Financial freedom isn’t just about saving money or cutting costs; it’s about truly understanding your financial position. Knowing your numbers means gaining a clear picture of your assets, liabilities, income, and expenses. This knowledge is the foundation for making informed decisions, reducing financial stress, and achieving stability. In this blog, we’ll explore why knowing your numbers is essential and how you can start your journey toward financial clarity today.

Why Knowing Your Numbers Matter

Many people focus on earning more or spending less, but without knowing your numbers, it’s like driving a car without a map or GPS. You might be moving, but you’re not necessarily headed in the right direction. Here’s why understanding your financial position is crucial:

-

- Know Where You Stand: Your net position – the difference between what you own and what you owe is a snapshot of your financial health. It gives you a clear idea of whether you’re building wealth or falling behind.

- Set Realistic Goals: When you know your numbers, you can set achievable financial goals, like paying off debt, saving for a home, or building an emergency fund.

- Identify Opportunities for Growth: Understanding your financial position helps you spot areas where you can save more, invest smarter, or cut unnecessary expenses.

- Reduce Financial Stress: Clarity about your finances reduces anxiety and empowers you to make confident decisions.

Your financial assets consist of your savings, investments, and retirement funds, which represent the resources you own that can contribute to your financial security and future wealth.

Breaking Down the Basics – What to Track

Knowing your numbers involves more than just looking at your bank balance. Here’s what you need to assess:

1. ASSETS

-

-

-

- Tangible Assets: Your home, car, or valuable items like jewellery or collectibles.

- Financial Assets: Savings accounts, investments, and retirement funds.

-

-

2. LIABILITIES

-

-

-

- Debts: Credit cards, personal loans, student loans, and mortgages.

- Recurring Obligations: Bills, subscriptions, and other regular expenses.

-

-

3. INCOME

-

-

-

- Primary Income: Salary or wages.

- Secondary Income: Side hustles, investment dividends, or rental income.

-

-

4. EXPENSES

-

-

-

- Fixed Expenses: Rent, insurance, and utilities.

- Variable Expenses: Groceries, entertainment, and travel.

-

-

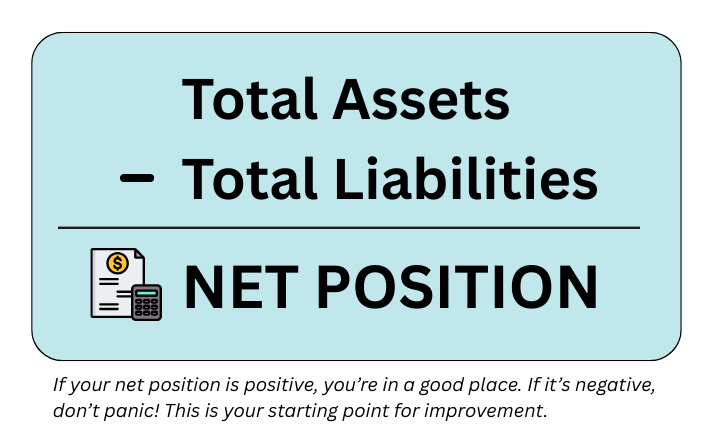

How to Calculate Your Net Position

The formula is simple: Net Position = Total Assets – Total Liabilities. Here’s an example:

Assets: $200,000 (home equity, savings, investments)

Liabilities: $150,000 (mortgage, credit card debt, loans)

Net Position: $50,000

If your net position is positive, you’re in a good place. If it’s negative, don’t panic this is your starting point for improvement.

Steps to Take Control of Your Numbers

1. START WITH A FINANCIAL INVENTORY

-

-

-

- Make a detailed list of all assets and liabilities.

- Use tools like spreadsheets or budgeting apps for accuracy.

-

-

2. TRACK YOUR SPENDING

-

-

-

- Review your bank and credit card statements to understand your spending habits.

- Categorise expenses to identify areas for adjustment.

-

-

3. CREATE A FINANCIAL PLAN

-

-

-

- Set short-term, medium-term, and long-term goals.

- Prioritise high-interest debt and build an emergency fund.

-

-

4. REVIEW REGULARLY

-

-

-

- Schedule monthly or quarterly reviews to track progress.

- Adjust your plan as needed based on life changes.

-

-

Common Mistakes to Avoid

1. IGNORING THE BIGGER PICTURE

-

-

- Focusing only on day-to-day expenses without understanding your overall financial health.

-

2. PROCRASTINATING

-

-

- Delaying the process of assessing your finances can make it harder to take control.

-

3. OVERLOOKING SMALL DEBTS

-

-

- Small debts add up and can significantly impact your net position.

-

4. NOT SEEKING HELP

-

-

- Don’t hesitate to consult a financial coach or use resources like our “Know Your Numbers” course.

-

How Our Course Can Help

Our “Know Your Numbers” course is designed to make this process easy and actionable. Here’s what you’ll gain:

1. STEP-BY-STEP GUIDANCE

-

-

- Learn how to assess and improve your financial position.

-

2. PRACTICAL TOOLS

-

-

- Access calculators, templates, and worksheets.

-

3. EXPERT INSIGHTS

-

-

- Benefit from tips and strategies sared by experienced financial coaches.

-

4. ONGOING SUPPORT

-

-

- Get access to our community and resources for continued learning.

-

Real Life Success Stories

- Emma’s Journey: After taking the “Know Your Numbers” course, Emma discovered she had enough savings to pay off a small loan. She’s now building her emergency fund and feels more confident about her future.

- James’ Transformation: James used the tools from the course to identify unnecessary expenses. By cutting these costs, he’s saved over $500 a month and is on track to pay off his credit card debt.

Conclusion

Knowledge is power, especially when it comes to your finances. Understanding your numbers isn’t just a one-time task—it’s a habit that leads to financial freedom. Take control of your financial future by joining our “Know Your Numbers” course today. Let’s build a stress-free, confident financial life together.