I talk a lot about building financial muscle and for good reason.

Why? Because some people today still don’t have their money working for them and they’re making dumb decisions when it comes to managing it effectively.

My concern is that when these people decide around 65 – 70 years of age that they would like to retire – they’re going to struggle!

Why, because they’re going to have nothing to enjoy their retirement years with, as they’ve spent everything they’ve earned along the way.

Financial muscle as I bang on about constantly, is making sure firstly that you’re hard earned money is working for you and not your bank’s.

And secondly, it’s about having something put away for “just in case” which “just in case” comes up a fair bit during our lifetime.

So how nice would it be to know that you’ve got money and it’s working to your advantage when you need it.

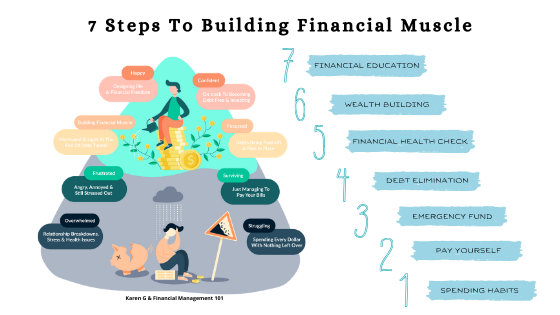

Here are 7 steps you need to know when it comes to building financial muscle and they are:

1 Looking at your spending habits. What are you spending your money on each and every payday? Are you spending it on things that are worthless and while short term makes you feel good initially but then when it comes to paying your bills you haven’t anything left to pay for them?

My guess is, this is when you start to feel stressed out and your life becomes very overwhelming.

The quickest and easiest way to get a handle on what you’re spending is to look at doing a budget. For the first month, you write down everything you spend and then deduct what you earn by what you’ve spent for the month.

More often than not, you’ve used credit to help get you out of a bind, but it’s not working and you’re getting further and further into debt.

2 Next, once you’ve worked out if there’s any surplus, you’ll want to make some adjustments in your spending to put away a small percentage around 10% of what you earn into a savings account.

Now 10% is not a lot of money, but you’ll need to do this first at payday before you pay any bills or use some of your income on other expenditure.

Once you’ve put away 10% or even $20 or $30 into a savings account then put on autopilot, where every payday money goes from your pay into this account. I guarantee you’ll start to think about your money a little differently.

Something magical happens when you know you have some money saved and you start to feel a little more confident and less stressed and it gives you a greater sense of security.

3 Ok the third area where you’ve got to be strict with yourself is to open another savings account, one that is too hard to get access to and start building on your emergency fund.

You’ll need to get your emergency fund up to at least $2000 as quickly as possible.

There are many ways to get this account up to $2000 and the first is to look around your home. What could you sell online that’s sitting around in your garage or shed that’s gathering dust?

The emergency fund is the 3rd most critical aspect to building financial muscle because it takes the pressure off you and your money when those unexpected things arise like your hot water goes on the blink or your fridge packs up.

The emergency fund is for exactly that emergencies that make life very difficult if they’re not fixed or replaced.

Ideally, the emergency fund needs to be at a balance where if you lost your job or you couldn’t work for 6 months, you would have enough money to be able to pay your bills until you get back to working again.

4 The major stress for most people is their ever-increasing debt, whether it be from overspending on credit or the mortgage on your home.

I can’t stress enough that when you finally become debt-free life is going to be a whole lot more fun. Things that used to stress you out are suddenly gone and all the pressure of working at a job that you probably don’t like now gives you the power and choice to look at whether you continue working there.

If you’re not working to pay down all your debts as fast as you can – you’re just throwing away good money to the banking institutions that are funding your poor money habits and making them richer while you become poorer.

Map out who you owe, how much you owe and then start with one debt at a time and pay that down until it’s gone. Once the first debt has been eliminated, then use the money that you paid the debt down with to double up on the next debt.

If you need a helping hand to work out how then download my debt reduction strategy by heading over to https://financialmanagement101.com.au/resources/ on my website or by following the link HERE at Debt Repayment Strategy.

5 Ok, so the next step in building financial muscle is to stop and do a quick financial health check.

A financial health check will look at quite simply if there are any areas within your money that you need to work on, or get more information on, to get you back on track and retiring comfortably.

I have a 5 min financial health check that you can download HERE to get you started.

6 Now you’ve got money being saved, your debts are being paid off, it’s now time to look at your wealth-building strategies.

Your wealth-building will consist of two parts:

- Investing and

- Protecting

Let’s talk about investing first.

Investing is about growing your money through facilities like superannuation and other investment options.

Superannuation is a way of saving for retirement.

Essentially your employer in Australia is putting away a percentage of your salary into a fund of your choice that invests the money until you retire.

It’s a forced type of saving but brilliant to help those in particular that are not good at saving and will see you have some money at the end of your working life.

This is a big topic that’s too big to cover off in this post, so I will write a post on this and explain in more detail shortly, so keep an eye out for it.

Other investment options for wealth building during your working years could consist of investing in shares, managed funds or property to name a few.

I would encourage anyone looking into wealth building to seek a financial adviser who is qualified to provide advice on what assets or which investment vehicle is best for you and your personal circumstances.

There are many out there so be careful and take the time to ensure they have your best interest at the forefront of their advice giving.

Next, I want to talk about protecting your money. This is a very important topic. Today, I’ll give you a brief summary but like the topic on superannuation, I’ll be writing more about this in another post.

But for now, let me explain why it’s important to have a Will or good Estate Plan.

A Will and Estate Plan are there to make sure your wishes at the end of your life are carried out and distributed properly.

A Will is a legal document that states what you would like to happen with your assets when you die and forms part of your Estate Plan.

An Estate Plan, on the other hand, records exactly what you would like to happen with your assets upon death and includes documents such as your Will, a testamentary trust, superannuation assets and may contain powers of attorney or other such documents that in the event of you being unable to make decisions, someone appointed by you will act on your behalf.

So as you can see from the brief descriptions above it is extremely important to make sure you are protecting what you’ve worked long and hard to build.

If you die without making a Will it means you die intestate and this causes a lot of heartache and headache for your loved ones left behind.

What actually happens here is that your estate is left to deal with either from the Supreme or Highest Court, depending on which state you live in Australia, who will appoint an administrator.

The administrator’s job is to arrange the funeral and distribute any leftover assets after paying any debts and taxes. Sometimes there are fees associated with an administrator taking care of your details which means your loved ones may not receive the full inheritance you had planned on leaving them.

So make sure you have a current Will your priority today because nobody knows when our time is up.

7 And lastly, the 7th step to building financial muscle is to get yourself ongoing financial education and support.

Just like a sporting team, they all use coaches to help them and guide them to their sporting greatness.

Financial coaching is much the same, an experienced coach who knows sound financial education can make the difference between living with financial stress or living your life the way you’ve always desired – happy and stress-free.

If you’ve read to the bottom of this and you’ve followed the steps outlined above then congratulations as you are one who is committed to living a financially comfortable life.

Why not continue with your financial education by working with me on a monthly basis.

I offer several options, but the first is the most preferred as it’s inexpensive and extremely supportive towards you achieving awesome financial health.

Check out the LEARNING HUB for more details.

I look forward to working with you

Here’s to your financial health, wealth and happiness.