Cash Flow is King: Why Every Small Business Owner Needs a Financial Plan (Not Just More Work)

If you’re a tradie, Franchisee or small business owner, chances are you’ve said this before:

“I just need more work.”

“If I can land that next big job, I’ll be sweet.”

“Once I get through this month, I’ll finally get on top of things.”

Sound familiar?

We’ve been sold this idea that working more hours or taking on more jobs is the key to financial stability.

But here’s the truth…

More work won’t fix your money problems if your financial plan is broken.

Let me say that again: More work won’t fix broken cash flow.

In fact, working harder without a system can actually worsen your money stress – leading to burnout, resentment, and a business that runs you, instead of the other way around.

In this blog, I’ll break down why cash flow is king, how small business owners end up in the trap of “more jobs = more chaos”, and what you can do to take control of your money (without working yourself into the ground).

The Myth of “More Work = More Money”

Let’s say you take on 3 new clients this month as a tradie. Awesome, right?

But then:

- You buy more materials

- You spend more hours on-site

- You hire a subbie to help out

- You juggle more admin

- You forget to invoice someone

- And suddenly – you’re busier than ever… but your bank account doesn’t show it

That’s because revenue doesn’t equal profit, and being busy doesn’t equal being financially fit.

You can be flat-out all month and still feel broke.

That’s the trap, and I see it every week with tradies, franchisees and business owners who are absolutely brilliant at what they do… but never learned how to manage the money side of things.

So What’s the Real Problem?

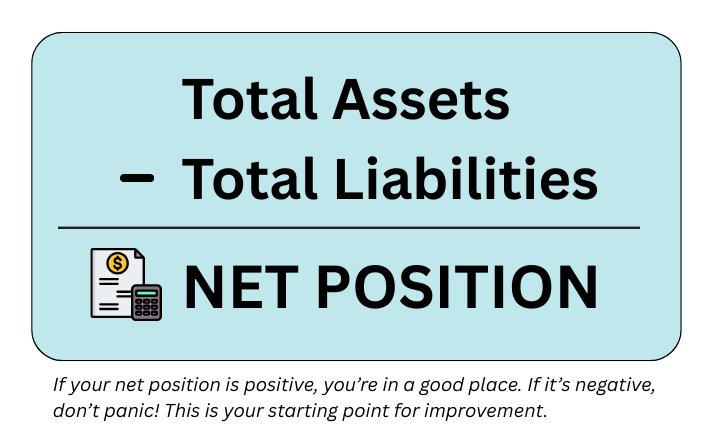

It comes down to one powerful truth:

Cash flow – not just income – is what makes or breaks your business.

Cash flow is the movement of money in and out of your business.

Not just how much you make, but:

- When you get paid

- How consistently money comes in

- What goes out each week

- Whether you’re left with a profit (or just scraping by)

If you don’t have control over your cash flow, you’re always reacting. You’re playing catch-up. And that stress leaks into everything – your health, your relationships, and even the quality of your work.

Here’s What Cash Flow Chaos Looks Like

If you’ve ever experienced any of these, you’re in a cash flow crunch:

- You avoid checking your account because you’re afraid of what you’ll see

- You wait until BAS is due to realise you owe thousands

- You struggle to pay your own wage regularly

- You’re always chasing late invoices

- You can’t take time off because you’re constantly hustling to “keep up”

- You’ve had to dip into your personal savings more than once

Sound familiar? You’re not alone. But the good news is – it’s fixable.

The Solution: A Simple, Small Business – Friendly Financial Plan

You don’t need a finance degree or a fancy accountant to get this sorted. You just need a clear plan for how money flows through your business. Here’s how to start building one.

1. KNOW YOUR BREAK-EVEN POINT

This is the minimum amount of money you need to earn each month to cover:

- Business expenses (tools, fuel, phone, materials, subs, etc.)

- Your personal wage

- Tax and super

- Any loan or debt repayments

Without knowing your break-even, you’re guessing. You’re flying blind. Once you’ve nailed this number, everything becomes clearer.

Now, you can set targets based on facts – not hope.

2. PAY YOURSELF A WAGE – YES, YOU!

This is the game changer. Every time income hits your account, it should be split into different buckets. That way, you’re not tempted to spend what should’ve gone to tax, bills, or your own pay.

Here’s a simple version that works great for small business owners:

✅ Income Account

Where all your payments land. This is your holding zone.

✅ Owner’s Pay Account

Your regular wage. Non-negotiable. You work hard, you deserve to be paid consistently.

✅ Expenses Account

Materials, suppliers, fuel, subscriptions, etc.

✅ Tax & BAS Account

Put aside 25 – 30% of every payment for Tax plus the GST portion. No more panic come BAS time.

✅ Profit Account

Even just 5% of each job. This is for rainy days, growth, or peace of mind.

You can set this up in 30 minutes through online banking. Once you do? You’ll sleep better knowing your money is finally working for you.

3. TRACK YOUR MONEY CASH FLOW

Once a week, check in on your numbers. This doesn’t need to be a 2-hour admin marathon. I’m talking 20–30 minutes to:

- See what came in

- Check what went out

- Update your numbers

- Chase unpaid invoices

- Move money into your buckets

Make this a weekly ritual (I call it a Money Date) and watch your confidence skyrocket. Because the more you look at your money, the less power it holds over you.

4. TRACK YOUR MONEY CASH FLOW

You can have all the work in the world, but if your prices don’t reflect the true cost of running your business – you’ll never get ahead.

Too many small business owners undercharge because they’re afraid of losing the work.

But if you’re not charging for:

- Admin time

- Quote prep

- Travel

- Time off tools

- Overheads

- Profit margin

…then you’re not building a business. You’re building a time bomb.

You should be pricing with confidence, knowing that it covers everything – not hoping for the best.

Inside The Edge, I teach you a simple pricing calculator so you know exactly what to charge and why.

5. BUILD A BUFFER FUND

We all know some work can be seasonal or unpredictable.

A job gets delayed. A client pays late. You get sick. And suddenly your cash flow takes a hit. That’s why a buffer fund is crucial.

Aim to build up 1–3 months’ worth of business expenses in a separate account. This gives you breathing space and avoids making panic-driven decisions like slashing prices or taking on crappy jobs just for quick cash.

Start small – $50 a week adds up. Automate it. Make it part of your money system.

The Truth? You Don’t Need More Work. You Need a Better Money Plan.

You don’t need to hustle harder. You don’t need to take every job that comes your way. You need to manage your money better so the work you’re already doing actually pays off. Imagine this:

- Getting paid consistently – even in quiet months

- No more panicked BAS seasons

- Knowing exactly what your business needs to earn each week

- Saying YES to time off without financial stress

- Watching your bank account grow, not shrink

That’s what happens when cash flow becomes your king, and your systems support you, not sabotage you.

And That’s Exactly What We Do Inside THE EDGE

THE EDGE is a 6-week coaching program for tradies, franchisees and small business owners who are ready to stop guessing and start owning their business money. We’ll help you:

✅ Set up a cash flow system

✅ Price for profit

✅ Get your BAS and tax sorted

✅ Pay yourself consistently

✅ Build a buffer

✅ Plan for growth (without working more hours)

It’s simple, structured, and built for people who are great at their trade, not spreadsheets.

Final Thoughts: Work Smarter. Get Paid Properly. Stress Less.

You didn’t go into business to work 24/7 and still worry about money.

You started your business for freedom, flexibility, and a better life. And the path to that life isn’t more work. It’s better cash flow.

So if you’re ready to take the pressure off and finally feel in control of your business money…