How to Turn Financial Stress into Financial Success with THE VAULT

If you’ve ever stayed awake at night worrying about bills, mounting debt, or an uncertain financial future, you’re not alone. Financial stress affects millions of people, but it doesn’t have to control your life. Through personalised support and expert guidance, THE VAULT can help you transform financial stress into lasting financial success.

The True Cost of Financial Stress

Financial stress doesn’t just impact your bank account – it affects every area of your life. Here’s how:

Mental Health

Anxiety and depression often stem from constant money worries.

Relationships

Money is one of the leading causes of conflict in relationships.

Physical Health

Stress-related illnesses like high blood pressure and migraines can arise from financial struggles.

The good news? You don’t have to stay stuck. Monthly Coaching provides the tools and strategies to regain control and start thriving.

How Monthly Coaching Inside THE VAULT Tackles Financial Stress

1. Clarity: Understand Your Money

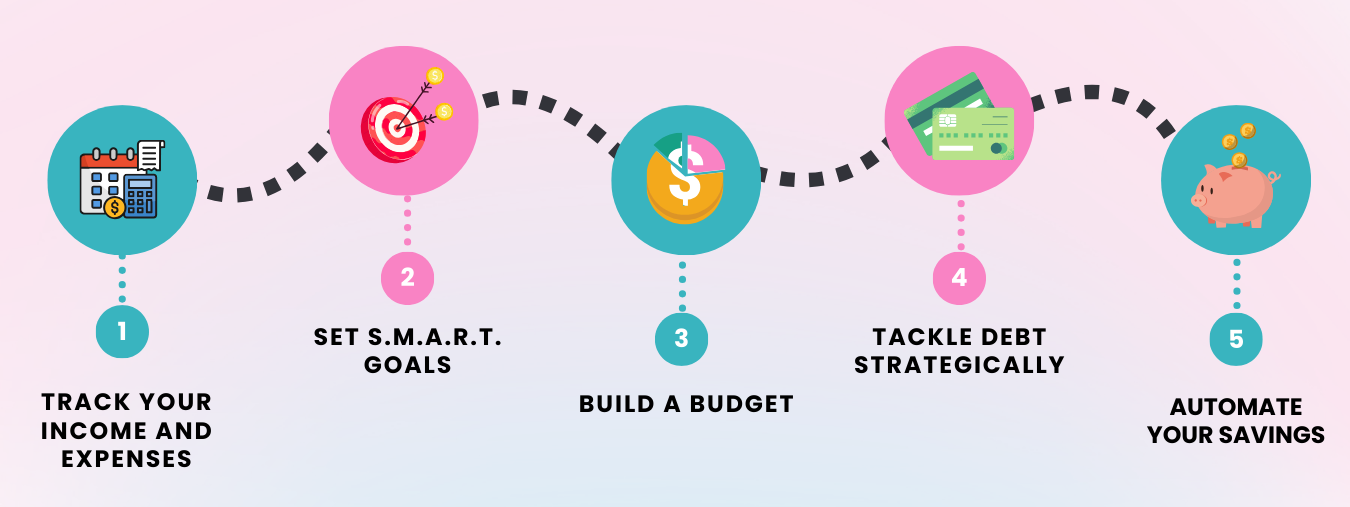

Financial stress often comes from uncertainty. Where’s your money going? How much debt do you have? Monthly Coaching inside THE VAULT starts by helping you gain clarity. Your coach will work with you to map out your financial picture so you know exactly where you stand.

2. Actionable Plans: One Step At A Time

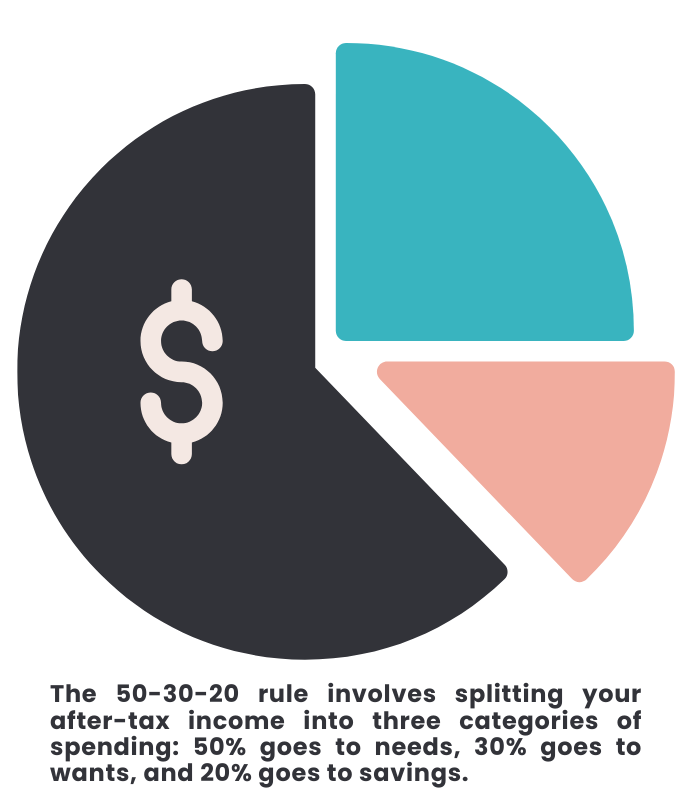

It’s easy to feel paralysed by the enormity of financial problems. A coach breaks things down into manageable steps, guiding you through proven strategies like those taught in the Mastering Budgeting and Savings Course.

3. Accountability: Stay On Track

Consistency is key to financial success, but life often gets in the way. Monthly check-ins ensure you stay focused on your goals, even when challenges arise.

4. Mindset Shifts: Turn Stress into Motivation

Managing money isn’t just about numbers, it’s about mindset. Coaches help you reframe negative thoughts about money, turning them into empowering beliefs that drive action.

Real Success Stories

Meet James and Laura, parents of two who were drowning in credit card debt and constantly stressed about unexpected expenses. Through Monthly Coaching, they learned how to:

-

- Create a sustainable budget using strategies from the Mastering Budgeting and Savings Course.

- Build an emergency fund to cover unforeseen costs.

- Pay off $20,000 in debt in just 18 months.

Today, they’re financially stable and planning their first overseas holiday – a goal they once thought was impossible.

THE VAULT: Unlock Everything You Need

With courses, tools, and resources at your fingertips inside THE VAULT, you’ll have everything you need to succeed.

Key resources include:

-

- The Mastering Budgeting and Savings Course, which teaches you to manage your money with confidence.

- Debt reduction tools that help you pay off balances faster.

- Goal-setting worksheets to turn dreams into actionable plans.

From Stress to Success

Financial stress doesn’t have to define your life. With the right support and a clear plan, you can overcome challenges and achieve financial success.

Ready to take the next step? Join THE VAULT today and unlock access to the tools and resources you need to take the stress out of managing your money.