Holiday Spending Survival Guide: How to Enjoy the Festive Season Without Breaking the Bank

The holiday season is here, and with it comes the urge to celebrate, give generously, and create beautiful memories with loved ones. But let’s be honest, the holidays can also bring financial stress if we’re not careful! Here’s a survival guide to help you enjoy the season without breaking the bank, keeping your finances on track as you head into the new year.

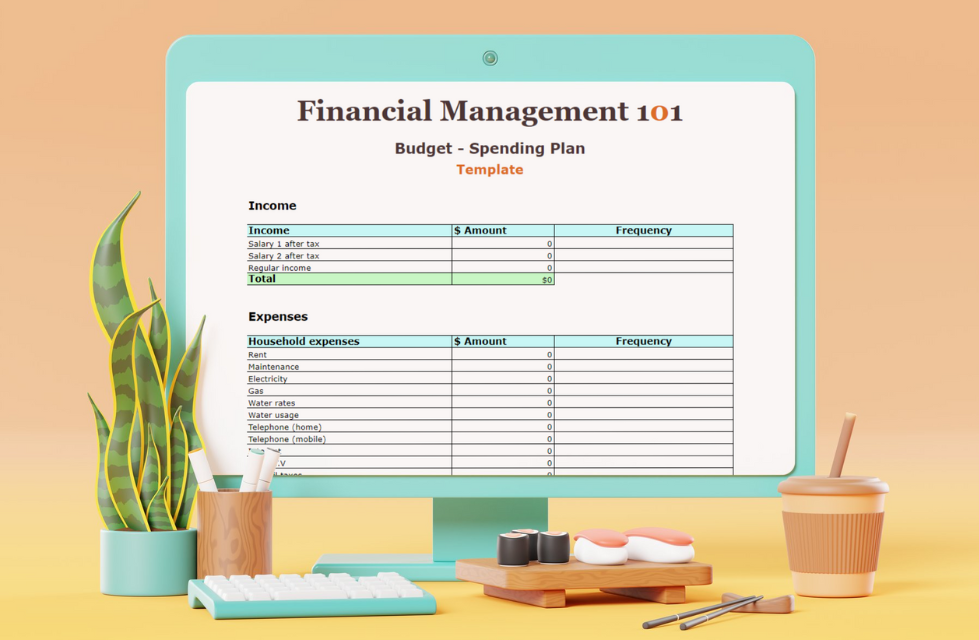

1. Set a Holiday Budget Before Spending

Before you dive into holiday shopping, set a total budget for the season. Think of this as your overall spending cap – a number that includes gifts, decorations, travel, and any other holiday-related expenses. Write this number down and commit to sticking with it. Having a clear limit makes it easier to say “no” to last-minute splurges that can quickly derail your budget.

2. Make a List and (and Check It Twice)

A gift list is a holiday essential! Write down each person you plan to buy for, along with a spending limit for each. Then, brainstorm gift ideas that fit within your set budget for each person. This approach helps keep your spending intentional and reduces the chances of overbuying or going overboard on any one gift. Plus, you’ll likely avoid those frantic, last-minute purchases that always seem to cost more.

3. Focus on Meaningful Over Material

Holiday shopping is often about finding that “perfect” gift, but the best gifts aren’t always the most expensive ones. Consider giving experiences, homemade gifts, or personalised items. Here are a few budget-friendly ideas:

- Experiences: Tickets to a show, cooking a meal together, or a picnic outing.

- DIY Gifts: Bake cookies, make a photo album, or create a handmade card.

- Quality Time: A heartfelt letter or spending a day together can mean a lot.

These gifts often leave a lasting impression, and they won’t hurt your wallet.

4. Avoid Financing Your Holidays with Debt

Credit card debt can sneak up on you, especially during the holidays. If possible, stick to cash or a debit card for holiday purchases. This way, you’re only spending money you actually have, avoiding any dreaded January credit card surprises. If you must use a credit card, try setting a hard limit and commit to paying off the balance immediately after the holidays to avoid high-interest charges.

5. Take Advantage of Sales and Discounts (But Be Smart About It)

Many retailers offer holiday sales, which can be a great opportunity if you’re strategic. Check for online discounts, use coupon codes, and compare prices before buying. However, resist the temptation to buy things just because they’re “on sale.” Stick to your list and buy only what you need. A great deal is only worth it if it aligns with your budget and your holiday gift plan.

6. Consider a “Secret Santa” for Larger Groups

If you’re buying for a big group – like extended family or friends, consider suggesting a Secret Santa or gift exchange. This way, each person only buys one gift, which saves everyone money. You can set a budget limit and focus on one thoughtful gift instead of buying for everyone. Plus, it makes gift-giving fun and more meaningful without the financial stress.

7. Don’t Forget Hidden Holiday Costs

Holiday expenses go beyond just gifts. Food, decorations, travel, and even extra utility costs can all add up. Budget a little extra for these “hidden” holiday expenses to avoid dipping into savings or putting them on credit. If you’re hosting, consider making it a potluck so that everyone can pitch in and share the costs.

8. Plan for Next Year’s Holidays

One of the best ways to manage holiday spending is to start planning now for next year. After the holidays, consider setting aside a small amount each month toward a “holiday fund.” This way, when the season rolls around again, you’ll already have money set aside, and you won’t need to scramble or rely on credit cards. It’s a great strategy for breaking the cycle of holiday debt and ensuring you’re financially prepared.

9. Prioritise Self-Care Over Stressful Spending

Finally, remember that the holiday season is about connection, gratitude, and joy. It’s easy to get swept up in the pressures of gift-giving, but focus on the experiences and people who matter most. Practice self-care, and don’t feel obligated to overspend just to make others happy. The memories you create with loved ones are often worth far more than anything you could buy.

FINAL THOUGHTS

The holidays don’t have to leave you financially stressed. By setting a budget, focusing on meaningful gifts, and avoiding unnecessary debt, you can enjoy the season without compromising your financial goals. Here’s to celebrating a joyful, financially stress-free holiday season and to starting the new year on solid ground!

Join the program Mastering Budgeting and Saving Techniques and learn how to budget, track and look at managing your money like a pro.