Breaking Free from Scarcity: How to Step into an Abundant Money Mindset

If you’ve ever felt like no matter how much you earn, it’s never enough, or if you catch yourself worrying about money even when things are going well, you might be stuck in a scarcity mindset. This mindset keeps you feeling like there’s never enough; enough money, enough opportunities, enough security. But the truth is, abundance is everywhere; we just have to shift our perspective to see it.

Breaking free from scarcity thinking doesn’t just improve your finances; it transforms how you approach life. Let’s explore how you can step into an abundant money mindset and start seeing possibilities instead of limitations.

Step 1: Recognise the Signs of Scarcity Thinking

The first step to shifting your mindset is awareness. Scarcity thinking can show up in many ways, such as:

-

-

- Feeling like you never have enough money, no matter how much you make.

- Being afraid to spend, even on things that align with your values.

- Hoarding money out of fear rather than saving with intention.

- Avoiding financial planning because you assume there’s no way to improve your situation.

- Comparing your financial success to others and feeling discouraged.

-

If any of these resonate with you, don’t worry – you’re not alone, and these patterns can be changed.

Step 2: Reframe Your Money Beliefs

Scarcity isn’t about how much money you have; it’s about how you think about money. If you believe money is hard to earn or that financial success is only for the lucky few, those beliefs will shape your financial reality.

Start by shifting your internal dialogue. Instead of saying, “I can’t afford that,” try, “How can I afford that?” This simple shift turns money from a limitation into an opportunity for creativity and resourcefulness.

Another powerful reframe is to see money as a tool rather than a source of stress. Money is neutral, it’s how we use it and think about it that determines whether it empowers us or controls us.

Step 3: Cultivate an Abundance Mindset Daily

Shifting from scarcity to abundance requires daily practice. Here are some ways to rewire your thinking:

-

-

- Gratitude Practice: Take a moment each day to appreciate the financial abundance you already have whether it’s a roof over your head, food in your fridge, or even a steady paycheck.

- Generosity: Giving, even in small ways, signals to your brain that there’s more than enough to go around. It could be donating a small amount to charity, tipping generously, or even sharing knowledge with someone who needs it.

- Visualisation: Spend time visualising your ideal financial future. Imagine yourself thriving, making wise financial choices, and feeling completely at ease with money.

-

Step 4: Take Action Toward Abundance

An abundance mindset isn’t just about thinking differently – it’s also about acting differently. Some action steps include:

-

-

- Investing in Yourself: Whether it’s taking a course, hiring a coach, or developing new skills, investing in yourself creates long-term financial and personal growth.

- Creating Multiple Income Streams: People with an abundance mindset look for opportunities, not just limitations. Could you start a side hustle? Negotiate a raise? Explore passive income options?

- Letting Go of Money Guilt: If you’ve been conditioned to feel guilty about spending or earning money, it’s time to release that. Money is simply an exchange of value, and you deserve financial prosperity.

-

Step 5: Surround Yourself with Abundance Thinkers

Your environment influences your mindset. If you’re constantly surrounded by negativity about money, it’s harder to adopt an abundance perspective. Seek out people, books, podcasts, and communities that reinforce abundance thinking.

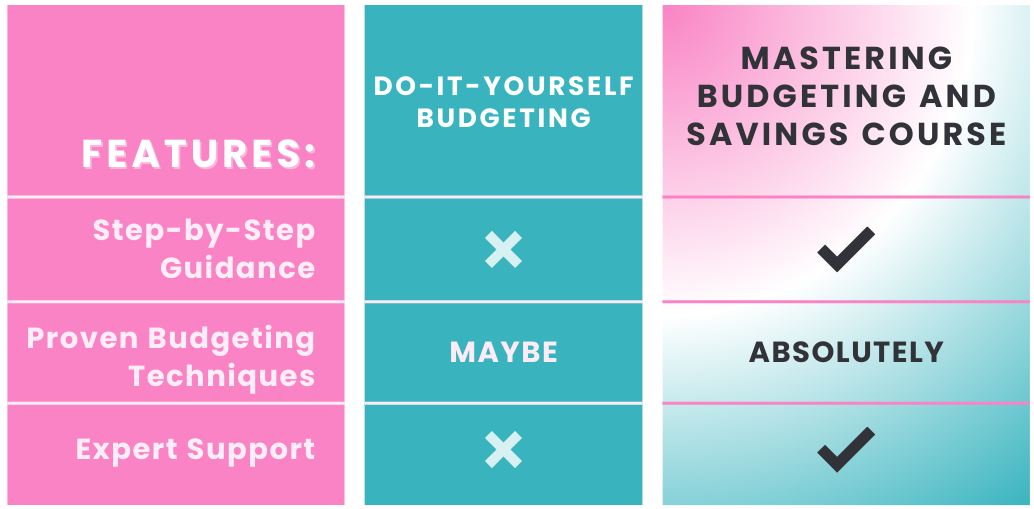

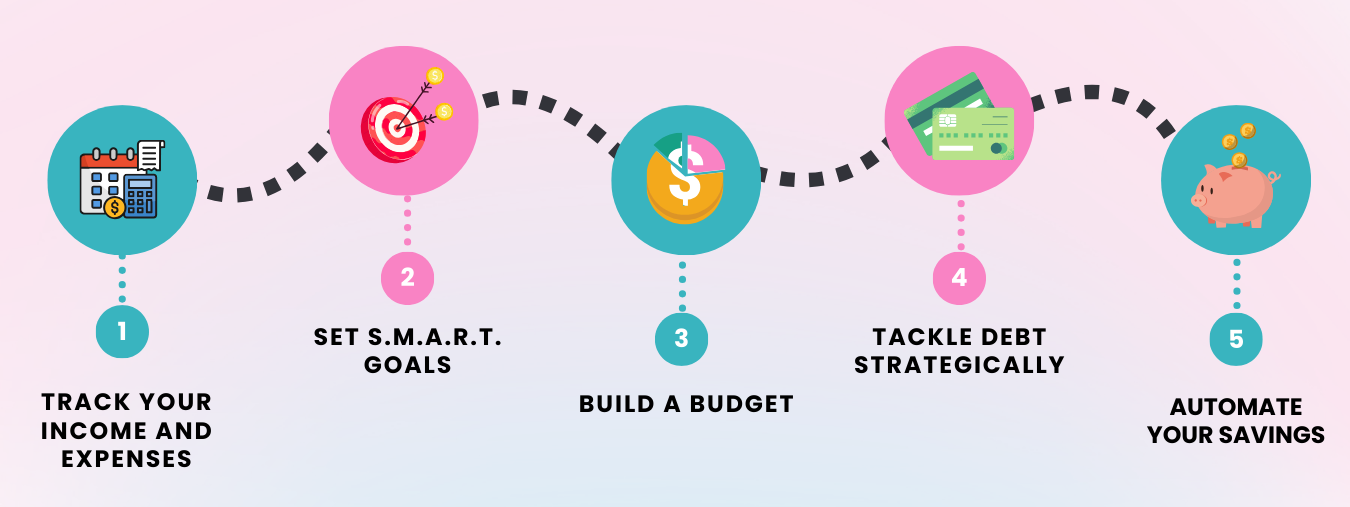

This is exactly why I created my Monthly Coaching program, where you gain access to THE VAULT – a wealth of financial education, tools, and resources to shift your mindset and transform your money habits. And for those ready to take full control of their financial future, the Master Your Money program offers step-by-step guidance on building lasting wealth.

Final Thoughts: Abundance is a Choice

Stepping into an abundant money mindset isn’t about waiting until you have “enough” money – it’s about changing how you view the money you already have. When you see possibilities instead of limitations, you unlock new levels of financial growth and confidence.

You are already capable of abundance. Now, it’s time to claim it.