The Secret Formula to Fix Your Finances in Just Three Months

Imagine if, in just three months, you could feel in control of your money, reduce your debt, and finally start saving for the future you’ve always dreamed of. It sounds ambitious, but it’s entirely possible with the right approach. Fixing your finances doesn’t have to be overwhelming or complicated, it just requires the right formula and commitment to taking small, consistent steps.

In this blog, I’ll break down a simple, three-month plan to get your finances on track. Whether you’re drowning in debt, struggling to save, or just looking to improve your financial habits, this formula will work for you.

Why Three Months?

Three months, or 90 days, is an ideal time frame to make significant progress without feeling like the journey is endless. It’s short enough to stay motivated but long enough to see measurable results. With a clear plan, you can achieve financial wins that build momentum and set the foundation for lasting success.

The Secret Formula: The 3-Step Plan

The formula for fixing your finances in three months revolves around three key pillars: Assess, Act, and Advance. Let’s break it down:

1. Assess: Understanding Your Starting Point (Week 1-4)

Before you can fix your finances, you need to understand them. Think of this as your financial health check.

Step 1: Audit Your Money

Start by tracking every dollar you spend for one month. Use a spreadsheet, app, or notebook to record:

-

-

- Fixed expenses (rent, bills, subscriptions)

- Variable expenses (groceries, dining out, entertainment)

- Irregular expenses (annual fees, gifts)

-

This exercise often reveals surprising patterns, like how much those small “treats” add up.

Step 2: Calculate Your Net Worth

Your net worth is your financial snapshot. Add up your assets (savings, investments, property) and subtract your liabilities (debts). Don’t be discouraged if it’s negative this is your starting point.

Step 3: Define Your Priorities

What matters most to you? Maybe it’s paying off debt, building an emergency fund, or saving for a holiday. Write down your top three financial goals for the next three months.

2. Act: Implementing Positive Change (Week 5-8)

This is where the magic happens. Once you know where you stand, it’s time to take action.

Step 1: Build a Realistic Budget aka Spending Plan

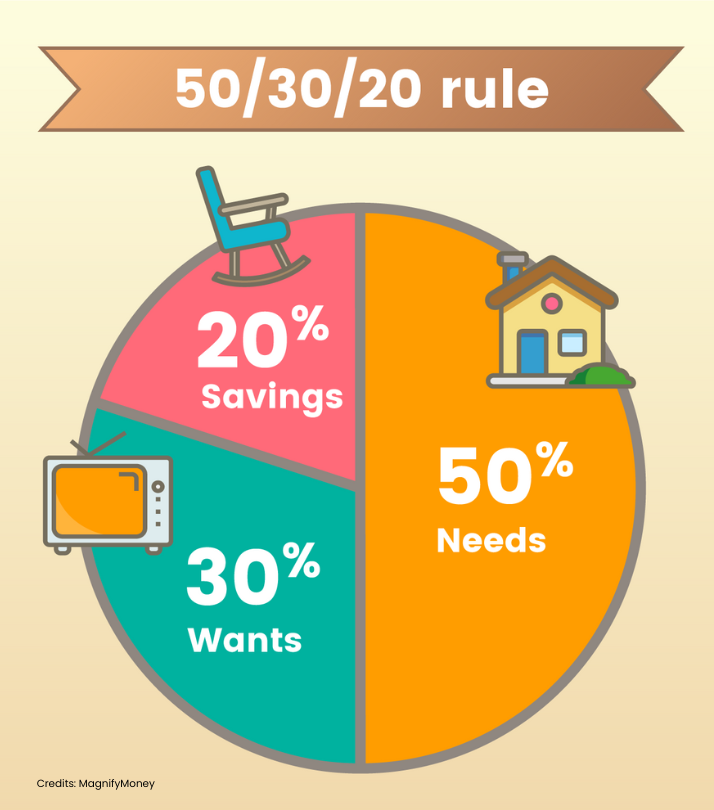

A budget or better known as spending plan, isn’t about deprivation; it’s about prioritising. Use the 50/30/20 rule as a guide:

-

-

- 50% for needs (housing, groceries, utilities)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

-

Adjust these percentages based on your goals. If you’re tackling debt, redirect some “wants” spending to accelerate repayment.

Step 2: Reduce Expenses Strategically

Look for quick wins, such as:

-

-

- Canceling unused subscriptions

- Cooking at home instead of dining out

- Negotiating bills like internet or insurance

-

Challenge yourself to a “no-spend week” to identify areas where you can cut back without feeling deprived.

Step 3: Start Paying-off Debts

List your debts and choose a repayment strategy:

-

-

- Snowball Method: Focus on the smallest debt first for quick wins.

- Avalanche Method: Prioritise the highest-interest debt to save money in the long term.

-

Set up automatic payments to avoid missed due dates and reduce financial stress.

Step 4: Automate Savings

Even if it’s just $10 a week, start saving. Set up an automatic transfer to a separate savings account. Treat it like a non-negotiable bill—it’s money for your future self.

3. Advance: Building Momentum (Week 9-12)

The final phase is about maintaining progress and preparing for the long term.

Step 1: Monitor and Adjust Your Plan

Review your budget and spending weekly. Are there areas where you’re overspending? Adjust as needed, but celebrate your wins along the way.

Step 2: Reduce Expenses Strategically

Consider ways to earn extra cash to speed up your progress:

-

-

- Selling unused items online

- Offering freelance services

- Picking up a side hustle

-

Even a small income boost can make a big difference when applied to debt or savings.

Step 3: Focus on Your Mindset

Financial success is as much about mindset as it is about math. Practice gratitude for what you have and visualize your financial goals. A positive attitude keeps you motivated during setbacks.

Common Challenges (and How to Overcome It)

1. “I don’t have enough money to save.”

Start small. Even $5 a week adds up over time. The habit of saving is more important than the amount at first.

2. “I don’t know where to start with my debt.”

Start with one debt. Focus on it, make a plan, and celebrate when you pay it off. Then move on to the next.

3. “It’s too overwhelming.”

Break it down into daily or weekly actions. Progress is progress, no matter how small.

The Ripple Effect of Fixing Your Finances

When you take control of your money, it doesn’t just impact your wallet. You’ll feel:

-

- Less Stress: No more sleepless nights worrying about bills.

- More Confidence: You’ll know exactly where your money is going.

- Increased Freedom: With less debt and more savings, you’ll have more choices in life.

How Programs Like the “Kickstart Your Journey” Can Help

Kickstart Your Journey is a 7-day motivational course on financial education, tailored to kick off a new year and aimed at achieving financial success, involves crafting a comprehensive and engaging curriculum.

Conclusion

Fixing your finances in just three months is entirely possible with the right formula. By assessing where you are, taking intentional action, and building momentum, you can transform your financial situation and set yourself up for long-term success.

Remember, it’s not about perfection, it’s about progress. Start today, and by the end of three months, you’ll be amazed at how much you’ve achieved.