How Do I Prioritise My Expenses and Manage My Spending?

Prioritising expenses and effectively managing your spending is critical for your mental health, financial stability, and future growth.

Here’s a step-by-step guide to assist you with this:

TRACK YOUR SPENDING

Before you can prioritise, you need to know where your money is going. Keep a record of all your expenses for a month or two. This can be done using budgeting apps, spreadsheets, or simply a notebook.

CREATE A BUDGET

Based on your tracking, categorise your expenses (like rent, groceries, entertainment, etc.) and allocate a specific amount to each category. Be realistic in your allocations.

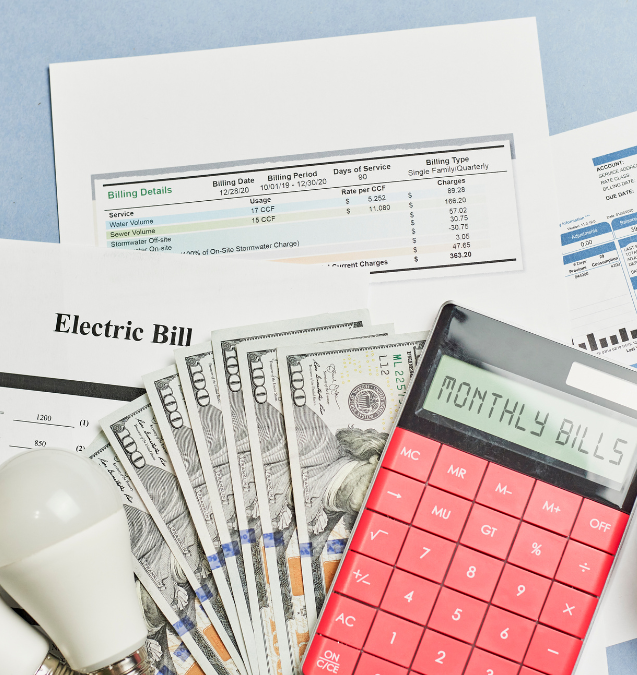

IDENTIFY NEEDS VS. WANTS

Separate essential expenses (needs) like rent, utilities, and groceries from non-essential (wants) like dining out, entertainment, etc. Prioritise your needs.

SET FINANCIAL GOALS

Define your short-term (like saving for a holiday) and long-term (like saving for retirement) financial goals. This will help you stay focused and motivated.

SAVE FIRST

Adopt a “pay yourself first” approach. Allocate a portion of your income to savings or investments before you start spending on non-essentials.

REDUCE UNNECESSARY EXPENSES

Look for areas where you can cut back. This might include dining out less, cancelling unused subscriptions, or opting for more affordable entertainment options.

EMERGENCY FUND

Build an emergency fund that can cover at least 3-6 months of living expenses. This should be a priority as it provides a financial cushion.

USE TOOLS AND RESOURCES

Utilise budgeting tools, financial planning apps, or consult with a financial advisor for personalised advice.

REVIEW AND ADJUST REGULARLY

Your budget is not set in stone. Review it regularly and make adjustments as your income, expenses, and financial goals evolve.

AVOID HIGH-INTEREST DEBTS

Try to minimise reliance on credit cards or high-interest loans. If you have existing debt, prioritise paying it off.

EDUCATE YOURSELF

Continuously learn about personal finance. Understanding concepts like compound interest, investment, and credit scores can significantly improve your financial decision-making.

MINDSET AND DISCIPLINE

Cultivating a mindset of financial discipline and delayed gratification is key. This includes resisting impulse purchases and making informed spending decisions.

Remember, personal finance is personal. Your priorities and goals will dictate how you manage your spending, so tailor these steps to fit your unique situation.