How to Stay Motivated When You Feel Trapped in Debt

Debt is like a bad haircut – it feels like everyone notices, and it seems to last forever. But fear not, for even bad hair grows out, and so can your debt! When you feel trapped under a mountain of debt, staying motivated can be a challenge. But with the right strategies, you can keep pushing forward and eventually conquer your financial obstacles.

Understanding the Debt Trap

Debt can feel overwhelming, especially when it seems like there’s no end in sight. High interest rates, minimum payments, and everyday expenses can create a cycle that’s hard to break. The key is to remember that every step you take towards paying off debt, no matter how small, brings you closer to financial freedom.

STEP 1. VISUALISE FREEDOM

Visualisation is a powerful tool for staying motivated. By clearly seeing your goal, you can maintain focus and drive, even when the going gets tough.

Action Steps:

- Create a Vision Board: Find images and quotes that represent your debt-free future. This could include pictures of a dream vacation, a new home, or simply a big “zero” to represent being debt-free. Place your vision board somewhere you’ll see it daily.

- Daily Visualisation: Spend a few minutes each day imagining your life without debt. Visualise the relief, the freedom, and the possibilities that come with being debt-free.

Visualising your goal helps you stay focused on the end result and keeps your motivation high.

What are your goals?

By clearly seeing your goal, you can maintain focus and drive, even when the going gets tough.

STEP 2: BREAK DOWN YOUR DEBTS

When you look at your total debt amount, it can seem insurmountable. Breaking it down into smaller, more manageable chunks can make it feel more achievable.

Action Steps:

- List Your Debts: Write down all your debts, including the amounts, interest rates, and minimum payments. This gives you a clear picture of what you’re dealing with.

- Set Milestones: Break your total debt down into smaller goals. For example, focus on paying off $500 or $1,000 at a time. Each milestone you reach is a victory that keeps you motivated.

By breaking down your debt, you create a series of achievable goals that make the overall task less daunting.

STEP 3: CELEBRATE SMALL WINS

Celebrating your progress is crucial for maintaining motivation. Each small win brings you closer to your ultimate goal and deserves recognition.

Action Steps:

- Acknowledge Every Victory: Paid off a credit card? Reduced your total debt by 10%? Celebrate these achievements! Reward yourself with something small and enjoyable, like a favorite meal or a day off to relax.

- Create a Rewards System: Set up a system where you reward yourself for reaching specific milestones. For example, treat yourself to a movie night after paying off your smallest debt, or plan a weekend getaway after paying off a larger chunk.

Celebrating small wins keeps you motivated and makes the journey to becoming debt-free more enjoyable.

STEP 4: FIND A DEBT-BUSTING BUDDY

Going through the debt repayment process alone can be isolating. Finding a friend or family member who is also working towards financial freedom can provide support and motivation. Even joining my monthly coaching sessions, can help and provide you the accountability you may need.

Action Steps:

- Share Your Goals: Talk to your debt-busting buddy about your goals and progress. Share tips, strategies, and encouragement with each other.

- Accountability Check-ins: Schedule regular check-ins with your buddy to discuss your progress and any challenges you’re facing. Knowing that someone else is rooting for you can be incredibly motivating.

Having a support system makes the debt repayment process less lonely and more motivating.

STEP 5: FOCUS ON PROGRESS, NOT PERFECTION

It’s easy to get discouraged by setbacks or slow progress. Instead of aiming for perfection, focus on the progress you’re making.

Action Steps:

- Track Your Progress: Use a spreadsheet, app, or journal to track your debt repayment journey. Celebrate the progress you’ve made, no matter how small.

- Learn from Setbacks: If you have a setback, don’t beat yourself up. Analyse what went wrong, learn from it, and get back on track. Remember, progress is more important than perfection.

By focusing on progress, you can stay motivated and avoid getting discouraged by minor setbacks.

STEP 6: REWARD YOUR PROGRESS

In addition to celebrating small wins, it’s important to reward your overall progress in non-monetary ways. This keeps you motivated without derailing your financial goals.

Action Steps:

- Plan Free or Low-cost Rewards: Treat yourself to activities that don’t cost much, like a hike, a movie night at home, or a day trip to a nearby park.

- Non-monetary Rewards: Focus on rewards that don’t involve spending money, such as taking a day off to relax, indulging in a favorite hobby, or spending time with loved ones.

Rewarding your progress helps you stay motivated and reinforces the positive steps you’re taking towards becoming debt-free.

STEP 7: EDUCATE YOURSELF

Knowledge is power, especially when it comes to managing debt. Educating yourself about personal finance can boost your confidence and motivation.

Action Steps:

- Read Books and Articles: Find books, blogs, and articles about personal finance and debt repayment. Learning from experts can provide new strategies and inspiration.

- Listen to Podcasts: There are many personal finance podcasts that offer tips, success stories, and motivation. Listen to them during your commute or while doing chores to stay inspired.

Educating yourself empowers you to make informed decisions and stay motivated on your debt repayment journey.

STEP 8: CREATE A DEBT REPAYMENT PLAN

Having a clear plan is essential for staying motivated and on track. A detailed plan helps you see the light at the end of the tunnel and keeps you focused on your goals.

Action Steps:

- Choose a Repayment Strategy: Decide on a repayment strategy that works for you, such as the debt avalanche or debt snowball method. Stick to it and track your progress.

- Set a Timeline: Establish a realistic timeline for paying off your debts. Having a clear end date can provide a sense of urgency and motivation.

A well-structured plan provides direction and keeps you focused on your debt repayment goals.

STEP 9: MAINTAIN A POSITIVE MINDSET

A positive mindset is crucial for staying motivated. Remind yourself that debt repayment is a journey, and every step you take brings you closer to your goal.

Action Steps:

- Practice Gratitude: Focus on the positive aspects of your life and your progress. Write down things you’re grateful for and reflect on them regularly.

- Stay Positive: Surround yourself with positive influences, whether it’s friends, family, or online communities. Avoid negativity and focus on the progress you’re making.

Maintaining a positive mindset helps you stay motivated and resilient throughout your debt repayment journey.

STEP 10: SEEK PROFESSIONAL HELP

If you’re struggling to stay motivated or manage your debt, consider seeking professional help. Financial advisors or credit counsellors can provide guidance and support.

Action Steps:

- Find a Credit Counselor: Look for reputable credit counseling agencies that can help you create a debt repayment plan and provide support.

- Consult a Financial Advisor: A financial advisor can offer personalised advice and strategies for managing your debt and building a strong financial future.

Professional help can provide the guidance and support you need to stay motivated and successfully manage your debt.

Conclusion

Staying motivated when you feel trapped in debt can be challenging, but it’s not impossible. By visualizing your goals, breaking down your debt, celebrating small wins, finding a debt-busting buddy, focusing on progress, rewarding yourself, educating yourself, creating a repayment plan, maintaining a positive mindset, and seeking professional help, you can stay motivated and make significant progress towards becoming debt-free. Remember, every small step you take brings you closer to financial freedom. Stay focused, stay positive, and keep pushing forward – you’ve got this!

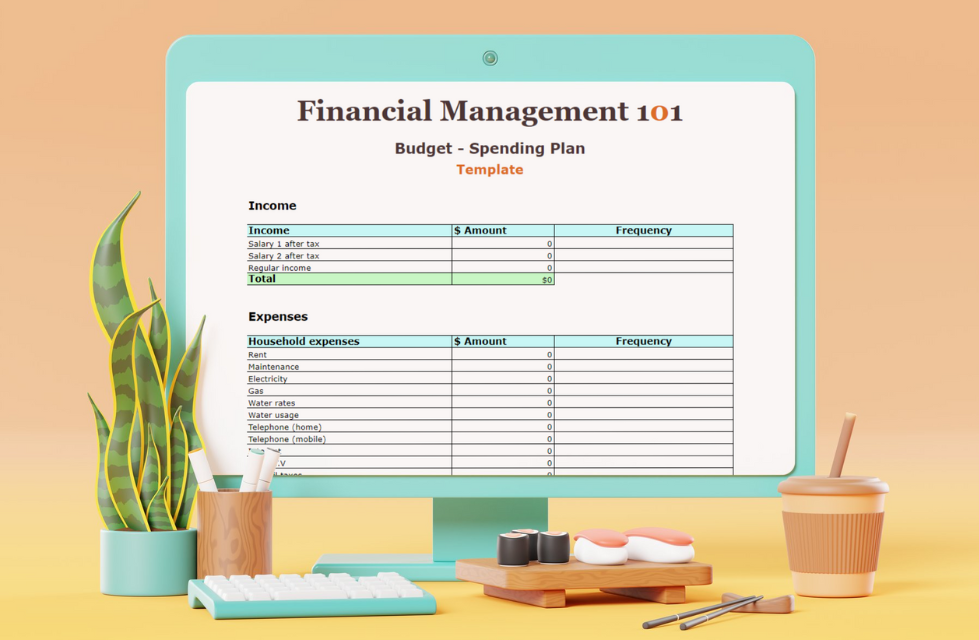

Learn the fundamental concepts of how budgeting and saving are important to your financial well-being. Registration is now open for the course: Mastering Budget and Saving Techniques. This is a hands-on course with me guiding you on how to budget, track and look at managing your money like a pro.

DEBT ELIMINATION WORKSHEET

Are you feeling overwhelmed by debt? Do you want a clear, actionable plan to help you pay off your debts and achieve financial freedom? This Debt Elimination Worksheet is here to guide you every step of the way.