Ever feel like your money is running you instead of the other way around? Like no matter how much you earn, there’s always more month than money?

If you nodded (or sighed), you’re not alone. The good news? You don’t need a finance degree, a six-figure income, or a strict budget to take control. You just need a money plan that works for you.

In this blog, we’ll ditch the overwhelm and walk through exactly how to create a simple, empowering money plan that gives you clarity, confidence, and real momentum.

Let’s go from chaos to clarity – starting today.

1. Start With Your “Why”: Anchor Your Money to What Matters

Before we dive into numbers, let’s get clear on your why. Because unless your money plan connects to something meaningful, it won’t stick.

Ask yourself:

- What would feeling in control of my money allow me to do?

- What does financial peace look like to me?

- What am I working toward?

Your answers might include:

- Paying off debt to sleep better at night

- Saving for a dream trip or home deposit

- Creating options so you can work less or start a business

Write your top 2 – 3 motivations down. These are your compass when the budget feels boring or things go off track.

2. Know Your Numbers (Without the Shame Spiral)

You can’t improve what you don’t measure. So let’s get honest, not harsh. Gather the basics:

- Your income (all sources)

- Your recurring bills

- Your debt repayments

- Your spending patterns (groceries, eating out, transport, etc.)

- Your current savings and investments

Pro tip: Use the last 2–3 months of bank statements to see where your money actually went. You might be surprised (hello, Uber Eats). This isn’t about judgment. It’s about clarity.

3. Create a Simple Money Plan (The 70/20/10 Rule)

Forget complicated budgets with 47 categories. Here’s a simple, flexible formula you can actually stick to:

- 70% for living: rent/mortgage, groceries, transport, lifestyle

- 20% for financial goals: savings, debt repayments, investments

- 10% for the future: extra super, long-term wealth building

The percentages aren’t set in stone. Adjust based on your situation. The key is having a structure that makes sure you’re not spending 100% of your income with nothing left to show for it.

Action step: Plug your own numbers into this formula and see where you land. If you’re off track, that’s your roadmap for change.

4. Automate Your Money Flow (And Take the Stress Out)

Once you know where your money should go, make it happen on autopilot.

Set up automatic transfers:

- To a separate savings account (nickname it for motivation: “Italy 2026” or “Debt-Free Me”)

- To cover bills and direct debits

- To long-term savings or investment accounts

When you automate, you eliminate the willpower game. You’ll save without thinking and avoid last-minute money panic.

Bonus tip: Use a separate account for discretionary spending (like a digital “cash envelope”). When it’s empty, it’s empty.

5. Create an Emergency Buffer (For Life’s “Oh No!” Moments)

Life is full of surprises. Your washing machine breaks, your car needs fixing, or your job suddenly changes.

Having even $1,000 in a buffer fund means you don’t have to reach for the credit card every time life happens.

Aim for 1 month of essential expenses first, then build to 3. But start where you are, every $50 counts. Keep it in a separate high-interest savings account you can access in a true emergency (not Friday night online shopping).

6. Track Progress Without Obsessing

You don’t need to check your bank app five times a day. But regular check-ins keep you engaged and help you spot problems early.

Ideas to stay on track:

- Weekly money date: review transactions, check balances, update goals

- Monthly review: celebrate wins, adjust if needed

Use a simple app or spreadsheet to track goals

The goal isn’t perfection. It’s progress.

7. Keep Learning and Stay Inspired

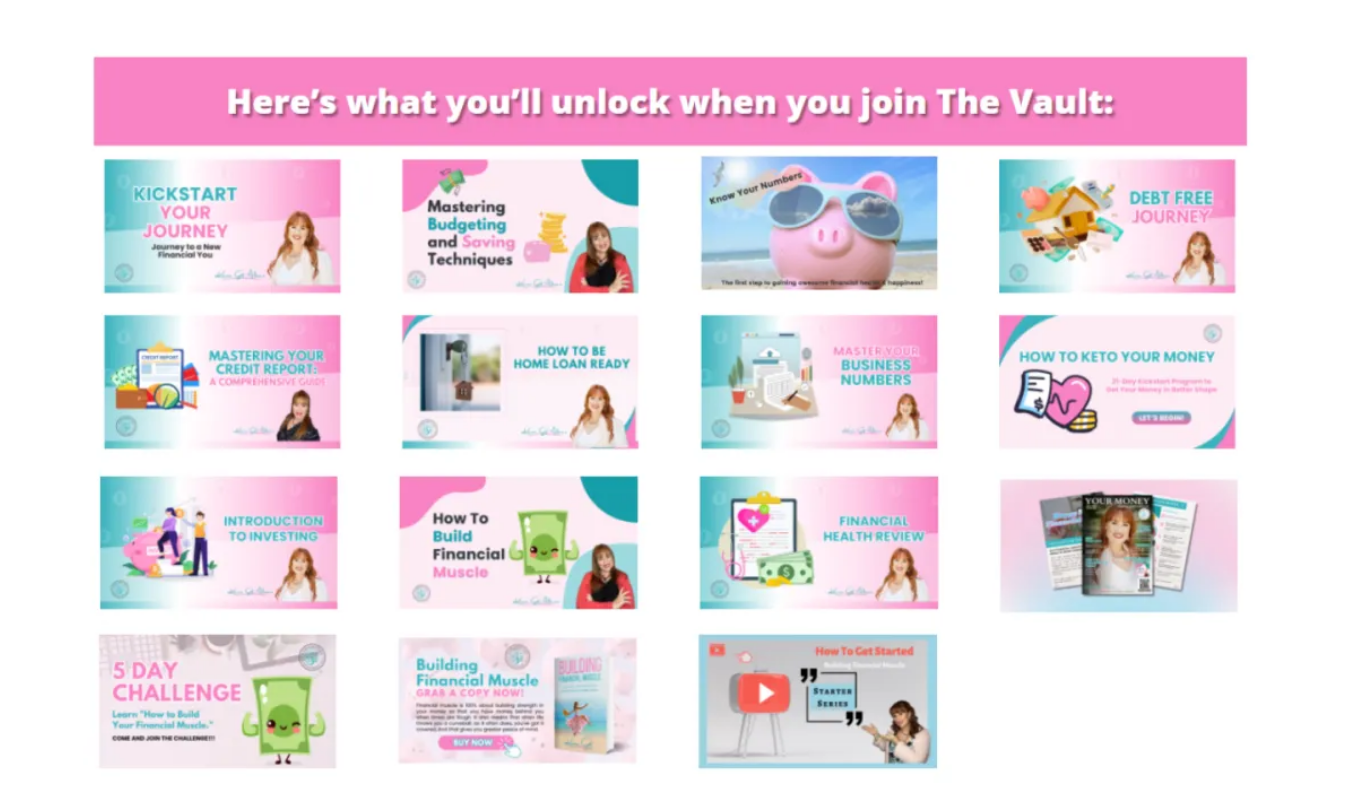

Your relationship with money is lifelong. The more you understand it, the more confident you’ll feel. Try:

- Reading a finance book this quarter

- Listening to a weekly money podcast

- Following finance educators on socials

- Booking a session with a financial coach to personalise your plan

There’s no shame in not knowing something – only in staying stuck.

Clarity = Confidence = Momentum

When your money feels chaotic, it can affect everything: your stress levels, your sleep, your relationships, and your ability to plan ahead. But creating a money plan that actually works isn’t about spreadsheets or sacrifice. It’s about:

- Getting clear on what matters to you

- Creating a simple, sustainable system

- Building habits that support your goals

And the best part? You can start today. One step. One decision. One plan.

If you’re ready to get out of the fog and into financial clarity, let’s talk. Book your free discovery call and let’s map out your next steps – with zero jargon, zero judgment, and 100% support.

Because you can feel good about your money. You just need a plan that fits your life.

No more chaos. It’s your time for clarity. Let’s make it happen.