Feb 26, 2025 | Book of the Week, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle

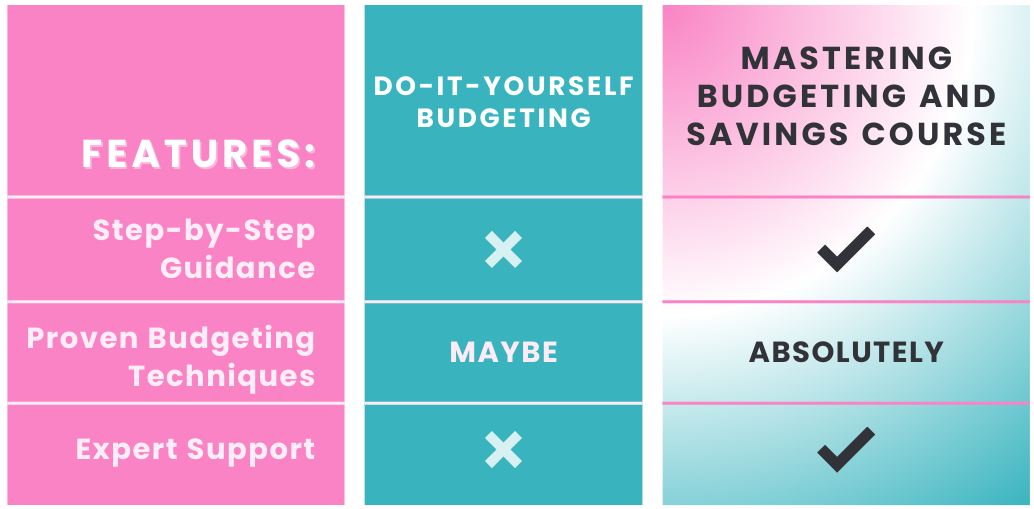

What does financial freedom mean to you? For some, it’s living debt-free; for others, it’s having enough savings to retire comfortably. Whatever your vision, one thing is certain: the journey to financial freedom starts with mastering the basics. That’s where the Mastering Budgeting and Savings Course comes in.

What is Financial Freedom?

Financial freedom isn’t about being rich – it’s about having the money to live the life you want without constant stress. Achieving it requires three things:

1. A clear understanding of your finances.

2. A plan to eliminate debt and build savings.

3. The discipline to stick with your plan long-term.

Why Budgeting is the Key to Freedom?

At the heart of every financial success story is a solid budget. Budgeting isn’t about restriction, it’s about prioritising what matters most to you. The Mastering Budgeting and Savings Course teaches you how to:

-

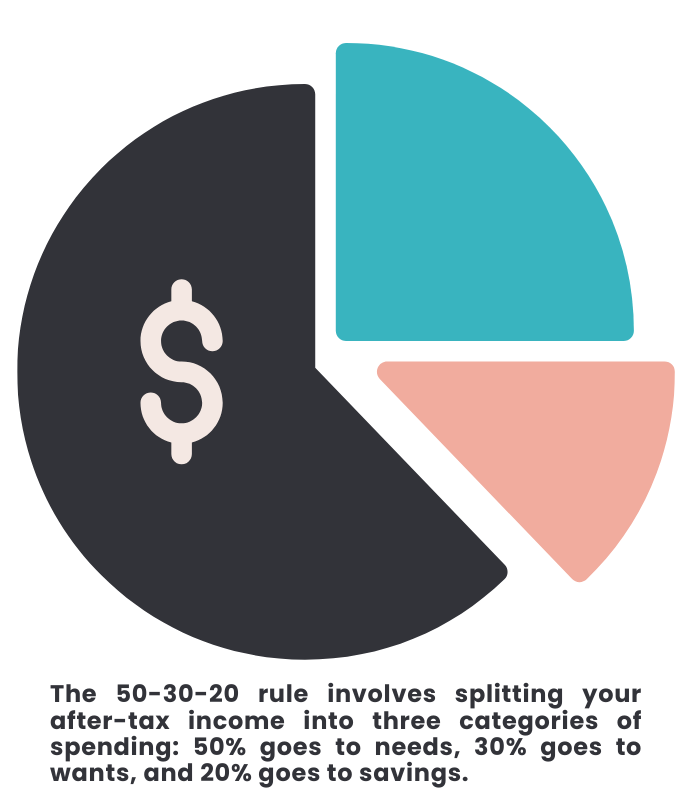

- Allocate your income effectively using the 50/30/20 rule (50% for needs, 30% for wants, and 20% for savings and debt).

- Identify and eliminate unnecessary expenses.

- Set realistic financial goals and track your progress.

How Savings Accelerate Your Journey

Saving money isn’t just about putting cash aside; it’s about creating financial security and opportunities. Through this course, you’ll learn how to:

-

- Build an emergency fund to cover unexpected expenses.

- Automate your savings for long-term goals like a home deposit or retirement.

- Maximise your savings by choosing the right accounts and tools.

Why This Course Works

The Mastering Budgeting and Savings Course is designed for busy individuals who want results. It’s broken down into actionable modules that guide you step-by-step through:

1. Assessing your financial situation.

2. Creating a budget that aligns with your goals.

3. Building and maintaining a sustainable savings plan.

4. Tackling debt with proven strategies.

Testimonials: Real People, Real Results

Meet Karen (yes, another Karen!), a 45-year-old who struggled to save for her dream home while juggling credit card debt. After taking the Mastering Budgeting and Savings Course, she:

- Saved $15,000 for a deposit in two years.

- Paid off her $10,000 credit card balance using the debt snowball method.

- Finally felt in control of her money for the first time in decades.

A Pathway to Financial Freedom

The journey to financial freedom starts with the first step. By enrolling in the Mastering Budgeting and Savings Course, you’ll gain the knowledge and confidence to take control of your money and create the life you’ve always wanted.

Are You Ready?

Financial freedom isn’t a dream – it’s a decision. Take action today and start building the foundation for a brighter tomorrow. Sign up now and make this the year you master your money and achieve financial freedom!

Don’t wait for the perfect moment – take control of your finances now! Enroll in the Mastering Budgeting and Savings Course today and start your journey to financial freedom.

Feb 19, 2025 | Book of the Week, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Side Hustle

If you’ve ever stayed awake at night worrying about bills, mounting debt, or an uncertain financial future, you’re not alone. Financial stress affects millions of people, but it doesn’t have to control your life. Through personalised support and expert guidance, THE VAULT can help you transform financial stress into lasting financial success.

The True Cost of Financial Stress

Financial stress doesn’t just impact your bank account – it affects every area of your life. Here’s how:

Mental Health

Anxiety and depression often stem from constant money worries.

Relationships

Money is one of the leading causes of conflict in relationships.

Physical Health

Stress-related illnesses like high blood pressure and migraines can arise from financial struggles.

The good news? You don’t have to stay stuck. Monthly Coaching provides the tools and strategies to regain control and start thriving.

How Monthly Coaching Inside THE VAULT Tackles Financial Stress

1. Clarity: Understand Your Money

Financial stress often comes from uncertainty. Where’s your money going? How much debt do you have? Monthly Coaching inside THE VAULT starts by helping you gain clarity. Your coach will work with you to map out your financial picture so you know exactly where you stand.

2. Actionable Plans: One Step At A Time

It’s easy to feel paralysed by the enormity of financial problems. A coach breaks things down into manageable steps, guiding you through proven strategies like those taught in the Mastering Budgeting and Savings Course.

3. Accountability: Stay On Track

Consistency is key to financial success, but life often gets in the way. Monthly check-ins ensure you stay focused on your goals, even when challenges arise.

4. Mindset Shifts: Turn Stress into Motivation

Managing money isn’t just about numbers, it’s about mindset. Coaches help you reframe negative thoughts about money, turning them into empowering beliefs that drive action.

Real Success Stories

Meet James and Laura, parents of two who were drowning in credit card debt and constantly stressed about unexpected expenses. Through Monthly Coaching, they learned how to:

Today, they’re financially stable and planning their first overseas holiday – a goal they once thought was impossible.

THE VAULT: Unlock Everything You Need

With courses, tools, and resources at your fingertips inside THE VAULT, you’ll have everything you need to succeed.

Key resources include:

-

- The Mastering Budgeting and Savings Course, which teaches you to manage your money with confidence.

- Debt reduction tools that help you pay off balances faster.

- Goal-setting worksheets to turn dreams into actionable plans.

From Stress to Success

Financial stress doesn’t have to define your life. With the right support and a clear plan, you can overcome challenges and achieve financial success.

Ready to take the next step? Join THE VAULT today and unlock access to the tools and resources you need to take the stress out of managing your money.

Feb 12, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Saving Money, Self Development

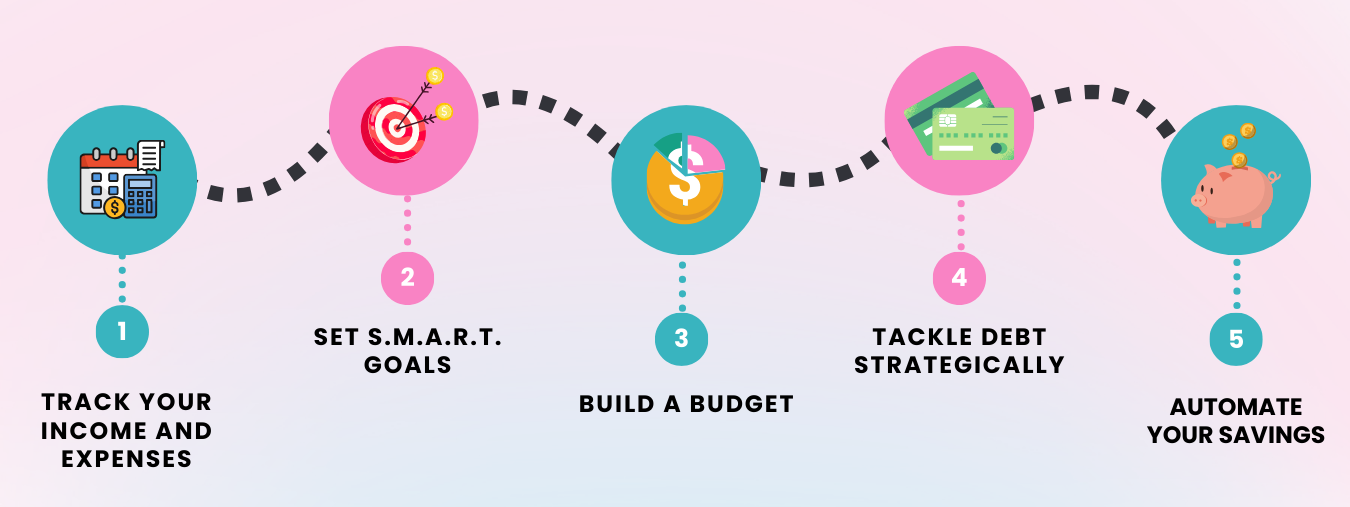

Do you ever feel like your finances are controlling you, instead of the other way around? The good news is that financial control isn’t about being perfect – it’s about making intentional choices and taking consistent steps toward your goals. Let’s break down the five steps that can help you master your money and regain control of your financial future.

STEP 1: KNOW YOUR NUMBERS

Before you can improve, you need to understand your starting point. Here’s how:

- Track your income and expenses. Use an app, spreadsheet, or pen and paper to list every dollar coming in and going out.

- Identify your financial position. Calculate your net worth by subtracting your liabilities (debts) from your assets (savings, property, etc.).

- Spot patterns. Are there expenses you can cut back on or habits you can change?

The insights from this step often surprise people, and they’re the foundation for everything else.

STEP 2: SET SMART GOALS

Vague goals like “save money” don’t work. Instead, use the SMART framework to set goals that are Specific, Measurable, Achievable, Relevant, and Time-bound.

For example:

- Short-term Goal: Save $1,000 for an emergency fund in three months.

- Medium-term Goal: Pay off a $5,000 credit card balance within a year.

- Long-term Goal: Save a 20% deposit for a home in five years

STEP 3: MASTER THE ART OF BUDGETING

The cornerstone of financial success is budgeting—and there’s no better resource to guide you than the Master Your Money Program. This program teaches you to create a budget that balances your needs, wants, and financial goals.

Key takeaways include:

- Understanding the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment).

- Setting up separate accounts for different spending categories.

- Tracking your progress and adjusting as need

STEP 4: ELIMINATE DEBT STRATEGICALLY

Debt doesn’t just drain your wallet; it drains your peace of mind. The Mastering Budgeting and Savings Course provides actionable strategies to tackle debt, including:

- The debt snowball method, which focuses on paying off smaller debts first.

- The debt avalanche method, which prioritizes high-interest debts.

- Techniques for negotiating lower interest rates or consolidating debt.

STEP 5: BUILD A FINANCIAL SAFETY NET

Life is unpredictable, but your finances don’t have to be. Automate your savings to build a robust emergency fund, ideally covering 3–6 months’ worth of expenses. Once your safety net is in place, you can focus on other financial goals with confidence.

Ready to Master Your Money?

Mastering your money isn’t a one-time fix, it’s a journey. But with the right tools, guidance, and a solid plan, you can achieve financial freedom. The Master Your Money Program is for YOU if you are tired of financial stress and ready to transform your relationship with money. Whether you’re managing a family, building your career, or chasing your dreams, this is your chance to gain the clarity, confidence, and habits you need to thrive.

This is more than a mindset shift—it’s a transformation that puts you on the path to lasting financial success! ?

Feb 5, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Debt, Debt Repayment, Educational Series, Episodes, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Net Worth, Relationships, Retirement, Saving Money, Self Development, Side Hustle

Managing money isn’t just about numbers; it’s about habits, mindset, and access to the right resources. That’s where THE VAULT comes in. It provides the roadmap, monthly coaching, tools, and support you need to transform your finances and unlock your financial potential.

Why Monthly Coaching Matters?

Imagine having a financial coach by your side every month, helping you navigate challenges, stay on track, and celebrate milestones. Here’s what makes regular coaching a life-changing experience:

1. Personalised Guidance

Your financial situation is unique, and cookie-cutter advice just won’t cut it. Monthly Coaching gives you tailored strategies to help you meet your goals, whether you’re tackling debt, building savings, or preparing for a big purchase.

2. Accountability

How often have you set a financial goal only to lose focus within weeks? A monthly check-in with your coach ensures you remain on track. Accountability is the key to transforming intentions into actions.

3. Supportive Community

Being part of a group of like-minded individuals who share their struggles, successes, and insights can be incredibly motivating. You’re not in this alone!

The Power of THE VAULT

1. Comprehensive Courses

THE VAULT includes everything from basic financial literacy to advanced topics like investment understanding. It also features my most popular program, the Mastering Budgeting and Savings Course, which has helped countless clients take control of their money.

2. Interactive Tools

Use tools like budget calculators, expense trackers, and goal-setting worksheets to make managing money practical and straightforward.

3. Live Webinars and Q&A Sessions

Join monthly webinars where you can ask questions, learn from experts, and gain new insights. Topics include budgeting, debt reduction, and financial goal setting.

4. Step-by-step Guides

Not sure where to start? THE VAULT includes step-by-step instructions to help you build a strong foundation in managing your money.

Success Stories: Real People, Real Results

Take the story of Lisa, a single mum working full-time. She joined THE VAULT after struggling for years to make ends meet. With Coach Karen’s guidance and the resources she got from THE VAULT, Lisa paid off $8,000 in credit card debt, built a $5,000 emergency fund, and started saving for her daughter’s education—all in under a year.

Her secret? Following the proven budgeting strategies in the Mastering Budgeting and Savings Course while leveraging the monthly coaching sessions for motivation and accountability.

Ready to Transform Your Finances?

With joining THE VAULT, the life you’ve always dreamed of is within reach. It’s not about earning more—it’s about managing what you have more effectively. Join today and start your journey to financial freedom!

Ready to take the next step? Join THE VAULT today and unlock access to the tools and resources you need to take the stress out of managing your money.

Jan 29, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Educational Series, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Home Loan, Mindset, Mortgage, Net Worth, Relationships, Retirement, Saving Money, Side Hustle

When it comes to improving your finances, it’s easy to feel like you need a big windfall or drastic lifestyle changes to make progress. But here’s the truth: small, consistent changes often lead to the biggest wins. Whether it’s trimming everyday expenses, tweaking your habits, or making smarter financial decisions, these small steps can create a ripple effect that transforms your wallet—and your life.

In this blog, we’ll explore 10 simple yet impactful changes you can make today to start seeing big financial results.

1 – Automate Your Savings

One of the easiest ways to build your savings without even thinking about it is to automate the process.

How It Helps:

-

-

- You prioritise savings before spending.

- It removes the temptation to skip saving.

How To Do It:

Set up a recurring transfer from your checking account to a savings account on payday. Even $10 or $20 a week adds up over time.

2 – Cancel Subscriptions You Don’t Use

Streaming services, gym memberships, and subscription boxes can quietly drain your wallet if you’re not careful.

How It Helps:

-

-

- Frees up money for other priorities.

- Eliminates guilt over unused services.

How To Do It:

Review your bank statements for recurring charges. Cancel any subscription you haven’t used in the past month.

3 – Switch to Cash for Discretionary Spending

Using cash or visa debit card instead of credit cards for things like dining out, entertainment, or shopping helps you stay within budget.

How It Helps:

-

-

- Makes spending feel more tangible.

- Helps you avoid overspending.

How To Do It:

As cash is getting hard these days to use and get out, you can either – withdraw a set amount each week for discretionary spending or open a visa debit card where it’s your cash and you can see what you spend and what you have left over. When the cash or money in your visa debit card is gone, you’re done for the week.

4 – Meal Prep to Avoid Eating Out

Eating out frequently is one of the biggest budget busters. Preparing meals at home is not only healthier but also significantly cheaper.

How It Helps:

-

-

- Reduces dining-out expenses.

- Saves time and stress during busy weeks.

How To Do It:

Plan and prepare your meals for the week on Sunday. Cook in batches and store portions in the fridge or freezer.

5 – Negotiate Your Bills

You’d be surprised how many service providers are willing to offer discounts or promotions if you simply ask.

How It Helps:

-

-

- Lowers your monthly expenses.

- Gives you more breathing room in your budget.

How To Do It:

Call your internet, phone, or insurance provider and ask if they can lower your rate. Mention competitor pricing to strengthen your case.

6 – Unsubscribe from Retail Emails

Retailers are experts at tempting you with “limited-time offers” and discounts. Avoid unnecessary spending by unsubscribing.

How It Helps:

-

-

- Reduces impulse purchases.

- Keeps your inbox less cluttered.

How To Do It:

Take five minutes to unsubscribe from any email lists that promote shopping. Out of sight, out of mind.

7 – Set Mini Financial Goals

Big goals like paying off debt or saving for a house can feel overwhelming. Breaking them into smaller milestones makes them more achievable

How It Helps:

-

-

- Keeps you motivated.

- Allows you to celebrate small wins.

How To Do It:

If your goal is to save $5,000, start with a mini goal of $500. Reward yourself (in a budget-friendly way) when you hit each milestone.

8 – Sell Items You No Longer Need

Decluttering your home can also give your wallet a boost. From clothes to gadgets, many unused items could be turned into cash.

How It Helps:

-

-

- Provides extra money for savings or debt repayment.

- Clears up space in your home.

How To Do It:

List items on platforms like Facebook Marketplace, eBay, or Gumtree. Focus on selling things you haven’t used in the past year.

9 – Use Cashback and Rewards Programs

If you’re already spending money, you might as well earn something back. Cashback and rewards programs offer a way to save while you spend.

How It Helps:

-

-

- Reduces the cost of everyday purchases.

- Can provide free perks like gift cards or travel rewards.

How To Do It:

Take five minutes to unsubscribe from any email lists that promote shopping. Out of sight, out of mind.

10 – Track Your Progress

Financial wins can feel invisible if you’re not paying attention. Regularly tracking your progress helps you stay motivated and see how far you’ve come.

How It Helps:

-

-

- Keeps you accountable.

- Provides encouragement to stick with your plan.

How To Do It:

Set aside 15 minutes each week to review your budget, check your savings, and reflect on your financial goals.

How Small Changes Add Up To Big Wins

Each of these changes might seem minor on its own, but together, they can create a powerful impact. For example:

-

- Automating savings builds a habit that grows over time.

- Canceling unused subscriptions frees up money to pay down debt.

- Tracking progress keeps you on track toward your larger financial goals.

When combined, these small actions help you feel more in control of your money and reduce financial stress.

Why Programs Like Master Your Money Make a Difference

If you’re looking for a structured way to implement these changes, programs like Master Your Money can guide you. By combining practical tips with personalised coaching, you’ll learn how to make sustainable financial progress and achieve your goals faster.

Conclusion

Improving your finances doesn’t have to involve drastic changes or sacrifices. By focusing on small, consistent actions, you can make big strides toward financial stability and freedom. Start with just one or two changes from this list and build from there.

Remember, every step you take brings you closer to a brighter financial future. So, what small change will you make today?

?? You’re earning good income but still feel stuck in a cycle of stress or overspending.

?? You want to break free from limiting beliefs like “I’m bad with money” or “There’s never enough.”

?? You’re ready to build wealth without sacrificing the things you love.

?? You dream of financial freedom and need the tools and mindset to make it happen.

This is more than a mindset shift—it’s a transformation that puts you on the path to lasting financial success! ?

Jan 22, 2025 | Book of the Week, Building Emotional Muscle, Building Financial Muscle, Credit Score, Debt, Debt Payment, Debt Repayment, Financial Education, Financial Freedom, Financial Health, Financial Management 101, Holiday Season, Holiday Spending, Mindset, Net Worth, Relationships, Saving Money, Self Development

Does the thought of opening your bank app make your stomach drop? Are you constantly worried about bills, debt, or whether you’ll ever have enough to get ahead? You’re not alone. Financial overwhelm is incredibly common, especially with the rising cost of living and competing demands on your paycheck. But here’s the good news: you don’t have to stay stuck in this cycle.

In this blog, we’ll explore why financial overwhelm happens and, more importantly, how you can overcome it. By following these practical steps, you can regain control, reduce stress, and create a plan to manage your money with confidence.

Why Do We Feel Overwhelmed by Money?

1. Too Many Unknowns

When you’re not sure where your money is going or how much debt you owe, it’s easy to feel out of control. The unknown creates anxiety, and avoidance becomes a coping mechanism.

2. Unrealistic Expectations

Social media and society often paint an idealised picture of what financial success looks like – think flashy cars, designer clothes, and lavish holidays. Trying to measure up can make you feel like you’re failing, even if you’re doing fine.

3. Emotional Baggage

Money is rarely just about numbers. It’s tied to emotions, past experiences, and even our self-worth. Financial stress can feel personal, making it harder to address objectively.

How to Stop Feeling Overwhelmed?

Step 1: Acknowledge Your Feelings

The first step to overcoming financial overwhelm is to acknowledge it. Pretending you’re fine or ignoring the problem only makes things worse.

How To Do This?

-

-

- Take a moment to name your emotions: Are you feeling stressed, ashamed, or frustrated?

- Write down your worries in a journal. Sometimes, seeing them on paper helps put them into perspective.

- Remind yourself that financial challenges are common and not a reflection of your worth.

Step 2: Understand Your Starting Point

You can’t fix what you don’t measure. It’s time to face the numbers, even if it feels uncomfortable. Knowledge is power, and understanding your financial situation is the first step to regaining control.

How To Do This?

-

-

- List Your Debts: Write down every debt you owe, including balances, interest rates, and minimum payments.

- Track Your Spending: For 30 days, track every expense. This helps you understand where your money is going.

- Calculate Your Net Worth: Add up your assets (savings, investments, property) and subtract your liabilities (debts).

This process might feel daunting, but remember: it’s just data. The goal is to understand your starting point, not to judge yourself.

Step 3: Simplify Your Finances

Complex financial systems add to the sense of overwhelm. Simplify your money management by automating as much as possible and consolidating accounts when appropriate.

How To Do This?

-

-

- Automate Bill Payments: Set up automatic payments for recurring expenses like utilities, rent, or mortgage.

- Streamline Accounts: Consider consolidating multiple credit cards or savings accounts to reduce confusion.

- Set Up Automatic Savings: Even a small, consistent transfer to savings builds momentum and reduces the stress of “finding” money to save.

Step 4: Break Goals Into Bite-sized Steps

Big financial goals can feel intimidating. Instead of trying to tackle everything at once, break your goals into smaller, actionable steps.

Example:

-

-

- Instead of “Pay off $10,000 in debt,” focus on paying an extra $100 a month toward your highest-interest debt.

- Instead of “Save for a home deposit,” aim to save $50 a week into a designated savings account.

- Instead of “Fix my finances,” commit to reviewing your budget once a week.

These small wins build confidence and momentum, making the larger goal feel achievable.

Step 5: Focus On What You Can Control

Financial overwhelm often comes from focusing on things outside your control, like unexpected expenses or economic conditions. Shift your energy to what you can influence.

What You Can Control:

-

-

- How you spend your money

- How you budget and save

- How you approach debt repayment

When you focus on actionable steps, you’ll feel more empowered and less overwhelmed.

Step 6: Build A Support System

You don’t have to navigate your financial challenges alone. Whether it’s a friend, family member, or myself as your financial coach, having someone to talk to can make a world of difference.

Ways To Build Support:

-

-

- Join a Community: Online groups or forums can connect you with people facing similar challenges.

- Work with a Coach: Programs like Master Your Money provide step-by-step guidance and accountability.

- Talk to Your Partner: If you share finances, make sure you’re working together toward shared goals.

Step 7: Shift Your Money Mindset

Sometimes, financial overwhelm is more about mindset than numbers. Reframing how you think about money can reduce stress and help you approach challenges with clarity.

Mindset Shifts To Try:

-

-

- Replace “I’ll never get out of debt” with “I’m taking small steps every day to reduce my debt.”

- Replace “I’m bad with money” with “I’m learning how to manage money better.”

- Focus on progress, not perfection.

Step 8: Celebrate Your Wins

Overcoming financial overwhelm doesn’t happen overnight, but every step you take is progress worth celebrating. Recognising your achievements – big or small, keeps you motivated.

Ways to Celebrate:

-

-

- Treat yourself to a small reward, like a coffee or a movie night, when you hit a milestone.

- Keep a “win journal” where you document every positive financial step.

- Share your success with someone who will cheer you on.

Why 2025 Can Be The Year You Break Free

This year is your opportunity to turn things around. With a clear plan, a supportive community, and the right mindset, you can overcome financial overwhelm and take control of your money. Programs like Master Your Money are designed to help you break through the noise and focus on what matters most: your financial peace of mind.

Conclusion

Feeling overwhelmed by your finances is common, but it’s not permanent. By taking small, intentional steps and focusing on what you can control, you can move from chaos to clarity. Remember, progress is better than perfection, and every step forward is a step closer to financial freedom.

Start today by choosing one action, whether it’s tracking your spending, automating a bill, or simply acknowledging your financial stress. Your future self will thank you for it.

?? You’re earning good income but still feel stuck in a cycle of stress or overspending.

?? You want to break free from limiting beliefs like “I’m bad with money” or “There’s never enough.”

?? You’re ready to build wealth without sacrificing the things you love.

?? You dream of financial freedom and need the tools and mindset to make it happen.

This is more than a mindset shift—it’s a transformation that puts you on the path to lasting financial success! ?