Debt and Savings Process

Your debt and savings are two major pillars of financial health. Look at where you stand with each:

-

- Debt: How much debt have you paid down? Did you reach any of your debt reduction targets?

- Savings: How is your emergency fund? Are you on track with your retirement savings or other savings goals?

If you didn’t reach your targets, that’s okay. Use this information to adjust for next year. Maybe you’ll aim to contribute a bit more to your debt payments or bump up your savings rate. Small changes can have a big impact over time, so don’t feel pressured to overhaul everything at once.

4. Assess Your Spending Habits

Sometimes, our spending habits change without us even noticing. Take a look at your spending patterns over the past few months. Are there categories where you consistently overspend, like dining out, online shopping, or subscriptions?

This review can reveal where your budget could use a little tweaking. By identifying your personal spending triggers, you can plan ahead and avoid overspending in the future. It’s all about aligning your spending with your priorities and making sure your budget works for you, not the other way around.

5. Update Your Financial Goals for 2025

Based on your review, set fresh goals for 2025. Remember to keep your goals specific and realistic. Here are a few examples to get you started:

-

- Build an emergency fund with three months’ worth of expenses by the end of the year.

- Pay off one credit card or reduce your debt by a specific amount.

- Save for a family vacation or a big purchase, like a car or home improvement project.

Whatever goals you choose, make sure they’re meaningful to you. When your goals reflect what you truly value, you’re more likely to stay committed.

6. Adjust Your Budget to Reflect New Priorities

A new year often brings new priorities. After reflecting on your 2024 finances, update your budget to reflect any changes in your income, expenses, or financial goals. This might mean increasing your savings contributions, adjusting debt payments, or cutting back in certain areas to make room for new expenses.

Remember, your budget is a tool, it’s there to serve you. Make adjustments that help you live comfortably within your means while still working toward your goals.

7. Setup a New System for Regular Check-ins

One of the best ways to stay on track financially is to check in regularly. Whether it’s a monthly review or a weekly “money date,” commit to a consistent routine where you:

-

- Review your spending and savings.

- Track your progress toward goals.

- Adjust your budget as needed.

Regular check-ins make it easier to catch any issues early and keep your goals top of mind. Plus, they help you stay accountable and give you the chance to celebrate progress each step of the way.

Final Thoughts

Reflecting on your financial journey from the past year can give you valuable insights and help you start 2025 with confidence. By assessing where you are now, you’re giving yourself the power to make informed decisions and set realistic, meaningful goals. Here’s to wrapping up 2024 on a positive note and building a prosperous year ahead!

Are you ready to to build wealth without sacrificing the things you love? Do want to break free from limiting beliefs like “I’m bad with money” or “There’s never enough”?

MASTER YOUR MONEY is for YOU if you are tired of financial stress and ready to transform your relationship with money. Whether you’re managing a family, building your career, or chasing your dreams, this is your chance to gain the clarity, confidence, and habits you need to thrive.

This is more than a mindset shift—it’s a transformational program that puts you on the path to lasting financial success! ? Click the button below to book a call with Karen to see if this program is right for you!

Dec 17, 2024 | Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Relationships, Retirement, Saving Money, Side Hustle

The holidays are a season of joy, but they can also come with a hefty price tag. If you’ve spent a bit more than planned, don’t stress! January is the perfect time to tackle that holiday debt and set yourself up for a fresh financial start. Here’s a simple guide to help you detox your debt and enter the new year feeling financially strong.

1. Assess Your Total Holiday Debt

Start by getting a clear picture of what you owe. List all your holiday-related expenses, from credit card balances to any financing or store credit used for gifts, travel, or holiday activities. Knowing your total debt helps you avoid surprises and gives you a clear starting point.

Jot down each debt’s balance, interest rate, and minimum payment. This way, you’ll be prepared to choose the best strategy for paying it off efficiently.

2. Choose a Debt Repayment Strategy

Once you know what you’re dealing with, pick a strategy that works for you. Here are two popular options:

-

-

- The Snowball Method: Start by paying off your smallest debt first. Once it’s cleared, add that amount to the next smallest debt. This method builds momentum, as paying off smaller debts quickly can feel motivating.

- The Avalanche Method: Start with the debt that has the highest interest rate, saving you more money in the long run. Once you clear it, move to the next highest interest rate.

Both methods work well; it just depends on what motivates you more – quick wins or long-term savings.

3. Cut Back (Temporarily) to Boost Repayments

To pay down holiday debt faster, look for small, temporary cutbacks in your budget. This could be as simple as cutting down on dining out, skipping a few subscription services, or holding off on new purchases for a month or two. Every bit you save can go toward chipping away at your debt.

Even a few small changes can make a big difference over time. For example, redirecting $50 a week toward debt could mean paying off $200 extra per month, speeding up your progress considerably.

4. Avoid Adding New Debt

While you’re focusing on paying down holiday debt, try to avoid taking on new debt. This might mean holding off on big purchases or saying no to smaller “treat yourself” items for now. The goal is to keep your focus on reducing what you owe so that you’re starting the new year in a stronger financial position.

It’s all about setting boundaries. Give yourself permission to pause on non-essential spending, knowing you’ll get back to it once you’re in a more comfortable spot with your debt.

5. Consider a Balance Transfer or Consolidation Loan

If your holiday debt is spread across multiple high-interest credit cards, look into options for consolidating or transferring the balance. A balance transfer card with a 0% introductory offer can give you a breather, allowing you to pay down the principal without additional interest for a limited time.

Alternatively, a low-interest personal loan can help you consolidate multiple debts into one manageable monthly payment. Just be sure to read the fine print and choose an option with favorable terms that genuinely help your situation.

6. Look for Extra Income Opportunities

Bringing in a little extra cash can speed up your debt payoff. You might consider picking up a side hustle, selling unused items around the house, or offering freelance services if you have skills others can use. Even a small boost in income can help you make extra payments and reduce your debt faster.

Use any additional income exclusively for debt payments until you’re in a more comfortable place financially. It’s a short-term effort with long-term benefits!

7. Set New Financial Goals to Stay Motivated

While paying down holiday debt is the priority, it’s important to stay focused on your broader financial goals. Once your debt is more manageable, shift your efforts toward building savings, contributing to your emergency fund, or working on other long-term goals.

Set one or two financial goals for the year, like “Build a $1,000 emergency fund by June” or “Pay down $2,000 in debt by year-end.” Having these goals can keep you motivated and give you something to look forward to once the holiday debt is under control.

Start Today for a Better Tomorrow!

Holiday debt doesn’t have to weigh you down for long. With a focused approach and small adjustments, you can knock out that debt and start the new year with confidence. Remember, every little effort counts, and you’ll feel empowered as you watch your debt shrink. Here’s to a fresh financial start and a strong, debt-free 2025!

Are you ready to take control of your finances and start your debt-free journey? In this empowering 30-day course, we’ll guide you through actionable steps to help you break free from debt and achieve financial stability. Join the Debt-Free Journey Challenge today!