When people think about managing their finances, budgeting is often the first thing that comes to mind. While budgeting is an essential tool, it’s only one piece of the puzzle. To truly take control of your financial life, you need to understand your net position. This bigger-picture view is the cornerstone of long-term financial success. In this blog, we’ll dive into what net position is, why it matters, and how it can transform your approach to money management.

What is Net Position?

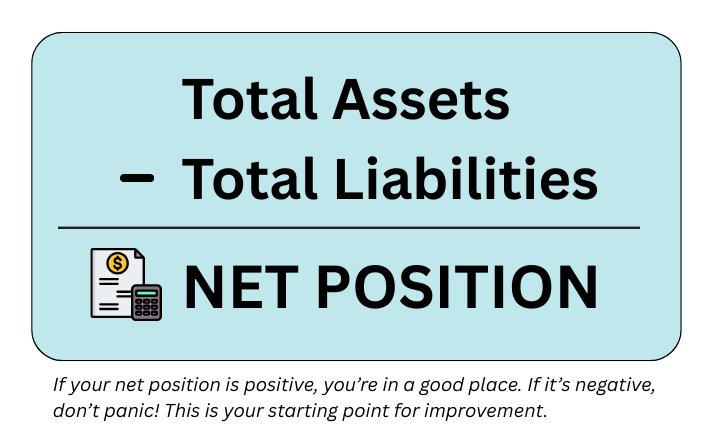

Your net position is the difference between what you own (your assets) and what you owe (your liabilities). It’s essentially your financial scorecard, giving you a snapshot of your overall financial health. Here’s a simple formula:

Assets include things like your home, car, savings, and investments. Liabilities include mortgages, credit card debt, personal loans, and other financial obligations. Knowing your net position helps you understand whether you’re building wealth or accumulating debt.

Why Net Position Matters More Than Budgeting

Budgeting is about managing your monthly cash flow, how much money comes in and goes out. While this is important, it doesn’t give you a complete picture of your financial health. Here’s why focusing on your net position is a game-changer:

1. PROVIDES A HOLISTIC VIEW

-

-

- Budgeting focuses on short-term goals, like paying bills or saving for a vacation. Net position shows your long-term financial standing, including the value of your assets and the weight of your debts.

-

2. HELPS SET REALISTIC GOALS

-

-

- Understanding your net position allows you to set achievable financial goals, whether it’s buying a home, retiring early, or becoming debt-free.

-

3. REVEALS FINANCIAL TRENDS

-

-

- Tracking your net position over time helps you see whether your financial health is improving or deteriorating.

-

4. GUIDES BETTER DECISION-MAKING

-

-

- Knowing your net position helps you make informed decisions about spending, saving, and investing.

-

Common Misconceptions About Net Position

Budgeting is about managing your monthly cash flow, how much money comes in and goes out. While this is important, it doesn’t give you a complete picture of your financial health. Here’s why focusing on your net position is a game-changer:

1. “Only Wealthy People Need to Track Their Net Position”

-

-

- False! Everyone, regardless of income level, can benefit from understanding their net position. It’s about knowing where you stand and where you’re headed.

-

2. “Budgeting Alone is Enough”

-

-

- While budgeting is crucial for managing day-to-day expenses, it doesn’t address your overall financial health.

-

3. “It’s Too Complicated”

-

-

- Tracking your net position can be as simple as listing your assets and liabilities in a spreadsheet or using a financial app.

-

Steps to Improve Your Net Position

1. ELIMINATE HIGH-INTEREST DEBT

-

-

- Focus on paying off credit cards and personal loans first. These often carry the highest interest rates and can significantly impact your financial health.

-

2. INCREASE YOUR SAVINGS

-

-

- Build an emergency fund with at least three to six months’ worth of living expenses. This provides a financial safety net and reduces the need for high-interest debt during emergencies.

-

3. INVEST WISELY

-

-

- Grow your assets by investing in a diversified portfolio. Consider long-term investments like retirement accounts or real estate.

-

4. REDUCE LIABILITIES

-

-

- Pay down loans and avoid taking on new debt unless it’s for a strategic purpose, like buying a home.

-

5. TRACK YOUR PROGRESS

-

-

- Revisit your net position quarterly or annually to measure your progress and adjust your financial plan as needed.

-

How Our “Know Your Numbers” Course Can Help

Our “Know Your Numbers” course is designed to take the guesswork out of understanding your net position. Here’s what you’ll learn:

1. HOW TO CALCULATE YOUR NET POSITION

-

-

- Step-by-step guidance on listing your assets and liabilities.

-

2. TOOLS AND TEMPLATES

-

-

- Access user-friendly calculators and spreadsheets to track your progress.

-

3. STRATEGIES FOR IMPROVEMENT

-

-

- Learn actionable steps to grow your assets, reduce your liabilities, and increase your net worth.

-

4. REAL-LIFE EXAMPLES

-

-

- See how others have transformed their financial health by focusing on their net position.

-

Success Stories

1. JOAN’S TRANSFORMATION

Joan discovered her net position was negative due to high credit card debt. Using strategies from the course, she paid off her debt in two years and now has a positive net worth of $20,000.

2. PETER’S JOURNEY

Peter thought he was doing well because he had a high income. After calculating his net position, he realised his debt outweighed his assets. He’s since restructured his finances and is on track to achieve financial independence.

Conclusion

Understanding your net position is the key to unlocking financial freedom. It’s not just about how much you earn or spend; it’s about the bigger picture of what you own versus what you owe. By focusing on your net position, you can make smarter financial decisions, set realistic goals, and build a secure future. Ready to take control? Join our “Know Your Numbers” course today and start your journey toward financial clarity and success.