Why Most Resolutions Fail (And How to Succeed with Your Finances This Year)

Every January, millions of people make resolutions, vowing to lose weight, save money, or finally organise their lives. Yet, by February, most of those resolutions are a distant memory. When it comes to finances, the stakes are even higher, failed resolutions can lead to continued debt, stress, and a lack of progress toward your goals. But why do so many resolutions fail? More importantly, how can you set yourself up for success, especially with your financial goals?

This year, let’s break the cycle. Here’s why most resolutions don’t stick and how you can set realistic, actionable financial goals that actually work.

The Problem with Resolutions

1. They’re Too Vague

A resolution like “save more money” or “spend less” sounds great in theory, but without specifics, it’s destined to fail. What does “save more” mean? How much? By when? Without clarity, it’s easy to lose focus.

2. No Plan, Just Hope

Many resolutions rely on sheer willpower. While motivation can get you started, it won’t sustain you for the long haul. A solid plan is essential for turning intentions into results.

3. All-or-Nothing Thinking

Ever decided to “cut all unnecessary spending” and then given up after one unplanned purchase? All-or-nothing approaches set you up for failure because they don’t allow for flexibility.

4. No Accountability

When no one knows about your goals, it’s easy to let them slide. Having someone to cheer you on, or nudge you when you’re slipping makes a huge difference.

Why Financial Intentions Are Different

Financial goals often come with emotional baggage. Many of us have habits or mindsets about money that were shaped long before we started earning. Whether it’s fear of budgeting, guilt about past mistakes, or simply feeling overwhelmed, these emotions can sabotage even the best intentions.

The good news? Financial habits are learnable. With the right mindset, tools, and support, you can rewrite your financial story.

How to Succeed with Your Financial Goals This Year

1. Get Specific About Your Goals

Instead of “save more money,” try something like:

-

-

-

- “Save $1,000 for an emergency fund by March 31.”

- “Pay an extra $200 per month toward my credit card debt.”

- “Spend no more than $400 a month on dining out.”

-

-

Specific goals give you a clear target to aim for. Break them down into smaller, actionable steps, and you’ll feel a sense of accomplishment with every milestone.

2. Create a 90-Day Action Plan

While it’s tempting to set year-long goals, short-term plans are more effective. That’s why 90 days is the perfect timeframe—it’s long enough to make meaningful progress but short enough to stay motivated.

For example:

-

-

-

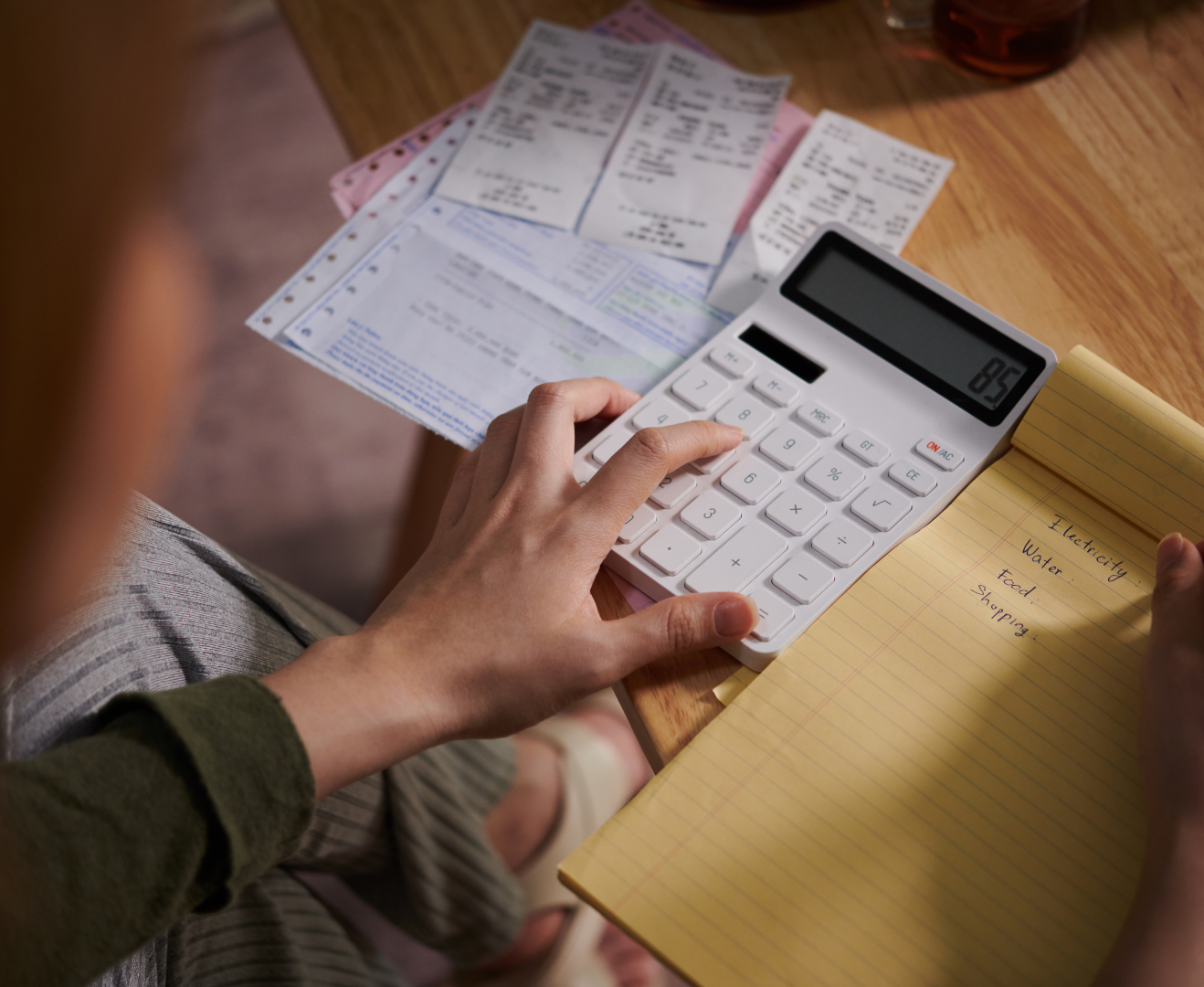

- Month 1: Assess your financial situation. Track all your expenses and create a realistic budget.

- Month 2: Implement your budget and identify areas to cut back. Start small, like reducing subscription services or packing lunches for work.

- Month 3: Focus on building momentum. Add any savings or debt reduction progress to your plan.

-

-

3. Reframe Your Money Mindset

Your mindset plays a massive role in your financial success. If you believe “I’m just bad with money” or “I’ll never get out of debt,” those beliefs will hold you back. Instead, practice positive affirmations like:

-

-

-

- “I am capable of learning new money skills.”

- “Every small step I take brings me closer to financial freedom.”

-

-

Even better, pair these affirmations with concrete actions. Every time you stick to your budget or save a little extra, you’re proving to yourself that change is possible.

4. Start Small But Stay Consistent

Big changes often fail because they’re overwhelming. Start with small, manageable habits that build over time.

-

-

-

- Save $5 a day by skipping a coffee run.

- Commit to a weekly money check-in where you review your budget and spending.

- Set up automatic transfers to your savings account—even if it’s just $10 a week.

-

-

These small wins add up and help build confidence and momentum.

5. Track Your Progress

It’s easy to lose motivation when you don’t see results. That’s why tracking is so important. Whether it’s a spreadsheet, an app, or even a notebook, record every step of your financial journey.

-

-

-

- Watch your savings grow each week.

- Celebrate when you pay off a credit card.

- Note the changes in your spending habits.

-

-

Seeing progress, no matter how small, reinforces your commitment to your goals.

6. Find Your Why

Why do you want to improve your finances? Maybe it’s to take your family on a dream vacation, eliminate the stress of living paycheck to paycheck, or finally buy a home.

Your “why” is your motivation. Write it down, visualize it, and keep it front and center. When the going gets tough, reminding yourself of your deeper purpose will help you stay on track.

7. Get Support

Accountability is a game-changer. Whether it’s a friend, partner, or coach, having someone to share your goals with can make all the difference. Programs like the 90-Day Money Makeover offer a built-in support system, with resources, community, and guidance to keep you on track.

Common Pitfalls and How to Avoid Them

1. Expecting Perfection

You will slip up and that’s okay. What matters is how you recover. Instead of giving up after a mistake, ask yourself: “What can I learn from this?”

2. Overloading Yourself

Don’t try to tackle everything at once. Focus on one or two key goals at a time. Once you’ve mastered them, move on to the next.

3. Comparing Yourself to Others

Your financial journey is unique. Comparing your progress to others will only discourage you. Stay focused on your own goals and celebrate your wins.

Conclusion

This year, break the cycle of failed resolutions and make 2025 the year you take control of your finances. By setting clear goals, creating a plan, and staying consistent, you’ll build habits that last a lifetime.

Remember: small steps lead to big changes. Start with one goal today, and by next January, you’ll be amazed at how far you’ve come. If you’re ready to supercharge your progress, join the LEARNING HUB and get immediate access to all courses and books including ongoing financial and mindset monthly coaching now.