The receipts are in, the spreadsheets are done, and you’ve (hopefully) high-fived your tax agent. The end of financial year (EOFY) is behind us – but what now?

For many Australians, EOFY feels like the finish line. But what if I told you it’s actually the starting line for something bigger: your financial transformation?

This fresh start isn’t just about filing taxes. It’s about taking back control, getting intentional, and building the kind of financial life that makes you feel calm, confident, and in charge.

Here’s exactly how to use the post-EOFY energy to fuel your financial success in the new year.

1. Reflect, Don’t Regret: Review Your Financial Year With Curiosity

Before you launch into new goals, pause to reflect. What worked last year? What didn’t? Where did your money actually go?

This isn’t about blame or shame. It’s about building awareness. If you don’t know your patterns, how can you shift them?

Look at:

- Income vs. spending: Were you living within your means?

- Savings progress: Did you build or drain your emergency fund?

- Debt: Did it grow, shrink, or stay the same?

- Investments: Did you start, stop, or ignore them?

Pro tip: Ask yourself: “What would I love to feel differently about my money this year?”

2. Reset Your Financial Goals (Make Them Feel Exciting!)

Generic goals like “save more money” or “spend less” don’t motivate anyone. Your goals should feel like a reward, not a punishment.

Examples:

- Old: Save $5,000

- New: Save $5,000 to take the family on a Bali holiday

Or:

- Old: Pay off credit card

- New: Clear my credit card so I can sleep better at night and finally stop stressing over bills

The more emotionally connected you are to the why, the easier it is to stay focused.

Try this:

- Choose 1 short-term goal (within 6 months)

- Choose 1 long-term goal (6+ months to 3 years)

- Attach a reason and an emotion to each

3. Do a Budget Reset That Reflects the Life You Want

Forget rigid old-school budgets. Let’s talk about a spending plan that reflects your values.

Where do you want your money to go? Think beyond bills. Think joy, freedom, peace of mind. Start by:

- Reviewing subscriptions: Are you using them all?

- Updating your cost of living: Groceries, fuel, and utilities have changed – so should your plan

- Adjusting categories: Maybe you’re spending more on wellness, less on takeaway

Bonus idea: Create a “Fun Fund” for guilt-free spending on the things you love. Yes, really.

4. Revisit (or Create) Your Emergency Fund

This year has already shown us how unpredictable life can be. Having a financial buffer can be the difference between stress and peace of mind.

Even $1,000 can give you breathing room. Ideally, aim for 3 months of expenses, but start small and build momentum.

Hot tip: Keep your emergency fund in a high-interest savings account you don’t touch unless it’s a genuine emergency.

5. Re-assess Your Super and Insurance

Post-EOFY is the perfect time to check in on the financial foundations you often forget about.

- Superannuation: Are your contributions on track? Is your fund performing? Are fees eating into your future?

- Personal insurance: Are you covered for income protection, life, or trauma? Is it still aligned with your needs?

Even a quick 20-minute review can help you spot easy wins or avoid future issues. Need help? A financial coach (like me) or adviser can guide you through these choices in plain English.

6. Start a New Habit (Small, Consistent Wins Add Up)

Want to save more, spend better, or build wealth? It starts with habits. Pick one new habit that supports your bigger goal. For example:

- Transfer $50 to savings every payday

- Spend 5 minutes a week reviewing your money

- Read or listen to one money podcast per month

- Tiny habits build massive momentum.

Try this: Schedule a 15-minute “money date” with yourself every week. Make it fun: coffee, music, candle, whatever makes it feel less like a chore.

7. Get Support: Don’t go it alone!

If the last financial year felt overwhelming, you don’t have to repeat that story.

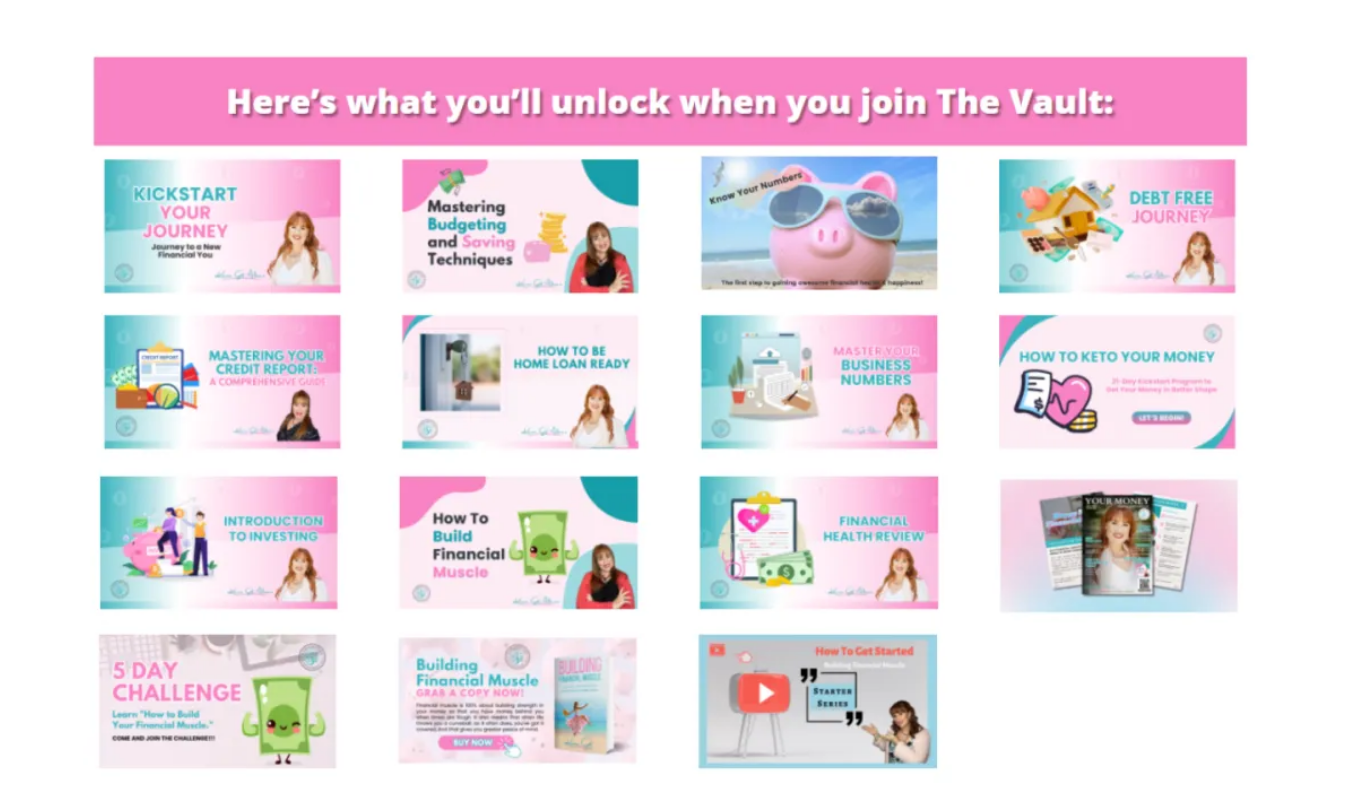

Whether it’s talking to a financial coach (yep, that’s me!), joining a money challenge, or signing up for a workshop, getting support can fast-track your progress and boost your confidence.

You’re not behind. You’re not bad with money. You just haven’t had the right tools or team yet.

EOFY is Done. Your Financial Comeback Starts Now.

This new financial year is more than a date change, it’s an opportunity. You can choose to:

- Set goals that actually excite you

- Build a money plan that fits your real life

- Create calm, clarity, and confidence in your finances

Ready to stop winging it and start winning it? Book your free discovery session today and let’s create a plan you can stick to, without the stress.

Your fresh start is waiting. Let’s make it count.

You survived EOFY. Now let’s help your money thrive.