Unlock Your Financial Potential: The Power of THE VAULT

Managing money isn’t just about numbers; it’s about habits, mindset, and access to the right resources. That’s where THE VAULT comes in. It provides the roadmap, monthly coaching, tools, and support you need to transform your finances and unlock your financial potential.

Why Monthly Coaching Matters?

Imagine having a financial coach by your side every month, helping you navigate challenges, stay on track, and celebrate milestones. Here’s what makes regular coaching a life-changing experience:

1. Personalised Guidance

Your financial situation is unique, and cookie-cutter advice just won’t cut it. Monthly Coaching gives you tailored strategies to help you meet your goals, whether you’re tackling debt, building savings, or preparing for a big purchase.

2. Accountability

How often have you set a financial goal only to lose focus within weeks? A monthly check-in with your coach ensures you remain on track. Accountability is the key to transforming intentions into actions.

3. Supportive Community

Being part of a group of like-minded individuals who share their struggles, successes, and insights can be incredibly motivating. You’re not in this alone!

The Power of THE VAULT

1. Comprehensive Courses

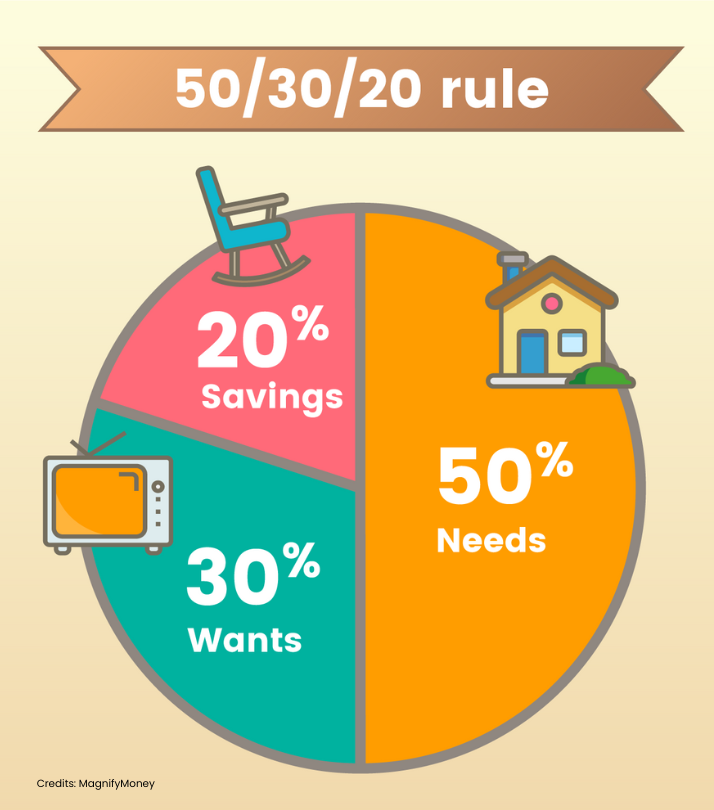

THE VAULT includes everything from basic financial literacy to advanced topics like investment understanding. It also features my most popular program, the Mastering Budgeting and Savings Course, which has helped countless clients take control of their money.

2. Interactive Tools

Use tools like budget calculators, expense trackers, and goal-setting worksheets to make managing money practical and straightforward.

3. Live Webinars and Q&A Sessions

Join monthly webinars where you can ask questions, learn from experts, and gain new insights. Topics include budgeting, debt reduction, and financial goal setting.

4. Step-by-step Guides

Not sure where to start? THE VAULT includes step-by-step instructions to help you build a strong foundation in managing your money.

Success Stories: Real People, Real Results

Take the story of Lisa, a single mum working full-time. She joined THE VAULT after struggling for years to make ends meet. With Coach Karen’s guidance and the resources she got from THE VAULT, Lisa paid off $8,000 in credit card debt, built a $5,000 emergency fund, and started saving for her daughter’s education—all in under a year.

Her secret? Following the proven budgeting strategies in the Mastering Budgeting and Savings Course while leveraging the monthly coaching sessions for motivation and accountability.

Ready to Transform Your Finances?

With joining THE VAULT, the life you’ve always dreamed of is within reach. It’s not about earning more—it’s about managing what you have more effectively. Join today and start your journey to financial freedom!

Ready to take the next step? Join THE VAULT today and unlock access to the tools and resources you need to take the stress out of managing your money.